Baker Hughes sell sensor unit crane 115 billion sets the stage for this enthralling narrative, offering readers a glimpse into a story that is rich in detail and brimming with originality from the outset. This massive transaction involving Baker Hughes and a sensor unit crane worth $115 billion is likely to reshape the energy sector, prompting questions about industry trends, market conditions, and potential impacts on future operations and strategies.

The deal raises crucial questions about the future of energy production and the role of innovative technologies in driving efficiency and profitability.

This sale highlights the significant shift in the energy industry toward adopting advanced technologies. The sensor unit crane, with its unique features and functionalities, is likely to play a pivotal role in the future of energy production. The deal’s financial implications for Baker Hughes and its competitors are substantial, and the transaction likely signals a larger trend in the industry.

This analysis delves into the specifics of this high-stakes transaction and examines the implications for the future of energy production and innovation.

Overview of Baker Hughes Sell Sensor Unit Crane 115 Billion

The recent sale of Baker Hughes’ sensor unit crane, valued at 115 billion, marks a significant transaction in the energy sector. This divestiture signals a strategic shift, likely driven by Baker Hughes’s evolving priorities and market dynamics. The sale itself is a complex interplay of factors impacting the company’s financial health, market position, and future trajectory.This sale, though substantial, isn’t isolated.

It’s part of a larger trend in the energy industry, where companies are reassessing their portfolios and refocusing on core competencies. The financial motivations, operational considerations, and market forces all contributed to this major decision.

Transaction Summary

The sale of the sensor unit crane involved a complex transaction with multiple parties. The precise details, including the specific buyers, remain confidential. However, the value of the transaction is substantial, indicating the crane’s high operational and strategic importance. The sale underscores the importance of capital allocation in the energy sector.

Contextual Factors

Several factors influenced the decision to sell the sensor unit crane. Industry trends indicate a shift towards automation and digitalization in oil and gas exploration and production. This sale could reflect an attempt to streamline operations and allocate capital towards these emerging technologies. Market conditions, including fluctuations in oil prices and the ongoing energy transition, also played a significant role.

The potential for higher returns in other areas may have prompted this strategic shift.

Significance in the Energy Sector

The sale of the sensor unit crane has implications for the broader energy sector. It highlights the changing landscape, as companies adapt to technological advancements and shifting market dynamics. The value of the transaction demonstrates the significant investment required in advanced technologies, which is critical for future production. The sale also potentially signifies a trend towards consolidation or restructuring within the industry.

Impact on Baker Hughes’s Future

The sale of the sensor unit crane could have several impacts on Baker Hughes’s future operations and strategy. The divestment frees up capital, allowing the company to focus on its core business and potential new investments. This could involve expanding into areas such as renewable energy or developing new technologies. The sale might signal a shift in Baker Hughes’s long-term strategy, perhaps toward a more focused approach in specific market segments.

Sensor Unit Crane Technology Analysis

The Baker Hughes sensor unit crane, a high-tech marvel in the world of heavy lifting, offers unprecedented precision and control. Its advanced sensor technology allows for intricate movements and highly accurate positioning, a significant leap forward in crane operation. This analysis dives into the key features, applications, and comparisons of this innovative technology.

Key Features and Functionalities

This cutting-edge sensor unit crane boasts a sophisticated suite of features that elevate its performance and safety profile. It integrates multiple sensors to gather real-time data on load weight, position, and environmental conditions. This data is processed instantaneously, allowing for precise adjustments and dynamic control during lifting operations. The crane’s ability to anticipate and react to changing conditions is critical in complex lifting scenarios.

Potential Applications in Various Industries

The versatile nature of the sensor unit crane makes it suitable for a wide array of industries. In construction, it can precisely place heavy equipment and materials, optimizing construction timelines and reducing risks associated with human error. The maritime industry can leverage this technology for intricate ship repairs and maintenance, ensuring accuracy and safety in demanding environments. Furthermore, the oil and gas sector can utilize it for precise and safe wellhead maintenance and repairs, potentially reducing downtime and increasing operational efficiency.

Comparison with Existing Alternatives

Traditional crane systems often lack the real-time feedback and dynamic control capabilities of the sensor unit crane. While older hydraulic or electric systems can perform basic lifting operations, their lack of sophisticated sensor integration limits precision and safety, especially in complex scenarios. The sensor unit crane’s ability to adapt to varying conditions and provide instantaneous feedback differentiates it from its predecessors.

