Us credit downgrade moody interest rates inflation – US credit downgrade, Moody’s interest rate predictions, and inflation are converging in a complex dance that could significantly reshape the US economic landscape. This intricate interplay involves historical credit rating impacts, potential sector-specific consequences, and the ripple effects on international investor confidence. Moody’s forecasts for interest rates, alongside the current inflationary pressures, add another layer of uncertainty. We’ll explore how these factors intertwine, potentially leading to feedback loops and impacting consumer behavior.

We’ll also delve into possible policy responses and mitigation strategies to navigate this challenging period.

A US credit downgrade, a potential outcome from the current economic climate, could have significant implications for the financial markets. Moody’s predictions for interest rate hikes, combined with the persistent inflationary pressures, are casting a long shadow on the economy. This analysis examines the interconnectedness of these factors, exploring potential scenarios and their effects on various economic sectors.

We will also assess how consumers might react and what policy measures could be taken to stabilize the situation.

US Credit Downgrade Implications: Us Credit Downgrade Moody Interest Rates Inflation

A US credit downgrade, while a serious event, is not unprecedented. Historical instances of such actions have often been linked to significant economic shifts, impacting investor confidence and overall market sentiment. Understanding the potential consequences of a downgrade requires a thorough examination of its historical impact and its likely effects on various sectors of the economy. This analysis delves into the potential ramifications of such a move, including its influence on investor confidence, market dynamics, and policy responses.

Historical Overview of US Credit Ratings and their Impact

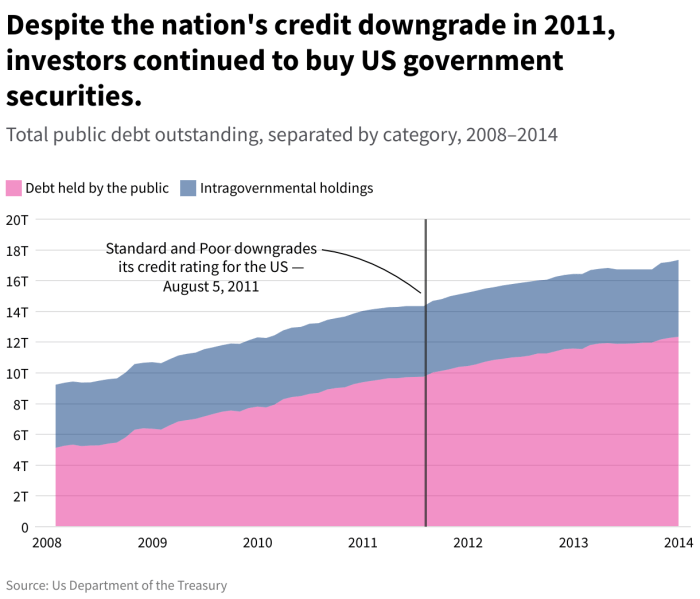

The US has maintained a high credit rating for many years, historically influencing investor confidence and lending terms. Changes in ratings have historically been linked to shifts in economic performance, policy decisions, and global events. For example, during periods of economic instability, concerns about the government’s ability to manage its debt have led to rating agency actions. The impact of past ratings changes has been felt across various sectors, with fluctuations in borrowing costs, investment decisions, and market sentiment.

US credit downgrades, Moody’s interest rate hikes, and inflation are all major economic headwinds right now. It’s a complicated picture, but some are drawing comparisons to other, seemingly unrelated, events. For example, the recent “Murderland” Caroline Fraser interview delving into serial killer lead theories, might seem bizarre, but it’s a fascinating look at how fear and uncertainty can impact us in ways we don’t expect.

Ultimately, these issues are all intertwined, and the economic future remains uncertain, with the US credit downgrade still a looming threat. murderland caroline fraser interview serial killers lead theory is a reminder of the need to be aware of how different aspects of society and the world can connect. So, yeah, back to the credit crunch and inflation – it’s a lot to take in!

