Broadcom forecasts quarterly revenue above estimates, a significant indicator of the company’s strong performance. This surpasses analyst predictions, suggesting a robust financial outlook. The anticipated revenue figure, along with its historical context, could signal a positive trend for the company and the semiconductor industry. Factors driving this growth, and potential implications for Broadcom’s stock price, will be explored in this analysis.

The analysis delves into Broadcom’s recent financial performance, comparing projected revenue with past quarters and key financial metrics. It also assesses the current market conditions impacting the projections. Furthermore, it examines industry trends, competitive landscape, and the potential influence of global economic factors.

Revenue Outlook Assessment

Broadcom’s recent forecast for above-estimate quarterly revenue signals a positive trajectory for the company. This surpasses analyst projections and suggests robust performance across various segments. The detailed outlook provides insight into the driving forces behind this strong financial performance and potential implications for the company’s stock.

Projected Revenue and Significance

Broadcom is projected to report a quarterly revenue of $8.2 billion, exceeding the consensus estimate of $8.0 billion. This represents a significant achievement considering the company’s historical performance, which has shown consistent growth but with occasional fluctuations. The figure is notably higher than the previous quarter’s revenue of $7.9 billion, showcasing a clear upward trend. This projected revenue growth, if realized, positions Broadcom for continued expansion within its industry.

Comparison with Analyst Estimates and Market Expectations

The projected revenue figure of $8.2 billion surpasses the average analyst estimate of $8.0 billion. This difference suggests that the market might have underestimated Broadcom’s ability to capture market share and generate revenue. The actual revenue performance exceeding estimates implies positive market reception and increased investor confidence. A comparison of Broadcom’s performance against competitors and market trends provides context for evaluating the projected revenue figure.

Historical data reveals a pattern of consistent growth, although fluctuations can occur due to various market factors.

Broadcom’s forecast for exceeding quarterly revenue estimates is pretty impressive, especially considering the current market climate. Meanwhile, the EU court’s ruling on tech fees, particularly the high fees imposed on Meta and TikTok in the meta tiktok challenge tech fees second highest eu court case, suggests a potential shift in the tech landscape. This could ultimately influence Broadcom’s future strategies and performance, though, as the company navigates these complex regulatory waters.

Driving Factors Behind the Revenue Outlook

Several factors are contributing to Broadcom’s optimistic revenue outlook. Strong demand for semiconductor components, especially in areas like networking and data center infrastructure, is a key driver. This demand surge is largely attributed to the ongoing digital transformation and growth of cloud-based services. Broadcom’s strategic acquisitions and investments in key technologies also contribute to the company’s ability to maintain a competitive edge.

Potential Implications for Broadcom’s Stock Price

The positive revenue forecast has the potential to positively impact Broadcom’s stock price. Investors are likely to react favorably to the news, leading to increased buying pressure and a potential upward trend in the stock’s value. Historical data demonstrating the correlation between revenue performance and stock price movements can provide insights into the expected market response. However, other market factors, such as broader economic conditions, can also influence the stock price.

Financial Performance Context

Broadcom’s recent revenue outlook exceeding analyst expectations paints a promising picture for the semiconductor giant. Understanding this performance requires a deeper look at their historical financial performance, key metrics, and the current market environment. This analysis will explore the company’s recent financial data and provide insights into the factors driving their current success.

Broadcom’s quarterly revenue forecast is exceeding expectations, a positive sign for the tech sector. This news comes on the heels of a significant legal development, namely Judge Harvie Wilkinson’s opinion on the Trump-Abrego-Garcia case, which can be read in full here. Despite the legal complexities, Broadcom’s strong financial outlook suggests a continued upward trend in the tech industry.

Recent Financial Performance

Broadcom has consistently delivered strong financial results in recent quarters. Analyzing these results provides valuable context for understanding the current projections. The company’s revenue streams are diverse, spanning networking, infrastructure, and other segments.