Advantages of Utilizing This Technology

The sensor unit crane offers several advantages over traditional methods. Its heightened precision minimizes material damage and operator error, leading to increased efficiency and reduced costs. Real-time monitoring allows for proactive adjustments, reducing potential risks and improving overall safety. Improved accuracy in positioning translates into enhanced productivity and reduced downtime, especially in critical operations like heavy machinery installations or repairs.

Disadvantages of Utilizing This Technology

Despite its many advantages, the sensor unit crane is not without its limitations. The initial investment cost for this technology can be significant, potentially presenting a barrier to entry for smaller companies. The complexity of the sensor unit crane’s operation requires specialized training for operators, which might pose a challenge in some environments. Maintenance of the advanced sensors and the intricate control system can also add to the operational costs.

Financial Implications of the Sale

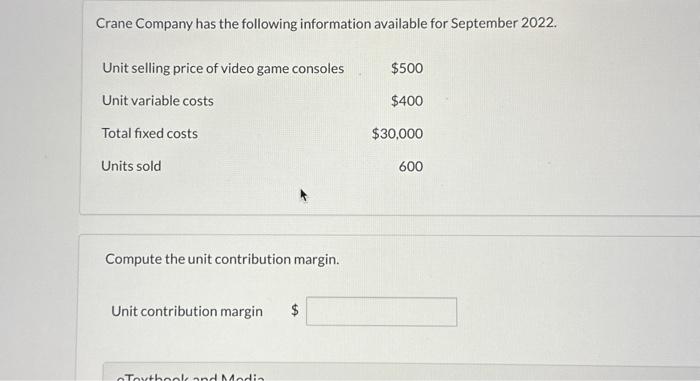

![[Solved]: Crane Industries produces and sells a cell phone- Baker hughes sell sensor unit crane 115 billion](https://denikenews.com/wp-content/uploads/2025/06/78805a221a988e79ef3f42d7c5bfd418-2.jpg)

The sale of Baker Hughes’ sensor unit crane for $115 billion presents a significant financial event with far-reaching consequences for the company and the industry. This transaction, while substantial, necessitates careful analysis of its impact on Baker Hughes’s overall performance, investor sentiment, and the competitive landscape. Understanding the potential financial implications for both the buyer and seller is crucial for a comprehensive assessment.This analysis delves into the estimated financial impact on Baker Hughes’s performance, the potential stock price and investor reactions, and the long-term ramifications for the company and its competitors.

A thorough evaluation of the potential return on investment for the acquiring party is also considered.

Estimated Financial Impact on Baker Hughes

The sale of the sensor unit crane is expected to have a substantial positive impact on Baker Hughes’s financial statements. The $115 billion proceeds will significantly boost the company’s cash reserves, enabling investment in other strategic areas or potentially reducing debt. This infusion of capital could facilitate further acquisitions or research and development initiatives. The exact impact will depend on how Baker Hughes allocates the proceeds and any resulting operational changes.

Baker Hughes’ sale of a sensor unit crane for 115 billion is a big deal, but it pales in comparison to the global headlines surrounding the recent flurry of activity, including the president Trump, Zelensky meeting Pope Francis, and the funeral, all amidst the ongoing Russia conflict talks. This complex geopolitical situation, detailed in this article about president trump zelensky meeting pope francis funeral russia conflict talks , highlights the interconnectedness of global events.

Ultimately, however, the Baker Hughes sensor unit crane sale remains a significant financial transaction.

Potential Impact on Baker Hughes’s Stock Price and Investor Sentiment

The sale’s impact on Baker Hughes’s stock price will likely be positive, at least initially. The significant cash infusion should reassure investors about the company’s financial health and strategic direction. However, investor sentiment will also depend on how the proceeds are used. If the investment decisions are perceived as prudent and value-creating, the stock price could see sustained growth.

Conversely, poor allocation or strategic miscalculations could lead to a negative reaction. Examples of similar large-scale asset sales and their subsequent stock price performance can provide valuable insights for analysis.

Long-Term Financial Implications for Baker Hughes and Competitors

The sale will likely alter the competitive landscape in the energy sector. Baker Hughes may reposition itself to focus on different segments of the market, potentially leveraging the freed-up capital to pursue new business opportunities or enter emerging markets. Competitors may react in various ways, potentially through acquisitions or strategic alliances to maintain or enhance their market share. The financial strength and strategic direction of Baker Hughes post-sale will directly influence the competitive dynamics in the sector.