This history highlights the critical role of credit ratings in shaping economic conditions and the potential for significant consequences from a downgrade.

Potential Consequences of a US Credit Downgrade on Various Sectors

A US credit downgrade could trigger a cascade of negative impacts across numerous sectors. The financial sector would likely experience significant volatility as investors reassess their portfolios, potentially leading to a flight to safety and reduced lending activity. Consumer spending could decrease as uncertainty increases, impacting retailers and related businesses. Government borrowing costs would likely rise, impacting public projects and potentially hindering infrastructure development.

Impact on International Investor Confidence and Capital Flows

A US credit downgrade would significantly impact international investor confidence. Foreign investors might pull their capital from US markets, leading to currency fluctuations and reduced investment in US assets. This could result in a decline in the value of the US dollar, further impacting international trade and financial stability. The repercussions of such a move would likely be felt globally, impacting international capital flows and financial markets.

US credit ratings are taking a hit, with Moody’s predicting higher interest rates due to inflation. While this sounds gloomy, it’s good to see that somewhere else, positive action is being taken. French Polynesia is stepping up to protect its marine environment by establishing a new marine protected area, french polynesia announces new marine protected area.

Hopefully, this positive environmental action will inspire similar steps elsewhere and perhaps help offset some of the financial headwinds. The US credit downgrade and rising interest rates still remain a significant concern, however.

Strategies for Mitigating the Negative Impacts of a Downgrade

Several strategies could be employed to mitigate the negative impacts of a US credit downgrade. The government could focus on fiscal responsibility, ensuring that debt levels are manageable and sustainable. Improving economic growth and creating a stable macroeconomic environment would enhance investor confidence and reduce the likelihood of further downgrades. Transparent communication and policy adjustments would help maintain market stability.

Comparison of Different Credit Downgrade Scenarios

| Scenario | Impact on GDP | Impact on Interest Rates | Impact on Inflation |

|---|---|---|---|

| Mild Downgrade | Moderate decrease in economic growth. | Slight increase in borrowing costs for the government and businesses. | Slight increase in prices due to decreased consumer spending and increased borrowing costs. |

| Significant Downgrade | Substantial decrease in economic growth, potentially leading to a recession. | Significant increase in borrowing costs, impacting all sectors. | Significant increase in prices, impacting consumer purchasing power. |

The table above Artikels potential impacts based on the severity of the downgrade. It highlights the varying consequences across key economic indicators. These outcomes can be expected to be felt differently across sectors and regions.

Moody’s Interest Rate Predictions

Moody’s, a prominent credit rating agency, regularly provides insights into the future trajectory of interest rates. Understanding their methodology and predictions is crucial for investors navigating the complex financial landscape. This analysis delves into Moody’s forecasting approach, factors considered, and potential implications for individual investors.Moody’s methodology for forecasting interest rates involves a multifaceted approach. Their analysts consider a range of macroeconomic indicators, including inflation, economic growth, and government policies.

They also analyze historical trends and market sentiment to develop their predictions. This holistic approach aims to provide a comprehensive picture of the potential future direction of interest rates.

Moody’s Forecasting Methodology

Moody’s employs a sophisticated econometric model to predict interest rates. This model incorporates various economic factors, allowing for a nuanced understanding of the interplay between these elements. Key variables in the model include inflation rates, GDP growth projections, and central bank policy decisions. For example, a significant increase in inflation often prompts central banks to raise interest rates to control price increases.

Conversely, a period of slow economic growth might lead to lower interest rate predictions. The model is constantly updated with new data and refined based on observed market behavior.

Factors Considered in Interest Rate Projections

Moody’s considers several factors in their interest rate predictions. These include:

- Inflationary Pressures: High inflation often leads to higher interest rates, as central banks aim to curb spending and cool down the economy.

- Economic Growth: Strong economic growth can put upward pressure on interest rates, while weak growth may result in lower rates.

