Feds musalem estimates 50 50 chances tariffs triggering prolonged US inflation. The Federal Reserve’s assessment of a 50/50 chance of tariffs prolonging US inflation highlights a crucial juncture in economic policy. This uncertainty underscores the delicate balance between protecting domestic industries and maintaining a stable economic climate. The potential ripple effects on supply chains, consumer prices, and overall economic growth are significant, and this article will delve into the factors contributing to this 50/50 probability and explore the potential outcomes.

The Federal Reserve’s current monetary policy stance is being scrutinized alongside the potential impact of tariffs. The article will analyze the Fed’s projected interest rate path, its assessment of the current economic climate, and differing views within the Fed regarding tariffs. We will examine how tariffs could disrupt supply chains, affect consumer demand, and potentially influence the trade balance and exchange rates.

Historical data on past tariff implementations and their effects on inflation will be compared to the current situation.

Understanding the Fed’s Perspective

The Federal Reserve (Fed) is the central bank of the United States, responsible for maintaining price stability and maximum employment. A key aspect of their role involves managing interest rates to influence economic activity. Their current monetary policy stance is crucial for understanding the trajectory of inflation, unemployment, and economic growth. The Fed’s projected interest rate path reflects their assessment of the current economic climate and anticipated future developments.The Fed’s approach involves carefully weighing competing factors.

The Fed’s Musalem is tossing up a 50/50 chance that tariffs could prolong US inflation, which is a pretty significant worry. Meanwhile, Time magazine is bolstering its editorial team with new hires for news and audience engagement, which is a smart move given the current media landscape. This hiring, as reported by Time magazine , highlights the need for quality reporting in an era of information overload, which is really relevant to the uncertainty surrounding inflation and tariffs.

Still, the 50/50 chance of tariffs prolonging inflation remains a concern for economists.

While inflation remains a concern, the labor market has shown significant improvement. Their interest rate decisions are made based on a comprehensive analysis, considering economic indicators, and forecasts, with the goal of balancing competing economic forces.

