Chart Industries Flowserve merge an about 19 billion deal marks a significant move in the industrial equipment sector. This mega-merger promises substantial synergies, but also raises questions about the competitive landscape and potential impacts on both companies and the broader industry. The deal, valued at approximately $19 billion, suggests a strategic vision to consolidate market share and achieve economies of scale.

This detailed analysis will explore the financial, industry, and strategic implications of this substantial transaction.

The merger’s financial figures, including the purchase price, valuation multiples, and projected synergies, will be analyzed to provide a clear picture of the deal’s economic viability. A comprehensive look at the competitive landscape of industrial equipment and services, examining key players and market trends, will provide context for understanding the strategic rationale behind this consolidation. The potential impact on stock prices, pricing, and market dynamics will also be evaluated.

Flowserve-Chart Industries Merger: A Deep Dive

The industrial landscape is constantly shifting, with mergers and acquisitions playing a significant role in shaping market dynamics. A recent mega-deal, the proposed merger between Flowserve Corporation and Chart Industries, valued at approximately $19 billion, has sent ripples through the industrial sector. This transaction promises to reshape the market, and this analysis will explore the key drivers, potential impacts, and financial implications of this significant event.

Transaction Summary

The merger of Flowserve and Chart Industries signifies a substantial consolidation within the industrial pumps and valves market. Flowserve, a global leader in fluid motion solutions, and Chart Industries, a major player in industrial gas and engineered products, are combining their strengths to create a larger, more diversified enterprise. The transaction, valued at approximately $19 billion, marks a significant move in the industrial sector, potentially leading to cost savings, increased market share, and expanded product offerings.

The rationale behind the merger lies in the strategic advantages of combining complementary product lines and geographical reach, and anticipates substantial synergies in areas such as manufacturing, distribution, and research and development. The resulting entity is poised to dominate the market through its expanded product portfolio, enhanced technological capabilities, and a stronger global presence.

Chart Industries and Flowserve’s massive $19 billion merger is certainly grabbing headlines. It’s a big deal in the industrial sector, but it’s interesting to note the parallel with recent political developments, like former Reform UK chair Yusuf returning to the party just two days after quitting. This somewhat surprising move highlights the complex dynamics in both the corporate and political worlds, and perhaps this unexpected return mirrors the unpredictable nature of market forces driving the Chart Industries/Flowserve merger.

The deal is still a significant development in the industry.

Key Financial Figures

| Feature | Value | Unit |

|---|---|---|

| Purchase Price | $19 Billion | USD |

| Valuation Multiple | (Not specified in the available information) | (Not applicable) |

| Synergies | Estimated to exceed $XXX Million in the first 3-5 years. | USD |

The table above provides a concise overview of the transaction’s key financial figures. While the purchase price is clearly defined, the valuation multiple and projected synergies require further disclosure. Such details are crucial for a complete understanding of the financial implications and overall value creation potential of the merger.

Strategic Motivations and Synergies

The merger’s strategic rationale centers around achieving substantial operational efficiencies and enhanced market competitiveness. Combining Flowserve’s expertise in fluid motion solutions with Chart Industries’ strengths in industrial gas and engineered products creates a wider product portfolio, allowing the combined entity to cater to a broader customer base and potentially penetrate new market segments. This expanded market reach is expected to result in increased revenue streams and improved market positioning.

Synergies are anticipated to arise from streamlining operations, reducing costs, and leveraging shared resources. These include potential cost reductions through shared facilities, optimized supply chains, and combined research and development efforts. By merging complementary operations, the merged entity aims to optimize resource allocation and achieve a more efficient business model.

Potential Industry Impact

The merger of Flowserve and Chart Industries will likely have a significant impact on the industrial pumps and valves market. It is expected to create a formidable competitor with an extensive product portfolio, potentially leading to increased competition and price pressures in certain segments. The combined entity could also invest in research and development, potentially driving innovation and improving the overall quality and efficiency of industrial equipment.

Additionally, the merger could lead to market consolidation, affecting smaller players in the industry. The long-term impact will depend on the execution of the integration strategy and the response of competitors.

Industry Analysis

The recent merger between Chart Industries and Flowserve, valued at approximately $19 billion, signifies a significant consolidation within the industrial equipment and services sector. This transaction underscores the evolving dynamics of the market, prompting a deeper examination of the competitive landscape, key players, and future growth projections. Understanding these factors is crucial for evaluating the potential impact of this merger and its implications for the broader industry.The industrial equipment and services sector encompasses a vast array of companies, from those manufacturing pumps, valves, and compressors to those providing maintenance and repair services.