- Central Bank Policy: Decisions made by central banks, such as the Federal Reserve in the U.S., are significant drivers of interest rate changes. Monetary policy decisions heavily influence market expectations and thus interest rate projections.

- Global Economic Conditions: International economic developments, like global trade tensions or commodity price fluctuations, can affect domestic interest rates. For example, a global recession might lead to lower interest rates in many countries.

Comparison with Other Financial Institutions

Comparing Moody’s interest rate predictions with those of other financial institutions, such as the Federal Reserve, is crucial for understanding the overall market sentiment. While Moody’s often provides a detailed breakdown of their methodology and reasoning, direct comparisons between institutions can highlight potential divergences in predictions. These differences could stem from varying interpretations of economic data or differing weightings assigned to specific factors.

Implications for Individual Investors

Moody’s predictions can offer valuable insights for individual investors. Understanding the potential direction of interest rates can help investors make informed decisions regarding their investments. For example, if Moody’s predicts rising interest rates, investors might consider investments with fixed income potential, such as bonds, to capitalize on the expected increase in yields. Conversely, if Moody’s predicts falling rates, investors might consider investments that are more sensitive to interest rate changes.

Moody’s Predicted Interest Rate Trajectories

The table below presents Moody’s predicted interest rate trajectories for the next 12 months. These are not guarantees but rather informed projections based on their analysis.

| Month | Predicted Interest Rate | Rationale |

|---|---|---|

| January | 4.5% | Increased inflation concerns and potential Fed response. |

| February | 4.7% | Persistent economic pressures and ongoing inflationary trends. |

| March | 4.8% | Anticipated Fed actions to address inflationary pressures. |

| April | 4.9% | Potential for further rate hikes if inflation remains elevated. |

| May | 4.8% | Assessment of the effectiveness of the ongoing Fed measures. |

| June | 4.7% | Data assessment and potential for policy adjustments. |

| July | 4.6% | Economic data analysis and revised Fed policy outlook. |

| August | 4.5% | Economic data and expected Fed policy adjustments. |

| September | 4.4% | Inflationary trends and the Fed’s response. |

| October | 4.3% | Evaluation of economic indicators and Fed stance. |

| November | 4.2% | Economic data and anticipated Fed policy response. |

| December | 4.1% | Final review of economic performance and potential policy adjustments. |

Inflationary Pressures and Their Relation

The current inflationary environment in the US is a complex interplay of factors, impacting everything from consumer wallets to the overall economic outlook. Understanding the drivers behind this pressure, and how they affect credit ratings and interest rates, is crucial for navigating these turbulent times. High inflation necessitates careful consideration of its potential effects on spending habits and the long-term stability of the financial system.The current state of inflation in the US is characterized by sustained price increases across various sectors.

This persistent rise in prices erodes purchasing power and impacts consumer confidence, which, in turn, can affect economic activity. Understanding the interconnectedness of inflation, interest rates, and credit ratings is essential to appreciating the potential consequences.

Current State of US Inflation

Inflationary pressures remain elevated, with the Consumer Price Index (CPI) exhibiting sustained increases. The recent surge in prices has been driven by a variety of factors, including supply chain disruptions, increased demand, and rising energy costs. These factors often interact in complex ways, amplifying the inflationary effect.

Key Drivers of Inflation

Several key factors contribute to the current inflationary environment. Supply chain disruptions, stemming from global events and geopolitical uncertainties, have hampered production and distribution, leading to shortages and price hikes. Increased demand, following periods of economic recovery, often outstrips supply, driving up prices. The energy sector, particularly volatile due to geopolitical events and weather patterns, plays a significant role, influencing the cost of goods and services.

Potential Interactions with Credit Ratings and Interest Rates

High inflation often leads to higher interest rates as central banks attempt to cool down the economy. This rise in borrowing costs impacts businesses and consumers, potentially affecting their ability to meet financial obligations. Subsequently, elevated interest rates can negatively affect credit ratings, especially for entities with high levels of debt. The relationship between inflation and credit ratings is thus indirect, mediated by interest rate changes.

