Afc says africa has 4 trillion local capital available fund infrastructure – AFC says Africa has 4 trillion local capital available to fund infrastructure. This presents a monumental opportunity for economic growth across the continent. Imagine the potential for revitalized transportation networks, robust energy grids, and improved communication systems. How can this vast pool of capital be harnessed to unlock Africa’s infrastructure potential? What challenges might hinder its mobilization?

Let’s delve into the details and explore the possibilities.

This substantial capital pool, potentially unlocking transformative infrastructure development, could reshape African economies. The potential benefits are vast, ranging from increased trade and economic activity to improved living standards and job creation. The critical question becomes how this significant resource can be effectively channeled into projects that truly yield tangible and sustainable results.

Overview of the Statement

The African Football Confederation (AFC) recently asserted that Africa possesses a staggering $4 trillion in local capital ready to fund infrastructure projects. This statement, while potentially groundbreaking, requires careful consideration to understand its implications and feasibility. The claim signals a significant shift in the narrative surrounding African economic development, suggesting a substantial pool of untapped resources waiting to be mobilized.This assertion points towards a potential paradigm shift in Africa’s approach to development.

Instead of solely relying on foreign investment, the statement suggests that Africa has the financial capacity within its own borders to drive infrastructural growth. This could lead to more sustainable and locally controlled development initiatives, fostering greater economic independence and regional integration.

Potential Implications for African Economies

The availability of this substantial capital pool has the potential to significantly boost African economies. Increased investment in infrastructure, such as roads, ports, and energy grids, can spur economic activity, create jobs, and attract further investment. This could lead to improved living standards, reduced poverty, and greater opportunities for entrepreneurship and business growth.

Ways to Mobilize and Invest the Capital

Several strategies could be employed to mobilize and effectively invest this capital. One approach involves promoting local entrepreneurship and small and medium-sized enterprises (SMEs). Supporting these businesses with access to credit, training, and mentorship programs could encourage them to participate in infrastructure development projects.

- Public-private partnerships (PPPs) can be instrumental in leveraging private sector expertise and capital while ensuring public accountability and oversight. This approach can attract both local and foreign investors.

- Developing robust financial markets and institutions is crucial. This includes strengthening banking systems, fostering the growth of capital markets, and creating a favorable regulatory environment for investment.

- Improving access to affordable and reliable credit for businesses and individuals is essential to facilitate investment in infrastructure. Microfinance institutions and other financial instruments can play a key role in achieving this.

Challenges and Opportunities

While the potential is substantial, several challenges must be addressed to effectively leverage this capital. Corruption, lack of transparency, and inadequate regulatory frameworks can hinder the mobilization and efficient allocation of resources.

- Ensuring good governance and accountability is paramount to prevent misappropriation of funds and ensure that projects are implemented effectively.

- Strengthening institutions and promoting transparency in financial transactions is essential to fostering trust and encouraging investment.

- Building capacity and skills within the workforce is critical to effectively manage and implement large-scale infrastructure projects.

Addressing the Potential

Furthermore, fostering regional cooperation and integration is vital. Shared infrastructure projects can unlock economies of scale and reduce duplication of effort, while facilitating trade and investment within the continent. This could involve creating regional infrastructure funds and coordinating projects across borders.

Identifying the Sources of Capital: Afc Says Africa Has 4 Trillion Local Capital Available Fund Infrastructure

Africa’s vast potential for infrastructure development hinges on the availability and effective mobilization of substantial capital. The reported $4 trillion in local capital presents a significant opportunity, but its successful deployment requires a deep understanding of the diverse sources available. This exploration delves into the various pools of capital, highlighting the roles of investors, corporations, and governments, and the potential contributions of foreign investment and aid.

Furthermore, it Artikels the appropriate financial instruments to effectively channel these resources into impactful projects.The sheer magnitude of this capital necessitates a multi-faceted approach to its mobilization. The involvement of all relevant stakeholders, including individuals, corporations, and government entities, is crucial. This necessitates a transparent and conducive environment that fosters investment confidence and encourages participation.

Individual Investors

Individual investors, often overlooked, represent a significant pool of capital. Their participation can be encouraged through accessible investment avenues, such as mutual funds and bonds tailored to local needs and risk appetites. For example, successful microfinance programs in several African nations demonstrate how targeted investment opportunities can mobilize substantial capital from individuals with modest savings. By creating accessible and attractive investment vehicles, individuals can contribute meaningfully to infrastructure projects.

