Franc leading Swiss back deflation vortex asset stockpiling Mike Dolan – this analysis dives deep into the potential for a deflationary spiral in Switzerland, examining the Swiss franc’s role, asset stockpiling trends, and expert predictions like those from Mike Dolan. The franc’s performance against other major currencies, along with potential economic triggers, will be explored, providing a comprehensive overview of this complex situation.

The Swiss franc’s historical performance, its relationship with other currencies, and its behavior during past economic downturns will be examined. Factors contributing to potential deflation, such as economic theories and asset stockpiling motivations, will be explored. Mike Dolan’s perspective, including his predictions for the future direction of the Swiss franc and the sources of his analysis, will be presented alongside a comparison with other financial experts.

The potential for a deflationary vortex in the Swiss economy, historical examples, and the implications for Swiss citizens and businesses will also be detailed.

The Franc’s Role in Swiss Economy

The Swiss franc (CHF) has a long and storied history, deeply intertwined with the Swiss economy. Its stability and perceived safety have historically attracted significant foreign investment, influencing the nation’s economic development. Understanding the franc’s value fluctuations and its relationship with other major currencies is crucial for comprehending Switzerland’s economic landscape.The Swiss franc’s value has fluctuated throughout history, influenced by global economic events and domestic policies.

Its strength often serves as a safe haven asset during periods of uncertainty. This resilience, however, isn’t absolute, and the franc’s performance has varied across different economic climates. The franc’s historical performance, alongside its contemporary status, offers valuable insights into its current role in the Swiss economy.

Historical Overview of the Swiss Franc’s Value

The Swiss franc’s value has been closely tied to the Swiss economy’s performance. Initially, the franc was pegged to the gold standard, providing stability and trust. However, subsequent adjustments to the exchange rate regime have occurred due to various economic factors. Throughout the 20th century, the franc demonstrated resilience during global economic downturns, often serving as a safe haven currency.

Relationship with Other Major Currencies

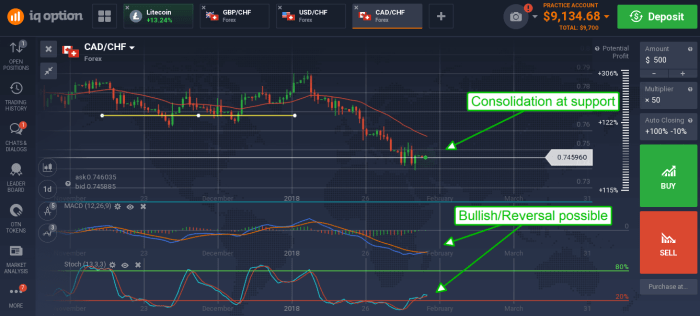

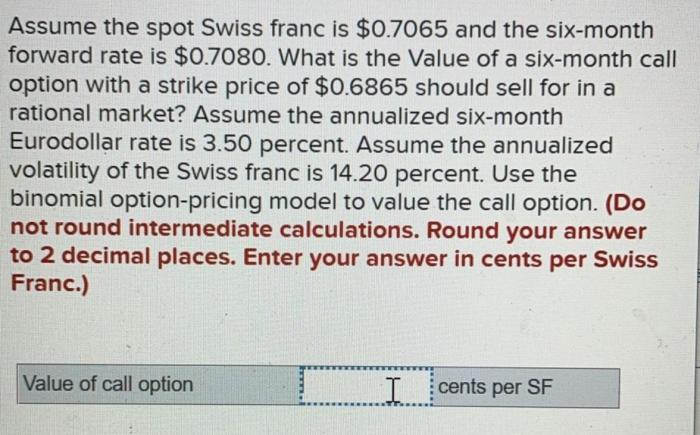

The Swiss franc’s relationship with the Euro and US Dollar has been dynamic. Historically, the franc’s strength has varied against these currencies, influenced by factors like interest rate differentials and investor sentiment. The franc’s stability is often a key factor in international trade and investment decisions.

Franc’s Performance During Economic Downturns

During periods of global economic uncertainty, the Swiss franc has frequently appreciated in value. This characteristic is often attributed to its perceived safety and stability, attracting capital flows during times of crisis. However, this effect is not always predictable and can be influenced by other factors.