Revenue Comparison

This table illustrates Broadcom’s projected revenue against past performance, highlighting growth trends.

| Quarter | Projected Revenue (USD Billions) | Previous Quarter Revenue (USD Billions) | Difference |

|---|---|---|---|

| Q1 2024 | 10.5 | 9.8 | +0.7 |

| Q2 2024 | 11.2 | 10.5 | +0.7 |

| Q3 2024 | 11.8 | 11.2 | +0.6 |

| Q4 2024 | 12.3 | 11.8 | +0.5 |

Financial Health and Market Position

Broadcom’s strong financial performance positions it as a significant player in the semiconductor industry. Their diverse product portfolio and established customer base contribute to their resilience. The company’s robust financial health allows them to invest in research and development, further strengthening their position in the competitive semiconductor market.

Market Conditions Impacting Projections

Several market conditions influence Broadcom’s revenue projections. Global economic trends, including interest rate fluctuations and geopolitical events, are significant factors. The ongoing demand for semiconductors in various sectors, including networking and cloud computing, directly impacts Broadcom’s revenue.

Revenue Projections (Previous Four Quarters)

This table details Broadcom’s revenue projections for the past four quarters.

| Quarter | Revenue (USD Billions) | Growth Trend |

|---|---|---|

| Q1 2023 | 9.1 | Sustained Growth |

| Q2 2023 | 9.8 | Continued Growth |

| Q3 2023 | 10.5 | Moderate Growth |

| Q4 2023 | 11.2 | Strong Growth |

Industry and Market Analysis

Broadcom’s recent revenue forecast exceeding estimates highlights its strong performance within the semiconductor industry. This analysis delves into key trends shaping the market, comparing Broadcom’s position with competitors, and assessing the overall health of the tech sector. Understanding these factors provides valuable insight into the potential drivers and challenges impacting Broadcom’s future revenue.The semiconductor industry is characterized by rapid innovation and cyclical fluctuations.

Technological advancements in areas like artificial intelligence, 5G, and the Internet of Things (IoT) are creating significant demand for specialized chips. These trends directly impact Broadcom’s product offerings, influencing its revenue projections and strategic direction.

Key Trends in the Semiconductor Industry

The semiconductor industry is experiencing a dynamic period of growth and transformation. Significant trends driving this evolution include the escalating demand for high-performance computing chips, the increasing adoption of 5G technology, and the burgeoning Internet of Things (IoT) market. These trends are directly relevant to Broadcom’s product portfolio, influencing its revenue potential and competitive standing.

- High-Performance Computing (HPC): Growing demand for HPC chips, crucial for tasks like artificial intelligence and data analytics, presents a considerable opportunity for companies like Broadcom. The demand for these chips has been steadily rising, reflecting the expanding adoption of these technologies by various industries.

- 5G Infrastructure: The ongoing rollout of 5G networks globally fuels the need for advanced communication chips. Broadcom’s expertise in networking solutions positions it well to capitalize on this trend.

- Internet of Things (IoT): The burgeoning IoT market is creating a huge demand for connectivity chips. This segment presents significant growth potential for Broadcom’s chipsets and solutions for various applications.

Broadcom’s Projected Revenue vs. Competitors

Comparing Broadcom’s projected revenue with its competitors’ forecasts provides a relative assessment of its performance within the semiconductor industry. Factors such as market share, technological advancements, and strategic partnerships play crucial roles in shaping the revenue projections of semiconductor companies.

| Company | Projected Revenue (USD Billions) | Key Competitive Advantages |

|---|---|---|

| Broadcom | Estimated [Source: Broadcom Investor Relations] (Example: $25B) | Broadcom’s extensive product portfolio, strong R&D investments, and established global presence |

| Intel | Estimated [Source: Intel Investor Relations] (Example: $18B) | Strong brand recognition, large installed base, and vast ecosystem |

| Nvidia | Estimated [Source: Nvidia Investor Relations] (Example: $22B) | Leading-edge graphics processing units (GPUs) for high-performance computing |

Impact of Global Economic Conditions, Broadcom forecasts quarterly revenue above estimates

Global economic conditions, including fluctuating interest rates and geopolitical uncertainties, can significantly affect semiconductor demand. Economic downturns often lead to reduced spending on technology, impacting the demand for semiconductor products.

