Big business trumps tax cuts essay delves into the complex relationship between corporate tax cuts and their impact on the economy. This essay examines the arguments for and against such policies, considering potential benefits like job creation and investment, alongside potential drawbacks such as increased income inequality and reduced government revenue. A critical overview of historical examples and alternative policies will provide a well-rounded perspective.

The essay explores the potential economic consequences of tax cuts for big businesses, comparing and contrasting different policies to highlight their effects on both corporations and the broader economy. It analyzes the impact on employment, wages, and societal well-being, examining the ethical implications of such policies.

Introduction to Big Business and Tax Cuts

Big business, in the context of this essay, refers to corporations with significant market share, substantial capital, and considerable influence on the global economy. These entities, often multinational conglomerates, operate across various sectors and employ thousands, impacting not only their shareholders but also their employees, suppliers, and consumers. Understanding how tax policies affect their operations is crucial to comprehending their impact on broader economic trends.Historically, tax policies have played a pivotal role in shaping the landscape of big business.

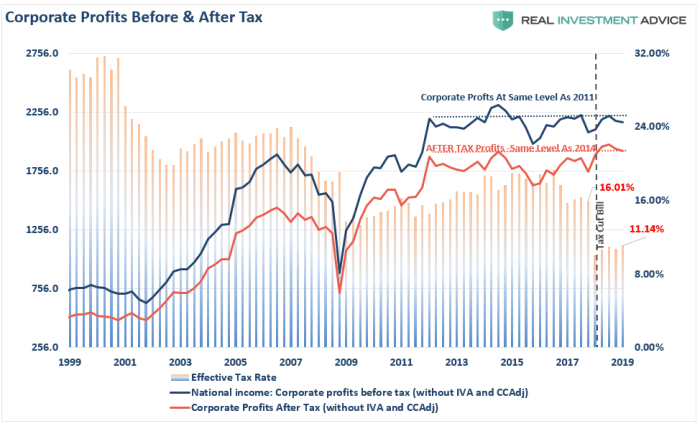

The 2017 Tax Cuts and Jobs Act, for instance, significantly lowered the corporate tax rate in the United States, prompting considerable debate about its long-term effects. Similarly, various countries have implemented tax incentives and deductions tailored to attract foreign investment and boost domestic industries. Analyzing past examples illuminates the complex interplay between tax policies and corporate behavior.The potential economic consequences of tax cuts for big businesses are multifaceted.

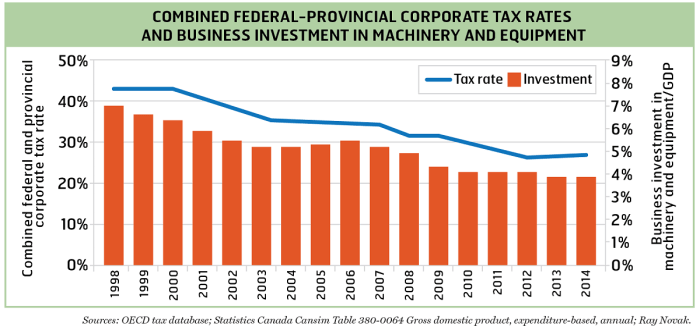

Reduced tax burdens can lead to increased profits, potentially driving investment, job creation, and innovation. However, such benefits may not be universally distributed, and their effect on the overall economy hinges on factors like the business’s investment strategies, the competitiveness of the market, and the overall economic climate. Further, tax cuts can potentially exacerbate income inequality if the benefits are disproportionately concentrated among high-income individuals and corporations.

Comparison of Different Tax Policies

Different tax policies impact big business and the economy in varying ways. This comparison highlights the diverse outcomes of different approaches.

| Policy | Impact on Big Business | Impact on Economy |

|---|---|---|

| Example Policy 1: Lowering the corporate tax rate | Potentially increased profitability, potentially increased investment in new projects and expansion, potentially leading to job creation. But may also lead to reduced government revenue, which could impact public services. | Potential for economic growth, driven by increased investment and job creation. However, the reduced tax revenue may result in cuts to public services, potentially slowing economic growth in other areas. The long-term effect is dependent on factors such as the use of profits and the health of the economy. |

| Example Policy 2: Tax incentives for research and development | Encouraging innovation and technological advancements. Big businesses might allocate more resources to research and development, potentially leading to higher profits and improved competitiveness in the long term. | Potential for long-term economic growth driven by technological advancements and innovation. This could lead to increased productivity and competitiveness, potentially raising the overall standard of living. |