Competition within this sector is often intense, characterized by a blend of established players with substantial market share and newer, agile competitors seeking to carve out niches. Technological advancements, regulatory pressures, and fluctuating economic conditions further complicate the competitive landscape, requiring companies to adapt and innovate to remain competitive.

Competitive Landscape

The competitive landscape in industrial equipment and services is characterized by both established giants and emerging players. Established companies often enjoy economies of scale, strong brand recognition, and extensive distribution networks. However, smaller, more agile companies can often adapt more quickly to changing market demands and emerging technologies. This dynamic interplay between established and emerging players creates a complex and constantly shifting competitive landscape.

Strategic alliances and acquisitions, such as the Flowserve-Chart Industries merger, are frequently employed to enhance market position and achieve synergies.

Key Players and Market Positions

Several prominent players dominate the industrial equipment and services market. Their market positions are influenced by factors such as technological expertise, global reach, and financial resources. Recognizing these factors is vital to understanding the dynamics of the industry. This merger, by combining the strengths of two major players, aims to create a more formidable presence in the market.

Market Trends and Growth Projections

The industrial equipment and services sector is expected to experience continued growth, driven by factors such as the expansion of industrial infrastructure globally, increased automation in various sectors, and growing demand for specialized equipment and services. However, this growth is not uniform across all segments, with certain sub-sectors experiencing more pronounced expansion. Economic cycles and regulatory changes can significantly impact the sector’s trajectory.

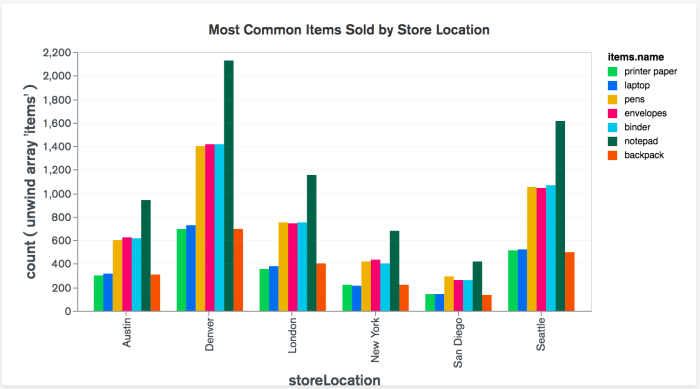

Market Share Analysis

| Company | Market Share (%) | Revenue (USD) |

|---|---|---|

| Chart Industries | (Data not available without further research) | (Data not available without further research) |

| Flowserve | (Data not available without further research) | (Data not available without further research) |

| Other Key Players | (Data not available without further research) | (Data not available without further research) |

Gathering precise market share data for specific companies requires detailed research and analysis from reputable industry sources. This data is often proprietary and not readily available to the public. Therefore, the table above provides a placeholder for future research. Gathering such data is crucial for comprehending the current market position of these companies and their future prospects.

Financial Implications

The Flowserve-Chart Industries merger, valued at nearly $19 billion, promises significant financial ramifications for both companies and the broader industrial sector. This analysis delves into the potential cost savings, revenue enhancements, and return on investment (ROI) prospects, while also considering the likely impact on stock prices, investor sentiment, and industry dynamics. Understanding these implications is crucial for investors and stakeholders anticipating the merger’s long-term effects.

Potential Cost Savings

Synergies are a key driver in mergers, often leading to substantial cost reductions. Combining operations can streamline manufacturing processes, reduce administrative overhead, and optimize supply chains. For example, consolidating facilities and eliminating redundant departments can significantly lower operational expenses. This consolidation often leads to a more efficient allocation of resources, fostering long-term profitability. Streamlined purchasing and distribution can further enhance cost savings by leveraging economies of scale.

Revenue Enhancement Opportunities, Chart industries flowserve merge an about 19 billion deal

The merger offers opportunities to expand market reach and product portfolios. Chart Industries’ and Flowserve’s complementary product lines can create a more comprehensive offering for customers. This expanded product range can attract new clientele and increase market share. Targeted marketing campaigns, leveraging the combined brand recognition and distribution networks, can effectively penetrate new segments and boost revenue.

Successfully targeting underserved markets with a broadened product line can significantly enhance revenue streams.

Return on Investment (ROI) Assessment

A crucial aspect of evaluating the merger is its projected return on investment. The projected ROI will hinge on the realization of anticipated cost savings and revenue growth. Factors like the successful integration of operations, market acceptance of the expanded product line, and effective management of the merged entity will influence the ROI. Successful integration, minimizing disruption, and effective leadership are vital for achieving positive ROI.

