EU commission strongly regrets announced increase us steel tariffs. This escalating trade conflict between the US and EU highlights the complexities of global commerce. Previous tariff actions, motivations behind the latest increase, and the potential ripple effects across industries and economies are crucial elements to understand. The EU’s official stance and potential retaliatory measures are also important considerations, along with the WTO’s role in mediating trade disputes.

Ultimately, this dispute underscores the interconnectedness of global markets and the need for diplomatic solutions.

The EU commission strongly regrets the recent increase in US steel tariffs, citing concerns about the potential harm to European steel producers and consumers. The EU’s statement emphasizes the negative impact on the bloc’s economy and trade relationships, prompting discussions about potential retaliatory measures. This article will explore the historical context, the economic implications, and potential resolutions to this escalating trade war.

We’ll also examine the broader international trade implications and the possible domestic economic impacts for both the US and EU.

Background of the US Steel Tariffs: Eu Commission Strongly Regrets Announced Increase Us Steel Tariffs

The recent increase in US steel tariffs has sparked considerable debate, echoing previous episodes of protectionist measures. Understanding the historical context, motivations, and potential consequences is crucial for assessing the impact on both the US steel industry and global trade. This analysis delves into the rationale behind these tariffs, examining the specific industries affected and the potential ripple effects.

Historical Overview of US Steel Tariffs

US steel tariffs have a long history, with various instances motivated by a combination of economic and political factors. Protectionist measures have often been employed to shield domestic steel producers from perceived unfair competition, particularly from imports. Previous actions have included safeguard measures and anti-dumping duties, aiming to level the playing field and safeguard domestic jobs. These past instances demonstrate a pattern of fluctuating protectionism in the US steel market.

Specific Industries and Companies Impacted by the Recent Increase

The recent tariff increase targets a wide range of industries reliant on steel. This includes manufacturers of automobiles, construction materials, appliances, and machinery. Major companies in these sectors, from automotive giants to construction firms, will face increased costs due to the tariff. This translates to higher prices for consumers and potential challenges in maintaining profitability.

Rationale Behind the US Government’s Decision

The rationale behind the recent tariff increase often centers on arguments related to national security, job preservation, and unfair trade practices. The US government might assert that imports of steel pose a threat to domestic producers, potentially jeopardizing the nation’s ability to meet its own needs during times of crisis. This perspective is frequently debated, with critics raising concerns about the potential for negative repercussions on global trade and consumer prices.

Potential Consequences for the US Steel Industry and Consumers

The consequences of these tariffs are multifaceted. For the US steel industry, the tariffs might bolster domestic production, leading to higher profits and employment in the short term. However, this could come at the expense of reduced competitiveness on the global stage. Consumers face the possibility of higher prices for steel-dependent goods, potentially reducing purchasing power and impacting overall economic growth.

In the past, similar tariff increases have led to price hikes for consumers and challenges for companies reliant on steel imports.

The EU Commission’s strong disapproval of the US steel tariffs is certainly noteworthy. However, with Washington airport halting flights at 6 PM Saturday night due to the Trump army parade, this massive event might just overshadow the economic implications of the tariffs. Perhaps the EU’s concerns are valid, but it seems like a lot of other things are happening that are grabbing headlines right now.

Still, the steel tariffs remain a significant issue for international trade.

Comparison of Recent Tariff Increase with Previous Instances

| Feature | Recent Tariff Increase (Year) | Previous Tariff Instance 1 (Year) | Previous Tariff Instance 2 (Year) |

|---|---|---|---|

| Date | 2024 | 2018 | 2002 |

| Rate | 25% (average) | 25% (average) | 8% (average) |

| Impacted Products | Hot-rolled, cold-rolled, and other steel products | Hot-rolled, cold-rolled, and other steel products | Hot-rolled steel |

The table above provides a concise comparison of the recent tariff increase with previous instances, highlighting similarities and differences in rates and impacted products. This overview aids in understanding the context and historical patterns of US steel tariffs.