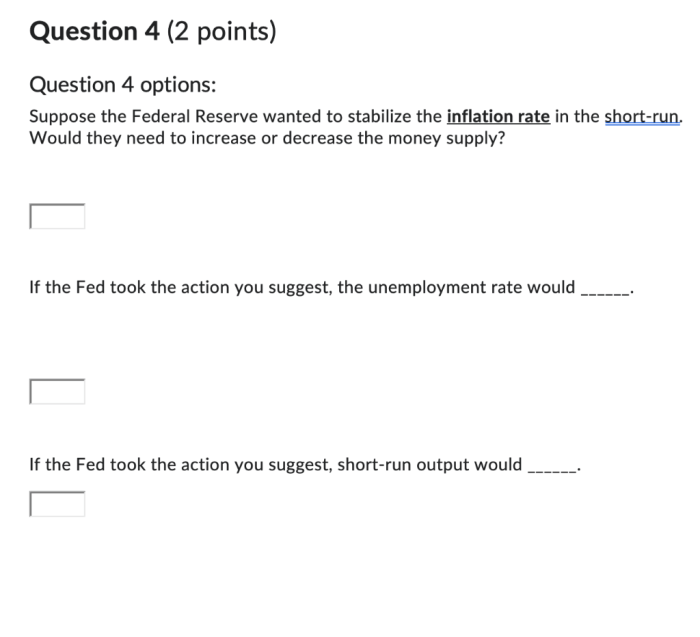

Current Monetary Policy Stance

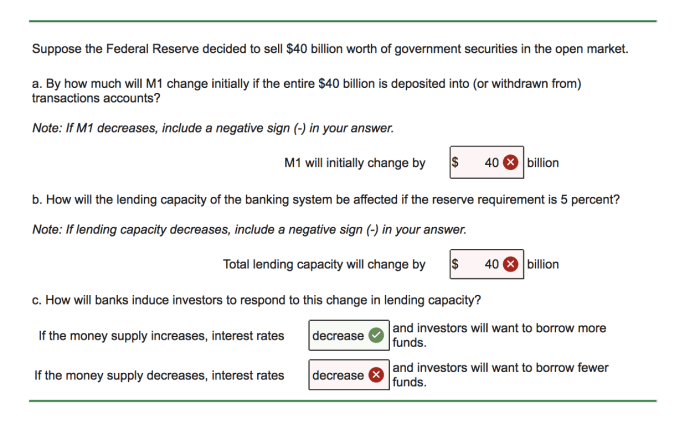

The Federal Reserve’s current monetary policy stance is characterized by a gradual tightening of monetary policy. This involves raising interest rates to curb inflation, which has been above the Fed’s 2% target for some time. The rationale behind this approach is to cool down the economy and prevent inflation from becoming entrenched. The aim is to achieve a soft landing, bringing inflation back to the target level without triggering a recession.

Rationale Behind Projected Interest Rate Path

The Fed’s projected interest rate path is predicated on several factors, including inflation expectations, labor market conditions, and economic growth projections. The current projections anticipate continued interest rate increases, although the pace may slow as the impact of previous hikes takes hold. The specific path is dynamic, responding to incoming economic data and revised forecasts.

Fed’s Assessment of the Current Economic Climate

The Fed assesses the current economic climate through various indicators. Inflation remains a significant concern, although it has shown signs of moderating. Unemployment rates are near historic lows, suggesting a robust labor market. Economic growth is expected to continue, albeit at a potentially slower pace.

Different Views Within the Federal Reserve Regarding Potential Impact of Tariffs

Opinions within the Federal Reserve regarding the potential impact of tariffs are varied. Some economists believe that tariffs could exacerbate inflationary pressures by increasing input costs for businesses. Others contend that the impact will be muted or even beneficial by shifting supply chains. These different views highlight the complexity of analyzing external factors like tariffs.

Comparison of Fed’s Estimates to Other Economic Forecasts and Analyses

The Fed’s estimates are compared to other economic forecasts and analyses from private institutions and academic researchers. While the Fed’s projections align with some other forecasts, there are notable differences in the projected pace of interest rate hikes and the timing of potential economic downturns. This divergence in estimates underscores the inherent uncertainty in economic forecasting.

Analyzing the Potential Impact of Tariffs

Tariffs, taxes imposed on imported goods, can significantly impact the US economy, particularly concerning inflation. Their effect is multifaceted, influencing supply chains, consumer prices, and even international trade relationships. Understanding these intricate connections is crucial for assessing the potential consequences of implementing tariffs.Tariffs introduce an extra cost for imported goods, which can lead to price increases for consumers.

This effect can be amplified if the imported good is a key component in the production of other goods or services. Disruptions to global supply chains, a common consequence of tariffs, can further exacerbate these price increases. The complexity of global trade means that tariffs rarely have isolated effects; rather, they create ripple effects across multiple sectors and regions.

Potential Effects on US Inflation

Tariffs can disrupt supply chains, making it more expensive to import raw materials and finished goods. This increased cost is often passed on to consumers, leading to higher prices for goods and services. The extent of this inflationary pressure depends on several factors, including the magnitude of the tariffs, the sensitivity of domestic industries to imported inputs, and the availability of alternative sources.

The Fed’s Musalem is hedging their bets, estimating a 50/50 chance that tariffs could prolong US inflation. This uncertainty highlights the complex interplay of global economic factors, and, interestingly, the historical context of figures like Pope Leo Robert Prevost , whose contributions to the understanding of such economic forces might offer some insight. Ultimately, the 50/50 chance of prolonged inflation remains a significant concern for the economy.

For example, if a significant portion of a country’s electronics manufacturing relies on imported components, tariffs on those components could lead to substantial price increases for electronics.

The Fed’s Musalem’s 50/50 chance of tariffs prolonging US inflation is a pretty significant concern. Goldman Sachs, for example, is adjusting their risk assessment after the tariff move, bracing for more uncertainty, as detailed in this piece goldman sachs pares risk after tariff move braces more uncertainty. This all just underscores how impactful these tariff decisions could be on the broader economic outlook, potentially influencing the Fed’s Musalem’s 50/50 inflation prediction.