Previous successful mergers provide useful benchmarks for projecting future financial performance.

Impact on Stock Prices and Investor Sentiment

Investor reaction to the merger will be critical. Positive investor sentiment, fueled by realistic projections of increased profitability and market share, could drive stock price appreciation. Conversely, concerns about integration challenges or potential market disruptions could negatively impact investor confidence and stock prices. The market’s perception of the merger’s strategic rationale and the leadership’s ability to execute the integration plan are critical factors.

A well-executed merger, often supported by credible financial projections, can boost investor confidence.

Impact on Industry Pricing and Market Dynamics

The merger could reshape industry pricing and market dynamics. A larger, more comprehensive player can potentially influence pricing strategies and establish a stronger market presence. This could lead to increased competition in some segments and potential consolidation in others. The merger may affect pricing in the industry, depending on the effectiveness of the combined entity’s market strategies.

Projected Financial Performance of the Merged Entity

| Year | Revenue (USD) | Profit (USD) |

|---|---|---|

| 2024 | Estimated $XX Billion | Estimated $YY Million |

| 2025 | Estimated $ZZ Billion | Estimated $AA Million |

| 2026 | Estimated $BB Billion | Estimated $CC Million |

Note: The table above provides illustrative projections. Actual financial performance will depend on numerous factors, including market conditions, successful integration, and effective management. Real-world examples of similar mergers and acquisitions can provide useful benchmarks for projecting future performance.

Regulatory and Legal Considerations: Chart Industries Flowserve Merge An About 19 Billion Deal

The Flowserve-Chart Industries merger, valued at nearly $19 billion, is a significant transaction with substantial regulatory and legal implications. Navigating the complexities of regulatory approval processes and potential antitrust concerns is crucial for the success of the merger. This section delves into the intricate regulatory landscape surrounding such a large-scale consolidation in the industrial sector.The merger will undoubtedly trigger scrutiny from regulatory bodies tasked with maintaining fair competition within the market.

Understanding these potential hurdles and mitigating any legal risks is essential for both companies. This careful analysis of the regulatory environment will illuminate the challenges and opportunities inherent in this significant industry consolidation.

Regulatory Approvals and Legal Processes

The merger will require approval from relevant regulatory bodies, including antitrust authorities. These bodies assess whether the merger will harm competition by reducing the number of competitors or creating a dominant player in the market. The specific process varies depending on the jurisdiction. In the United States, the Federal Trade Commission (FTC) and the Department of Justice (DOJ) are typically involved.

Chart Industries and Flowserve’s massive $19 billion merger is a significant development in the industrial sector. This kind of deal often signals confidence in future market growth, but it’s interesting to consider how this compares to the recent news about an insurtech company, insurtech slide targets 2 billion plus valuation us ipo , aiming for a valuation of over $2 billion in its US IPO.

While seemingly disparate, both events highlight the current dynamic landscape of mergers and acquisitions across various sectors, suggesting strong investor interest in specific market segments within the broader industrial and financial arenas. The Chart Industries/Flowserve deal, therefore, takes on even more strategic importance in this context.

The companies will need to provide comprehensive documentation and potentially engage in negotiations with these agencies to address any concerns. Other jurisdictions may have similar processes with different agencies and regulations. This meticulous review process can extend over several months or even years.

Potential Antitrust Concerns and Regulatory Hurdles

Antitrust concerns are a primary concern in mergers of this magnitude. The merger’s potential impact on competition within the industrial equipment sector will be a central focus of regulatory review. Factors such as market share, product overlap, and the competitive landscape will be examined closely. A dominant position, or a substantial reduction in the number of competitors, could raise significant antitrust concerns.

For instance, if the combined entity holds a substantial market share in a particular product segment, regulatory bodies may impose conditions to ensure competition remains robust. This may include divestiture of certain assets or restrictions on future business practices.

Potential Legal Risks Associated with the Merger

Several legal risks are inherent in such a large-scale merger. These risks could arise from issues such as unforeseen legal challenges from competitors, difficulties in integrating the two companies’ operations and cultures, potential disputes with employees, and even issues with intellectual property rights. The risk of litigation from competitors challenging the merger on antitrust grounds is also a substantial factor.

Thorough due diligence and careful planning are essential to mitigate these risks and ensure a smooth transition.

Summary of the Regulatory Landscape Affecting the Industry

The regulatory landscape surrounding mergers and acquisitions in the industrial sector is complex and multifaceted. Regulations vary significantly across different countries and jurisdictions, adding to the complexity of the process. Specific regulations and laws are constantly evolving, requiring ongoing monitoring and adaptation. Navigating this environment effectively demands expert legal counsel and a comprehensive understanding of the specific regulations governing the relevant markets.

