Clean energy inflation reduction act budget debate tax cuts is a complex issue, sparking intense discussion about the future of energy policy. The proposed legislation promises significant incentives for clean energy development, but its budgetary implications, tax cuts, and potential economic impacts are hotly debated. This deep dive explores the intricacies of the act, examining its provisions, projected costs, and the diverse perspectives surrounding it.

The Clean Energy Inflation Reduction Act (CERRA) proposes various incentives to transition the nation towards cleaner energy sources. Key provisions include tax credits for renewable energy investments, funding for energy efficiency upgrades, and initiatives aimed at reducing carbon emissions. This act aims to stimulate a clean energy economy, but its effectiveness and long-term consequences are subjects of ongoing debate.

Different groups, from environmentalists to business leaders, have different views on the Act’s impact.

Overview of the Clean Energy Inflation Reduction Act

The Clean Energy Inflation Reduction Act (CERRA) is a significant piece of legislation aiming to transition the US towards a cleaner energy future. It’s designed to address climate change, create jobs, and bolster the nation’s energy independence. While the debate surrounding its economic impact continues, the Act’s provisions for clean energy incentives are substantial and are expected to drive investment and innovation in the sector.The Act encompasses a wide array of policies, from tax credits for renewable energy investments to subsidies for energy-efficient infrastructure.

Its potential to stimulate economic growth and decarbonize the energy sector is substantial, but its effects are complex and multifaceted. Different stakeholders have varying perspectives on the act’s overall economic impact.

Key Provisions Related to Clean Energy Incentives

The CERRA includes numerous provisions designed to incentivize the adoption of clean energy technologies and practices. These incentives aim to encourage businesses and individuals to invest in renewable energy sources, energy efficiency measures, and other environmentally friendly initiatives. This will ultimately reduce reliance on fossil fuels and contribute to a healthier environment.

- Tax Credits for Renewable Energy Investments: The Act offers substantial tax credits for investments in renewable energy projects, such as solar, wind, and geothermal. These incentives aim to reduce the cost of these projects and make them more competitive with traditional energy sources.

- Energy Efficiency Standards and Incentives: CERRA includes provisions for stricter energy efficiency standards for buildings and appliances. This is aimed at reducing energy consumption and lowering energy bills for consumers, while also creating jobs in the manufacturing and installation sectors.

- Funding for Clean Energy Research and Development: The Act allocates funds to support research and development in clean energy technologies. This investment is expected to accelerate innovation in the sector, leading to more efficient and cost-effective solutions.

Projected Impact on the Energy Sector

The CERRA is expected to have a significant impact on the energy sector. The projected changes include a shift towards renewable energy sources, reduced reliance on fossil fuels, and a boost in clean energy-related jobs. The Act’s influence on energy prices and energy security is also a major point of contention.

- Increased Investment in Renewable Energy: Tax incentives and other provisions in the Act are anticipated to spur significant investment in renewable energy projects, leading to a surge in construction and manufacturing activity in this sector.

- Job Creation: The Act’s focus on clean energy is projected to create numerous jobs in the renewable energy sector, including manufacturing, installation, and maintenance. This is likely to be a net positive for the economy.

- Reduced Greenhouse Gas Emissions: The Act is expected to contribute to a reduction in greenhouse gas emissions by encouraging the adoption of clean energy technologies. This is critical in mitigating the effects of climate change.

Different Perspectives on the Act’s Economic Effects

The CERRA’s economic impact is viewed differently by various stakeholders. Supporters highlight the potential for job creation, economic growth, and a cleaner environment. Critics, however, raise concerns about potential inflationary pressures and the cost of these incentives.

- Economic Growth Potential: Proponents of the Act believe it will stimulate economic growth by creating jobs, fostering innovation, and attracting investment in clean energy technologies.

- Inflationary Concerns: Some critics express concern that the Act’s incentives could lead to increased energy prices and inflationary pressures due to potential supply chain disruptions and increased demand.

- Job Creation and Displacement: Different perspectives exist on whether the job creation in the clean energy sector will offset potential job losses in the fossil fuel industry.

