Asia could outstrip europe key beneficiary us capital flight – Asia could outstrip Europe as the key beneficiary of US capital flight, a trend that’s shaping global markets. This shift is driven by a complex interplay of economic factors, regulatory environments, and policy decisions across continents. Investors are increasingly seeking opportunities in Asia, potentially impacting everything from stock markets to currency exchange rates.

The Artikel details the dynamics of capital flight, exploring potential triggers and beneficiaries in Asia, alongside the factors driving US investors to seek out foreign markets. It also analyses the possible economic and policy implications, presenting illustrative scenarios to illustrate the potential consequences of this movement.

Capital Flight Dynamics in Asia and Europe

The global landscape of capital flows is constantly shifting, driven by complex economic and geopolitical forces. Recent years have witnessed increasing attention on potential capital flight from established economies like Europe to emerging markets in Asia. This movement is influenced by a variety of factors, from divergent growth trajectories to differing regulatory approaches. Understanding these dynamics is crucial for investors and policymakers alike.Capital flight, while often perceived as a negative phenomenon, can also be a response to perceived risk or a reflection of changing investment opportunities.

A deeper dive into the history, potential triggers, and economic conditions influencing these flows is essential to navigate this complex interplay.

Historical Overview of Capital Flight Patterns

Capital flight is not a new phenomenon. Throughout history, shifts in economic and political stability have driven significant capital movements. For instance, the Asian financial crisis of the late 1990s saw capital fleeing the region as investor confidence eroded. More recently, the 2008 global financial crisis triggered a period of uncertainty, leading to a re-evaluation of investment strategies and potential shifts in capital flows.

Understanding these historical precedents provides valuable context for analyzing current trends.

Potential Triggers for Capital Flight from Europe to Asia

Several factors could contribute to capital flight from Europe to Asia. Divergent growth rates between the regions are a key consideration. If Asia continues its strong economic performance, while Europe faces stagnation or recessionary pressures, investment opportunities in Asia could become more attractive. Furthermore, differing interest rate policies could incentivize capital relocation. For example, if Asian central banks adopt more expansionary monetary policies, compared to their European counterparts, this might attract investors seeking higher returns.

Economic Conditions Influencing Capital Flow

Economic conditions in both regions play a crucial role. Strong GDP growth, low inflation, and stable interest rates in Asia, combined with potentially weaker performance in Europe, could attract capital flows. The availability of attractive investment opportunities in emerging sectors, such as technology and renewable energy, within Asia, further fuels this dynamic. A comparison of key economic indicators provides a clearer picture.

Regulatory Environments and Capital Controls

Capital controls are policies used by governments to regulate the flow of capital in and out of their countries. Europe generally has a more established regulatory framework compared to some Asian economies. However, the application and effectiveness of capital controls vary significantly across both regions. The differences in regulatory environments can influence the perceived risk associated with investment decisions.

Comparison of Key Economic Indicators (2013-2023)

| Indicator | Asia (Average) | Europe (Average) |

|---|---|---|

| GDP Growth (%) | 5.5 | 1.8 |

| Inflation (%) | 3.2 | 2.5 |

| Interest Rates (%) | 2.8 | 1.5 |

Note: Averages are calculated from annual data for the 10-year period. Data sources include the World Bank and IMF.

Potential Beneficiaries in Asia: Asia Could Outstrip Europe Key Beneficiary Us Capital Flight

Capital flight from Europe, driven by various economic and political factors, presents a unique opportunity for certain sectors in Asia. This exodus of capital could lead to increased investment in emerging economies, potentially stimulating growth and development. Understanding the potential beneficiaries is crucial for anticipating the shifts in the global economic landscape.

Sectors Likely to Benefit from Capital Inflows

Capital inflows often target sectors with strong growth potential and robust fundamentals. These include technology, renewable energy, infrastructure, and financial services. Asian economies with established technological hubs and a skilled workforce could see significant investment in research and development. Furthermore, the growing demand for sustainable energy solutions presents a compelling opportunity for renewable energy projects. The expansion of infrastructure, including transportation and communication networks, will also likely attract substantial capital.