Effect on Consumer Spending Patterns

High inflation directly impacts consumer spending patterns. As prices rise, consumers are forced to allocate a larger portion of their income to necessities, leaving less for discretionary spending. This can lead to a decrease in overall consumer demand, potentially impacting economic growth. The shift in spending priorities can be observed across various sectors, from retail to entertainment.

Historical Relationship Between Interest Rates and Inflation, Us credit downgrade moody interest rates inflation

Historically, a positive correlation exists between interest rates and inflation. Central banks often raise interest rates to curb inflation, aiming to reduce spending and cool down the economy. This strategy, while effective in some cases, can also have negative consequences, such as a potential recession. The precise relationship is complex and influenced by various economic factors.

Interconnectedness of Inflation, Interest Rates, and Credit Ratings

| Inflation | Interest Rates | Credit Ratings | Economy |

|---|---|---|---|

| Increased prices | Higher borrowing costs | Potential downgrades | Reduced spending, potential recession |

This table illustrates the interconnectedness of these factors. High inflation typically necessitates higher interest rates set by central banks to curb price increases. The consequent rise in borrowing costs can negatively impact credit ratings, especially for highly indebted entities. These changes, in turn, can impact economic growth and activity, leading to potential recessionary pressures.

The relationship between inflation, interest rates, and credit ratings is a complex feedback loop. Changes in one factor can trigger a cascade of effects on the others, impacting the overall economic outlook.

Interconnectedness of Factors

The US economy is a complex system where various factors, including creditworthiness, interest rates, and inflation, are interconnected. A credit downgrade, interest rate adjustments, and inflationary pressures can create feedback loops, potentially exacerbating economic challenges. Understanding these interactions is crucial for assessing the potential impact on consumers and the overall economic landscape.These interconnected forces can amplify or mitigate the impact of each other.

A credit downgrade could lead to higher borrowing costs, fueling inflationary pressures, while rising inflation might necessitate higher interest rates, which could, in turn, affect consumer spending and investment decisions. This intricate interplay necessitates a comprehensive understanding of how these elements influence each other.

Potential Feedback Loops

The US credit rating, interest rate predictions, and inflationary pressures are deeply intertwined. A negative credit rating from Moody’s, or other credit rating agencies, signals a perceived increase in the risk of the US government defaulting on its debt. This, in turn, often leads to investors demanding higher yields for US Treasury bonds. Consequently, higher interest rates make borrowing more expensive for consumers and businesses.

This, in turn, can slow economic activity, potentially contributing to lower inflation. However, if inflation remains high, the Federal Reserve might raise interest rates further, creating a reinforcing cycle.

Examples of Mutual Influence

Several historical examples illustrate how these factors have interacted. For instance, during the 2008 financial crisis, a decline in credit ratings for subprime mortgages led to a surge in borrowing costs for various sectors, ultimately contributing to a significant economic downturn. Similarly, the inflationary pressures of the 1970s led to higher interest rates, aiming to cool down the economy, but the effect was complex and not always effective.

Flow Chart of Interrelationships

The interconnectedness of these factors can be visualized as a feedback loop.

Moody’s recent credit downgrade and rising interest rates are definitely adding fuel to the inflation fire. It’s a complex economic picture, and while I’m following the latest developments closely, I’m also intrigued by the new ice facility opening in New Jersey. This new facility seems to be a fantastic addition to the area’s recreational options, but I’m still wondering how these economic headwinds will impact the long-term success of such projects, especially considering the current US credit situation.

It’s a lot to keep track of!

Credit Downgrade --> Higher Borrowing Costs --> Reduced Economic Activity

|

| Increased Demand for US Treasuries --> Higher Interest Rates

|

V

Inflationary Pressures

This simplified representation shows how a credit downgrade can lead to higher borrowing costs, reducing economic activity.

Higher borrowing costs can, in turn, increase demand for US Treasuries, pushing interest rates higher. This, combined with existing inflationary pressures, creates a reinforcing cycle that can be challenging to manage.