Impact on Consumer Prices and Demand

Tariffs directly impact consumer prices by raising the cost of imported goods. This can lead to a decrease in consumer demand for imported goods as consumers seek more affordable alternatives. If tariffs affect essential goods or services, this could potentially lead to a broad-based increase in the cost of living, impacting consumer spending habits. For example, tariffs on imported steel could increase the cost of cars and construction materials, leading to decreased demand for these products.

Potential Scenarios for Inflationary Pressures, Feds musalem estimates 50 50 chances tariffs triggering prolonged us inflation

The duration and severity of inflationary pressures resulting from tariffs are unpredictable. Factors such as the level of tariff implementation, the responsiveness of businesses to price changes, and the overall economic climate will play a crucial role. In some cases, the inflationary impact might be short-lived as businesses adapt to new supply chains. In others, the inflationary pressure could be sustained, leading to higher consumer prices for an extended period.

For example, if tariffs on imported agricultural products persist, food prices might rise steadily over time.

Influence on Trade Balance and Exchange Rates

Tariffs can affect a country’s trade balance by reducing imports and potentially increasing exports. However, the impact on exchange rates is complex. A tariff might initially weaken the currency of the imposing country as foreign demand for its goods decreases. However, if the tariffs lead to a significant shift in global trade flows, the impact on exchange rates could be more nuanced.

Historical Data on Tariffs and Inflation

Historical data regarding tariffs and their impact on inflation are often complex to analyze due to the influence of other economic factors. However, studies have shown a correlation between tariff increases and inflation in certain instances. The precise relationship varies depending on the specific tariffs imposed, the overall economic environment, and the responsiveness of industries. The impact of tariffs on inflation can be better understood by considering the effects on supply chains, production costs, and consumer demand.

Potential Impacts of Tariffs on Various Sectors

| Sector | Potential Impact (Positive/Negative) | Explanation |

|---|---|---|

| Manufacturing | Negative | Increased input costs from tariffs could lead to higher production costs and potentially reduce competitiveness in the global market. |

| Retail | Negative | Higher prices for imported goods would translate to higher costs for retailers, potentially affecting profitability and consumer spending. |

| Agriculture | Negative | Tariffs on agricultural imports could raise food prices and reduce access to affordable agricultural products. |

Assessing the 50/50 Probability: Feds Musalem Estimates 50 50 Chances Tariffs Triggering Prolonged Us Inflation

The Federal Reserve’s recent assessment of a 50/50 chance of tariffs triggering prolonged US inflation warrants careful consideration. This nuanced perspective highlights the complex interplay between trade policies and economic outcomes, demanding a deeper understanding of the factors influencing this probability. The 50/50 estimate itself isn’t a definitive prediction but rather a reflection of the significant uncertainty surrounding the potential effects of tariffs.The 50/50 probability estimate underscores the inherent ambiguity in forecasting the long-term economic consequences of policy changes.

It suggests a significant degree of uncertainty, necessitating a thorough examination of the various factors that could tilt the scales in either direction. This includes not only the direct effects of tariffs on import prices but also the ripple effects throughout the supply chain and consumer behavior.

Factors Influencing the Probability

The probability of tariffs triggering prolonged inflation is influenced by a multitude of interconnected factors. These factors include the magnitude and scope of the tariffs, the responsiveness of domestic industries and consumers to price changes, and the overall health of the global economy. A significant increase in import costs due to tariffs could directly impact inflation, but the extent of this impact depends on how businesses and consumers react.

- Tariff Magnitude and Scope: The magnitude and breadth of the tariffs play a critical role. Targeted tariffs on specific goods might have a less significant impact compared to broad-based tariffs affecting numerous industries. The degree of tariff imposition on essential goods would likely have a greater impact on inflation compared to tariffs on less essential goods.

- Domestic Industry and Consumer Response: Domestic industries’ ability to absorb increased input costs and consumers’ willingness to pay higher prices will directly impact the potential for inflation. If industries can pass on increased costs to consumers, or if consumers are willing to pay higher prices for goods, inflation is more likely to persist. Historically, supply chain disruptions and consumer behavior have been significant contributors to inflationary pressures.

- Global Economic Conditions: The overall health of the global economy significantly impacts the effectiveness of tariffs in triggering prolonged inflation. If the global economy is experiencing a downturn, the impact of tariffs on prices might be less severe. For example, during periods of economic weakness, consumers may be less inclined to absorb higher prices.

