Income driven repayment plans what student loan borrowers need to know. Navigating the world of student loan repayment can feel overwhelming, especially with various income-driven repayment plans (IDRP) available. This guide provides a comprehensive overview, explaining the different types of IDR plans, the application process, repayment options, and financial considerations. Understanding these intricacies is key to making informed decisions about your student loan future.

We’ll delve into the specifics of each plan, comparing and contrasting their features. From eligibility criteria to potential forgiveness scenarios, this resource will equip you with the knowledge to choose the plan that best aligns with your financial situation. We’ll also touch on crucial financial implications and offer practical tips for effective financial management while on an IDR plan.

Get ready to take control of your student loan journey!

Understanding Income-Driven Repayment Plans (IDRPs)

Navigating student loan repayment can feel overwhelming. Fortunately, income-driven repayment plans (IDRPs) offer a structured approach, potentially making monthly payments more manageable. These plans tie your monthly payments to your income, aiming to ease the financial burden of student loan debt. Understanding the various types, features, and eligibility criteria is crucial for borrowers to make informed decisions.IDRPs are designed to make student loan payments more affordable by adjusting the amount you pay each month based on your income and family size.

This allows borrowers to focus on building their careers and finances without the pressure of an overly burdensome loan payment. Understanding the different types of IDR plans is essential to choosing the plan that best suits your financial situation.

Types of Income-Driven Repayment Plans

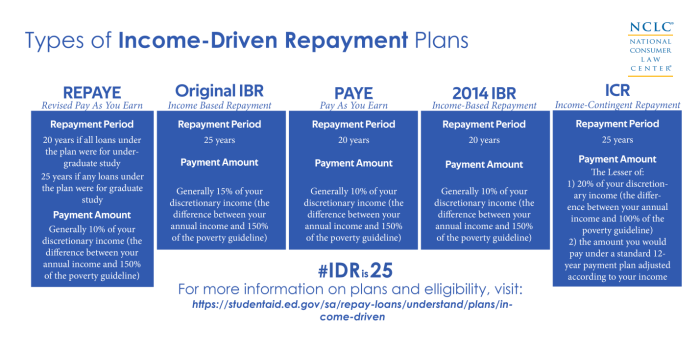

Different IDR plans offer various approaches to loan repayment. Each plan has unique features and benefits. Pay As You Earn (PAYE), Revised Pay As You Earn (REPAYE), and Income-Based Repayment (IBR) are some of the most common plans.

- Pay As You Earn (PAYE): PAYE allows borrowers to make monthly payments based on a percentage of their discretionary income. This plan is particularly beneficial for borrowers with lower incomes. A significant benefit is that under PAYE, if you make payments for 20 years, the remaining balance will be forgiven. This is a significant factor to consider when choosing this plan.

- Revised Pay As You Earn (REPAYE): REPAYE is a revised version of PAYE, adjusting some of the criteria and rules. It generally has a lower monthly payment amount than standard PAYE. A crucial aspect is the maximum repayment period, which can differ significantly depending on the specific circumstances of the borrower.

- Income-Based Repayment (IBR): IBR is another popular option where your monthly payment is determined by your income and family size. It typically has a lower payment amount than standard repayment plans but might not result in forgiveness if the loan repayment period is not met. This is a crucial point to consider, as borrowers might need to factor in the loan repayment period and potential forgiveness scenarios when selecting a plan.

Calculating Monthly Payments

IDR plans calculate monthly payments using a formula that considers the borrower’s discretionary income, family size, and other factors. The exact calculation varies depending on the specific IDR plan.

Monthly payment = (Discretionary Income)

(Percentage determined by the plan)

The percentage used in the formula depends on the IDR plan and is adjusted periodically to account for inflation.

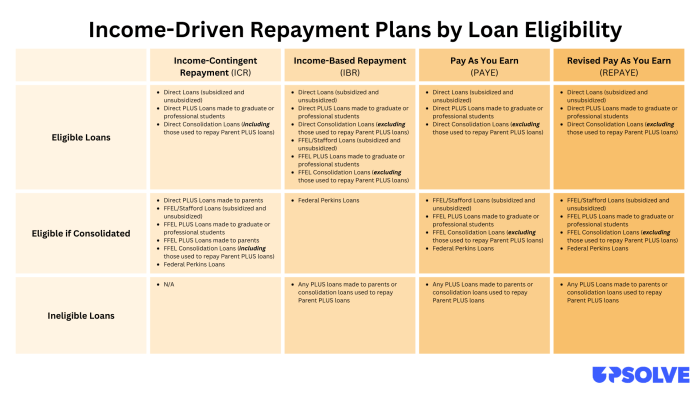

Eligibility Criteria

Eligibility for IDR plans varies depending on the specific plan. Generally, borrowers must meet certain income requirements and other conditions to participate. These requirements might involve a specific amount of debt and other factors. It’s essential to understand the eligibility criteria before applying for a plan.