Historical Examples of Tax Policies

Examining historical examples of tax policies affecting large corporations provides valuable insights into their potential consequences. For instance, the 2001 and 2003 tax cuts, designed to stimulate economic growth, had mixed results, highlighting the complexity of predicting economic outcomes from such policies. The effects are further complicated by global economic conditions, regulatory changes, and broader societal trends.

Potential Economic Consequences

Reduced tax burdens for big businesses can translate to increased profits, potentially boosting investment, job creation, and innovation. However, the extent of these benefits hinges on factors like market competition and economic conditions. Conversely, decreased government revenue might affect public services and infrastructure development, which can indirectly influence economic growth. The distribution of benefits is also critical; if disproportionately concentrated among high-income individuals and corporations, it could worsen income inequality.

Arguments for Tax Cuts for Big Business

Proponents of tax cuts for large corporations often argue that these reductions stimulate economic growth and job creation. They believe that by lowering the tax burden on businesses, companies will have more capital available to invest in expansion, research and development, and new technologies. This, in turn, leads to increased productivity, higher output, and ultimately, a stronger economy. The idea is that the benefits will “trickle down” to workers and consumers in the form of higher wages, lower prices, and increased overall prosperity.This approach assumes that corporations will reinvest the savings from lower taxes, rather than simply increasing profits for shareholders.

While some corporations may choose to distribute the savings to shareholders, the overall goal is that the investment will create a virtuous cycle of growth. This theory is central to the argument for tax cuts, with proponents suggesting that a healthy business environment benefits everyone.

Economic Growth and Job Creation

Lower corporate tax rates are often presented as a catalyst for economic growth. The argument suggests that businesses will use the extra capital to expand operations, hire more employees, and invest in new projects. This increased activity leads to greater production, higher demand, and ultimately, economic expansion. Proponents cite historical examples where tax cuts have been followed by periods of economic growth.

Potential Benefits for Investors and Shareholders

Reduced corporate tax burdens can translate into increased profitability for investors and shareholders. This is due to the increased revenue generated by the business, resulting in higher dividends and potentially greater stock valuations. This can create a positive feedback loop, encouraging further investment and driving economic growth. A company with lower tax burdens will potentially generate more revenue and profit, ultimately benefitting investors.

Examples of Successful Economic Models

While identifying a singular “successful economic model” based solely on tax cuts for big business is complex and contentious, various examples of economic recoveries following tax cuts are often cited. Some examples include tax cuts implemented in the United States during specific periods, which were followed by periods of job creation and economic growth. It is crucial to note that economic success is a multifaceted issue, and attributing it solely to tax cuts can be overly simplistic.

Many other factors, such as technological advancements, global economic conditions, and government spending policies, influence the economic landscape. Furthermore, a rigorous and comparative analysis of these examples is crucial to understanding the correlation between tax cuts and economic outcomes. The nuances of each case and the wider context need careful consideration.

Potential Arguments

- Increased investment in research and development (R&D): Lower taxes may incentivize businesses to invest more in R&D, leading to innovation and new technologies. This can drive productivity improvements and enhance the competitiveness of the company in the long run.

- Expansion into new markets: Tax cuts can provide the financial resources for companies to explore new markets, leading to greater market share and global competitiveness. This expansion can potentially create jobs in the home country as well as abroad.

- Attracting foreign investment: Lower tax rates might attract foreign companies to invest in the country, creating job opportunities and stimulating economic activity. This depends on various factors, such as the overall investment climate and regulatory environment.

- Job creation: The increased activity and expansion resulting from tax cuts may lead to a rise in job opportunities, boosting employment levels and reducing unemployment.