While AFC reports Africa boasts $4 trillion in local capital ready to fund infrastructure projects, a sobering reminder of the fragility of life comes with news of a small plane carrying six people crashing into the Pacific Ocean near San Diego. This tragic incident highlights the unpredictable nature of life alongside the incredible potential for development in Africa.

Despite these setbacks, the $4 trillion figure still suggests vast opportunities for investment and growth in the continent’s infrastructure.

Corporate Sector

Corporations, both local and multinational, possess substantial financial resources. Their involvement is crucial for large-scale projects, and incentivizing this participation requires clear regulatory frameworks and attractive returns. Corporations often seek projects that align with their business strategies, such as those that enhance their supply chains or create new markets. Attractive returns and a stable legal environment are key to attracting corporate investment in infrastructure.

Government Entities

Government entities hold a critical role in mobilizing capital through fiscal policies, public-private partnerships, and direct investment. Government funding, particularly for critical infrastructure projects like transportation networks and energy grids, plays a critical role. Effective public-private partnerships (PPPs) are key in leveraging both public funds and private sector expertise and resources. Examples of successful PPPs in various countries demonstrate the potential for synergistic development.

Foreign Investment and Aid

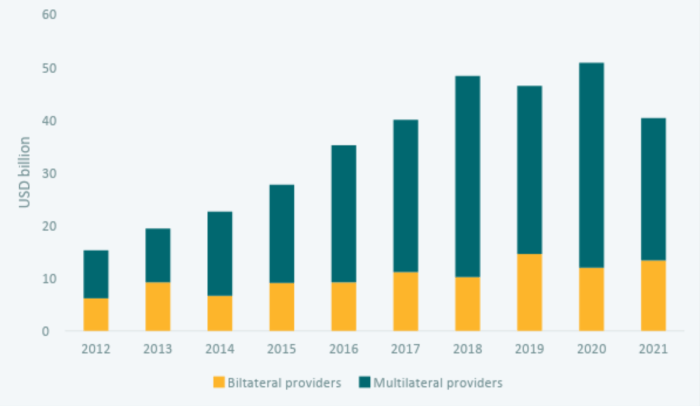

Foreign investment and aid can play a substantial role in complementing local capital. However, effective utilization of foreign capital demands a well-structured framework that minimizes potential risks and ensures alignment with local development priorities. Foreign investment can bring specialized expertise, advanced technologies, and access to global markets, which can help accelerate infrastructure development. The key lies in carefully structuring investment agreements to maximize benefits for all stakeholders.

Financial Instruments

Various financial instruments can be employed to mobilize this capital effectively. These include bonds, equity investments, project finance, and infrastructure funds. Bonds, for example, offer a way to raise capital for large-scale projects, while equity investments provide long-term participation in the ventures. Project finance structures, often used for large infrastructure projects, allow for the separation of project risks and capital requirements.

Infrastructure funds provide a specialized mechanism to aggregate capital for multiple infrastructure projects.

A well-designed mix of these financial instruments can efficiently mobilize and channel the $4 trillion capital for sustainable infrastructure development.

Assessing the Infrastructure Needs

Africa boasts a vast array of untapped potential, but realizing this potential hinges on robust infrastructure. A critical first step towards unlocking economic growth and improving quality of life across the continent is a comprehensive assessment of existing infrastructure and future needs. This involves analyzing the current state of infrastructure in various sectors and identifying key areas for investment.Understanding the present state of infrastructure in Africa is crucial for planning effective interventions.

The continent faces diverse challenges, from the disparity in infrastructure development between different nations to the specific needs of each region. This assessment will Artikel the infrastructural gaps, providing a foundation for targeted investments and strategic planning.

Current State of Infrastructure in Africa

Africa’s infrastructure landscape is a complex mosaic, with varying levels of development across different countries and regions. Some nations have made significant strides in key areas like transportation and energy, while others still face considerable hurdles in basic infrastructure provision. This disparity reflects historical factors, economic realities, and varying levels of governmental commitment to infrastructure development.

Infrastructure Needs by Category

The needs across Africa fall into several key categories. Transportation infrastructure, including roads, railways, and ports, is critical for connecting markets and facilitating trade. Reliable energy sources are vital for powering industries, homes, and businesses. Effective communication networks, encompassing telecommunications and internet access, are essential for enabling economic activity and social interaction. Water infrastructure, crucial for public health and agricultural productivity, also represents a substantial need in many African nations.