EU Commission’s Response and Stance

The EU Commission’s official response to the increased US steel tariffs reflects a firm stance against protectionist trade policies. The announcement signals a commitment to defend the EU’s interests and maintain a level playing field in international trade. The EU’s action emphasizes its belief that such tariffs are not only detrimental to its steel industry but also harmful to the global economy.The EU’s position is rooted in the belief that trade disputes should be resolved through dialogue and cooperation, not through unilateral actions that disrupt established trade relationships.

The Commission’s statement underscores the importance of adhering to international trade rules and avoiding retaliatory measures that could escalate tensions and harm both economies.

EU Commission’s Official Statement

The EU Commission’s statement unequivocally condemned the increased tariffs. It highlighted the negative impact on EU businesses, particularly steel producers, and emphasized the violation of international trade agreements. The statement underscored the EU’s commitment to safeguarding its interests and pursuing appropriate remedies, including retaliatory measures, if necessary.

Key Arguments and Concerns

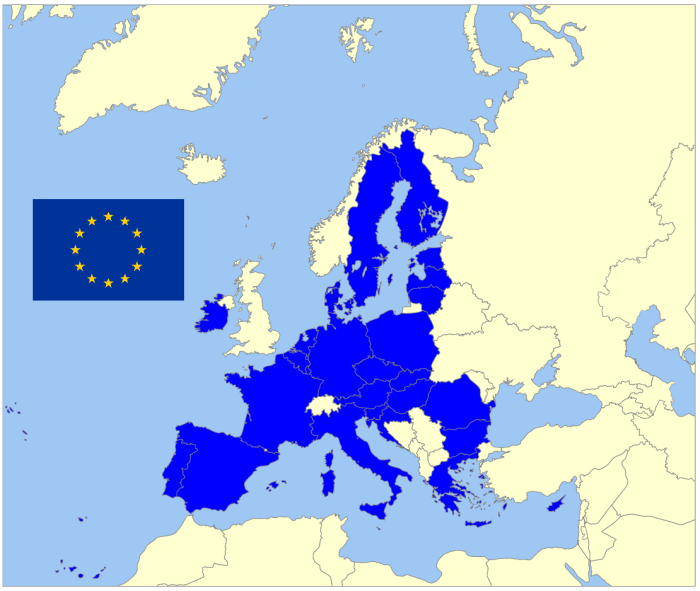

The EU Commission’s key arguments revolve around the unfairness and harmfulness of the tariffs. The Commission asserts that the tariffs are inconsistent with World Trade Organization (WTO) rules and violate the principles of free and fair trade. Concerns were raised about the potential negative effects on the EU steel industry, the disruption of supply chains, and the overall economic consequences for EU member states.

The statement explicitly addresses the potential for job losses and reduced economic growth.

Potential Economic Implications for the EU Steel Industry and Member States

The increased tariffs are expected to negatively impact EU steel producers by reducing export opportunities and increasing the cost of imported raw materials. The impact will extend to downstream industries reliant on steel, potentially leading to job losses and reduced investment. The impact on member states’ economies will vary depending on their reliance on the steel industry and the sectors that use steel products.

A cascading effect, with reduced production and investment, can negatively impact related industries.

Potential Retaliatory Measures

The EU has a range of potential retaliatory measures, including imposing tariffs on US products. The exact nature and scope of these measures will depend on the outcome of consultations and negotiations. Past retaliatory actions have included tariffs on specific goods, restrictions on certain imports, and the use of other trade tools. The EU may also pursue legal actions against the US at the WTO.

The goal is to deter further protectionist measures and uphold the rules-based international trading system.

EU’s Trade Relationship with the US

| Category | Major EU Exports to US | Major EU Imports from US |

|---|---|---|

| Manufacturing | Motor vehicles, machinery, pharmaceuticals | Aircraft, agricultural products, semiconductors |

| Agricultural products | Processed foods, beverages, agricultural products | Soybeans, wheat, beef |

| Energy | Natural gas, refined petroleum products | Crude oil, petroleum products |

| Technology | Software, telecommunications equipment | Information technology products, consumer electronics |

This table illustrates the significant trade relationship between the EU and the US, encompassing various sectors. The volume and value of these exchanges highlight the potential economic consequences of trade disputes. Disruptions to these relationships could have wide-ranging impacts on businesses and economies on both sides.