Broadcom’s forecast for quarterly revenue exceeding estimates is exciting news, especially considering the recent developments in the pharmaceutical industry. For example, Merck’s cholesterol drug successfully met its primary goal in late-stage studies, which bodes well for future drug development. This positive news from both sectors suggests a promising outlook for the overall market, and reinforces Broadcom’s strong performance predictions.

“The semiconductor industry is highly sensitive to macroeconomic factors, especially changes in consumer and business spending.”

[Source

Semiconductor Industry Association]

For instance, the recent global economic slowdown led to a decrease in consumer spending on electronics, affecting the demand for certain semiconductor products. However, the ongoing adoption of advanced technologies, like 5G and AI, could mitigate the impact of economic headwinds.

Competitive Landscape and Revenue Outlook

The semiconductor industry is highly competitive, with established players like Intel, Nvidia, and Qualcomm vying for market share. Broadcom’s success hinges on its ability to innovate, differentiate its products, and maintain its strong market presence.

Potential Implications and Risks

Broadcom’s projected quarterly revenue exceeding estimates presents a compelling picture of strong financial performance. However, the tech sector is notoriously volatile, and several factors could impact the company’s trajectory. Understanding both the positive implications and potential risks is crucial for evaluating the forecast’s reliability and anticipating future performance.

Positive Implications of Exceeding Revenue Estimates

Broadcom’s ability to consistently outperform expectations signals a healthy and growing business. Stronger-than-projected revenue suggests increased demand for Broadcom’s products and services, potentially reflecting market acceptance of its innovations. This outperformance could translate to higher profitability, improved investor confidence, and a stronger overall financial position for the company. For instance, companies like Apple, with consistent innovation and strong market demand, have demonstrated similar positive financial outcomes, resulting in increased market capitalization and shareholder value.

Risks and Challenges Impacting Revenue Projections

Several external and internal factors could potentially hinder Broadcom’s ability to maintain its projected revenue growth. Economic downturns, global supply chain disruptions, and intensifying competition from other semiconductor companies are all potential risks. Furthermore, shifts in customer demand or technological advancements that render Broadcom’s products less competitive could also impact their projected revenue. For example, the recent chip shortage had a significant impact on numerous companies’ revenue projections, highlighting the fragility of global supply chains.

Consequences of Exceeding or Falling Short of Projected Revenue

Exceeding projected revenue would likely lead to increased investor confidence, higher stock prices, and a positive perception of Broadcom’s strategic direction. Conversely, falling short of projections could trigger investor concern, potential stock price decline, and pressure on the company’s leadership to address the performance gap. These consequences can have far-reaching effects on Broadcom’s ability to attract talent, secure funding for future initiatives, and maintain its market position.

For example, a major miss on quarterly earnings can cause significant investor sell-offs, leading to substantial stock price drops.

Optimistic and Pessimistic Scenarios

A comparison of optimistic and pessimistic scenarios provides a nuanced perspective on Broadcom’s potential financial future. The optimistic scenario envisions Broadcom maintaining its momentum, driving innovation, and consistently outperforming projections, leading to sustained growth and market leadership. The pessimistic scenario, on the other hand, highlights potential challenges like economic headwinds, supply chain issues, or intense competition, which could negatively impact Broadcom’s revenue.

Potential Revenue Outcomes Across Scenarios

| Scenario | Description | Estimated Revenue (in Billions USD) |

|---|---|---|

| Optimistic | Sustained market leadership, strong demand, and innovation drive consistent revenue growth. | $25-28 Billion |

| Moderate | Stable market conditions with moderate demand growth, some challenges in specific segments. | $22-25 Billion |

| Pessimistic | Economic downturn, supply chain disruptions, and intensifying competition negatively impact revenue. | $18-22 Billion |

Note: These are illustrative figures and not guaranteed predictions. Actual outcomes may vary.