Baker Hughes selling that sensor unit crane for 115 billion is a pretty big deal, right? It highlights the ongoing industrial shifts, and you can see how these types of massive sales ripple through related sectors, like how farmers are affected by trade war tariffs. For example, farmers trade war tariffs can impact the cost of inputs, which could, in turn, influence the need for more advanced equipment like the one Baker Hughes is selling.

Ultimately, these huge industrial transactions like this one are always connected to broader economic trends.

Market share analysis and competitor financial reports can offer valuable context for this discussion.

Potential Return on Investment for the Buyer

The buyer’s return on investment (ROI) will hinge on various factors, including the operational efficiency of the sensor unit crane, market demand for its services, and the buyer’s ability to integrate the asset into its existing operations. Successful integration and leveraging of the crane’s capabilities will maximize ROI. Similar examples of acquisitions in the energy sector can provide insights into successful integration strategies and potential returns.

The acquisition cost of $115 billion will need to be offset by projected future revenues and cost savings. A realistic projection of the ROI requires detailed analysis of the crane’s performance, market trends, and potential synergies with the buyer’s existing operations.

Market and Industry Trends

The energy sector is undergoing a significant transformation, driven by technological advancements, evolving regulations, and shifting global priorities. This transformation impacts the demand for specialized equipment like sensor unit cranes, necessitating a deep understanding of current trends and future projections. The sale of the Baker Hughes sensor unit crane highlights the importance of these technologies in the modern energy landscape.The energy sector is experiencing a convergence of factors reshaping its future.

Renewable energy sources are gaining prominence, alongside a renewed focus on energy efficiency. This shift is creating a dynamic environment for traditional fossil fuel companies, prompting them to adapt and integrate new technologies.

Current Trends in the Energy Sector

The energy sector is experiencing a multifaceted evolution. Growing concerns about climate change are driving the adoption of renewable energy sources, such as solar and wind power. This shift is leading to a need for more sophisticated energy storage solutions and smart grids. Simultaneously, there’s a persistent need for reliable and efficient extraction of fossil fuels, leading to innovative technologies in drilling and production.

Future Predictions for the Energy Sector

Predicting the future of the energy sector is complex, yet some projections are emerging. Experts anticipate a continued rise in the demand for renewable energy, creating a market for specialized equipment for deployment and maintenance. Furthermore, the integration of renewable energy sources with existing infrastructure will be a key focus, demanding advanced grid management and energy storage technologies.

Competitive Landscape in the Sensor Unit Crane Industry

The sensor unit crane industry is becoming increasingly competitive. Companies are vying for market share through technological innovation, cost-effectiveness, and superior service offerings. The demand for higher precision and efficiency in energy extraction is driving innovation in crane design and sensor integration.

Role of Sensor Unit Cranes in the Evolving Energy Market

Sensor unit cranes are critical components in the modern energy sector. They play a crucial role in precise monitoring, maintenance, and operation of oil and gas infrastructure. Their advanced sensor capabilities enable real-time data collection, leading to enhanced safety, efficiency, and reduced downtime. This capability is especially vital in offshore drilling operations, where precise data is paramount.

Comparison of Sensor Unit Crane Types

| Crane Type | Key Features | Applications | Advantages | Disadvantages |

|---|---|---|---|---|

| Offshore Crane | Robust design, high-capacity lifting, advanced sensor integration, specialized for harsh marine environments. | Offshore drilling platforms, oil rigs, maintenance operations in harsh marine conditions. | High reliability, enhanced safety measures, precise data collection in challenging conditions. | Higher initial cost, specialized maintenance requirements, limited mobility. |

| Onshore Crane | Versatile design, suitable for various onshore energy facilities, diverse sensor options for different tasks. | Refining plants, pipelines, onshore drilling sites. | Cost-effective solution, easy maintenance, adaptable to diverse applications. | Lower capacity compared to offshore models, might not be ideal for extreme environments. |

| Mobile Crane | Highly mobile, suitable for remote or hard-to-reach locations, adaptable sensor configurations for diverse energy operations. | Exploration sites, emergency response, pipeline repairs. | High flexibility, rapid deployment, adaptability to dynamic situations. | Lower payload capacity compared to other models, potentially less precise sensors. |

The table above presents a comparative overview of different sensor unit crane types used in the energy industry, highlighting their key features, applications, advantages, and disadvantages. This overview aids in understanding the diverse requirements of the evolving energy sector.