Vulnerabilities in the System

Several vulnerabilities exist within this system. A sudden and significant decline in consumer confidence, triggered by a credit downgrade or escalating inflation, could lead to a sharp decline in spending, triggering a recession. Furthermore, if the Federal Reserve’s attempts to combat inflation through interest rate hikes are perceived as ineffective, or if they create significant financial hardship for borrowers, the negative feedback loops could accelerate.

Impact on Consumer Behavior

The interconnectedness of these factors will directly impact consumer behavior. Higher interest rates on loans, mortgages, and credit cards would make borrowing more expensive, reducing consumer spending and investment. Consumers might postpone purchases, potentially impacting retail sales and economic growth. Conversely, if consumers anticipate further interest rate increases and inflation, they may anticipate higher prices, impacting spending and saving habits.

Policy Responses and Mitigation Strategies

A US credit downgrade, coupled with rising interest rates and inflation, poses significant challenges to the nation’s economic stability. Effective policy responses are crucial to mitigating these negative impacts. The government’s role in managing such crises is multifaceted, requiring a balanced approach that addresses both immediate pressures and long-term sustainability. This section examines potential policy responses, their impact on key economic indicators, and the government’s role in crisis management.

Potential Policy Responses

Various policy instruments can be employed to address the interconnected challenges of a credit downgrade, interest rate hikes, and inflation. These responses often involve a delicate balancing act between short-term relief and long-term economic health. Effective policy requires a thorough understanding of the complex interplay between fiscal and monetary policies.

Fiscal Stimulus

Fiscal stimulus, such as increased government spending or tax cuts, aims to boost aggregate demand and counteract the negative effects of a credit downgrade. Increased government spending can stimulate economic activity by creating jobs and increasing consumer confidence. Tax cuts, on the other hand, can put more money in the hands of consumers, encouraging spending and investment. However, fiscal stimulus can potentially lead to increased government debt and inflationary pressures.

The magnitude of the stimulus package, as well as its composition, will influence its impact on inflation and interest rates. For example, targeted spending on infrastructure projects can have a positive impact on the long-term economy.

Monetary Tightening

Monetary tightening, a tool employed by central banks, involves raising interest rates to curb inflation. Higher interest rates make borrowing more expensive, reducing consumer spending and investment. This approach aims to cool down the economy and reduce inflationary pressures. A key example is the Federal Reserve’s recent actions to combat inflation. The effectiveness of monetary tightening depends on its timing and the overall economic context.

Government Intervention in Economic Crises

Government intervention plays a critical role in managing economic crises. The government acts as a stabilizer, using various policies to mitigate the negative consequences of economic shocks. This role includes providing social safety nets, managing public debt, and ensuring market stability. A well-defined and consistent approach is essential to restore confidence and guide the economy toward recovery.

Managing Inflation and Ensuring Economic Stability

Managing inflation and ensuring economic stability require a multifaceted approach. This involves controlling the money supply, regulating interest rates, and encouraging productivity growth. Central banks, like the Federal Reserve, play a pivotal role in managing inflation through monetary policy. The effectiveness of these strategies depends on their ability to address the root causes of inflation and avoid triggering a recession.

Summary Table of Policy Options

| Policy | Impact on Interest Rates | Impact on Inflation |

|---|---|---|

| Fiscal Stimulus | Increase | Slight increase |

| Monetary Tightening | Decrease | Decrease |

Summary

In conclusion, the convergence of a potential US credit downgrade, Moody’s interest rate projections, and inflation creates a complex and interconnected web of potential economic consequences. This analysis has highlighted the potential for significant impacts across various sectors, from finance to consumer spending. Understanding the intricate relationships between these factors is crucial for navigating this period of uncertainty.

The interplay of these elements will be critical to future economic stability, and the effectiveness of policy responses will be essential to mitigating potential damage. The implications are substantial, and careful consideration of these factors is vital for informed decision-making.