Arguments Against Tax Cuts for Big Business

Tax cuts for large corporations, while proponents argue for increased investment and job creation, often overlook the potential negative consequences for the general public and the broader economy. These cuts can exacerbate existing inequalities and strain public resources, ultimately harming the very economic growth they are intended to stimulate. A critical examination of the potential drawbacks is essential for a balanced understanding of this complex issue.The allure of tax cuts for big business often focuses on the promise of increased investment and job creation.

However, a deeper dive reveals a more nuanced reality, one that frequently overlooks the potential for significant harm to the public good. This analysis will delve into the potential negative impacts of such cuts, considering their effect on income inequality, social programs, economic stability, and public services.

Potential Impact on Income Inequality

Tax cuts for large corporations, while potentially boosting profits, often disproportionately benefit the wealthiest individuals and shareholders. This can lead to a widening gap between the rich and the poor, exacerbating existing societal inequalities. Historical data on tax cuts and their impact on income distribution provides a clear picture of the potential for these policies to worsen the wealth gap.

For instance, certain tax cuts in the past have been correlated with a rise in the income share held by the top 1 percent, while the income share of the middle and lower classes has remained stagnant or declined.

While researching the “big business trumps tax cuts essay,” I stumbled upon a fascinating connection to the recent Netflix documentary on the Tylenol murders. This incident, as explored in tylenol murders documentary netflix , highlights how a company’s actions can have far-reaching consequences. It makes you think about how similar issues of corporate responsibility and public trust might play out in the larger context of tax cuts and big business today.

Impact on Social Programs

Reduced government revenue from tax cuts for big business can significantly impact social programs vital to the well-being of the public. These programs, from education to healthcare to social safety nets, are crucial for maintaining a functioning society and mitigating poverty. The diminished funding available for these programs could lead to decreased access to essential services, increased hardship for vulnerable populations, and a decline in the overall quality of life for many.

For example, cuts in funding for education programs could lead to under-resourced schools and a decline in educational opportunities for disadvantaged students.

Impact on Economic Stability

While proponents claim tax cuts stimulate economic growth, they may also exacerbate existing economic issues. Reduced government revenue can lead to decreased public investment in infrastructure, research, and development, ultimately hindering long-term economic growth. This reduction in public investment could potentially stifle innovation and productivity, negatively affecting the overall economic landscape. Moreover, reduced government spending can lead to decreased demand, potentially triggering a recession or other economic instability.

Potential Negative Impacts on Public Services and Infrastructure

The diminished government revenue resulting from tax cuts for big business can directly impact the funding available for public services and infrastructure. This reduction in funding can lead to underinvestment in critical areas like transportation, sanitation, and environmental protection. Roads and bridges may deteriorate, public transit may suffer, and access to clean water and sanitation may be compromised.

This, in turn, can impact the productivity and well-being of the entire population.

My recent essay on big business trumps tax cuts highlighted how corporate interests often prioritize short-term gains over long-term societal well-being. This is particularly concerning when considering the devastating impact on communities like those in the Philippines, whose fishing livelihoods are threatened by rising water levels, as detailed in this article about philippines fishing communities rising water.

Ultimately, the argument for prioritizing tax cuts for big business needs to be reevaluated in light of these real-world consequences.

Comparison of Potential Benefits and Drawbacks

| Benefit | Drawback |

|---|---|

| Increased Investment | Increased Inequality |

| Job Creation | Reduced Government Revenue |

| Economic Growth (potentially short-term) | Strain on Public Services |

It is crucial to recognize that the benefits of tax cuts for big business are often short-term and potentially superficial, while the drawbacks can be significant and long-lasting. A comprehensive analysis must consider the broader societal impact and long-term consequences of such policies.

Alternative Policies and Solutions

Tax cuts for big business, while proponents argue for increased investment and job creation, often lead to widening income inequality and reduced government revenue. Alternative policies, focused on fairer taxation and sustainable economic growth, can achieve similar goals while mitigating these negative consequences. These policies can foster a more equitable distribution of wealth and resources, benefiting both businesses and individuals.

Promoting Equitable Economic Growth

A key to promoting equitable economic growth is to address the root causes of income inequality. This requires policies that encourage investment in human capital, such as education and training programs, and support for small and medium-sized enterprises (SMEs). These initiatives help build a more diverse and robust economy, where opportunities are not limited to a select few.