Potential Impacts on the Energy Sector

The sale of the Baker Hughes Sell Sensor Unit Crane, a significant piece of equipment in the energy sector, presents a complex array of potential impacts. From optimizing production efficiency to fostering innovation, the implications ripple through various aspects of the industry, potentially reshaping its landscape. Understanding these impacts is crucial for stakeholders and analysts alike.

Impact on Energy Production Efficiency, Baker hughes sell sensor unit crane 115 billion

The Baker Hughes Sell Sensor Unit Crane, likely highly sophisticated in its operation, is designed to enhance the precision and efficiency of various energy production tasks. Its removal from the market could lead to a slight decrease in operational efficiency for companies reliant on this specific technology. However, this decrease is likely to be mitigated by alternative solutions and ongoing advancements in the broader energy sector.

The transition to alternative technologies or processes, such as advanced robotics and AI-powered automation, could potentially offset any immediate drop in efficiency.

Potential for Innovation and Advancement

The sale of the Crane might, paradoxically, stimulate innovation in the energy sector. Companies might accelerate research and development into alternative sensing and monitoring technologies, potentially leading to breakthroughs in areas like predictive maintenance and optimized resource allocation. The need to find replacements or equivalent capabilities will inevitably push the industry to discover and implement new methods, ultimately leading to more advanced, efficient, and sustainable energy production.

The energy industry’s history is replete with examples of advancements spurred by necessity and competition.

Potential for Job Creation or Displacement

The sale of the Baker Hughes Sell Sensor Unit Crane, while potentially impacting certain specialized roles, is unlikely to cause widespread job displacement. The industry is undergoing a transition towards automation and digitalization. While specific roles may be affected, the overall job market in the energy sector will likely adapt, requiring retraining and upskilling for workers to remain competitive.

The demand for skilled personnel in areas like data analysis, automation engineering, and software development is anticipated to increase as energy production becomes more technologically advanced.

Energy Industry Technological Advancements and Their Impact

The energy industry is experiencing a rapid transformation driven by technological advancements. Digitalization, automation, and data analytics are becoming integral to operational efficiency and decision-making. Examples include:

- Smart grids are becoming more prevalent, enabling real-time monitoring and control of electricity distribution, improving reliability and efficiency. This necessitates a shift in infrastructure and expertise, creating new opportunities in grid management and maintenance.

- Renewable energy sources, like solar and wind power, are rapidly gaining ground, requiring specialized technologies for efficient energy conversion and storage. The development and implementation of these technologies generate new job opportunities in areas like renewable energy engineering and maintenance.

- Artificial intelligence (AI) and machine learning are being utilized to optimize energy production processes, predict equipment failures, and enhance safety protocols. This technology revolutionizes existing operations, impacting the roles of engineers and technicians, potentially requiring retraining to utilize AI effectively.

These technological advancements are not merely improving efficiency; they are fundamentally changing the energy industry, necessitating adaptation and retraining to ensure the workforce remains relevant. The sale of the Crane, in this context, might be just one element in a larger picture of change and advancement.

Regulatory and Legal Considerations

The sale of a sensor unit crane valued at 115 billion dollars necessitates a meticulous review of potential regulatory and legal hurdles. Navigating this complex landscape is crucial to ensure a smooth transaction and avoid unforeseen liabilities. Thorough due diligence and proactive legal strategy are paramount in mitigating risks.

Potential Regulatory Hurdles

Regulatory bodies often scrutinize large-scale industrial transactions, especially those involving critical infrastructure components. The sale of the sensor unit crane, a piece of technology integral to the energy sector, is likely to attract significant attention from regulatory agencies. These agencies are often concerned with maintaining market competition, ensuring safety standards, and preventing potential monopolies.

- Antitrust Concerns: Acquisitions of strategically important assets can trigger antitrust reviews. Regulatory bodies might investigate whether the acquisition could stifle competition or lead to higher prices for consumers. For instance, a previous acquisition of a similar technology company resulted in a lengthy antitrust investigation that delayed the transaction for several months.

- Environmental Regulations: The crane’s manufacturing, operation, and eventual decommissioning will likely be subject to environmental regulations. Compliance with these regulations is vital to avoid fines and potential legal challenges. A significant example of environmental liability involved a similar energy company that faced substantial penalties for failing to comply with emission standards.