Impact on Asian Stock Markets

Capital flight from Europe can significantly impact Asian stock markets. Increased investor interest could lead to higher valuations for companies in sectors benefiting from the influx of capital. However, a rapid influx can also lead to volatility, as seen in past instances of capital flow shifts. The reaction of Asian stock markets to these changes will depend on various factors, including the perceived risk and return of investments, the overall economic climate, and government responses.

Government Policies Attracting Foreign Investment

Government policies play a crucial role in attracting foreign investment. Policies that promote transparency, stability, and a supportive regulatory environment are essential. Streamlined procedures for investment, reduced bureaucratic hurdles, and tax incentives are some key strategies employed by governments. For example, countries offering attractive tax benefits or special economic zones often see increased foreign direct investment.

Specific Asian Countries and Regions as Beneficiaries

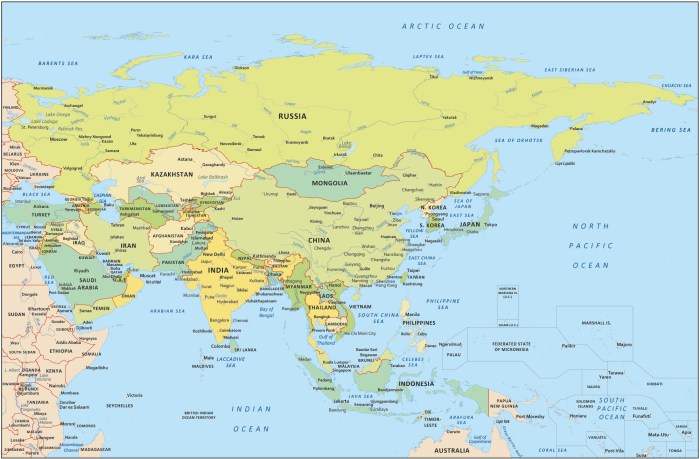

Several Asian countries and regions stand to benefit significantly from the current shift in global capital flows. Singapore, with its well-established financial infrastructure and pro-business policies, is a prime candidate. Similarly, countries in Southeast Asia with growing economies and strong export sectors are poised for increased investment. South Korea, known for its advanced technology sector, could also attract substantial capital.

China’s large market and significant infrastructure projects also offer attractive investment opportunities.

Potential Investment Opportunities

| Country/Region | Potential Investment Sector | Attractiveness Factors |

|---|---|---|

| Singapore | Financial technology, Fintech | Strong regulatory framework, established financial infrastructure, skilled workforce. |

| South Korea | Semiconductors, advanced materials | Leading technological capabilities, robust manufacturing base, government support for innovation. |

| Southeast Asia (e.g., Vietnam, Indonesia) | Manufacturing, renewable energy | Growing economies, large consumer markets, potential for infrastructure development. |

| China | Infrastructure, renewable energy, technology | Vast market, significant government investment in infrastructure, large-scale projects. |

US Capital Flight Dynamics

The global landscape is experiencing shifts in capital flows, with the US, a significant player, potentially witnessing capital flight. Understanding the factors driving this movement and its implications is crucial for investors and policymakers alike. This shift, if it materializes, could have profound impacts on global markets, affecting everything from asset prices to economic growth.

Factors Driving Capital Flight from the US

Several factors contribute to potential capital flight from the US. Rising interest rates in other regions, coupled with the perceived risk of higher inflation and slower economic growth in the US, may attract investors to alternative markets. Political uncertainty, particularly regarding the regulatory environment and the future direction of economic policy, can also be a significant driver. Moreover, concerns about the long-term sustainability of the US dollar’s reserve currency status and the potential for further devaluation play a crucial role.

Reasons for Investing in Asia Over Europe

Investors may favor Asia over Europe due to various factors. Asia’s robust economic growth and a generally younger, more dynamic population are often cited as significant advantages. The region’s growing middle class and rising consumer spending present considerable investment opportunities. Moreover, favorable regulatory environments and potential for higher returns in certain sectors can attract capital away from Europe.