Summary Table of IDR Plans

| Plan | Maximum Repayment Period | Potential Forgiveness | Other Key Features |

|---|---|---|---|

| Pay As You Earn (PAYE) | 20 years | Yes, after 20 years of qualifying payments. | Lower monthly payments, potentially beneficial for lower-income borrowers. |

| Revised Pay As You Earn (REPAYE) | 25 years | Yes, under certain conditions. | Lower monthly payments, adjustments from PAYE. |

| Income-Based Repayment (IBR) | 20-25 years (depending on income) | Potentially, after 20 or 25 years, based on specific conditions. | Lower monthly payments, based on income and family size. |

Navigating the Application Process

Applying for an income-driven repayment plan (IDR) for your student loans can feel daunting, but understanding the process can ease the stress. This section details the steps involved, the required documentation, and potential challenges to help you navigate the application smoothly. Taking the time to gather the necessary information and complete the forms correctly is key to a successful application.The application process for income-driven repayment plans varies slightly depending on the specific plan and the loan servicer.

However, there are common steps and required documents that all borrowers need to be aware of. This guide aims to provide a comprehensive overview of the application process.

Steps Involved in Applying for an IDR Plan

Successfully navigating the IDR application hinges on understanding the sequence of steps. First, determine which IDR plan best suits your financial situation. Thorough research and consideration of your income and expenses are crucial in this decision. Next, familiarize yourself with the application requirements and gather the necessary documentation. Diligent preparation will save time and frustration during the application process.

Once all the required documents are gathered, complete the application forms accurately and submit them on time. Monitoring your application status is important to ensure timely processing.

Completing Application Forms

Carefully reviewing and completing the application forms is essential. Misinformation or missing information can delay or even deny your application. Read each section of the form thoroughly, ensuring all requested details are accurate and complete. Use clear and concise language when providing information. Seek assistance from the loan servicer or a financial advisor if needed.

Double-checking the accuracy of the entered information is crucial before submitting the application.

Gathering Necessary Documentation

The documentation required for IDR plan applications typically includes proof of income and family size. Accurately documenting your income and family size is vital for the proper assessment of your repayment plan. Gather relevant documents to support your claim. Ensure that all documentation is organized and readily accessible to facilitate submission. This careful preparation can prevent unnecessary delays.

Documentation Requirements

To illustrate the required documentation, here’s a table summarizing the typical documents needed for various IDR plans. Note that specific requirements may vary depending on the loan servicer and the individual’s circumstances.

| IDR Plan | Required Documents | Supporting Evidence |

|---|---|---|

| Pay As You Earn (PAYE) | Tax returns, pay stubs, W-2 forms, bank statements | Evidence of employment, income verification |

| Revised Pay As You Earn (REPAYE) | Tax returns, pay stubs, W-2 forms, bank statements, proof of dependents | Evidence of employment, income verification, dependent verification |

| Income-Contingent Repayment (ICR) | Tax returns, pay stubs, W-2 forms, bank statements | Evidence of employment, income verification |

| Income-Based Repayment (IBR) | Tax returns, pay stubs, W-2 forms, bank statements, proof of dependents | Evidence of employment, income verification, dependent verification |

Potential Challenges

During the application process, borrowers might encounter various challenges, such as difficulty in obtaining required documents or issues with the application form. These roadblocks can be overcome with careful planning and preparation. Seeking guidance from financial advisors or the loan servicer can help alleviate these challenges. Thorough communication with the loan servicer about any issues or concerns is essential.

It’s also important to understand the time frame for processing the application.

Repayment and Forgiveness Options

Navigating the complexities of income-driven repayment plans (IDRPs) can feel overwhelming. Understanding the different repayment options and forgiveness criteria is crucial for borrowers to make informed decisions about their student loan management. This section dives into the specifics of repayment schedules and potential forgiveness, providing clarity on how these plans work and how they affect the total amount you repay.The diverse range of IDR plans offers borrowers flexibility based on their income and financial situation.

