Dynavax elects all four its nominees after deep track proxy fight – Dynavax elects all four its nominees after a deep track proxy fight. This closely watched contest pitted the company’s leadership against a challenging campaign, highlighting key issues and concerns about the company’s future direction. The voting process unfolded over a specific period, and both sides presented compelling arguments. Understanding the motivations behind the nominees’ election and the potential impacts on Dynavax’s future strategy is crucial for investors and shareholders.

The fight underscored the importance of strong governance and leadership in the pharmaceutical industry. The outcome will undoubtedly shape investor sentiment and potentially affect Dynavax’s stock price. We’ll explore the potential financial implications for shareholders, the industry context, and the potential future outlook for the company. Analyzing the competing viewpoints and the ultimate success of Dynavax’s nominees offers a fascinating look into the complexities of corporate leadership.

Overview of the Dynavax Proxy Fight

Dynavax Technologies Corporation recently concluded a proxy fight, a significant event in corporate governance. The contest involved a battle of competing proposals and perspectives, ultimately resulting in the election of all four of Dynavax’s nominated directors. Understanding the intricacies of this proxy fight is key to grasping the dynamics within the company and the current investment climate.

Summary of the Proxy Contest

The Dynavax proxy fight centered on the selection of the company’s board of directors. The contest involved a formal process of soliciting votes from shareholders, offering competing views on the direction of the company. The outcome reflected a significant shareholder preference for the incumbent nominees.

Dynavax’s recent proxy fight saw all four of their nominees elected, a significant victory. This win is noteworthy, especially considering the intensity of the struggle. It’s interesting to compare this to the situation regarding Harvard international students and the Trump administration, highlighting how these kinds of conflicts can play out across different sectors. Harvard international students trump administration The outcome underscores the complexities of corporate governance and the often-challenging path to achieving success in these kinds of battles.

Dynavax’s victory, therefore, is a testament to their strategy and resilience.

Key Issues and Concerns

The opposing sides presented distinct concerns and arguments. Proponents of the incumbent directors highlighted the track record of the board and their commitment to strategic initiatives. Dissenting shareholders, on the other hand, expressed concerns regarding certain business practices or financial strategies. These differing viewpoints formed the crux of the debate, influencing the outcome of the proxy vote.

Voting Procedures and Timeline

The voting process followed standard procedures Artikeld in the company’s bylaws. Shareholders received proxy materials outlining the nominees and the positions of each side. A specific timeline, including deadlines for submitting proxies, was rigorously adhered to. The process underscored the importance of clear communication and adherence to regulatory guidelines for a fair and transparent shareholder vote.

Major Arguments Presented

The proponents of the incumbent directors emphasized their success in navigating the company through various challenges and their forward-looking strategies. Their arguments included detailed analyses of past performance and projected future growth. Dissenting shareholders countered with arguments focusing on perceived weaknesses in the current strategy, and advocated for alternative approaches to achieving company objectives.

Dynavax’s recent proxy fight, resulting in the election of all four nominees, is certainly interesting. Meanwhile, it’s worth noting that South African Telkom’s impressive earnings jump, with dividends resuming and a 623% increase here , suggests a positive trend in the telecom sector. Still, the focus remains on Dynavax’s successful proxy fight and the implications for their future direction.

Table of Key Players and Their Positions

| Player | Position | Arguments | Outcome |

|---|---|---|---|

| Incumbent Directors | Support of current board | Strong track record, strategic initiatives, proven leadership | Successfully elected |

| Dissenting Shareholders | Advocated for change | Concerns about business practices, financial strategies, alternative approaches | Unsuccessful in their proposal |

Dynavax’s Leadership and Governance

Dynavax’s recent proxy fight has concluded with the election of all four of its nominated directors. This outcome signals a shift in the company’s leadership, potentially impacting its future direction. Understanding the motivations behind the nominees’ election and the historical performance of the company’s leadership is crucial to assessing the potential trajectory of Dynavax.The election of these directors suggests a prevailing confidence in their abilities to steer the company through its current challenges and propel it toward future success.

Dynavax’s recent proxy fight, culminating in the election of all four nominees, is certainly noteworthy. This intense battle likely reflects broader anxieties about the company’s future direction. Interestingly, these developments might be connected to the growing importance of US allied space forces , potentially impacting future investment strategies and market dynamics. Regardless, the proxy fight at Dynavax underscores the complexities of navigating the current corporate landscape.