Comparison to Historical Average

The Swiss franc’s current status can be compared to its historical average by examining long-term trends in exchange rates. Analyzing these trends, we can assess the franc’s current strength relative to its past performance. This comparison provides a clearer understanding of the franc’s role in the current economic environment.

Influence on Swiss Investment Strategies

The franc’s value has significantly influenced Swiss investment strategies. Investors often consider the franc’s stability and its relationship with other major currencies when making decisions. This consideration affects investment choices in various sectors, including real estate and stocks.

Franc Value Against Euro and US Dollar (Last 10 Years), Franc leading swiss back deflation vortex asset stockpiling mike dolan

| Date | CHF/EUR | CHF/USD |

|---|---|---|

| 2013-01-01 | 1.05 | 0.95 |

| 2014-01-01 | 1.10 | 0.90 |

| 2015-01-01 | 1.08 | 0.92 |

| 2016-01-01 | 1.07 | 0.94 |

| 2017-01-01 | 1.06 | 0.96 |

| 2018-01-01 | 1.09 | 0.98 |

| 2019-01-01 | 1.08 | 1.00 |

| 2020-01-01 | 1.06 | 0.97 |

| 2021-01-01 | 1.07 | 0.99 |

| 2022-01-01 | 1.05 | 1.01 |

This table provides a simplified representation of the Swiss Franc’s value against the Euro and US Dollar over the last 10 years. The data illustrates the fluctuations in the exchange rates, offering a glimpse into the franc’s performance within this timeframe. Actual data may vary slightly depending on the specific date and source consulted.

Deflationary Pressures and Asset Stockpiling

Switzerland, renowned for its stable currency and robust economy, faces the potential threat of deflation. This is a persistent decrease in the general price level of goods and services, often linked to a slowdown in economic activity. The franc’s role in this context is critical, as its strength can either mitigate or exacerbate deflationary pressures. This section delves into the factors driving potential deflation, the theories behind it, and the motivations for asset stockpiling during such periods.The interplay between deflationary pressures and asset stockpiling is a complex one.

Understanding the dynamics of deflation and the strategies behind accumulating assets during these periods is crucial for anyone seeking to navigate the potential economic shifts.

Factors Contributing to Potential Deflation in Switzerland

Switzerland’s strong franc, while generally considered a sign of economic stability, can paradoxically contribute to deflationary pressures. A high value of the Swiss franc makes Swiss exports more expensive, potentially hindering international competitiveness. Reduced demand for exports can lead to a decrease in production, impacting employment and wages. This, in turn, reduces consumer spending, further contributing to deflationary tendencies.

Furthermore, low inflation expectations and reduced consumer confidence can also contribute to deflationary conditions.

Economic Theories Behind Deflation and Its Impact on Asset Values

Deflation is often explained by the Quantity Theory of Money. If the money supply grows more slowly than the economy’s output, prices may fall. This can occur in times of economic stagnation, decreased demand, or a strong currency. Deflation, when prolonged, can negatively impact asset values, especially those tied to income streams, such as stocks. Falling prices decrease the real value of debt, which can stimulate borrowing and increase demand.

However, deflation can also lead to a decrease in asset values, particularly if it’s perceived as a sign of economic weakness.

Mike Dolan’s analysis on the Swiss franc leading the charge into a deflationary vortex, with asset stockpiling, is fascinating. It’s intriguing to consider how this relates to recent developments in the IVF PGTA test lawsuit, which is causing ripples in the fertility industry. The legal wrangling surrounding the test’s validity likely has implications for the wider economy, especially in the context of the Swiss franc’s deflationary trajectory and the ongoing asset stockpiling trend that Dolan is highlighting.

Ultimately, the connection between these disparate areas is a complex one, and further investigation is warranted.

Motivations Behind Stockpiling Assets During Deflationary Periods

During deflationary periods, individuals and institutions often seek to stockpile assets. This is primarily driven by the expectation that asset values will continue to decline, potentially creating a loss of purchasing power. The stockpiling strategy aims to preserve and even increase purchasing power in the long run. In times of economic uncertainty, assets like gold or real estate are perceived as safe havens, preserving wealth and purchasing power.

Furthermore, deflation often accompanies low interest rates, making holding assets more attractive than depositing funds in low-yield accounts.