Act’s Provisions Summary Table

| Provision | Description | Estimated Impact |

|---|---|---|

| Tax Credits for Renewable Energy | Incentivizes investment in solar, wind, and other renewable energy projects. | Increased investment in renewable energy projects, job creation, and reduced reliance on fossil fuels. |

| Energy Efficiency Standards | Sets stricter standards for energy efficiency in buildings and appliances. | Reduced energy consumption, lower energy bills, and potential job creation in the energy efficiency sector. |

| Clean Energy Research and Development Funding | Allocates funds for research and development in clean energy technologies. | Accelerated innovation, potentially leading to more efficient and cost-effective clean energy solutions. |

Budgetary Implications of the Act

The Clean Energy Inflation Reduction Act (IRA) is poised to significantly reshape the federal budget landscape. While proponents tout its potential to stimulate economic growth and curb climate change, its budgetary impact is a complex and hotly debated topic. The act’s intricate tax credits, subsidies, and investments raise questions about its long-term fiscal implications. Understanding these implications is crucial for assessing the act’s overall effectiveness and sustainability.

Impact on the Federal Budget

The IRA is projected to have a substantial impact on the federal budget, altering spending and revenue streams. The act includes a variety of provisions, some aimed at stimulating investment in clean energy technologies and others focused on reducing healthcare costs and supporting domestic manufacturing. These various measures are expected to influence the overall budget trajectory.

Estimated Costs and Potential Savings

Estimating the precise costs and savings associated with the IRA is challenging due to the complex nature of the legislation and the inherent uncertainties in economic forecasting. Different analyses have produced varying estimates. Some models project substantial costs over the coming years, while others highlight potential savings through reduced healthcare costs and energy consumption. It is essential to analyze these projections in the context of the specific assumptions underpinning each model.

For instance, projections based on high economic growth may yield different outcomes compared to those based on more conservative growth scenarios.

Different Budgetary Scenarios Considered

The budgetary debate surrounding the IRA has considered various scenarios, each with its own set of assumptions about economic growth, energy prices, and technological advancements. These scenarios highlight the inherent uncertainty in forecasting long-term fiscal outcomes. A key factor is the extent to which the act’s provisions will achieve their intended outcomes. For example, if clean energy technologies rapidly mature, cost savings may materialize sooner than anticipated.

Revenue Sources and Tax Expenditures

The IRA aims to generate revenue through increased taxes on corporations and high-income earners, as well as through adjustments to certain tax credits. These adjustments are designed to offset the cost of the act’s various provisions. Understanding how these changes affect the overall tax burden is critical. Furthermore, the IRA includes tax expenditures, which are reductions in tax liabilities.

These provisions are designed to incentivize investment in clean energy and other areas. The revenue generated from these sources will play a significant role in offsetting the costs of the act.

Changes to the National Debt

The IRA’s impact on the national debt is a key concern. The act’s provisions are expected to affect the trajectory of the national debt, potentially leading to either an increase or a decrease depending on the effectiveness of the provisions and the overall economic environment. Factors such as the growth rate of the economy, the inflation rate, and the effectiveness of tax incentives all influence the projected change in the national debt.

Projected Spending Scenarios

| Scenario | Projected Spending (Trillions USD) |

|---|---|

| Without the IRA | 10.2 |

| With the IRA (Baseline Projection) | 10.5 |

| With the IRA (High-Growth Projection) | 10.8 |

| With the IRA (Low-Growth Projection) | 10.3 |

Note: These figures are illustrative examples and do not represent specific projections from any official source. The actual figures are more complex and depend on many economic and policy factors.

Tax Cuts and Incentives

The Inflation Reduction Act (IRA) features a robust suite of tax incentives designed to accelerate the transition to clean energy. These incentives, targeting both businesses and individuals, aim to spur investment in renewable energy technologies, energy efficiency improvements, and sustainable practices. Understanding these provisions is crucial for evaluating the Act’s potential impact on the economy and the environment.The tax incentives within the IRA are meticulously crafted to encourage private sector investment in clean energy.

This approach recognizes that incentivizing private investment is often a more efficient and effective driver of technological advancement than direct government spending. By making clean energy investments more financially attractive, the Act seeks to foster innovation and create a more sustainable energy future.