Navigating income-driven repayment plans can be tricky for student loan borrowers. Understanding the different options and their implications is key. Just as important as understanding these plans is being aware of scams, like those involving fake DMV text messages circulating across multiple states. Learning how to spot these scams, as detailed in this helpful guide, dmv scam texts multiple states how to avoid falling victim , is crucial.

Ultimately, staying informed about both financial pitfalls and common scams will help you make smart decisions about your student loan repayment strategy.

Each plan has its own repayment structure, affecting the total amount owed and the timeline for repayment. Forgiveness criteria, often tied to the length of repayment, provide an opportunity for borrowers to eliminate some or all of their remaining debt after a set period of service.

Navigating income-driven repayment plans for student loans can be tricky, but understanding the specifics is crucial. Recent political discourse, like Charles Koch’s speech on Trump tariffs, highlights the complexities of economic policy, which indirectly affects student loan programs. Understanding these intricate repayment plans is essential for borrowers to make informed decisions, and knowing how factors like economic policies, as seen in Charles Koch’s speech on Trump tariffs , can influence these plans is key to responsible financial management.

Different Repayment Options Under IDR Plans

Various IDR plans offer different repayment structures. These options influence the monthly payment amount and the total amount repaid. The monthly payment is typically calculated as a percentage of your discretionary income, and that percentage can vary between plans. For example, some plans cap the maximum monthly payment, while others don’t.

- Pay As You Earn (PAYE): PAYE calculates monthly payments based on a percentage of discretionary income. This often results in lower monthly payments compared to other plans, but the total amount repaid over the life of the loan can be higher, especially if income increases over time.

- Revised Pay As You Earn (REPAYE): Similar to PAYE, REPAYE calculates monthly payments based on a percentage of discretionary income. However, the specific percentages and maximum repayment amounts may differ. The total repayment amount depends on individual income and the specific plan terms.

- Income-Contingent Repayment (ICR): ICR calculates monthly payments based on a percentage of discretionary income, typically lower than other plans. This leads to lower monthly payments but often results in a longer repayment period and a potentially higher total repayment amount. The loan may not be forgiven unless specific conditions are met.

Income Fluctuations and Monthly Payments

Income fluctuations can significantly impact monthly payments under IDR plans. For example, if your income increases, your monthly payment might increase accordingly, reflecting the higher portion of your income designated for repayment. Conversely, a decrease in income may lead to lower monthly payments. These fluctuations can make it challenging to budget and plan long-term. It is essential to understand how income changes will affect your monthly payment obligations.

- Example: A borrower with an income of $50,000 might have a monthly payment of $300 under PAYE. If their income increases to $70,000, their monthly payment might increase to $420. Conversely, if their income decreases to $30,000, their monthly payment might decrease to $180.

Loan Forgiveness Criteria and Length of Repayment

Loan forgiveness under IDR plans is contingent on meeting specific criteria, including the length of repayment. The length of repayment required to qualify for forgiveness varies between plans and can be substantial, sometimes lasting 20 to 25 years.

- Specific Conditions: The exact conditions for loan forgiveness vary across IDR plans. For instance, some plans may require borrowers to make a specific number of qualifying monthly payments before they can be considered for loan forgiveness. Others may have stricter eligibility requirements or income limitations.

Comparison of Loan Forgiveness Options

Each IDR plan offers varying loan forgiveness options, with different criteria for eligibility. Some plans might forgive a portion of the loan after a specific number of qualifying payments, while others offer full forgiveness.

- Comparing Plans: PAYE, REPAYE, and ICR plans each have their own forgiveness criteria. Understanding the specifics of each plan, including the required length of repayment and the percentage of the loan that may be forgiven, is essential for borrowers to choose the most suitable plan for their financial situation.

Estimated Total Repayment Amounts

The following table provides estimates of total repayment amounts under different IDR plans, considering potential loan forgiveness. It’s important to remember that these are estimations and actual amounts may vary depending on individual circumstances.

| IDR Plan | Estimated Total Repayment (Example, $100,000 Loan) | Potential Forgiveness | Notes |

|---|---|---|---|

| PAYE | $120,000 | Partial (depending on income and length of repayment) | Lower monthly payments, potentially higher total repayment |

| REPAYE | $115,000 | Partial (depending on income and length of repayment) | Similar to PAYE, with possible variations in monthly payments |

| ICR | $130,000 | Partial (with strict conditions) | Lowest monthly payments, potentially longest repayment period |

Financial Implications and Considerations

Choosing an income-driven repayment plan (IDR) for student loans requires careful consideration of its financial implications. While IDR plans offer potential relief from overwhelming monthly payments, they can also impact credit scores, budgeting, and long-term financial goals. Understanding these potential consequences is crucial for making an informed decision.IDR plans often involve lower monthly payments than standard repayment plans, making them attractive for borrowers facing financial hardship.