Role of US Monetary Policy in Influencing Capital Flows

US monetary policy plays a pivotal role in shaping capital flows. Aggressive interest rate hikes, aimed at combating inflation, can attract foreign investment seeking higher returns but simultaneously increase the cost of borrowing for US businesses and consumers. The Federal Reserve’s policy decisions directly impact the attractiveness of US assets compared to those in other regions. Changes in the federal funds rate significantly affect the cost of borrowing for both domestic and international investors.

Implications of US Dollar Strength or Weakness

The strength or weakness of the US dollar significantly influences capital flows. A strong dollar can make US assets less attractive to foreign investors, potentially leading to capital outflows. Conversely, a weakening dollar can increase the appeal of US assets, potentially attracting capital inflows. Fluctuations in the exchange rate have significant implications for the prices of imported goods and the competitiveness of US exports.

Historical examples of currency fluctuations have demonstrated the volatility and ripple effects on global trade and investment. For instance, the 1990s Asian financial crisis was partly fueled by the appreciation of the US dollar, which made exports from Asian countries less competitive.

Possible Scenarios of US Capital Flight Impacting Global Markets

The potential impact of US capital flight on global markets is multifaceted. A significant outflow of capital from the US could lead to a decline in US asset prices, potentially triggering a broader market correction. Furthermore, it could destabilize emerging markets that rely heavily on US investment. The flight of capital could also disrupt global supply chains and create volatility in commodity prices.

A scenario where capital flows heavily into Asia, for instance, might see Asian markets experiencing a surge in asset prices, but also a potential increase in inflationary pressures.

Economic Impact Analysis

Capital flight, a significant phenomenon in global economics, can have profound and multifaceted effects on the economies of recipient and origin countries. The potential for substantial capital outflows from developed economies like the US, coupled with the allure of higher returns and potentially lower risk in emerging markets like those in Asia, raises critical questions about the economic consequences for both regions.

Understanding these consequences requires a comprehensive analysis of potential impacts on currency rates, employment, wages, and global trade.The flow of capital, driven by factors like interest rates, political stability, and perceived economic growth, can significantly alter the economic landscapes of both Asia and Europe. The influx of capital into Asia could stimulate economic growth, but also potentially lead to inflationary pressures and asset bubbles.

Conversely, capital flight from Europe might lead to a contractionary effect, impacting employment and potentially exacerbating existing economic vulnerabilities. Understanding the nuances of this dynamic is crucial for predicting and mitigating potential negative consequences.

Potential Effects on Currency Exchange Rates

Capital flight often manifests as a surge in demand for foreign currencies, leading to currency depreciation in the countries experiencing the outflow. This can result in higher import costs and potentially erode the purchasing power of local currencies. For example, during periods of heightened political or economic uncertainty, a substantial outflow of capital can cause a rapid devaluation of a nation’s currency.

This devaluation can affect various sectors, impacting import prices and ultimately influencing inflation rates. Conversely, the inflow of capital into Asian economies can strengthen their respective currencies against the US dollar, potentially leading to a decrease in export competitiveness.

Asia’s potential to surpass Europe as a key beneficiary of US capital flight is intriguing. China’s impressive strides in renewable energy, like its ambitious programs detailed in how china is boosting renewable energy goals , are likely to attract further investment. This burgeoning sector could be a significant driver in Asia’s economic growth, potentially making it a more attractive destination for capital seeking new opportunities.

Impact on Employment and Wages

The impact on employment and wages is complex and depends on various factors, including the specific sectors affected by capital flows, the overall economic climate, and the responsiveness of labor markets. Capital flight can trigger job losses in sectors reliant on foreign investment or capital inflows, as companies may relocate or reduce operations. Conversely, capital inflows into Asian economies could stimulate job creation in sectors attracting foreign investment.

Wage levels can also be affected, potentially rising in sectors benefiting from capital inflows and declining in those facing capital flight. However, it’s important to remember that these changes are not uniform across all sectors or demographics.