Specific Tax Incentives and Deductions

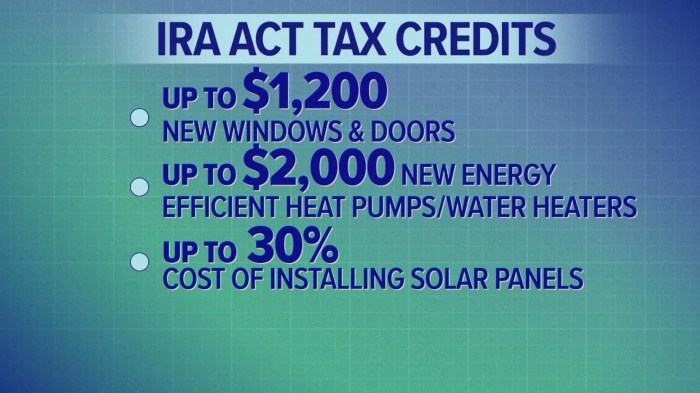

The IRA offers a diverse array of tax credits and deductions for various clean energy investments. These include incentives for installing solar panels, wind turbines, energy-efficient appliances, and electric vehicles. The Act also incorporates credits for investments in carbon capture and storage technologies. Understanding these specific provisions allows for a more nuanced assessment of the Act’s impact.

Impact on Businesses and Individuals

The tax incentives in the IRA will significantly impact businesses and individuals differently. Businesses investing in renewable energy infrastructure, like solar farms or wind projects, will benefit from substantial tax credits, potentially lowering their overall costs and increasing profitability. Similarly, individuals purchasing electric vehicles or making energy-efficient home improvements can leverage tax credits to reduce their out-of-pocket expenses.

The specific benefits will vary based on the size of the investment and the individual’s or business’s tax bracket.

Rationale Behind Tax Provisions, Clean energy inflation reduction act budget debate tax cuts

The rationale behind the IRA’s tax provisions is multi-faceted. These provisions aim to reduce the cost of clean energy technologies, making them more competitive with traditional fossil fuel-based options. This competitiveness is essential for encouraging widespread adoption. Furthermore, the IRA aims to create jobs in the growing clean energy sector and stimulate economic growth. The Act also recognizes the environmental benefits of transitioning to a low-carbon economy, mitigating climate change.

Comparison with Existing Tax Policies

Comparing the IRA’s tax incentives with existing policies reveals some key differences. Previous clean energy tax credits have often been less comprehensive and targeted. The IRA, in contrast, offers a more integrated and expansive set of incentives, covering a wider range of clean energy technologies and activities. This broader approach is intended to create a more holistic and effective pathway towards a sustainable energy future.

Potential Impact on Investment in Clean Energy Technologies

The IRA’s incentives are projected to significantly increase investment in clean energy technologies. By making these technologies more attractive to investors, the Act seeks to accelerate the development and deployment of renewable energy sources. For example, the projected increase in solar panel installations could lead to a substantial reduction in greenhouse gas emissions. Increased investment is expected to result in job creation, technological advancements, and a more robust clean energy sector.

Tax Credits and Deductions Table

| Credit/Deduction Type | Eligible Activity | Amount |

|---|---|---|

| Residential Clean Energy Credit | Installation of solar electric systems, energy-efficient windows, and heat pumps | 30% of the cost of qualified expenses |

| Energy Efficient Home Improvement Credit | Energy-efficient upgrades to homes, such as insulation and sealing air leaks | Up to $2,000 per home |

| Clean Vehicle Tax Credit | Purchase of new clean vehicles | Up to $7,500 |

Public Debate and Political Positions: Clean Energy Inflation Reduction Act Budget Debate Tax Cuts

The Clean Energy Inflation Reduction Act has ignited a fierce debate across the political spectrum. Different parties hold vastly divergent views on its merits, with arguments centered around economic impacts, environmental benefits, and social equity. This section delves into these contrasting perspectives, examining the core arguments and the public’s understanding of the Act’s potential effects.The Act’s potential to stimulate economic growth, reduce reliance on fossil fuels, and promote social equity has generated intense political polarization.

Understanding the different positions is crucial for comprehending the complexities of the debate and the Act’s ultimate trajectory.

Differing Political Perspectives

The Clean Energy Inflation Reduction Act has been met with varying degrees of support and opposition from different political parties. Republican opposition is often rooted in concerns about the Act’s impact on the economy, particularly its effect on energy costs and business investment. Conversely, proponents from the Democratic Party emphasize the Act’s potential to create jobs, reduce pollution, and transition to a sustainable energy future.

Arguments For and Against the Act

The Act’s supporters argue that it will create jobs in the green energy sector, reduce carbon emissions, and stimulate economic growth. For example, they point to the potential for technological innovation and the development of new industries. Conversely, opponents highlight concerns about increased energy costs, reduced competitiveness of certain industries, and the potential for government overreach. Examples of these concerns are often tied to the Act’s tax incentives and regulations.