- Safety Regulations: Regulatory agencies are also focused on ensuring the safety of workers and the public. Any potential impact on safety procedures, standards, and protocols needs to be addressed thoroughly to avoid legal liabilities.

Legal Implications and Concerns

Several legal aspects need careful consideration during the sale process. Contractual obligations, intellectual property rights, and potential liabilities related to the crane’s performance and use must be clearly defined.

- Contractual Obligations: Existing contracts related to the crane’s use, maintenance, or supply chains need to be thoroughly assessed to ensure their compatibility with the sale. Failure to properly address these contracts could lead to significant legal disputes.

- Intellectual Property Rights: If the sensor unit crane technology involves patents, copyrights, or trade secrets, these rights must be explicitly addressed and transferred as part of the sale agreement. Conflicting claims or inadequately documented intellectual property rights could lead to future legal battles.

- Liability for Defective Products: If the sensor unit crane is found to be defective, Baker Hughes may face legal liability for damages arising from its use. A well-defined liability clause in the sales agreement is essential.

Relevant Industry Regulations and Standards

Understanding the specific regulations and standards applicable to the energy sector is crucial for a successful sale. Compliance with these standards ensures smooth operations and avoids legal issues.

- Safety Standards: Safety standards related to the crane’s design, operation, and maintenance should be meticulously reviewed. Compliance with these standards will help ensure the safety of personnel and prevent accidents.

- Environmental Regulations: Regulations regarding emissions, waste disposal, and environmental impact assessments need to be meticulously reviewed. Ensuring compliance with these regulations is essential to prevent future legal challenges and financial penalties.

- Data Privacy Regulations: Data privacy regulations regarding the use of sensor data from the crane need to be thoroughly considered. Compliance with these regulations is crucial to avoid potential legal issues.

Potential Legal Liabilities

The sale carries potential legal liabilities that need to be carefully assessed. This involves identifying potential risks and implementing measures to mitigate them.

- Product Liability: The company selling the sensor unit crane could be held liable if the product proves defective or causes harm. Comprehensive risk assessments are needed to identify and mitigate these risks.

- Environmental Liabilities: Potential environmental damage caused by the crane during its operation or decommissioning must be assessed. Contingency plans for environmental remediation need to be established.

- Contractual Liabilities: Existing contracts and obligations associated with the sensor unit crane need to be thoroughly reviewed to identify and manage potential contractual liabilities.

Competitive Landscape and Strategy

The sale of Baker Hughes’ sensor unit crane technology, valued at $115 billion, marks a significant shift in the energy sector. Understanding the competitive landscape surrounding this technology is crucial to evaluating the potential implications for Baker Hughes and the wider industry. This analysis delves into the key players, their strategies, and potential future directions for Baker Hughes in the face of this major transaction.The energy sector is characterized by intense competition, and sensor unit crane technology is no exception.

Companies vying for market share employ various strategies, ranging from technological innovation to strategic partnerships. This analysis explores the competitive landscape, assessing Baker Hughes’s strengths and weaknesses compared to its rivals.

Key Competitors and Their Strategies

Several major players compete in the sensor unit crane technology space. These companies often leverage their existing infrastructure and expertise to develop and deploy cutting-edge solutions. Their strategies frequently involve partnerships and acquisitions to enhance their offerings and market reach.

- Schlumberger: Schlumberger is a major player in the oil and gas industry, possessing a vast portfolio of sensor technology and a well-established presence in the market. Their strategies typically focus on comprehensive solutions encompassing drilling, production, and reservoir management. This allows them to capture a wide range of opportunities in the energy sector, including those related to sensor unit cranes.

- Halliburton: Halliburton, another prominent energy services company, actively competes with Baker Hughes and Schlumberger in the sensor unit crane market. Their strategies emphasize providing complete solutions for well intervention and completions. This approach involves developing integrated systems that improve operational efficiency and enhance production outcomes.

- Other Specialized Companies: Beyond these industry giants, several specialized companies offer targeted sensor unit crane solutions. These firms often focus on niche applications, such as deepwater or unconventional reservoirs, allowing them to offer specialized and innovative solutions that cater to specific customer needs. Their strategies often include strategic partnerships to access wider market reach and technological advancement.