Transportation Infrastructure Needs

Significant gaps exist in road networks, particularly in rural areas, hindering efficient movement of goods and people. Railways, where present, often face maintenance challenges and limited connectivity. Ports and airports need upgrading to accommodate increased traffic and support regional trade. The need for integrated transportation systems, connecting various modes of transport, is often overlooked, but crucial for efficiency and cost reduction.

For example, many African countries lack seamless connections between road and rail networks, which negatively impacts the movement of goods and services.

Energy Infrastructure Needs

The continent faces a significant energy deficit, with many communities lacking access to reliable electricity. Renewable energy sources, such as solar and wind, hold great potential for addressing this issue, but require significant investment in infrastructure and technology. Ensuring a stable and sustainable energy supply is essential for driving industrial growth and improving living standards. For instance, countries with large solar resources often lack the infrastructure to harness and distribute this energy effectively.

Communication Infrastructure Needs

Bridging the digital divide is crucial for fostering economic growth and social progress. Broadband internet access and mobile network coverage are essential for empowering individuals and businesses. Developing robust communication infrastructure enables participation in the global economy and promotes knowledge sharing. For instance, countries with limited internet access experience challenges in attracting foreign investment and hindering online commerce.

Prioritizing Infrastructure Projects

A robust framework for prioritizing infrastructure projects is crucial for maximizing impact. Factors to consider include the project’s potential economic returns, social benefits, environmental sustainability, and political feasibility. A comprehensive cost-benefit analysis, incorporating local context and long-term vision, is essential for making informed decisions. For instance, a project that offers high economic returns but has negative environmental impacts should be carefully evaluated and potentially modified to mitigate those effects.

Comparison of Infrastructure Needs Across African Countries

The infrastructure needs vary significantly across African countries. Landlocked countries often face challenges in developing efficient transportation networks. Coastal countries may have more developed ports but still face issues with inland transportation. Analyzing the specific context of each nation is crucial for developing tailored solutions. For instance, the infrastructure needs of a rapidly growing, industrializing nation differ from those of a primarily agricultural economy.

Evaluating the Feasibility of Mobilization

Africa boasts a substantial pool of local capital, estimated at $4 trillion, ripe for investment in infrastructure. However, translating this potential into tangible projects requires a strategic approach to attracting and allocating these funds. Successful mobilization hinges on addressing crucial factors, from fostering a conducive investment climate to mitigating potential obstacles.The task is not merely about identifying the capital; it’s about ensuring its efficient deployment into impactful infrastructure projects.

This involves creating a robust framework for attracting and allocating capital, encouraging private sector participation, and implementing effective governance mechanisms. Transparency and accountability are paramount to build trust and encourage further investment.

Mechanisms for Attracting and Allocating Capital

Several mechanisms can attract and allocate local capital to infrastructure projects. These include establishing dedicated investment funds specifically targeted at infrastructure development, creating public-private partnerships (PPPs) to leverage private sector expertise and resources, and implementing innovative financing instruments like impact bonds and green bonds. These mechanisms can attract both domestic and foreign investment.

Examples of Successful Infrastructure Projects

Numerous successful infrastructure projects funded by local capital in Africa demonstrate the viability of this approach. Examples include the construction of new roads, bridges, and power plants in countries like Ghana, Kenya, and Nigeria. These projects often involve local contractors, creating jobs and stimulating economic growth. These projects showcase the power of local capital to drive development and improvement in infrastructure.

Role of Policy and Regulatory Frameworks

Sound policy and regulatory frameworks are crucial for encouraging investment in infrastructure projects. These frameworks should provide clarity on land acquisition procedures, streamline bureaucratic processes, and ensure transparent and predictable regulations. Moreover, they must protect investors’ rights and provide a stable legal environment.

Potential Obstacles to Mobilization

Several obstacles hinder the mobilization of this capital. Corruption and lack of transparency can deter investment, creating an environment where funds are misappropriated or allocated inefficiently. Furthermore, security concerns in certain regions can create uncertainty for investors, potentially impacting project feasibility. Addressing these issues is crucial for building trust and encouraging investment.