- Investing in Human Capital: Increased funding for education, vocational training, and skills development programs empowers individuals to compete in the modern economy. This investment not only improves individual livelihoods but also boosts productivity and innovation across the workforce. Examples include the G.I. Bill in post-World War II America, which dramatically increased access to higher education and contributed to economic growth and social mobility.

- Support for Small and Medium-Sized Enterprises (SMEs): SMEs are the backbone of many economies. Policies that provide access to capital, mentorship, and business development services can foster growth and job creation. Such policies, often implemented through government-backed loan programs or business incubators, can have a significant impact on local economies.

- Progressive Taxation: Progressive tax systems, where higher earners pay a larger percentage of their income in taxes, can help redistribute wealth and fund public services. This can be achieved through adjustments to tax brackets and credits. Examples of successful progressive taxation systems can be found in various Scandinavian countries, which consistently rank high in social and economic indicators.

Targeted Tax Incentives

Instead of broad tax cuts for big business, targeted incentives can be more effective in stimulating specific areas of growth. These incentives can be tailored to promote innovation, research and development, or job creation in sectors facing challenges. Such a targeted approach can avoid the unintended consequences of indiscriminate tax breaks for the wealthiest corporations.

- Incentivizing Research and Development (R&D): Government grants and tax credits for R&D can stimulate innovation and technological advancement. This can lead to breakthroughs in various fields, from medicine to renewable energy, ultimately benefitting society. Many countries have successful R&D tax credit programs.

- Investing in Infrastructure: Investments in infrastructure, such as transportation networks and communication systems, can improve efficiency and reduce costs for businesses. This can create jobs and boost productivity across the economy. The US interstate highway system, a massive infrastructure project, is a prime example of how investments in infrastructure can lead to significant economic gains.

Comparison of Policy Approaches

| Policy Approach | Target Group | Potential Outcomes |

|---|---|---|

| Progressive Income Tax | Individuals | Reduced income inequality, increased government revenue for social programs |

| Targeted R&D Incentives | Companies engaged in R&D | Increased innovation, technological advancements, and potential for job creation in specific sectors |

| Small Business Loans/Grants | Small Businesses | Increased job creation, economic growth at local levels |

| Infrastructure Investment | All economic sectors | Improved efficiency, reduced costs for businesses, and potential for job creation |

Case Studies and Examples

Examining real-world implementations of tax cuts for large corporations offers crucial insights into their actual impacts. This section delves into specific case studies, highlighting the effects on economic growth, job creation, and overall societal well-being. By analyzing these examples, we can better evaluate the validity of arguments surrounding tax cuts for big business.Understanding the nuanced effects of tax policies requires careful consideration of various factors, including the specific economic context of each case study.

This approach allows for a more comprehensive understanding of how tax cuts translate into real-world outcomes. Analyzing these examples is vital to forming a balanced perspective on the potential benefits and drawbacks of such policies.

Ireland’s Experience with Tax Incentives

Ireland has long been a popular destination for multinational corporations due to its attractive tax incentives. The country’s strategy has focused on low corporate tax rates to attract foreign investment and stimulate economic activity. While this approach has undeniably boosted Ireland’s economy, it also raises concerns about the fairness of the tax system and its potential impact on domestic industries.

- Ireland’s low corporate tax rate has attracted significant foreign investment, particularly in technology and pharmaceutical sectors. This influx of capital has contributed to job creation and economic growth.

- However, the reliance on foreign investment has led to concerns about the development of domestic industries. Some argue that the focus on attracting multinational companies has overshadowed the need for supporting smaller businesses and local entrepreneurs.

- Furthermore, the tax incentives have raised questions about whether they are truly beneficial for the long-term economic well-being of the country. Critics suggest that the benefits of these incentives might be outweighed by the potential for revenue loss and the widening gap between the rich and the poor.

The Impact of Tax Cuts in the United States

The United States has implemented various tax cuts for corporations over the years, with varying results. Analyzing these instances reveals a complex relationship between tax cuts and economic outcomes, highlighting the difficulty of isolating the effects of specific policies.

- In recent decades, the United States has experienced periods of both economic growth and stagnation following tax cuts for big business. It’s crucial to recognize that numerous factors influence economic performance, making it difficult to attribute any specific outcome solely to tax policy.