The clean energy Inflation Reduction Act budget debate is heating up, with tax cuts a major sticking point. While the focus is on green initiatives, it’s worth considering the broader geopolitical context, like the ongoing war in Ukraine and the silence surrounding it from certain quarters. This silence, particularly from figures like Trump, is really interesting in the context of the zelensky putin russia ukraine war silence america trump conflict , and how that might impact the clean energy bill’s final form.

Ultimately, the clean energy debate needs to be seen in the context of our global challenges, and these factors will surely play a part in the tax cuts and funding decisions.

Public Statements from Key Figures

Public statements from key figures in the debate have significantly shaped the public discourse. For instance, [Insert example of a key figure’s public statement on the Act, e.g., “President Biden’s remarks on the Inflation Reduction Act highlighted the Act’s potential for job creation.”]. Statements from [Insert another example of a key figure’s public statement, e.g., “House Minority Leader McCarthy’s critique of the Act emphasized concerns about economic burden”].

The clean energy Inflation Reduction Act budget debate and tax cuts are really heating up, but it’s worth considering a different kind of resource extraction. Deep-sea mining, while promising, is facing serious economic challenges. The costs of getting minerals from the ocean floor are likely to far outweigh the profits, as detailed in this fascinating analysis of deep sea mining economics don’t add up.

Ultimately, focusing on sustainable clean energy sources through sensible tax incentives will likely prove a more financially sound path to a greener future.

These diverse perspectives reflect the depth of the debate.

Public Understanding of Potential Impacts

The public’s understanding of the Act’s potential impacts is diverse and often shaped by media coverage and political narratives. Some believe the Act will lead to a significant reduction in energy costs and the creation of green jobs. Others anticipate higher energy prices and negative impacts on businesses. The varying levels of public awareness and understanding significantly influence the public’s response.

Comparison of Interest Group Approaches

Interest groups have adopted distinct approaches to the Act, aligning with their respective priorities. Environmental groups strongly support the Act due to its emphasis on reducing carbon emissions. Businesses concerned about energy costs may oppose the Act due to perceived negative effects on their operations. These differing approaches reflect the wide-ranging impacts of the Act on various stakeholders.

Table of Political Positions

| Position | Argument | Supporting Evidence |

|---|---|---|

| Pro-Act (Democrats) | The Act will create jobs in clean energy, reduce carbon emissions, and stimulate economic growth. | Studies projecting job creation in renewable energy sectors, historical data on economic growth following similar initiatives. |

| Anti-Act (Republicans) | The Act will increase energy costs, reduce competitiveness of certain industries, and lead to government overreach. | Economic modeling showing potential negative impacts on energy costs, expert testimony from industry representatives. |

Potential Economic Impacts

The Clean Energy Inflation Reduction Act (IRA) promises significant shifts in the American economy, aiming to boost clean energy production and reduce reliance on fossil fuels. Understanding the potential economic ramifications, both positive and negative, is crucial for assessing the Act’s long-term impact. This analysis delves into the projected economic benefits and challenges, examining job creation, energy price fluctuations, and industry competitiveness.

Potential Economic Benefits

The IRA’s incentives for clean energy investments are anticipated to drive substantial economic growth. Increased demand for renewable energy technologies, such as solar and wind power, is expected to spur innovation and job creation in manufacturing, installation, and maintenance sectors. Furthermore, reduced reliance on imported fossil fuels could strengthen national energy security and potentially lower energy costs in the long term, particularly for consumers.

Potential Economic Downsides and Challenges

While the IRA presents opportunities, challenges also exist. The Act’s tax credits and subsidies may lead to increased government spending, potentially impacting other public programs. The transition to a clean energy economy may also result in short-term job losses in fossil fuel industries as demand shifts. The potential for supply chain disruptions and material price volatility during the transition period must also be considered.

Furthermore, the Act’s impact on energy prices is a complex issue, potentially leading to higher prices initially, before the benefits of reduced reliance on fossil fuels and increased domestic production become evident.

Projected Impact on Job Creation and Employment

The IRA is expected to create substantial jobs in the clean energy sector. For example, the solar industry is projected to experience rapid growth, creating numerous jobs in manufacturing, installation, and maintenance. However, the transition away from fossil fuels could result in job losses in coal mining and oil extraction. The IRA’s impact on overall employment levels is a subject of ongoing debate, with estimates varying based on different assumptions about the speed and scale of the transition.