Potential Impacts and Benefits

Africa’s vast reservoir of local capital, estimated at $4 trillion, presents a tremendous opportunity for infrastructure development. This capital, coupled with well-prepared infrastructure projects, holds the key to unlocking significant economic and social progress across the continent. However, realizing this potential requires careful consideration of the multifaceted impacts and benefits, both positive and potentially negative.The potential benefits are substantial, ranging from improved economic conditions to enhanced social well-being and regional integration.

A crucial element in achieving these benefits is the responsible and strategic mobilization of these resources. This includes ensuring transparency, accountability, and effective project management to maximize the positive impacts while mitigating potential risks.

Positive Economic Impacts, Afc says africa has 4 trillion local capital available fund infrastructure

The infusion of $4 trillion in local capital can drive significant economic growth across African nations. Investment in infrastructure, such as transportation networks, energy grids, and communication systems, will foster trade and commerce. Improved connectivity will reduce logistical costs and facilitate the movement of goods and services, potentially boosting export revenues and creating new market opportunities. Furthermore, increased productivity stemming from improved infrastructure will likely lead to higher economic output and generate more employment.

Social Benefits of Improved Infrastructure

Enhanced infrastructure will improve the quality of life for millions across the continent. Improved transportation networks will reduce travel times and costs, enabling access to healthcare, education, and other essential services. Access to reliable energy will improve living conditions and facilitate business operations, particularly in underserved communities. The creation of new jobs in the construction and maintenance sectors of these infrastructure projects will significantly reduce unemployment rates and improve the economic prospects of many Africans.

Potential Environmental Concerns and Considerations

Infrastructure development, while essential, can have environmental consequences. Careful planning and implementation are critical to mitigating these risks. Sustainable construction methods, environmentally friendly energy sources, and effective waste management systems are crucial. For example, the construction of hydroelectric dams can significantly impact local ecosystems. Thorough environmental impact assessments and community consultations are essential to ensure that infrastructure projects do not come at the cost of environmental sustainability.

Potential Long-Term Benefits for Regional Economic Integration

Improved infrastructure will facilitate cross-border trade and investment, strengthening regional economic integration. The construction of seamless transportation networks, efficient energy systems, and robust communication systems will create a more interconnected and prosperous continent. This integration will create opportunities for regional cooperation, shared resources, and joint ventures, thereby fostering a more resilient and dynamic economic environment. Countries can leverage shared infrastructure to develop integrated supply chains and optimize resource utilization, leading to more efficient and sustainable development.

Structuring Information for Analysis

Africa’s vast potential for infrastructure development hinges on effectively structuring the information surrounding its available capital and needs. This requires a clear understanding of the specific infrastructure gaps in different countries, alongside potential funding sources and the feasibility of capital mobilization. Careful consideration of the financial instruments available and the challenges inherent in this process is crucial for successful implementation.

Infrastructure Needs and Funding Sources by Country

Analyzing infrastructure needs across African nations is paramount to targeted development strategies. A comparative overview facilitates the identification of priority areas and tailored funding approaches. This table provides a glimpse into the potential for leveraging local and foreign capital.

Note: Figures represent estimated costs and are subject to variation based on specific project details and economic conditions. The table provides a simplified overview, and a detailed assessment would involve extensive data collection and analysis.

AFC’s claim that Africa has $4 trillion in local capital available for funding infrastructure is pretty significant. It’s a huge potential, and seeing how that capital is actually being utilized is key. This potential is further explored in a fascinating photo essay, ” inside cecot photo essay “, which offers a great look into the practical aspects of this economic landscape.

Hopefully, this kind of investment will translate into real progress and development across the continent.

Financial Instruments for Capital Attraction

The choice of financial instruments significantly impacts the success of infrastructure projects. Selecting appropriate instruments can attract the necessary capital while ensuring financial stability and sustainability.

AFC’s announcement about Africa’s $4 trillion in local capital ready for infrastructure investment is quite significant. This massive pool of funds could potentially revitalize the continent’s development, but the global landscape is complex. The current geopolitical tensions, particularly surrounding the Ukraine minerals and their impact on US security, as seen in the ukraine minerals us security shield trump narrative, are likely to influence how this capital is deployed.

Ultimately, Africa’s potential for growth hinges on navigating these complexities and harnessing its vast resources effectively.

Note: The table presents a limited selection of instruments, and other innovative or customized financial instruments might be applicable in specific contexts.

Key Challenges in Capital Attraction and Allocation

Several obstacles hinder the effective attraction and allocation of capital for infrastructure development in Africa.