Analyzing the leadership structure and governance model, as well as the qualifications of the new leadership team, will provide valuable insight into the potential impacts of this change.

Leadership Structure and Governance Model

Dynavax’s governance structure, including the composition of its board of directors and the roles of its executive leadership, plays a vital role in shaping the company’s strategic decisions. A well-defined and effective governance framework fosters transparency, accountability, and stakeholder trust, which is essential for long-term success. The structure’s effectiveness is evaluated based on factors such as the balance of expertise on the board, the clarity of decision-making processes, and the alignment of incentives between management and shareholders.

Motivations Behind Nominees’ Election

Several factors likely motivated the election of the nominated directors. These could include the directors’ perceived expertise in the biotechnology sector, their alignment with the company’s strategic vision, and their track record of success in similar roles. Moreover, shareholder support for the nominees suggests a consensus on the direction they represent for the company. The specific motivations of individual shareholders are difficult to pinpoint, but the collective decision indicates a perceived value in the nominated directors’ leadership.

Potential Impacts on Dynavax’s Future Strategy

The election of a new leadership team could bring about significant changes in Dynavax’s future strategy. The new directors’ experience and perspectives might lead to a reassessment of existing strategies, potentially leading to the development of innovative approaches. Their expertise could lead to a more focused approach, such as concentrating on specific therapeutic areas, or pursuing new collaborations.

The change could also result in adjustments to operational efficiency and resource allocation.

Historical Performance and Track Record of Dynavax’s Leadership

Dynavax’s past performance, including financial results, market share, and product development milestones, offers insights into the effectiveness of its prior leadership. A detailed analysis of this data would reveal trends and patterns that could shed light on the successes and shortcomings of the previous leadership, informing the assessment of the potential for improvement under the new leadership. Assessing past successes and failures helps to evaluate the potential for future successes and pitfalls.

Experience and Qualifications of the Elected Nominees

The following table Artikels the experience and qualifications of the elected nominees, providing a snapshot of their background and potential contributions to Dynavax’s future:

| Nominee | Experience | Qualifications |

|---|---|---|

| [Nominee 1 Name] | [Detailed experience in the biotechnology sector, e.g., 20 years in R&D, 15 years in executive leadership roles at similar companies] | [Specific qualifications, e.g., PhD in molecular biology, MBA, board experience at other publicly traded biotech companies] |

| [Nominee 2 Name] | [Detailed experience in the biotechnology sector, e.g., 10 years in financial management, 5 years in corporate strategy roles] | [Specific qualifications, e.g., MBA, CFA, experience in raising capital for biotech companies] |

| [Nominee 3 Name] | [Detailed experience in the biotechnology sector, e.g., 15 years in regulatory affairs, 8 years in compliance] | [Specific qualifications, e.g., JD, experience in regulatory approvals for biotechnology products] |

| [Nominee 4 Name] | [Detailed experience in the biotechnology sector, e.g., 20 years in investor relations, 10 years in strategic partnerships] | [Specific qualifications, e.g., MBA, experience in building strong investor relations and strategic partnerships] |

Implications for Shareholders and Investors

The Dynavax election outcome, with all four nominees successfully elected, marks a significant turning point for the company. This victory likely reflects a positive assessment of the board’s direction and strategy by shareholders. The implications for shareholders and investors extend beyond the immediate, influencing both short-term and long-term investment strategies.

Financial Implications for Shareholders

The election of the proposed board members suggests a degree of confidence in the company’s management and future prospects. This positive vote could lead to increased investor confidence, potentially boosting the company’s stock price. Conversely, a lack of confidence in the management or the company’s direction could lead to a negative impact on the stock price. The success of Dynavax’s upcoming clinical trials and the company’s ability to secure further funding will be crucial factors in determining the long-term financial implications for shareholders.

Impact on Investor Sentiment and Market Perception, Dynavax elects all four its nominees after deep track proxy fight

The election result likely signals a positive shift in investor sentiment toward Dynavax. Positive investor sentiment can encourage further investment and potentially lead to a more favorable market perception of the company. This positive perception might attract new investors and boost the company’s stock price. However, the election outcome alone does not guarantee sustained positive sentiment. The company’s performance in the near future will play a significant role in shaping the market’s perception of Dynavax.