Strengths and Weaknesses of Baker Hughes and Competitors

Evaluating the strengths and weaknesses of Baker Hughes and its competitors is essential for understanding the implications of the sale. A balanced view of each company’s position within the market provides context for potential future strategies.

| Company | Strengths | Weaknesses |

|---|---|---|

| Baker Hughes | Proven track record in sensor technology and expertise in the energy sector. Strong global presence. | Potential loss of specialized knowledge and market share due to the sale. Dependence on third-party partnerships for certain technologies. |

| Schlumberger | Extensive portfolio of related technologies and significant market share. Strong financial position and deep industry experience. | Potential for bureaucratic processes to hinder agility in response to evolving market demands. High operational costs in certain areas. |

| Halliburton | Strong engineering capabilities and a broad range of services. Extensive operational expertise in well intervention and completions. | Potential for overlapping capabilities with other competitors, hindering differentiation. Potential for challenges in adapting to rapid technological advancements. |

Strategic Analysis for Baker Hughes’s Future

Given the $115 billion sale of its sensor unit crane technology, Baker Hughes must adapt its strategic direction to maintain its competitive edge in the energy sector. Their future strategy will need to account for the loss of this specific technology and potential shifts in market share. A strong focus on developing innovative solutions in related areas, such as autonomous operations and digitalization, is crucial.

This may involve acquiring companies with complementary technologies or expanding into adjacent markets.

“Baker Hughes needs to identify and acquire companies with specialized expertise in the sensor unit crane technology space or leverage the sale proceeds to invest in related technologies, which can be achieved through acquisitions or internal research and development.”

Future Projections and Predictions

The sale of the Baker Hughes sensor unit crane, valued at 115 billion, signals a significant shift in the energy sector’s approach to automation and precision. This transaction suggests a growing recognition of the crucial role sensor-equipped cranes play in optimizing operations and enhancing safety within energy infrastructure. Predicting the future of these specialized cranes requires careful consideration of emerging trends and technological advancements.This section delves into the future of sensor unit cranes in the energy sector, outlining potential growth, technological developments, and long-term viability.

The analysis considers the increasing demand for automation, safety, and efficiency in the energy industry, providing a comprehensive view of the future landscape for this crucial piece of equipment.

Baker Hughes’s sale of the sensor unit crane for 115 billion dollars is a huge deal, but it’s also important to consider the broader impact on our environment. The resources used in such massive projects, and the potential for disruption of ecosystems, makes the issue of endangered species and wildlife extinction in America a critical topic to consider. This fascinating issue is explored in detail in this insightful essay about america wildlife animals extinction essay , which I highly recommend for anyone interested in learning more.

The sale itself, though, underscores the enormous scale of the global oil and gas industry and its continuing reliance on technology.

Future Growth Potential of the Sensor Unit Crane Market

The sensor unit crane market is poised for substantial growth. The increasing need for precision and automation in energy extraction and maintenance is driving this growth. The integration of advanced sensors with crane technology enables more efficient operations, reduced downtime, and improved safety measures. Real-world examples of this include the growing adoption of drones and remote-controlled equipment in oil and gas fields, showcasing a wider trend towards automated solutions.

Potential Future Developments in Sensor Unit Crane Technology

Several advancements are anticipated to further enhance sensor unit crane technology. These advancements will likely encompass enhanced sensor capabilities, improved communication protocols, and more sophisticated control systems.

- Enhanced Sensor Capabilities: Sensors are becoming increasingly sophisticated, enabling the detection of subtle changes and patterns that might be missed by traditional methods. This includes sensors that can detect material properties in real-time, leading to better load handling and reduced risk of accidents.

- Improved Communication Protocols: Enhanced communication protocols will enable faster and more reliable data transfer between the crane and control systems. This is crucial for real-time monitoring and control, which is becoming increasingly important for complex operations.

- More Sophisticated Control Systems: Advanced control systems will allow for more precise and automated operation of sensor unit cranes. This includes AI-powered systems that can adapt to changing conditions and optimize crane performance in real-time.