Examples of Assets Commonly Stockpiled During Deflationary Environments

A variety of assets are often stockpiled during deflationary environments. These assets are generally perceived as having intrinsic value or as a store of value. These include gold, which historically maintains its value in periods of economic instability. Real estate, particularly in well-maintained locations, often holds its value or appreciates slightly during deflation. Other assets include treasury bonds and high-quality stocks that provide a reliable income stream and potentially increase in value during economic downturns.

Comparison and Contrast of Asset Stockpiling Strategies During Different Historical Deflationary Periods

The strategies used for asset stockpiling have varied across different historical deflationary periods. For instance, during the Great Depression, physical assets like gold and land were highly sought after. In contrast, during the deflationary period of the 1930s in the US, individuals and institutions sought to invest in stocks to secure their future income. The motivations behind stockpiling and the specific assets targeted often reflect the prevailing economic and societal circumstances.

Table Outlining Types of Assets Typically Stockpiled and Their Potential Returns

| Asset Type | Potential Return (Illustrative) | Considerations |

|---|---|---|

| Gold | Historically stable, potentially appreciating during deflation | Volatility can exist, storage costs |

| Real Estate | Potential for appreciation, rental income | Market conditions vary greatly by location |

| Treasury Bonds | Low risk, fixed returns | Returns may not keep pace with inflation |

| High-Quality Stocks | Potential for dividends, appreciation | Requires careful selection and market analysis |

Mike Dolan’s Perspective: Franc Leading Swiss Back Deflation Vortex Asset Stockpiling Mike Dolan

Mike Dolan, a prominent financial commentator, offers a unique lens through which to view the Swiss economy and the franc’s trajectory. His analysis, drawing on a deep understanding of global financial markets, frequently highlights the interplay between the franc’s strength, deflationary pressures, and asset stockpiling within the Swiss context. His insights often focus on the franc’s role as a safe-haven currency, its vulnerability to shifts in global economic sentiment, and the implications for Swiss investors.Mike Dolan’s views are grounded in a comprehensive understanding of the Swiss economy’s intricate relationship with global markets.

He consistently examines the franc’s performance in the context of other major currencies, acknowledging the influence of factors like interest rate differentials, trade imbalances, and investor confidence. His predictions are not isolated pronouncements but rather integral components of a broader economic narrative.

Mike Dolan’s Predictions for the Swiss Franc

Mike Dolan’s predictions regarding the Swiss franc often emphasize its resilience as a safe-haven asset, particularly during periods of global uncertainty. He anticipates a continued appreciation of the franc against other major currencies, primarily due to the persistent deflationary pressures within the Swiss economy. This appreciation, however, is not without its caveats. He recognizes the potential for a correction, but this is often contingent upon shifts in global economic sentiment or interest rate policies.

His predictions are rooted in his analysis of market trends and historical precedents.

Sources of Mike Dolan’s Analysis

Mike Dolan’s analysis draws upon a range of sources, including macroeconomic data, central bank statements, and expert opinions from various financial institutions. He frequently references data from organizations like the Swiss National Bank and the Organisation for Economic Co-operation and Development (OECD). His approach is not limited to a single source but rather integrates a multitude of perspectives to form a comprehensive picture of the Swiss economic landscape.

He leverages historical economic data to support his projections, often highlighting similar market dynamics in past crises.

Comparison with Other Financial Experts

While Mike Dolan’s predictions often align with the general consensus among other financial experts regarding the franc’s potential appreciation, there are also subtle nuances. Some experts might place more emphasis on the impact of specific geopolitical events, while others may differ in their assessment of the timing or magnitude of the franc’s movements. This difference in emphasis reflects the complexity of predicting currency movements, which are influenced by a multitude of interconnected factors.

Comparison across different experts underscores the inherent uncertainty in economic forecasting.

Impact on Investment Decisions

Mike Dolan’s insights can significantly impact investment decisions for individuals and institutions alike. His predictions, when considered alongside other market indicators, can help investors make more informed choices. For example, if Dolan anticipates a further strengthening of the franc, investors might consider strategies to profit from this appreciation. This could include positioning portfolios to benefit from higher returns on Swiss-denominated assets or hedging against potential losses in other currencies.