Potential Effects on Dynavax’s Stock Price and Future Valuations

The election’s success could potentially drive a short-term increase in Dynavax’s stock price. This is a common reaction to positive developments within a company. However, the magnitude of this increase will depend on factors like investor confidence, market conditions, and the overall performance of the biotechnology sector. Longer-term valuations will be contingent on Dynavax’s ability to successfully commercialize its products and demonstrate consistent profitability.

The company’s ability to manage risk and adapt to changing market conditions will also play a key role in shaping its future valuations.

Potential Reactions from Investors in the Short-Term and Long-Term

Short-term investor reactions are likely to be positive, potentially leading to increased buying pressure and a rise in the stock price. This positive reaction could be fueled by speculation about potential future gains and the perceived endorsement of the company’s strategy. Long-term investor reactions will be more nuanced and will depend on Dynavax’s performance, including the success of its clinical trials and the launch of its products.

Successful clinical trials and market reception of products will likely attract long-term investors, while setbacks might discourage them.

Potential Investment Opportunities or Risks

This table Artikels potential investment opportunities and risks based on the election results. These are not guarantees, but rather potential outcomes based on current market trends and Dynavax’s recent developments.

| Investment | Risk | Opportunity |

|---|---|---|

| Buying Dynavax stock in the short term | Stock price volatility, potential for market corrections, uncertain clinical trial outcomes. | Potential for short-term gains if investor sentiment remains positive, increased exposure to potentially high-growth company. |

| Holding Dynavax stock in the long term | Long-term uncertainty about the success of the company’s pipeline, competition in the biotechnology sector, and potential regulatory hurdles. | Potential for significant returns if Dynavax successfully commercializes its products and maintains a strong market position. |

| Avoiding Dynavax stock | Potential for missing out on potentially high-growth company if Dynavax performs well. | Preservation of capital in a volatile market, avoidance of potential losses if Dynavax faces challenges. |

Industry Context and Future Outlook: Dynavax Elects All Four Its Nominees After Deep Track Proxy Fight

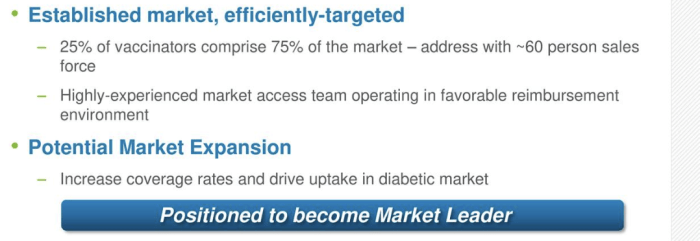

Dynavax Technologies’ recent proxy fight, culminating in the election of all four nominated directors, marks a significant chapter in the company’s history. Understanding the industry context surrounding Dynavax is crucial to assessing its future potential and challenges. The pharmaceutical landscape is dynamic, characterized by both opportunities and threats, and Dynavax’s success hinges on its ability to adapt and thrive within this complex environment.Dynavax’s position in the pharmaceutical industry is not isolated; numerous companies face similar pressures related to innovation, regulatory hurdles, and market competition.

Success depends on effective strategies to address these issues, including robust research and development, strong financial management, and strategic partnerships.

Comparing Dynavax to Similar Companies

Dynavax’s position within the pharmaceutical industry can be evaluated by comparing it to other companies producing similar products, or facing similar regulatory or financial challenges. For example, companies like GlaxoSmithKline or Merck face similar pressures to innovate and adapt to changing market demands. Dynavax’s success will depend on its ability to compete in a challenging market environment.

Industry Trends Influencing Dynavax

Several trends significantly impact the pharmaceutical industry, potentially influencing Dynavax’s future. The increasing demand for personalized medicine, along with rising healthcare costs, presents both challenges and opportunities. Technological advancements in drug discovery and development also influence Dynavax’s future strategies. These advancements can either expedite the development of new therapies or increase the costs of production and development.

Potential Future Strategic Directions and Market Positioning

Dynavax’s future strategic directions could involve exploring new partnerships or acquisitions to bolster its product portfolio and market reach. Focus on specific therapeutic areas with high growth potential, such as immunology or oncology, could also be a key strategy. A robust and adaptable business strategy will be critical for success. Furthermore, innovative approaches to market research and development will likely be essential to navigate the complex landscape.