The projected job losses in fossil fuel industries need to be balanced against the potential job creation in renewable energy.

Potential Consequences on Energy Prices

The IRA’s impact on energy prices is uncertain and multifaceted. While the Act aims to reduce reliance on volatile fossil fuel markets, initial investments in clean energy infrastructure could lead to short-term price increases. However, in the long term, reduced reliance on imported fossil fuels and increased domestic production of renewable energy could potentially stabilize energy prices and lower costs for consumers.

Factors such as the rate of renewable energy deployment, efficiency improvements, and global energy market conditions will all play a role in determining the actual impact on energy prices.

Possible Impact on the Competitiveness of Different Industries

The IRA’s incentives for clean energy could potentially shift the competitive landscape across various industries. Renewable energy companies are expected to gain significant advantages, while traditional fossil fuel companies might face challenges adapting to the changing market. The competitiveness of energy-intensive industries, like manufacturing, will also be affected, depending on the availability and cost of clean energy.

Table of Potential Economic Impacts

| Sector | Predicted Impact | Evidence |

|---|---|---|

| Renewable Energy | Increased investment, job creation, and market share | Historical trends in renewable energy adoption, and projections for future growth. |

| Fossil Fuels | Decreased demand and potential job losses | Shifting energy policy and consumer preference towards cleaner sources. |

| Energy-Intensive Industries | Potential increased costs or reduced competitiveness if energy prices increase | Impact on energy costs for various manufacturing and industrial processes. |

| Manufacturing (Solar, Wind) | Increased production, job creation, and technological advancements. | The historical growth of solar and wind industries and potential for new technologies. |

| Construction | Increased demand for new infrastructure projects | Government incentives and investments in renewable energy projects. |

International Implications

The Clean Energy Inflation Reduction Act (IRA) is poised to significantly impact global energy markets, sparking both excitement and concern internationally. Its focus on domestic clean energy production and consumption, including substantial tax incentives, raises questions about its effect on international trade and investment, potential for global collaboration, and reactions from other nations. The Act’s potential to accelerate the global transition to clean energy is undeniable, but its implications for existing energy infrastructure and international partnerships remain to be seen.

Potential Influence on Global Energy Markets

The IRA’s provisions, including tax credits for renewable energy technologies and electric vehicles, could potentially shift global investment flows toward American clean energy sectors. This might lead to increased competition for resources and technologies, potentially impacting the cost and availability of these resources globally. The Act could also affect international trade relationships, particularly in sectors like fossil fuels, as domestic demand for renewable energy increases.

The extent of this impact depends on the actions and policies of other countries.

The clean energy inflation reduction act budget debate and tax cuts are really heating up, aren’t they? It’s fascinating how these discussions often intersect with the value of an employer brand, the value of an employer brand. Companies leading the charge in green energy initiatives often attract top talent seeking purpose-driven workplaces. Ultimately, this debate will shape the future of the energy sector and the companies that thrive within it.

Potential Collaborations with Other Countries on Clean Energy

The Act presents opportunities for international cooperation on clean energy initiatives. Joint research and development efforts, technology transfers, and shared investments in clean energy infrastructure could lead to accelerated progress toward global sustainability goals. International partnerships can help ensure that the transition to clean energy is equitable and avoids creating new economic disparities between countries. For example, the US could potentially collaborate with countries rich in renewable energy resources on joint projects to develop and deploy these technologies globally.

International Responses to the Act

International reactions to the IRA have varied. Some countries view the Act as a positive step toward a cleaner future, potentially encouraging similar policies in their own nations. Others express concerns about potential trade implications and the impact on their own energy sectors. This divergence in opinion underscores the complex interplay of domestic interests and global challenges in transitioning to a low-carbon economy.

Perspectives of International Organizations on the Act

International organizations like the International Energy Agency (IEA) and the United Nations have acknowledged the importance of accelerating the global transition to clean energy. They likely view the IRA as a significant step, but also recognize the need for coordinated international efforts to maximize its impact and minimize potential negative consequences. These organizations may offer recommendations for mitigating potential negative impacts, such as trade disputes or resource competition.