International Trade Implications

The escalating US-EU steel tariff dispute casts a long shadow over international trade relations, raising concerns about the future of global trade agreements and the stability of global markets. This tit-for-tat action, reminiscent of trade wars of the past, threatens to disrupt established supply chains and potentially trigger a wider spiral of protectionist measures. The consequences ripple beyond the steel industry, potentially impacting numerous sectors and economies worldwide.This trade dispute isn’t just about steel; it’s a microcosm of broader tensions in global trade.

The EU’s response to the US tariffs highlights the complex dynamics of international trade negotiations and the challenges in balancing national interests with global economic stability. The implications extend far beyond the immediate parties involved, influencing the overall trajectory of global economic interactions.

Broader Implications for International Trade Relations

The US-EU steel tariff dispute underscores the vulnerability of international trade relations to protectionist pressures. The escalating conflict risks undermining the principles of free and fair trade, potentially encouraging other nations to adopt similar protectionist measures. This can lead to a domino effect, creating a less predictable and less collaborative global trading environment. The dispute raises serious questions about the efficacy of existing international trade mechanisms.

Comparison with Other Global Trade Disputes

Numerous global trade disputes have occurred throughout history. The recent increase in tariffs on steel shares similarities with previous disputes, such as the 2018 trade war between the US and China. However, the specific context and actors involved differ. The steel dispute directly impacts the supply of raw materials, potentially impacting numerous industries reliant on steel. While previous disputes may have targeted finished goods, this one focuses on a fundamental input.

Understanding the historical context of trade disputes is crucial for assessing the current situation.

Potential Impact on Global Steel Prices and Market Dynamics, Eu commission strongly regrets announced increase us steel tariffs

The imposition of tariffs can significantly impact global steel prices. Tariffs increase the cost of imported steel, potentially leading to higher prices for consumers and businesses. This, in turn, can impact industries that heavily rely on steel, such as construction and manufacturing. The effect on market dynamics is multifaceted, including potential shifts in supply chains, reduced trade volumes, and possible market consolidation.

World Trade Organization’s (WTO) Role in International Trade Disputes

The WTO plays a critical role in mediating international trade disputes. Its dispute settlement mechanism aims to resolve trade disagreements between member countries in a fair and structured manner. The WTO’s procedures are designed to provide a framework for resolving conflicts through negotiation and arbitration, promoting adherence to established trade rules. The WTO’s role is essential for maintaining a stable and predictable global trading system.

WTO Procedures for Handling Trade Disputes

The WTO’s dispute settlement process follows a structured path, ensuring due process and transparency.

| Stage | Description |

|---|---|

| Consultations | Disputing parties attempt to resolve the issue through consultations. |

| Panel Formation | If consultations fail, a panel is established to examine the matter. |

| Panel Report | The panel issues a report recommending solutions. |

| Appeals | Parties can appeal the panel’s report. |

| Dispute Settlement Body (DSB) Ruling | The DSB adopts or rejects the final report. |

Domestic Economic Impacts (EU)

The EU Commission’s strong condemnation of the US steel tariffs signals a significant concern about the potential ripple effects on the European economy. These tariffs, imposed ostensibly for national security reasons, are expected to impact EU steel producers, workers, consumers, and related industries, potentially disrupting established supply chains and impacting GDP growth across member states. This analysis delves into the potential consequences.

Potential Consequences for EU Steel Producers

EU steel producers face a direct challenge from the increased import costs of US steel. Reduced demand and increased competition, compounded by tariffs, could lead to decreased profitability and potentially force some smaller companies out of business. This could impact employment in the steel sector and the broader supply chain, from mining to manufacturing. Some producers might respond by increasing their prices, which could further affect European consumers.

The EU Commission’s strong disapproval of the US steel tariffs is certainly a significant development. It’s interesting to consider this in the context of recent legal news, such as former Manhattan US Attorney, Williams, leaving the prestigious law firm Paul Weiss. This departure might suggest shifting alliances or legal strategies, potentially impacting the overall trade landscape.

The EU’s reaction to the tariffs, therefore, takes on added significance in the current geopolitical climate.