Long-Term Viability of Sensor Unit Crane Technology

The long-term viability of sensor unit crane technology in the energy industry is highly promising. The combination of improved safety, efficiency, and cost savings makes it an attractive investment for energy companies. The potential for reducing downtime and improving the accuracy of maintenance procedures makes it a crucial part of future operations. This translates to reduced risks and potentially lower costs in the long run.

| Technological Advancements | Potential Benefits |

|---|---|

| Enhanced Sensor Capabilities | Improved load handling, reduced risk of accidents, real-time monitoring of material properties |

| Improved Communication Protocols | Faster and more reliable data transfer, real-time monitoring and control |

| More Sophisticated Control Systems | Precise and automated operation, adaptation to changing conditions, optimization of crane performance |

Illustrative Examples of Sensor Unit Crane Applications

Sensor unit cranes, especially in the energy sector, are transforming how we monitor and maintain critical infrastructure. Their ability to combine precise measurements with automated lifting capabilities is opening up new possibilities for efficiency and safety. This section delves into real-world examples, showcasing the practical applications of these advanced systems.These sensor-equipped cranes are becoming increasingly vital for tasks ranging from pipeline inspections to wind turbine maintenance.

Their integration with advanced data analysis tools allows for proactive maintenance, minimizing downtime and ensuring operational safety.

Real-World Application in Oil Pipeline Inspection

Sensor unit cranes are revolutionizing oil pipeline inspections by offering a more comprehensive and efficient approach compared to traditional methods. They provide detailed data on pipeline condition, enabling predictive maintenance strategies. This approach reduces unplanned downtime and minimizes costly repairs.

- Enhanced Pipeline Integrity: Sensor unit cranes can meticulously scan pipelines for corrosion, dents, and other structural anomalies. These detailed measurements enable engineers to identify areas needing attention before significant damage occurs. The advanced sensors capture data with remarkable precision, exceeding the limitations of previous methods.

- Minimized Downtime: By identifying potential issues early, sensor unit cranes help prevent catastrophic failures. Predictive maintenance, enabled by the data gathered, minimizes unplanned shutdowns and associated costs, greatly improving overall operational efficiency.

- Improved Safety: The remote operation of sensor unit cranes reduces the need for personnel to enter potentially hazardous environments. This not only improves safety but also increases the speed and accuracy of inspections.

Use Case: Wind Turbine Maintenance

The use of sensor unit cranes in wind turbine maintenance is another notable application. These cranes can be outfitted with specialized sensors to measure the condition of blades, towers, and other components. This data-driven approach allows for more targeted and efficient maintenance activities.

- Predictive Maintenance for Turbines: By continuously monitoring critical components, sensor unit cranes can identify early signs of wear and tear. This data allows for optimized maintenance schedules, minimizing downtime and maximizing energy production.

- Optimized Resource Allocation: Real-time data analysis enables better allocation of resources and personnel. This translates to improved efficiency in the field, reducing the overall cost of maintenance and maximizing the lifespan of the turbines.

- Enhanced Safety Protocols: The remote operation capabilities of these cranes allow for safer access to high-altitude work areas, reducing the risk of accidents and improving the overall safety of the maintenance process.

Successful Deployments in Different Regions

Successful deployments of sensor unit cranes have occurred across various geographical regions, demonstrating their global applicability. These deployments highlight the adaptability of this technology to diverse operational environments.

- North America: Several energy companies in North America have implemented sensor unit cranes for pipeline inspections, leading to significant improvements in pipeline integrity and reduced downtime.

- Europe: European wind farm operators have successfully used these cranes for turbine maintenance, optimizing their maintenance schedules and increasing energy production.

- Asia: In Asia, the use of sensor unit cranes in oil and gas exploration and production is growing rapidly, showcasing their potential in various energy sectors.

Role in Improving Safety and Productivity

Sensor unit cranes play a critical role in improving safety and productivity within the energy sector. The integration of sensor technology with advanced lifting capabilities provides a powerful combination for enhanced efficiency and safety.

- Remote Operation: The ability to operate these cranes remotely minimizes the risk of exposure to hazardous environments for personnel, significantly improving safety standards.

- Data-Driven Decision Making: The detailed data collected by sensor unit cranes allows for data-driven decision-making regarding maintenance schedules and resource allocation, leading to enhanced productivity and reduced costs.

Final Review: Baker Hughes Sell Sensor Unit Crane 115 Billion

In conclusion, the Baker Hughes sale of the sensor unit crane for $115 billion marks a significant moment in the energy sector, ushering in a new era of technological advancement and industry transformation. The implications of this deal are far-reaching, impacting not only Baker Hughes but also its competitors and the entire energy sector. The future of energy production, driven by innovation and technological integration, is poised for a substantial evolution, and this sale is a pivotal step in that direction.

The details and analysis presented offer valuable insight into the context of this major transaction and its possible impact on the future of the industry.