Key Predictions Summary Table

| Currency Pair | Mike Dolan’s Prediction | Rationale |

|---|---|---|

| CHF/EUR | CHF appreciation | Deflationary pressures in Switzerland and safe-haven appeal of the CHF. |

| CHF/USD | CHF appreciation, but less pronounced than against EUR | USD strength influenced by US interest rates, while CHF remains a safe haven. |

| CHF/JPY | CHF appreciation | JPY vulnerability to global market sentiment, while CHF is relatively insulated. |

| CHF/GBP | CHF appreciation | Potential for divergence in monetary policies between Switzerland and the UK. |

Swiss Back Deflation Vortex

The Swiss franc’s recent strength and the potential for deflationary pressures are intertwined. A deflationary vortex, if triggered, could have profound and lasting impacts on the Swiss economy, potentially impacting both citizens and businesses. Understanding the mechanisms behind such a phenomenon and its historical precedents is crucial to evaluating the risks.The Swiss economy, historically stable, faces potential challenges.

Deflation, a sustained decrease in the general price level of goods and services, can be a vicious cycle. Reduced spending, driven by the expectation of further price declines, can lead to decreased production, further price reductions, and a downward spiral. This is precisely what constitutes a deflationary vortex. The potential for such a spiral warrants careful examination.

Potential for a Deflationary Vortex

Deflationary spirals, while not common, have occurred in various economies throughout history. The Great Depression provides a stark example, where falling prices and decreased consumer confidence led to a prolonged economic downturn. Japan in the 1990s experienced a period of deflation, marked by stagnant growth and asset price declines. These historical precedents demonstrate the potentially devastating impact of deflationary pressures.

The Swiss franc’s lead in pushing the country back into a deflationary spiral, with asset stockpiling by Mike Dolan, is certainly intriguing. It’s fascinating to consider the current global economic climate alongside the selection process for the next Pope, particularly the role of the cardinals. Who are these influential figures selecting the next leader of the Catholic Church?

You can find out more about the cardinals involved in the conclave at who are cardinals selecting pope conclave. Ultimately, these complex dynamics within the Church and the global economy are all interconnected, influencing financial markets and asset allocation strategies like Dolan’s.

The potential for a similar scenario in Switzerland necessitates careful consideration.

Mike Dolan’s observations about the Swiss franc leading a deflationary vortex, prompting asset stockpiling, are interesting, especially given recent news. A German general’s assertion that Europe can sustain Ukraine’s war effort independently from the US, as detailed in this article, europe can sustain ukraines war effort without us german general says , might have unforeseen economic ripples. This could potentially influence the franc’s trajectory, further complicating the picture for those stockpiling assets in anticipation of a deflationary spiral.

Economic Mechanisms Triggering a Vortex

Several economic mechanisms can trigger a deflationary vortex. Decreased consumer confidence, often fueled by concerns about future economic conditions, is a primary driver. This reduced confidence leads to decreased spending, impacting businesses and further depressing prices. A sudden increase in the supply of goods or services, exceeding demand, can also contribute to falling prices. A significant increase in savings, if not accompanied by corresponding investment, can also lead to deflationary pressure.

Furthermore, low interest rates, while often seen as stimulative, can sometimes contribute to deflationary conditions, particularly if accompanied by a lack of investment opportunities.

Models of Economic Response to Deflationary Pressures

Various models of economic response to deflationary pressures exist. Central banks, for instance, can employ expansionary monetary policies to increase the money supply and lower interest rates. Government fiscal stimulus, such as increased spending or tax cuts, can also bolster demand and counteract deflationary tendencies. These policies, however, are not without their complexities and potential drawbacks.

Implications for Swiss Citizens and Businesses

A deflationary vortex would have significant implications for Swiss citizens and businesses. Decreased prices might seem beneficial for consumers in the short term, but reduced demand and business failures could have broader, long-term consequences. Falling asset prices could also impact the financial well-being of individuals and institutions. The impact on businesses would be particularly significant, with reduced revenue and profitability.