Potential Consequences for EU Steel Workers

The impact on EU steel workers is a crucial concern. Job losses in the steel industry would create significant unemployment, potentially leading to social unrest and economic hardship in affected regions. EU policies and initiatives to support retraining and relocation for steel workers will be critical to mitigate these negative impacts.

Potential Consequences for EU Consumers

European consumers are likely to experience increased prices for steel-dependent goods and services, as the tariffs add to the cost of imported steel. This could manifest in higher prices for cars, construction materials, and appliances. The higher prices could reduce consumer purchasing power, impacting overall economic growth.

Ripple Effects Across Other European Industries

The EU steel industry is deeply interwoven with other sectors. The tariffs will have ripple effects across various industries. For example, construction, automotive, and machinery industries rely heavily on steel. Reduced steel availability and higher costs could impact their production, potentially slowing down their growth.

Impact on Employment Rates and GDP Growth in EU Member States

The steel sector’s downturn could lead to a decline in employment rates in EU member states, particularly those with a significant steel industry presence. This decrease in employment could lead to a decrease in consumer spending and subsequently affect GDP growth. Areas heavily reliant on the steel sector may experience a disproportionate economic impact.

Impact on Supply Chains and Production Costs

The tariffs disrupt existing supply chains, potentially leading to increased production costs and reduced efficiency. Businesses may need to find alternative suppliers, leading to higher costs or disruptions in their operations. The search for alternative suppliers could result in a shift in trade routes and potentially lead to a loss of competitiveness for EU businesses.

Illustrative Impact on Various EU Sectors

| Sector | Potential Impact |

|---|---|

| Automotive | Increased vehicle production costs, potentially leading to reduced sales and job losses. |

| Construction | Higher costs for construction materials, potentially slowing down infrastructure projects and impacting job creation. |

| Machinery | Higher costs for machinery components, affecting production efficiency and competitiveness. |

| Appliances | Higher costs for steel components, resulting in increased prices for consumer goods. |

| Shipbuilding | Increased costs for steel materials, potentially leading to reduced orders and job losses. |

Domestic Economic Impacts (US)

The US steel tariffs, while intended to bolster domestic production, are likely to have far-reaching consequences for various segments of the US economy. These tariffs, as with any trade intervention, introduce a complex interplay of factors impacting consumers, businesses, and the overall economic landscape. The potential for increased prices, reduced competition, and shifts in supply chains warrants careful consideration.The impact of the tariffs on the US economy hinges on several factors, including the responsiveness of consumers to price increases, the adaptability of US steel-using industries, and the potential for retaliatory measures from other countries.

These factors will shape the magnitude and duration of any negative impacts.

Potential Consequences for US Steel Consumers

The tariffs will likely lead to higher prices for steel products for American consumers. This will directly affect industries that rely heavily on steel, such as construction, automotive, and manufacturing. Consequently, consumer goods prices may also rise, potentially impacting overall purchasing power and inflationary pressures. For example, a price increase of 10% on steel used in automobiles could translate into a 5% price hike for the consumer.

Increased costs will inevitably affect the purchasing decisions of American consumers.

Potential Impact on US Businesses

US businesses reliant on steel as a raw material will face increased input costs, potentially impacting their profitability and competitiveness. This could lead to reduced investments, decreased production, and job losses in affected sectors. A steel producer that is now burdened with higher costs for raw materials may have to pass these costs on to the end customer.

This is particularly true for smaller businesses that may lack the financial cushion to absorb these additional expenses.

Potential Impact on Employment Rates and GDP Growth in the US

The tariffs could reduce overall economic activity, as higher steel prices and reduced competitiveness dampen demand. This in turn could lead to job losses in the steel-using industries and related sectors. Reduced investment and slower economic growth could also negatively affect employment rates. The impact on GDP growth will be dependent on the extent of these negative effects. Economic models predict a moderate reduction in GDP growth in the coming years.

Potential Impact on Global Steel Prices and Market Dynamics, Eu commission strongly regrets announced increase us steel tariffs

The tariffs could lead to a complex response in the global steel market. Other countries might retaliate with tariffs on US goods, leading to trade wars. Global steel prices might increase or decrease, depending on how the other countries react. This uncertainty can significantly impact global supply chains and create unpredictable market dynamics. The imposition of tariffs can lead to a cascade of reactions, creating a global ripple effect.