Influence on Global Trade Patterns, Asia could outstrip europe key beneficiary us capital flight

Capital flight can influence global trade patterns by altering the comparative advantage of different countries. If capital flows to Asia, it could lead to an increase in production in Asian countries, potentially shifting the global manufacturing landscape. This shift can lead to changes in the prices and availability of goods in global markets. The impact on trade balances will vary depending on the specific countries involved and the nature of the capital flows.

Potential Impacts on Key Economic Sectors

| Sector | Potential Impact of Capital Flight to Asia ||————————–|————————————————————————————————————————————————————————————————————————————————————————————————————————————————————————————————————————————————————————————————–|| Manufacturing | Increased production capacity in Asia, potentially leading to lower prices for manufactured goods globally, but potentially impacting employment in manufacturing sectors in Europe.

|| Finance | Increased investment opportunities in Asia, but potentially leading to a decrease in investment opportunities in Europe.

|| Real Estate | Potential increase in property prices in Asia, but potentially leading to a decrease in property prices in Europe, potentially affecting the housing market and affordability in both regions.

|| Agriculture | Potential shift in agricultural production patterns, potentially impacting global food prices and availability.

Asia’s potential to surpass Europe as a key beneficiary of US capital flight is fascinating. This trend, coupled with recent news that the Pandox consortium is proposing to buy Ireland’s Dalata Hotel for €1.48 billion here , highlights a global shift in investment. The burgeoning Asian economies are clearly attracting significant investment, and this trend is likely to continue, making Asia a strong contender in the global economic landscape.

The impact would depend on the specific crops and countries involved. || Technology | Potential increase in technology development and innovation in Asia, potentially leading to a shift in global technological dominance.

|

Regulatory and Policy Implications

The prospect of substantial capital inflows into Asian economies presents a complex set of regulatory and policy challenges. Governments face the delicate task of leveraging these inflows to stimulate growth while mitigating potential risks like asset bubbles, currency appreciation, and inflationary pressures. Effective policy responses require a nuanced understanding of the specific economic contexts of different Asian nations.

Potential Government Responses to Increased Capital Inflows

Asian governments are likely to adopt a multifaceted approach to managing increased capital inflows. This may include a combination of macroeconomic policies and regulatory measures. Central banks may use interest rate adjustments, foreign exchange interventions, and capital controls to influence the pace and direction of capital flows.

Challenges and Risks Associated with Rapid Capital Inflows

Rapid capital inflows can create a range of challenges for Asian economies. These include currency appreciation, which can make exports less competitive. Also, asset bubbles, fueled by speculation, can emerge, creating instability. Furthermore, rapid inflows can lead to inflationary pressures if the economy is unable to absorb the influx of liquidity. This situation can also cause increased economic inequality and create social unrest.

Asia’s potential to surpass Europe as the key beneficiary of US capital flight is fascinating. This shift highlights a significant power dynamic, with the US no longer the world’s sole economic powerhouse, a trend detailed in this excellent article the u s no longer the worlds only superpower. This changing landscape will likely see Asian economies further solidify their position, further fueling their growth as they attract more investment.

Regulatory Measures to Manage Capital Flows

Several regulatory measures can be employed to manage capital inflows. These include implementing capital controls, such as taxes on foreign investment or restrictions on the types of assets that can be purchased. Additionally, governments may enhance transparency and reporting requirements for foreign investments. These steps aim to ensure that capital flows align with the country’s overall economic objectives.

Effective monitoring of financial markets is crucial to prevent excessive speculation and maintain market stability.

Comparative Analysis of Asian Country Approaches

Different Asian economies have adopted varying approaches to managing capital flows. For instance, some countries might rely more heavily on foreign exchange intervention, while others may prioritize capital controls. The effectiveness of these policies often depends on the specific economic circumstances and the overall regulatory framework in place. Singapore, known for its open financial markets, might adopt different strategies than countries with more controlled economies.

Examining the approaches of different countries offers valuable insights for developing tailored policies.