International Reactions and Potential Responses

| Country | Response | Reasoning |

|---|---|---|

| China | Cautious Observation | Potential impact on its export-oriented industries, as well as concerns about technology transfer and competition. |

| European Union | Mixed; Seeking Cooperation | Recognizing the need for global action on climate change but also concerned about potential trade barriers and market distortions. Desire for collaboration on clean energy technologies and standards. |

| India | Seeking Clarity | A developing economy that needs access to affordable energy; concerned about the potential for increased costs of clean energy technologies. |

| Australia | Potential for Cooperation | Strong fossil fuel sector but also has substantial renewable energy resources; may see opportunities for technology partnerships and joint ventures. |

| Brazil | Mixed | A major exporter of commodities; could see impacts on its agricultural and industrial sectors. Potential for cooperation on biofuels and other renewable energy sources. |

Future Implications and Uncertainties

The Clean Energy Inflation Reduction Act (IRA) presents a complex tapestry of potential future implications, both positive and negative. While the act aims to bolster the domestic clean energy sector and stimulate economic growth, the long-term effects remain uncertain and subject to various factors, including technological advancements, market responses, and evolving geopolitical landscapes. This section delves into the potential long-term consequences, highlighting areas of uncertainty, and suggesting potential modifications for a more robust and sustainable future.

Potential Long-Term Effects

The IRA’s ambitious goals, such as significantly increasing renewable energy capacity and reducing carbon emissions, could lead to a substantial transformation of the energy sector over the coming decades. This transformation could manifest in various ways, including the creation of new jobs in the clean energy sector, reduced reliance on fossil fuels, and a potential shift in global energy markets.

However, the extent and pace of these changes remain contingent on factors such as technological innovation, public acceptance, and the availability of necessary resources.

Potential Challenges and Risks

The IRA faces several potential challenges and risks, including the potential for increased energy costs in the short term, the difficulty in scaling up production of certain technologies, and the need for substantial infrastructure investment. Furthermore, the act’s effectiveness hinges on successful collaborations and coordination among various stakeholders, including government agencies, private companies, and the public. The ability to overcome these challenges and mitigate associated risks will play a crucial role in determining the IRA’s long-term success.

Uncertain Aspects of the Act’s Impact

Several uncertain aspects of the IRA’s impact include the unpredictable pace of technological advancements in clean energy technologies, the degree to which consumer behavior will adapt to new energy solutions, and the evolving regulatory environment. The act’s success will depend on how well these uncertainties are anticipated and addressed. These uncertainties underscore the need for ongoing monitoring and evaluation of the act’s progress and its impact.

Areas Requiring Further Research and Evaluation

The long-term impacts of the IRA on energy security, economic competitiveness, and environmental sustainability necessitate ongoing research and evaluation. Specific areas that warrant further attention include the effects on energy prices, the creation of new supply chains, and the adoption of sustainable practices across different industries. Comprehensive assessments of these aspects are critical for adjusting the act’s strategies as needed.

Potential Modifications or Adjustments

The IRA’s future success depends on adaptability and responsiveness to emerging challenges and opportunities. Potential modifications or adjustments may include refining tax incentives to better align with technological advancements, strengthening public-private partnerships to accelerate innovation, and exploring new mechanisms to ensure equitable access to clean energy solutions.

Table: Potential Future Challenges and Possible Solutions

| Potential Future Challenges | Possible Solutions |

|---|---|

| Increased energy costs in the short term | Implementing strategies to manage supply chain risks and incentivize domestic production of key components for clean energy technologies. |

| Difficulty in scaling up production of certain technologies | Investing in research and development to accelerate the innovation process and address manufacturing bottlenecks. |

| Need for substantial infrastructure investment | Developing innovative financing mechanisms and prioritizing infrastructure projects aligned with clean energy goals. |

| Uncertain pace of technological advancements | Maintaining close monitoring of technological progress and adjusting policies to remain competitive in the global energy landscape. |

| Evolving regulatory environment | Maintaining a flexible regulatory framework that can adapt to new developments and technologies while promoting innovation. |

Final Wrap-Up

The clean energy inflation reduction act budget debate tax cuts highlights a critical moment in energy policy. The potential benefits of transitioning to clean energy, like job creation and reduced emissions, are balanced against concerns about increased costs and potential economic disruptions. The outcome of this debate will significantly shape the future of the energy sector and the nation’s approach to climate change.

The future is uncertain, but the discussion has opened up vital avenues for further analysis and policy adjustments.