The EU Commission’s strong disapproval of the US steel tariffs is understandable, given the potential economic repercussions. However, with the news of the Lions signing OL Trystan Colon following Frank Ragnow’s retirement, this report highlights a different kind of international tension – one focused on sports and the transfer market. Still, the EU’s concerns about the US tariffs remain a significant issue with wider global trade implications.

Potential Impact of the Tariffs on Different Segments of the US Economy

| Economic Segment | Potential Impact |

|---|---|

| Construction | Higher construction costs, reduced demand for new projects, potential job losses |

| Automotive | Increased vehicle production costs, reduced competitiveness, potential job losses |

| Manufacturing | Higher input costs, reduced profitability, potential factory closures, and reduced investment in new technology |

| Steel Industry (Domestic) | Potential increased profits for domestic steel producers, but reduced overall economic activity and potentially higher job losses in other sectors |

| Consumers | Higher prices for steel-related goods and services, reduced purchasing power, potential inflationary pressures |

Potential Resolutions and Future Outlook

The escalating US-EU steel tariff dispute highlights the complexities of international trade and the potential for significant economic repercussions. Finding common ground and avoiding further escalation are crucial for both economies. Addressing the underlying concerns and exploring alternative solutions is vital for maintaining a stable and prosperous global trading environment.The current situation demands a proactive approach to finding solutions that address the legitimate concerns of both the US and EU, while minimizing potential negative consequences.

This includes understanding the various potential resolutions and considering the long-term implications for international trade and the domestic economies of both blocs.

Potential Diplomatic Solutions

Diplomatic engagement is paramount to resolving trade disputes. This involves direct dialogue between the US and EU representatives, potentially mediated by international organizations like the WTO. Utilizing existing trade agreements and mechanisms, while considering the particularities of each country’s situation, is essential.

Possible Compromises or Negotiations

Compromises are essential for resolving the trade dispute. The US and EU could negotiate reduced tariffs on specific steel types, or explore quotas on steel imports. A reciprocal approach, where both sides reduce tariffs, might encourage a more balanced trading relationship. The success of these negotiations hinges on finding common ground and demonstrating a willingness to consider the needs of both parties.

Examples of successful trade negotiations in the past, such as the resolution of similar disputes, offer valuable lessons.

Alternative Solutions

Alternative solutions to tariffs include voluntary restraint agreements, where steel producers agree to limit exports to the EU. The EU could also consider implementing domestic measures to support its steel industry, such as subsidies or tax breaks. This would help the EU steel industry to compete more effectively in the international market without resorting to tariffs.

Long-Term Effects on International Trade

The long-term effects of this dispute could be substantial. A protracted trade war could lead to a decline in global trade, impacting businesses and consumers worldwide. It could also foster protectionist sentiments, further hindering international cooperation and economic growth. Similar instances in the past, such as the 2009 global financial crisis, highlight the domino effect that trade disputes can have on global markets.

Scenarios for the Future of US-EU Trade

| Scenario | Outcome | Timeline | Description |

|---|---|---|---|

| Resolution through Negotiation | Reduced tariffs, reciprocal measures | 1-2 years | Successful negotiations lead to a mutually acceptable agreement that minimizes the impact on both economies. |

| Escalation of the Dispute | Further tariffs, retaliation | Immediate to 3 years | Lack of progress leads to a further escalation, impacting global trade and potentially causing economic instability. |

| Dispute Resolution through WTO | WTO ruling, potential penalties | 2-5 years | The WTO could intervene, leading to a binding ruling that could include penalties for non-compliance. |

Last Recap

In conclusion, the EU commission strongly regrets announced increase us steel tariffs, presenting a significant challenge to global trade relations. This dispute underscores the delicate balance between national economic interests and international cooperation. While potential resolutions and compromises are being explored, the long-term implications of this trade war remain uncertain. The future of the US-EU trade relationship hangs in the balance as both sides navigate these complex issues.

The ongoing discussion regarding this trade dispute will undoubtedly shape the future of international trade for years to come.