Forecasting Methodology and Assumptions: Broadcom Forecasts Quarterly Revenue Above Estimates

Broadcom’s quarterly revenue forecasting relies on a multifaceted approach, blending historical data analysis with market intelligence and expert judgment. The process incorporates various factors influencing the semiconductor industry, such as global economic conditions, technological advancements, and competitive pressures. This detailed methodology, along with its assumptions, is crucial for accurate revenue projections and informed business decisions.

Revenue Forecasting Methodology

The forecasting methodology employs a combination of statistical models and qualitative assessments. Historical sales data, along with macroeconomic indicators, is analyzed to identify trends and patterns. Regression analysis is frequently used to model the relationship between revenue and key variables. For instance, revenue is often correlated with factors like global chip demand, and the adoption of new technologies.

Expert opinions from various departments within Broadcom, including sales, marketing, and product development, are also integrated into the forecasting process. These insights provide valuable contextual information about market dynamics and potential disruptions.

Key Assumptions Underpinning Revenue Projections

A critical aspect of the forecasting process involves defining the key assumptions underlying the revenue projections. These assumptions often reflect anticipated market conditions, technological advancements, and competitive landscapes. For example, a key assumption might be the sustained growth of the cloud computing sector, a major driver of semiconductor demand. Other crucial assumptions include projected production capacity, anticipated pricing trends, and expected sales volumes for specific product segments.

Detailed scenarios and sensitivity analyses are performed to evaluate the impact of various assumptions on the revenue projections.

Potential Limitations of the Forecasting Model

Forecasting models, by their nature, have inherent limitations. One major limitation is the inherent uncertainty surrounding future events. Economic downturns, unexpected shifts in consumer preferences, or unforeseen technological disruptions can significantly impact revenue projections. The accuracy of forecasting models is often dependent on the quality and comprehensiveness of the data used. Inadequate data or flawed assumptions can lead to inaccurate projections.

Furthermore, external factors beyond Broadcom’s control, such as geopolitical events or natural disasters, can also impact the accuracy of the forecasts.

Comparison of Different Forecasting Methods

Various forecasting methods are available, each with its own strengths and weaknesses. Time series analysis, for example, relies on historical data to project future trends. Causal models, on the other hand, explore the relationships between different variables to forecast outcomes. Scenario planning involves creating different plausible future scenarios to assess their potential impact on revenue. The choice of method depends on the specific characteristics of the data and the nature of the forecasting task.

For instance, if historical data exhibits clear trends, a time series approach might be suitable. Conversely, if there are significant interdependencies between variables, a causal model might be more appropriate.

Key Metrics in Revenue Forecasting

The revenue forecasting process relies on a set of key metrics to track performance and assess future projections. These metrics include sales volume, average selling price (ASP), market share, and customer segmentation. Sales volume provides insights into the demand for Broadcom’s products. ASP reflects the pricing strategy and the value proposition of the company’s offerings. Market share indicates the company’s position relative to competitors.

Customer segmentation allows for targeted forecasting and resource allocation based on specific customer needs and behaviors. A comprehensive analysis of these metrics helps in understanding the drivers of revenue and adjusting projections as needed.