- Examining the correlation between tax cuts and economic growth requires considering the broader economic environment, including monetary policy, technological advancements, and global market conditions. These factors significantly affect the interpretation of the data.

- Analyzing specific sectors and industries affected by tax cuts, such as manufacturing or technology, can provide a more nuanced perspective on the impact. These analyses can offer insights into how tax policies influence job creation and innovation within particular industries.

The Dutch Experience: A Different Perspective

The Netherlands, while not as reliant on attracting foreign corporations as Ireland, has implemented policies that support business growth. This case offers a valuable perspective, showcasing a different approach to tax incentives.

- The Netherlands has a diversified economy, relying on both domestic and foreign investment. The country’s approach to tax incentives is more nuanced than simply lowering corporate tax rates, incorporating various support mechanisms for businesses.

- This approach aims to encourage entrepreneurship and innovation within the domestic sector, in addition to attracting foreign investment. This illustrates that there are multiple ways to foster economic growth.

- Evaluating the success of the Dutch model requires assessing the overall impact on job creation, economic growth, and social equity. These factors provide a more comprehensive understanding of the effects of the Dutch approach to business incentives.

The Impact on Employment and Wages: Big Business Trumps Tax Cuts Essay

Tax cuts for big business are often touted as a catalyst for job creation and economic growth. Proponents argue that the extra capital allows businesses to invest, expand, and hire more employees. However, the relationship between tax cuts and employment trends is complex and not always straightforward. Empirical evidence and historical data offer mixed results, and the impact on wages across different income levels deserves careful consideration.The connection between tax cuts and employment is often debated, with differing schools of thought on the matter.

Some argue that the increased profits from tax cuts directly translate into more investment, leading to job growth. Others maintain that the benefits of the tax cuts accrue primarily to company shareholders and executives, without a corresponding increase in employment. The effect on wages, too, remains a point of contention, with some believing that increased profits will trickle down to workers, while others fear a widening gap between the rich and the poor.

Historical Relationship Between Tax Policies and Job Creation

Historical data on tax policies and job creation presents a varied picture. While some periods have shown a correlation between tax cuts and employment growth, other instances show little or no relationship. Economic conditions, industry trends, and global events all play a role in employment figures, making it challenging to isolate the precise effect of tax policies. For instance, the impact of tax cuts during periods of recession may differ significantly from the impact in times of economic expansion.

Impact on Employment Trends

Analyzing employment data before and after tax cuts requires careful consideration of various factors. One must account for overall economic conditions, industry-specific developments, and the time lag between policy implementation and its effects on job markets. For example, the impact of tax cuts enacted during a period of high unemployment may be different from the impact during a period of robust economic growth.

Potential Impacts on Wages and Salaries

The potential impact of tax cuts on wages and salaries is multifaceted. Some economists believe that increased profits will trickle down, resulting in higher wages for all income levels. However, historical data suggests that the benefits of tax cuts often accrue disproportionately to higher-income earners, widening the income inequality gap. This is because the increased capital often goes into executive compensation, stock buybacks, or other forms of capital appreciation, rather than into hiring more workers or increasing salaries.

Comparison of Employment Data Before and After Tax Cuts

Numerous studies have attempted to compare employment data before and after tax cuts. These studies often reveal mixed results, with some showing positive correlations between tax cuts and job growth, and others showing no significant relationship. A key factor in interpreting these studies is the control for other economic variables and the specific characteristics of the industries under consideration.

For instance, comparing employment data in the technology sector with employment data in the manufacturing sector may yield different conclusions. Reliable studies typically account for these variables to provide a more accurate assessment of the impact of tax cuts.

Case Studies and Examples (Illustrative, not exhaustive)

To illustrate the complexities of assessing the impact of tax cuts on employment, consider the example of the 2017 US tax cuts. While proponents argued that the cuts would stimulate economic growth and lead to job creation, subsequent employment data revealed a mixed picture. Some sectors experienced growth, while others did not. This highlights the difficulty in isolating the effect of tax cuts from other macroeconomic factors.