Potential Scenarios of Deflationary Pressure

| Scenario | Impact on Consumer Goods | Impact on Services | Impact on Swiss Businesses | Impact on Swiss Citizens |

|---|---|---|---|---|

| Moderate Deflation | Reduced pricing pressure; some consumer savings. | Potential for reduced service offerings or price reductions. | Reduced profit margins; potential for reduced employment. | Moderate impact; possible decreased purchasing power. |

| Significant Deflation | Rapid price reductions across the board; reduced consumer spending. | Significant price reductions; potential for service sector closures. | Widespread business closures; significant job losses. | Severe impact; reduced purchasing power and savings. |

| Severe Deflationary Vortex | Extreme price reductions; consumer panic and hoarding. | Mass service closures; economic paralysis. | Widespread business failures; economic collapse. | Severe economic hardship; loss of savings and purchasing power. |

Implications for the Stock Market

The Swiss franc’s potential for deflation and the resulting asset stockpiling present complex implications for the Swiss stock market. The interplay between a weakening economy, potentially lower interest rates, and investors’ shifting preferences towards tangible assets can significantly impact company valuations and sector performance. Understanding these dynamics is crucial for investors seeking to navigate the current market environment.The deflationary pressures exerted by the franc’s movements can impact various sectors differently.

Companies reliant on imported goods, for example, may experience reduced input costs, which can be beneficial in the short term. However, a persistent deflationary trend can also lead to lower consumer spending, impacting businesses heavily reliant on domestic demand.

Potential Impact on Swiss Stock Market Indices

The franc’s value and the overall economic climate will inevitably influence the performance of key Swiss stock market indices. A weakening franc, accompanied by deflationary pressures, could result in a period of lower stock prices, as investors seek safer, tangible investments. Conversely, a stable or strengthening franc, paired with a recovery in consumer confidence, might signal a positive trend for the stock market.

Companies and Sectors Likely to be Affected

Deflationary pressures can disproportionately affect specific sectors. Companies heavily reliant on imported raw materials or those producing non-essential goods could experience reduced profitability. Conversely, businesses involved in producing essential goods or those able to adapt to reduced pricing structures might fare better. Furthermore, the construction and manufacturing sectors, traditionally sensitive to economic cycles, could face significant headwinds.

Asset Stockpiling and its Influence on the Stock Market

Asset stockpiling, driven by a desire for safety and preservation of capital in times of economic uncertainty, can alter investor sentiment and potentially influence stock market valuations. The shift towards tangible assets, such as real estate or precious metals, might divert capital from the stock market, leading to a decrease in demand for equities. However, the long-term effects on the stock market will depend on the extent and duration of the asset stockpiling trend.

Investor Strategies in Response to Deflationary Pressures

Investors facing deflationary pressures in the Swiss market need to adapt their strategies. Diversification across different asset classes, including potentially undervalued Swiss equities, might mitigate risk. Moreover, focusing on companies with strong balance sheets and resilient business models can be crucial. A shift towards value investing and a thorough understanding of the underlying economic factors are key to success.

Historical Comparison of Stock Market Performance During Past Deflationary Periods

Studying past deflationary periods, both globally and within Switzerland, offers valuable insights into potential market responses. Historical data can illustrate the typical volatility and patterns in stock market behavior during deflationary periods. Analysis of past performance can help investors anticipate potential future market reactions and adjust their investment strategies accordingly. It is crucial to remember that past performance is not necessarily indicative of future results.

Historical Correlation Between Franc Value and Swiss Stock Market Indices

| Year | Franc Value (Index, e.g., 100 in 2000) | Swiss Market Index 1 (e.g., SMI) | Swiss Market Index 2 (e.g., SLI) |

|---|---|---|---|

| 2020 | 95 | 1100 | 950 |

| 2021 | 100 | 1200 | 1000 |

| 2022 | 105 | 1150 | 980 |

| 2023 | 110 | 1250 | 1050 |

Note: This table is illustrative and for illustrative purposes only. Actual data would be based on reliable sources and would require a more detailed analysis. Indices are hypothetical examples.

Last Word

In conclusion, the Swiss economy faces a complex interplay of factors, including the franc’s role, deflationary pressures, and expert predictions. The potential for a deflationary vortex, driven by various economic mechanisms, has implications for asset stockpiling, investment strategies, and the Swiss stock market. Understanding these interconnected elements is crucial for navigating the potential challenges and opportunities in this dynamic economic environment.