- Political and regulatory instability: Unpredictable policy changes and bureaucratic hurdles can deter investors and delay projects. This requires governments to create a stable and transparent environment.

- Project risk assessment and management: Accurate risk assessments are crucial for securing financing. This involves careful evaluation of technical, economic, and political factors.

- Lack of skilled manpower: A shortage of experienced professionals in infrastructure development can hinder project execution. Capacity building is crucial.

- Corruption and lack of transparency: Corruption and opaque governance can deter investment and undermine project sustainability.

- Limited access to finance: Many African businesses and governments face difficulties in accessing capital, requiring innovative solutions.

Key Arguments of the Statement

“AFC says Africa has 4 trillion local capital available to fund infrastructure.” This assertion highlights the significant pool of capital within Africa that can be leveraged for infrastructure development. This implies a need for effective mobilization strategies, focusing on facilitating access to funding for infrastructure projects.

Illustrative Case Studies

Africa boasts a wealth of untapped local capital, poised to fuel infrastructure development. However, translating this potential into tangible projects requires successful case studies that demonstrate the viability and benefits of local funding. Understanding the mechanisms, outcomes, and community engagement in such projects provides crucial insights for future endeavors.This section explores exemplary infrastructure projects in Africa, funded by local capital, highlighting the successes, challenges, and lessons learned.

We’ll examine the funding models, community involvement, and overall impact, offering valuable insights for replicating these positive outcomes across the continent.

Successful Infrastructure Projects Funded by Local Capital

Several projects across Africa demonstrate the effectiveness of local capital in driving infrastructure development. These projects, while varying in scale and scope, share common threads of community engagement, effective funding mechanisms, and positive outcomes.

Funding Mechanisms

Local capital mobilization for infrastructure projects can take diverse forms. These include community-based savings and loan associations, local banks, and public-private partnerships involving local entrepreneurs.

- Community-based savings and loan associations, often rooted in traditional social structures, can mobilize significant capital for smaller-scale projects. These associations, fostering a sense of shared responsibility and collective prosperity, have proved effective in financing local infrastructure projects, like water wells and community centers.

- Local banks play a vital role in channeling local capital into infrastructure projects. Their established infrastructure and networks facilitate project financing and ensure responsible disbursement of funds. This often involves leveraging existing local knowledge and expertise, leading to more sustainable and effective outcomes.

- Public-private partnerships (PPPs) involving local entrepreneurs and businesses can stimulate infrastructure development. These collaborations allow leveraging the expertise and resources of both public and private sectors. By partnering with local entrepreneurs, governments can leverage their knowledge of local needs and market dynamics, potentially leading to more impactful and relevant projects.

Outcomes and Community Involvement

The success of these projects often hinges on the level of community involvement. Active participation in planning, execution, and maintenance ensures projects align with local needs and are sustainable in the long term.

- A notable example is the construction of a rural road in Ghana. The project involved local farmers, who actively participated in the planning and construction phases, contributing their labor and resources. This collaborative approach ensured the road’s alignment with local transportation needs and facilitated improved access to markets and healthcare facilities for the community.

- The successful implementation of community-led water projects in Kenya often involves community members taking ownership of maintenance. This approach ensures the longevity of the project and empowers the community to manage their own water resources, promoting health and sustainability.

Success Factors and Lessons Learned

Several factors contribute to the success of local capital-funded infrastructure projects. Effective project planning, community engagement, transparent governance, and appropriate technical expertise are key.

- Transparent governance structures are crucial to build trust and accountability in local capital mobilization initiatives. This ensures the funds are used effectively and efficiently, with clear mechanisms for monitoring and evaluation. Transparency also fosters public confidence in the project and encourages further participation.

- Engaging local communities in the planning and implementation phases is essential. By involving local stakeholders, projects are more likely to align with community needs and priorities, fostering ownership and ensuring sustainability.

End of Discussion

The statement that Africa has $4 trillion in local capital available for infrastructure development is undeniably significant. It highlights the immense potential within the continent to address critical infrastructure gaps and drive economic growth. However, realizing this potential requires meticulous planning, effective strategies, and a commitment to transparency and accountability. Success hinges on mobilizing this capital responsibly, prioritizing projects strategically, and mitigating potential obstacles.

The journey towards a brighter future for African infrastructure hinges on navigating these complexities and leveraging this substantial opportunity.