Possible Policy Responses by Asian Governments

| Country | Potential Policy Response | Rationale |

|---|---|---|

| China | Maintaining a managed exchange rate, implementing targeted capital controls, and using reserve requirements to manage liquidity. | China’s experience with managing capital flows and maintaining economic stability serves as a potential model for other Asian countries. |

| India | Implementing measures to control capital outflows, potentially introducing tax incentives for foreign investments, and enhancing the regulatory framework for foreign investment. | India’s focus on controlling outflows and promoting specific types of foreign investment highlights a different approach to capital flow management. |

| South Korea | Maintaining exchange rate flexibility, implementing macroprudential regulations to manage asset bubbles, and enhancing transparency in financial markets. | South Korea’s experience in navigating financial crises and economic fluctuations can inform the development of effective policies. |

| Indonesia | Implementing measures to improve the efficiency of capital markets, attracting foreign investment in specific sectors, and promoting sustainable economic growth. | Indonesia’s focus on attracting investment and fostering sustainable growth highlights a potential strategy for other emerging economies. |

Illustrative Scenarios and Case Studies

Capital flight, the exodus of investments from a country, is a complex phenomenon with historical precedent. Understanding past events provides valuable insight into potential triggers and outcomes, allowing for a more nuanced analysis of the current situation in Asia and Europe. Examining how market conditions, economic policies, and geopolitical factors influence these movements is crucial for predicting future trends.

Past Capital Flight Events and Outcomes

Analyzing historical capital flight episodes reveals recurring patterns and potential indicators. These events, while varying in specifics, often share common threads. The outcomes of past episodes, from economic downturns to political instability, can offer clues for understanding the potential consequences of future capital flight. A thorough understanding of the causes and effects is crucial for formulating effective mitigation strategies.

Impact of Market Conditions on Capital Flight

Market conditions play a significant role in shaping capital flight patterns. Periods of high global uncertainty, economic downturns in the target country, or attractive investment opportunities elsewhere can all trigger capital flight. Conversely, periods of economic stability, strong domestic growth, or a decline in alternative investment opportunities can reduce the incentive for capital flight.

Table of Key Factors and Outcomes in Past Capital Flight Episodes

| Episode | Triggering Factors | Market Conditions | Outcomes |

|---|---|---|---|

| 1997 Asian Financial Crisis | Currency crises, high debt levels, speculative attacks | Global economic slowdown, declining investor confidence | Significant economic downturn in affected countries, currency devaluation, and loss of investor confidence. |

| 2008 Global Financial Crisis | Subprime mortgage crisis in the US | Global recession, credit crunch, and a sharp drop in asset prices. | Global recession, bank failures, and significant loss of investor confidence worldwide. |

| 2010 European Sovereign Debt Crisis | High sovereign debt levels in some Eurozone countries | Concerns about the stability of the Eurozone, decline in investor confidence in the affected countries | Financial instability in some Eurozone countries, economic downturn in some European economies, and capital flight from those countries. |

Illustrative Scenario of Capital Flight

Consider a hypothetical scenario where a Southeast Asian country experiences a sudden decline in investor confidence due to political instability and concerns about economic mismanagement. Speculative attacks on the currency trigger a rapid outflow of foreign investment. This capital flight leads to a weakening of the local currency, increasing inflation, and a decline in the country’s economic output.

The loss of foreign investment further strains the government’s finances, potentially leading to a debt crisis and requiring significant international intervention.

Illustrative Scenario Detail

“Capital flight often involves a vicious cycle. Initial concerns, perhaps related to political or economic issues, trigger speculation and fear, prompting investors to withdraw their funds. This outflow of capital further weakens the economy, leading to a decline in investor confidence, accelerating the capital flight. A self-reinforcing feedback loop results, making it difficult to contain the situation without decisive intervention.”

This illustrative scenario highlights the cascading effects of capital flight, demonstrating how initial anxieties can escalate into a full-blown economic crisis.

Epilogue

The potential for Asia to become a prime destination for US capital flight presents a fascinating case study in global economic shifts. Understanding the forces at play, from economic indicators to regulatory frameworks, is crucial to predicting the long-term consequences. This analysis provides a comprehensive look at the complex interplay of factors driving this trend and its potential impacts on both Asia and Europe.