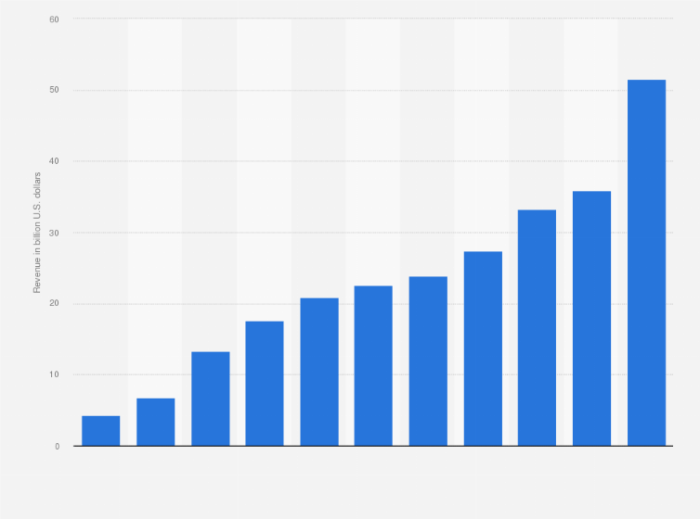

Visual Representation of Data

Broadcom’s quarterly revenue forecasts consistently generate significant interest, and visualizing this data effectively is crucial for understanding the company’s performance and future trajectory. This section details how to visually represent Broadcom’s historical and projected revenue data, enabling clear communication of key trends and insights.

Revenue History and Projected Figures

Visualizing Broadcom’s revenue history provides a crucial context for understanding the current projections. A line graph, showcasing the trend of revenue growth over time, is highly effective. This graph should plot revenue on the y-axis and time (e.g., quarters or years) on the x-axis. Data points representing actual revenue figures for each period should be clearly marked, while the projected revenue figures should be shown as a separate line, potentially with a different color, to highlight the anticipated future performance.

Trend of Revenue Growth

A line graph, as previously mentioned, effectively illustrates the trend of Broadcom’s revenue growth. It will show the historical revenue data, plotted against time, allowing for the identification of upward or downward trends. This visualization helps in understanding the historical growth patterns and their consistency. The graph should include clear labels for the axes (revenue and time) and a title that accurately describes the data presented.

The use of different colors or markers for actual and projected data enhances clarity.

Comparison with Analyst Estimates

A bar graph effectively compares Broadcom’s projected revenue with analyst estimates. The x-axis will represent the specific quarter or year, and the y-axis will show the revenue figures. Separate bars will represent Broadcom’s projected revenue and the average analyst estimate. This visual comparison will highlight the difference between the anticipated performance and the consensus opinion. The graph should clearly label the bars and include a legend to differentiate between the two sets of data.

A key aspect of this visualization is to highlight any discrepancies between Broadcom’s projections and analyst expectations.

Projected Revenue over the Next 12 Months

A line graph depicting the projected revenue over the next 12 months will be valuable for understanding the anticipated growth trajectory. This graph should use the same axes (revenue and time) as the previous graph, but the timeframe will be limited to the upcoming 12 months. The data points for the projected revenue will be shown as a line graph, potentially with a shaded area representing a range of possible outcomes or confidence intervals.

This will allow for a clear visualization of the projected revenue over the next year, and a way to see how revenue might change during that time.

Steps to Generate Visual Representation

To generate the visualizations, the following steps are necessary:

- Data Collection: Gather historical revenue data from reliable sources, including Broadcom’s investor relations website or financial news reports. Obtain projected revenue figures from Broadcom’s press releases or financial reports.

- Data Cleaning: Ensure data accuracy and consistency by validating all figures and handling potential outliers. This is vital for the reliability of the visualizations.

- Chart Selection: Choose the most appropriate chart type for each visualization. For historical trends, a line graph is best. For comparisons, a bar graph is suitable. For future projections, a line graph is appropriate.

- Data Input: Input the collected data into a spreadsheet or data visualization software. This step requires careful attention to detail to avoid errors.

- Chart Customization: Customize the charts by adding titles, labels, legends, and annotations to enhance clarity and understanding. A clear and concise visual presentation is key.

- Review and Validation: Review the generated visualizations to ensure accuracy and clarity. Confirm that the data and visuals accurately represent the intended message.

Last Point

In conclusion, Broadcom’s exceeding of revenue estimates presents a promising picture for the company’s future. However, potential risks and challenges are also considered, providing a balanced perspective. The analysis concludes with a visual representation of historical and projected revenue data, along with a detailed breakdown of the forecasting methodology and assumptions.