However, this lower payment amount often comes with a longer repayment period, potentially extending the overall cost of the loan. This increase in the total amount paid over time needs to be weighed against the short-term relief provided.

Impact on Credit Scores

IDR plans can sometimes have a negative impact on credit scores. While the monthly payments might be lower, the extended repayment period and potential for default, if not managed properly, can lower creditworthiness. Lenders often view the longer repayment timeframe as a risk factor, potentially leading to a less favorable credit report. Borrowers should carefully monitor their credit reports and work to maintain responsible financial habits throughout the IDR plan.

Budgeting and Financial Management, Income driven repayment plans what student loan borrowers need to know

Managing finances effectively during an IDR plan requires a thorough understanding of the plan’s terms and a commitment to responsible budgeting. Borrowers need to allocate funds for the lower monthly payments while maintaining other financial obligations, such as rent, utilities, and personal expenses. Creating a detailed budget that accounts for all income and expenses is essential.

Long-Term Financial Consequences

The long-term financial consequences of an IDR plan depend on several factors, including the chosen plan, the borrower’s income trajectory, and their ability to manage their finances. Borrowers should compare the total amount paid under an IDR plan with the total amount paid under a standard repayment plan to evaluate the long-term cost. Understanding the potential for loan forgiveness under certain IDR plans, and how this affects the overall cost, is also critical.

In some cases, the total amount paid might be higher than a standard plan, even with the possibility of loan forgiveness.

Comparison to Traditional Repayment Plans

IDR plans offer a structured way to manage student loan debt, but they come with a trade-off. The lower monthly payments of IDR plans often extend the repayment period, potentially resulting in a higher total cost over the lifetime of the loan. Comparing the total amount paid over time with a traditional repayment plan is crucial. Traditional plans typically involve higher monthly payments but result in a shorter repayment period, potentially leading to a lower total cost.

Tips for Effective Financial Management During IDR Repayment

“Careful financial planning is key to success with an IDR plan.”

It’s important to create a detailed budget and stick to it. Track all income and expenses meticulously.

- Create a Detailed Budget: Thoroughly itemize all sources of income and every expense, including the IDR loan payment. This allows for better financial control and tracking.

- Prioritize Debt Payments: Allocate funds for the IDR plan payment and ensure consistent payments to avoid potential credit score issues.

- Review and Adjust Budget Regularly: Income fluctuations and life changes require adjustments to the budget. Regular reviews are crucial for maintaining financial stability.

- Seek Professional Advice: Financial advisors can provide personalized guidance on managing debt and creating a suitable budget.

- Explore Additional Resources: Utilize available resources from student loan servicers and government agencies for financial assistance or educational materials.

- Maintain Good Credit Habits: Make timely payments, keep credit utilization low, and avoid unnecessary debt accumulation. This can help maintain or improve creditworthiness.

Important Considerations and Resources: Income Driven Repayment Plans What Student Loan Borrowers Need To Know

Choosing an income-driven repayment plan (IDR) for student loans can be a significant financial decision. Understanding the potential pitfalls and having access to helpful resources are crucial for making an informed choice. This section will highlight key considerations to avoid common mistakes and empower borrowers with the tools they need to navigate IDR plans effectively.IDR plans can offer a path to manageable monthly payments, but they often come with long repayment terms and potential limitations on loan forgiveness.

Carefully weighing the pros and cons, along with seeking expert advice, is vital before committing to an IDR plan.

Navigating income-driven repayment plans for student loans can be tricky, but understanding the options is key. Recent news about the high-profile call between Trump and Xi, as detailed in this article trump and xi have first call in months , highlights the complex global economic landscape. Ultimately, borrowers need to thoroughly research these plans and factor in potential changes to interest rates and overall economic conditions to make the best decisions about their repayment strategy.

Potential Pitfalls and Common Mistakes

Borrowers may overlook crucial details when considering IDR plans. Failing to thoroughly research the different IDR plan options available and their specific requirements can lead to an unsuitable plan selection. Not understanding the impact of IDR plans on credit scores, or potential delays in achieving loan forgiveness, are also significant mistakes to avoid. Furthermore, insufficient budgeting and financial planning can make the repayment process more challenging.