Global Perspective on Tax Cuts

A global race to the bottom in corporate tax rates is underway. Countries are increasingly competing to attract multinational corporations, often through substantial tax breaks. This complex landscape presents both opportunities and challenges, influencing investment decisions, economic growth, and ultimately, the distribution of wealth. Understanding the nuances of this global competition is critical to evaluating the impact of tax cuts for big business.The global landscape of corporate taxation is marked by a significant disparity in tax rates.

This disparity isn’t simply a matter of different levels of government revenue; it’s a complex interplay of economic factors, political ideologies, and international trade agreements. This competition for corporate investment has far-reaching consequences.

Global Trends in Tax Policies

Various countries are adopting diverse approaches to corporate taxation. Some prioritize high rates to fund public services and social programs, while others prioritize attracting foreign investment and economic growth through lower rates. This diversity highlights the conflicting goals and priorities within the global economy. Countries often adjust their tax policies based on their specific economic situations and political environments.

Varying Approaches in Different Countries

Countries employ a variety of strategies in their tax policies for large corporations. Some examples include:

- Tax Incentives: Many countries offer tax incentives, such as deductions for research and development, to encourage investment in specific sectors. This can be seen as a way to stimulate economic growth in areas perceived as crucial to the country’s future.

- Low Tax Rates: Other countries prioritize low corporate tax rates as a means to attract foreign direct investment. This strategy often targets specific industries or companies, with the intention of generating economic activity and jobs.

- Progressive Tax Systems: A progressive system can combine high rates for high profits with lower rates for smaller businesses, potentially fostering a balance between attracting investment and ensuring fair taxation.

The reasons behind these varied approaches are multifaceted and depend on a country’s unique economic and political context.

Data Illustrating Global Disparity in Tax Rates

The disparity in corporate tax rates across nations is substantial.

| Country | Corporate Tax Rate (estimated) | Justification |

|---|---|---|

| Country A | 15% | Attracting foreign investment and stimulating economic growth. |

| Country B | 30% | Funding public services and social programs. |

| Country C | 25% | Balancing investment attraction and public funding needs. |

Note: Data is illustrative and may not reflect the most current rates.

Influence of International Trade Agreements

International trade agreements play a significant role in shaping tax policies. These agreements often include provisions related to taxation and investment, sometimes setting precedents and norms for other countries.

“Agreements like the OECD’s Base Erosion and Profit Shifting (BEPS) project aim to prevent multinational corporations from exploiting loopholes in tax systems to avoid paying their fair share.”

Such agreements can influence the tax policies of nations, sometimes leading to harmonization or increased scrutiny of tax practices.

Ethical Considerations and Societal Impact

Tax cuts for big business, while potentially boosting short-term economic growth, often come at a cost to societal well-being and exacerbate existing inequalities. The ethical implications extend beyond the balance sheets of corporations and touch upon fundamental principles of fairness and social responsibility. This section delves into the potential downsides, exploring how these policies can harm vulnerable populations and undermine the very fabric of a just society.The argument for tax cuts often centers on stimulating investment and job creation.

However, the trickle-down effect, while theoretically possible, has not consistently materialized in a way that benefits society as a whole. The reality is that such policies often disproportionately favor the wealthy, reinforcing existing economic disparities. This section examines the potential long-term consequences of such policies on social justice and equity.

Ethical Implications of Tax Cuts for Big Business

Tax cuts for large corporations raise ethical concerns regarding fairness and social responsibility. These policies often shift the tax burden to lower-income individuals and communities, thereby reducing resources available for essential public services like education, healthcare, and infrastructure. This can have a cascading effect on social mobility and opportunities for individuals from marginalized backgrounds.

Exacerbation of Existing Inequalities

Tax cuts for big business can worsen existing socioeconomic inequalities in several ways. One key mechanism is the regressive nature of many tax policies. Lowering corporate tax rates, while seemingly beneficial for business, often means that other sources of revenue for public services are reduced. This can result in underinvestment in critical areas for marginalized communities, like affordable housing and access to quality education.

That big business trumps tax cuts essay is a fascinating read, especially considering recent events. The Harvey Weinstein retrial verdict here highlights the power imbalances that often go unaddressed in such discussions. Ultimately, the essay argues that corporate influence often overshadows the need for fairer tax policies, just as other powerful figures can exert undue influence on justice systems.