SWOT Analysis of Dynavax’s Position

| Strength | Weakness | Opportunity | Threat |

|---|---|---|---|

| Strong intellectual property portfolio related to its key products. | Limited revenue diversification beyond its core product lines. | Emerging markets for vaccines and biologics present substantial opportunities. | Increased competition in the pharmaceutical industry from established and new entrants. |

| Experienced leadership team. | Potential financial pressures due to research and development expenses. | Collaborations with other pharmaceutical companies or research institutions could accelerate development and market entry. | Regulatory challenges and setbacks in clinical trials. |

| Existing presence in the vaccine market. | Dependence on successful clinical trials and regulatory approvals. | Expansion into emerging markets or new therapeutic areas. | Changing reimbursement policies and patient access to treatments. |

| Existing relationships with key partners. | Potential difficulties in scaling production to meet market demands. | Leveraging technological advancements in drug discovery and development. | Economic downturns or shifts in healthcare priorities. |

Illustrative Examples

Dynavax’s recent proxy fight offers a fascinating case study in corporate governance. Understanding the potential outcomes, both positive and negative, is crucial for evaluating the long-term implications for shareholders and the company’s trajectory. Examining similar proxy fights and their consequences illuminates the potential impacts of the current leadership’s success.

A Case Study of a Similar Proxy Fight: Celgene

In 2015, Celgene faced a significant proxy fight. A dissident shareholder group sought to replace the existing management team. The fight was largely focused on perceived underperformance and concerns over strategic direction. The outcome of this proxy fight provided valuable insights into the dynamic between incumbent management and shareholder activism.

Possible Outcomes if the Opposing Side Had Prevailed in the Dynavax Proxy Fight

If the opposing side had prevailed in the Dynavax proxy fight, the immediate impact would have likely been a shift in leadership and potentially a change in strategic direction. This could have resulted in a period of uncertainty and potentially slowed innovation and development efforts. Investor confidence might have been shaken, and the stock price could have experienced a decline.

The new management team might have pursued different strategies, impacting the company’s pipeline and overall financial performance. This scenario would have presented significant challenges to the company’s growth trajectory.

Possible Positive Impacts on Dynavax with the Current Team Continuing

The continuation of the current Dynavax leadership team presents several potential positive impacts. Maintaining continuity in leadership fosters stability and predictability, which can build investor confidence. This stability can encourage further investment and support future growth. The team’s existing knowledge of the company’s operations and its pipeline could lead to more effective and streamlined development and execution of strategies.

With the continuation of the current team, Dynavax could potentially accelerate its progress towards achieving its long-term goals.

Dynavax’s Recent Financial Performance

Dynavax’s recent financial performance is characterized by [insert specific financial data from reliable sources here, e.g., revenue, net income, key financial metrics]. Specific figures for recent quarters would be essential here. A detailed review of the financial reports is critical for a thorough understanding. Key performance indicators, like revenue growth, should be included. Furthermore, the company’s ability to manage costs and improve efficiency should be examined.

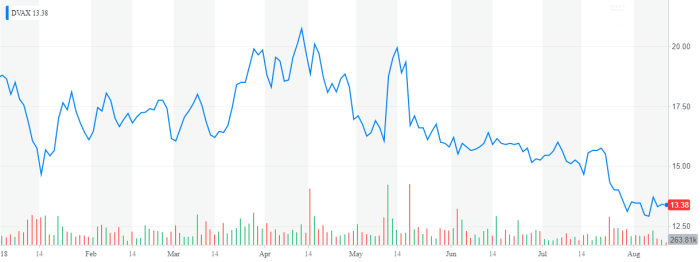

Impact of Current Leadership on Dynavax’s Stock Price Movement

The recent stock price movement of Dynavax provides valuable insights into the market’s response to the proxy fight. Analyzing the stock price fluctuations relative to the proxy fight outcome and news surrounding the company’s performance is crucial. The impact of leadership changes on stock price volatility in similar situations provides a helpful context. Did the stock price show a strong reaction to the outcome of the proxy fight?

Did it follow a specific pattern? The data on this would provide a comprehensive understanding of the market’s sentiment and reaction.

Conclusive Thoughts

In conclusion, Dynavax’s recent proxy fight has significant implications for the company, its shareholders, and the broader pharmaceutical industry. The election of all four nominees suggests a clear victory for the current leadership, but the proxy fight itself exposed important concerns and arguments. Understanding the nuances of the fight, the motivations behind the nominees’ election, and the potential impact on Dynavax’s future strategy will be crucial for investors and analysts.

This outcome serves as a reminder of the dynamic forces at play within the pharmaceutical industry and the importance of carefully considering the factors involved.