Resources for Additional Information and Support

Numerous resources can assist borrowers in their understanding of IDR plans. Government websites like the Department of Education’s student aid website provide comprehensive information about IDR plans, eligibility criteria, and application procedures. Non-profit organizations often offer counseling and support services to help borrowers navigate the complex process. Contacting a local consumer credit counseling agency is another helpful option for personalized guidance.

Furthermore, the Federal Student Aid website offers numerous tools, calculators, and guides that can help students evaluate their options.

Role of Financial Advisors

Financial advisors can play a valuable role in guiding borrowers through the IDR process. They can help borrowers assess their individual financial situations, compare different IDR plans, and develop a repayment strategy that aligns with their long-term goals. Advisors can also help borrowers understand the implications of each plan, including potential tax implications and the impact on their credit score.

Moreover, a financial advisor can offer valuable insights and support throughout the repayment period.

Understanding the Terms and Conditions

Before enrolling in an IDR plan, it’s essential to thoroughly review the terms and conditions. Pay close attention to the repayment period, interest accrual, and the specific requirements for loan forgiveness. Understanding the formula for determining monthly payments, as well as the factors influencing the potential for loan forgiveness, is paramount. Also, scrutinize the conditions for modifications or adjustments to the plan, as circumstances may change over time.

This meticulous review helps avoid unforeseen issues and ensures alignment with personal financial goals.

Contacting the Loan Servicer

When facing questions or concerns about an IDR plan, contacting the loan servicer is essential. Establish clear communication channels, such as phone numbers and email addresses, to ensure prompt and effective responses. Maintaining organized records of communication, including dates, times, and the names of representatives, is highly recommended. Furthermore, seeking clarification on specific terms, procedures, or requirements through official channels is vital to ensure accurate and complete information.

Illustrative Scenarios

Understanding how different income levels and family situations affect your student loan payments and potential forgiveness is crucial. This section provides hypothetical examples to illustrate the impact of various IDR plans on your monthly obligations and the path to loan forgiveness. Different plans have different eligibility requirements and forgiveness criteria, making personalized guidance vital.

Impact of Varying Income Levels

Different income levels significantly influence monthly payments and loan forgiveness potential. The monthly payment amount directly correlates with your discretionary income. Higher incomes often lead to higher payments and, in some cases, a shorter time to loan forgiveness.

Consider these scenarios:

- A borrower with a modest income might experience significantly lower monthly payments under a plan like PAYE, but the time to loan forgiveness may be longer.

- A borrower with a higher income might have a larger monthly payment but could potentially achieve loan forgiveness faster under an income-driven plan.

- Income fluctuations, such as job loss or a substantial pay raise, can impact the repayment amount and the potential for loan forgiveness.

Impact of Family Situations

Family situations, including dependents, can significantly affect the calculation of your income-driven repayment plan. The applicable income may be adjusted to account for certain circumstances, impacting your monthly payment.

For example:

- A single borrower with no dependents may have a different income threshold compared to a borrower with a spouse and children.

- The presence of dependents can affect the amount of income considered for the repayment calculation. The income calculation can vary based on the specific plan and the number of dependents.

Illustrative Table of IDR Plan Scenarios

The table below demonstrates how monthly payments and potential loan forgiveness can vary based on different scenarios and income-driven repayment plans. This is illustrative and not exhaustive; specific situations should be assessed by a qualified professional.

| Scenario | Income Level | Family Situation | Plan | Monthly Payment | Potential Forgiveness |

|---|---|---|---|---|---|

| Single, low income | $30,000 | No dependents | PAYE | $150 | After 20 years |

| Couple, moderate income | $60,000 | 2 dependents | REPAYE | $300 | After 15 years |

| High-income individual | $150,000 | No dependents | IBR | $800 | After 10-25 years, depending on the specific IBR plan |

| High-income individual with substantial debt reduction | $150,000 | No dependents | PAYE | $800 | After 20 years |

Final Thoughts

In conclusion, income driven repayment plans offer a variety of options for managing student loan debt. This guide has highlighted the key aspects of each plan, emphasizing the importance of careful consideration and proactive planning. Understanding the application process, repayment terms, and potential forgiveness options is crucial. Remember to consult with financial advisors and utilize available resources for personalized guidance.

By arming yourself with the right knowledge, you can confidently navigate the intricacies of IDR plans and make well-informed decisions about your student loan repayment journey.