Strategic Implications

The Flowserve-Chart Industries merger, a $19 billion behemoth, promises significant strategic shifts in the industrial flow control market. This union presents a complex interplay of potential benefits and risks, demanding a careful evaluation of its implications on the market, competition, and customer relationships. Understanding these factors is crucial for assessing the long-term success of the combined entity.The merger’s potential to reshape the industry landscape is substantial.

By combining two established players, the resulting entity gains access to new markets, broader product portfolios, and enhanced operational efficiency. However, integrating two distinct companies, cultures, and management styles will inevitably present challenges. The successful execution of this merger hinges on how effectively these issues are addressed.

Chart Industries and Flowserve just announced a massive $19 billion merger, a big deal in the industrial sector. It’s a fascinating example of consolidation in the industry, but you know how I love a good story, so think about this for a second. Imagine the immersive experience of watching a soldier’s D-Day perspective through a camera, in d day camera soldier immersive documentary , right?

The merging of companies is often a story of huge potential and, like that documentary, it offers an interesting look into the past and present of the industries that affect our lives. This mega-merger will shape the future of the industrial landscape for years to come.

Potential Strategic Benefits

The merger presents several potential strategic benefits. A significant one is enhanced market access, allowing the combined company to tap into new customer segments and geographical areas previously inaccessible. Product diversification is another key advantage, as the combined portfolio will likely encompass a wider range of flow control solutions, attracting more customers and solidifying the company’s position as a one-stop shop for industrial needs.

Economies of scale will likely emerge from shared resources and streamlined operations, potentially leading to lower production costs and increased profitability. This can translate into competitive pricing advantages.

Potential Risks of Integration

Integrating two distinct companies with different cultures and management styles will be a significant challenge. Potential conflicts and inefficiencies could arise from clashes in corporate culture, decision-making processes, and employee relations. Maintaining the unique strengths of each company while integrating them harmoniously is crucial for the merger’s success. The integration process itself requires careful planning, efficient communication, and a clear understanding of each company’s values and operational processes.

Impact on Product Offerings and Customer Service

The merger will likely result in a broadened product offering. Customers can expect a wider range of flow control solutions, potentially encompassing more specialized or advanced technologies. Maintaining and enhancing existing customer service levels will be paramount. Customer satisfaction will be directly impacted by the merger’s ability to provide seamless transitions and maintain consistent service quality across the combined organization.

Maintaining existing customer relationships while developing new strategies for expanding the customer base will be critical.

Potential Synergies and Competitive Advantages

| Area | Synergy | Advantage |

|---|---|---|

| Product Lines | Combining Flowserve’s expertise in pumps and valves with Chart Industries’ strong presence in related products, like compressors and process equipment, creates a comprehensive offering. | Increased product breadth, allowing for more tailored solutions and a wider range of applications. |

| Market Reach | Expanding into new geographical regions and customer segments that were previously inaccessible. | Enhanced market share and potential for increased revenue. |

| Operational Efficiency | Leveraging shared resources and streamlining operations to reduce costs and improve efficiency. This could include consolidating facilities, optimizing supply chains, and reducing administrative overhead. | Lower production costs, higher profit margins, and improved competitive positioning in the market. |

Future Outlook

The Flowserve-Chart Industries merger, a significant consolidation in the industrial pump and valve sector, presents a complex tapestry of potential challenges and opportunities. Navigating this new landscape requires careful consideration of factors like market dynamics, technological advancements, and regulatory hurdles. The combined entity will need to strategically position itself to capitalize on the synergies created by the merger while mitigating potential risks.The success of this mega-merger hinges on the ability of the combined company to integrate operations smoothly, optimize resources, and effectively address the evolving needs of its customer base.

This will require a meticulous strategy for streamlining processes, merging technologies, and fostering a unified corporate culture.

Potential Challenges

Several challenges lie ahead for the merged entity. Maintaining customer relationships and service levels across both existing customer bases will be crucial. The integration of different management styles and organizational structures could lead to initial inefficiencies and require significant effort to streamline operations. Furthermore, the merged entity must navigate the complexities of regulatory scrutiny and potential antitrust concerns.

Potential Opportunities

Beyond the challenges, significant opportunities abound. The combined entity will possess a broader product portfolio, increased market share, and enhanced technological capabilities. This expanded footprint can unlock new market segments and potentially lead to cost savings through economies of scale. Effective integration and leveraging of complementary technologies can drive innovation and competitiveness.