Furthermore, the increased profitability for corporations may not translate into increased wages or benefits for their employees, further widening the gap between the wealthy and the working class.

Long-Term Impact on Social Justice and Equity

The long-term impact of tax cuts for big business on social justice and equity is significant and often negative. Chronic underfunding of social programs can lead to a cycle of disadvantage for low-income individuals and communities. Limited access to essential services can impede upward mobility, creating a society where opportunities are unevenly distributed. This can manifest in increased rates of poverty, health disparities, and educational inequities.

Studies have consistently shown that disparities in wealth and income are linked to social problems like crime and lack of social cohesion.

Impact on Marginalized Communities

Tax cuts for big business can disproportionately affect marginalized communities. For instance, if tax cuts lead to reduced funding for public education, children from low-income families will likely be most affected. Similarly, cuts to affordable housing programs could result in increased homelessness and displacement within marginalized communities. These communities already face systemic disadvantages and lack the resources to absorb the negative impacts of such policies.

Reduced funding for healthcare initiatives will affect marginalized groups more severely, as they often rely on publicly funded services more than other populations.

Future Implications of Big Business Tax Cuts

Big business tax cuts, while potentially boosting short-term profits and investment, carry significant long-term implications for economic stability and future growth. The ripple effects can be profound, impacting various sectors and potentially exacerbating existing inequalities. Understanding these potential outcomes is crucial for policymakers and stakeholders alike.The future impact of tax cuts for large corporations is multifaceted and dependent on a range of variables, including the overall economic climate, the specific industries involved, and the government’s response to any resulting consequences.

Predicting precise outcomes is challenging, but analyzing potential scenarios and their likely ramifications is essential for informed decision-making.

Potential for Economic Instability

Tax cuts for big business, if not carefully managed, can create conditions that compromise economic stability. Large companies may prioritize short-term gains over long-term investments in infrastructure or employee development, potentially leading to a hollowing-out of the middle class and reduced consumer spending. This can create a vicious cycle, hindering broader economic growth and creating a less stable economic landscape.

Impact on Specific Industries, Big business trumps tax cuts essay

The impact of tax cuts will vary across industries. Tech companies, for example, might reinvest tax savings into further research and development, potentially leading to innovative breakthroughs. However, industries reliant on extensive labor forces might not see the same level of investment in their employees. This could result in a widening skill gap and a stagnation in some sectors.

Potential Scenarios Under Different Economic Conditions

Economic conditions will significantly influence the outcome of tax cuts. During a period of robust economic growth, the cuts might stimulate further investment and job creation. Conversely, during a recession or period of economic uncertainty, the same tax cuts might lead to reduced investment and slower job growth, exacerbating existing problems. A significant example is the 2008 financial crisis, where large corporate tax cuts did not prevent the recession, and may have even contributed to the conditions that led to it.

Long-Term Growth and Investment

A key consideration is how tax cuts influence long-term investment. If companies primarily use the savings to buy back shares, this can inflate stock prices but doesn’t necessarily translate into increased productivity or job creation. Conversely, reinvestment in research and development, or expansion into new markets, could foster long-term growth. The 1980s tax cuts, for example, had a complex and multifaceted effect on economic growth, with some sectors benefiting more than others.

Impact on Employment and Wages

The effect on employment and wages is crucial. While some companies may increase hiring, the overall impact on average wages is uncertain. A significant portion of the savings may not be distributed as higher wages, but instead channeled into executive compensation or share buybacks. This can lead to a growing income inequality gap.

Global Perspective on Tax Cuts

The international landscape plays a significant role. Tax cuts in one country can influence investment decisions in other countries, and the competitiveness of the global market. If multiple countries implement similar policies, the overall effect on economic growth could be diluted.

Ultimate Conclusion

In conclusion, the big business trumps tax cuts essay underscores the multifaceted nature of this economic debate. While proponents argue for economic growth and job creation, critics emphasize the potential for widening income inequality and harming public services. Ultimately, the essay highlights the need for a nuanced approach to taxation, considering the long-term effects of various policies on both big business and the general public.