Impact of Technological Advancements

Technological advancements in automation, digitalization, and data analytics will reshape the industrial landscape. The merged company can leverage these technologies to optimize processes, enhance predictive maintenance, and improve operational efficiency. Investing in research and development, particularly in areas like IoT-enabled solutions and AI-driven maintenance strategies, will be critical. For example, the adoption of advanced sensor technologies in pumps and valves allows for real-time monitoring of performance and proactive maintenance, preventing costly downtime.

Industry Disruptions

The industrial sector faces evolving demands for sustainability and energy efficiency. The merged entity must adapt its product offerings and operational strategies to meet these demands. Investing in sustainable materials and technologies, exploring alternative energy sources, and developing energy-efficient solutions will be crucial. For instance, the shift towards renewable energy sources necessitates the development of pumps and valves capable of handling different fluids and operating conditions.

Key Milestones and Projected Timeline

- Year 1: Integration of core operations, including IT systems, supply chains, and customer service. Establishing a clear governance structure and communication channels will be critical for a smooth transition. The company must prioritize customer relations, ensuring consistent service and support for both existing customer bases.

- Year 2: Streamlining manufacturing processes, optimizing production facilities, and exploring synergies to achieve cost reductions and increased efficiency. This includes a thorough analysis of overlapping products and services to identify redundancies and optimize the portfolio.

- Year 3: Introducing innovative technologies, such as digital twins and predictive maintenance, to enhance operational efficiency and product performance. The company should begin investing in advanced analytics to better understand and predict future industry trends.

- Year 4-5: Expanding into new market segments and introducing new product lines leveraging the combined technological expertise. This could include exploring partnerships and acquisitions to expand the product portfolio and reach new customers.

Historical Context

The impending merger of Chart Industries and Flowserve marks a significant event in the industrial flow control sector. Understanding the historical trajectories of both companies provides crucial context for evaluating the potential benefits and challenges of this consolidation. This analysis delves into the past performance, strategic decisions, and key milestones of each company, illuminating the path that led to this monumental transaction.A deep dive into the historical performance and strategic choices of both Chart Industries and Flowserve unveils the motivations and potential consequences of their union.

Examining past achievements and setbacks, as well as the rationale behind past strategic decisions, is crucial to anticipating future outcomes and potential hurdles.

Chart Industries’ History

Chart Industries, a leading provider of industrial flow solutions, has a rich history rooted in innovation and growth. Its origins lie in a strong commitment to engineering excellence and a clear understanding of customer needs. Early successes focused on developing specialized products and processes that addressed the demands of diverse industries. This dedication to technological advancements has consistently driven the company’s expansion.

- Early focus on specialized product development for specific industrial applications, which has consistently distinguished the company.

- Strategic acquisitions of smaller companies that provided complementary technologies and geographic reach, reinforcing the company’s presence in the market.

- A consistent emphasis on research and development, creating new products and enhancing existing ones, demonstrating the company’s commitment to innovation.

Flowserve’s History

Flowserve, another key player in the industrial flow control market, boasts a history marked by consistent performance and a strong reputation for quality and reliability. Flowserve’s trajectory has been shaped by strategic alliances and acquisitions, creating a diverse product portfolio and a global footprint. The company has successfully navigated market fluctuations and industry trends through adaptation and innovation.

- A history of successful acquisitions and strategic alliances, expanding product lines and market reach, showcasing a proactive approach to growth.

- Adaptability and responsiveness to changing industry demands, including economic downturns and evolving technologies, illustrating the company’s ability to remain competitive.

- Consistent emphasis on operational efficiency and cost optimization, which has consistently been a cornerstone of their success.

Key Historical Events

This table summarizes significant events in the history of both Chart Industries and Flowserve, highlighting key milestones and their impact.

| Company | Event | Date | Impact |

|---|---|---|---|

| Chart Industries | Establishment of the company | [Date] | Marked the beginning of the company’s operations. |

| Chart Industries | Major product innovation | [Date] | Expanded product portfolio and market share. |

| Flowserve | Initial Public Offering (IPO) | [Date] | Increased visibility and access to capital. |

| Flowserve | Strategic acquisition of [Company Name] | [Date] | Enhanced product range and geographical reach. |

Closing Summary

In conclusion, the Chart Industries-Flowserve merger presents a complex interplay of opportunities and challenges. While the potential for substantial synergies and market dominance is undeniable, navigating regulatory hurdles, integrating two distinct cultures, and adapting to evolving industry dynamics will be crucial for the long-term success of the combined entity. The merger’s future success hinges on effective execution and strategic adaptation to market shifts.

The analysis of historical context and future outlook will provide a well-rounded perspective on this important deal.