Underlying Assumptions and Methodologies

The 50/50 probability estimate is likely based on various economic models and statistical analyses. These models consider factors like historical data on inflation, supply chain dynamics, and consumer spending patterns. Furthermore, the models probably include various scenarios and potential outcomes, allowing for a range of possibilities.

- Econometric Models: The analysis likely utilizes econometric models to project the impact of tariffs on prices, considering the elasticities of supply and demand. These models are designed to capture the complex relationships between various economic variables.

- Historical Data Analysis: A thorough review of past trade policies and their impact on inflation is crucial. Past economic data on similar tariff implementations and their inflationary consequences would help provide a baseline for the current analysis. This data analysis might include comparisons of historical inflation rates before, during, and after tariff implementation in similar scenarios.

- Expert Opinions: Expert opinions from economists and policymakers are also likely factored into the assessment. Their insights on the current economic landscape and their perspectives on the potential responses of businesses and consumers to tariff implementation can inform the analysis. The analysis likely considered opinions from various perspectives.

Potential Uncertainties and Risks

Several uncertainties could alter the 50/50 probability estimate. Unforeseen market responses, changes in consumer behavior, and unforeseen global economic shocks can significantly impact the accuracy of the prediction. Also, the ability of the Fed to control inflation in the face of tariff-induced price pressures should be considered.

- Unforeseen Market Responses: Unexpected shifts in market behavior, such as increased import substitution or adjustments in production processes, could alter the inflation outcome. These unexpected responses could lead to a lower or higher inflation rate compared to the estimated 50/50 probability.

- Consumer Behavior Changes: Consumer reactions to price changes are crucial. Consumers might adjust their spending patterns or seek alternatives, potentially mitigating the impact of tariffs. The ability of consumers to absorb higher prices and adapt to changing conditions is a significant factor.

- Global Economic Shocks: Unforeseen global economic events, such as a sudden downturn in a major economy, could significantly impact the outcome of tariff implementation. The overall global economic situation influences how tariffs affect inflation.

Comparison to Alternative Scenarios

Alternative scenarios of tariff implementation, such as the complete removal or reduction of tariffs, would likely result in different outcomes regarding inflation. These scenarios should be considered to fully understand the complexities of the issue. Evaluating alternative policies is important to determine the best course of action.

Illustrating the Potential Scenarios

The Federal Reserve’s 50/50 assessment regarding tariffs and their potential to prolong US inflation highlights the intricate interplay of economic factors. Understanding the various potential scenarios is crucial for navigating the uncertainties and formulating effective policy responses. This section delves into the possible outcomes, examining their implications for economic growth, employment, and consumer spending.Tariff implementation, especially if coupled with existing inflationary pressures, could trigger a range of economic responses.

The outcomes, however, are not predetermined and depend on several interacting variables. The following analysis explores potential scenarios, from a severe recession to a more moderate stagnation, and the impact on key economic indicators.

Potential Tariff and Inflation Scenarios

Understanding the potential consequences of tariffs requires analyzing different scenarios. The table below illustrates the interplay between tariff implementation and its impact on inflation, while highlighting the corresponding economic responses.

| Scenario | Tariff Implementation | Inflationary Pressure | Economic Impact |

|---|---|---|---|

| High Inflation | Yes | High | Recession |

| Moderate Inflation | Yes | Moderate | Stagnation |

| Low Inflation | No | Low | Growth |

Consequences of Each Scenario

Each scenario Artikeld above carries distinct consequences for various economic indicators. A high inflation environment, coupled with tariffs, could lead to a significant recession. Reduced consumer spending, lower business investment, and a potential rise in unemployment would likely result. Conversely, a moderate inflationary environment, despite tariffs, might result in economic stagnation. Growth would be limited, and job creation could be slower than desired.

Finally, a scenario with low inflation, and no tariffs, could stimulate economic growth. Increased consumer spending, business investment, and lower unemployment would be expected.

Impact on Key Economic Indicators

The different scenarios will have varying impacts on crucial economic indicators. GDP (Gross Domestic Product) growth would likely be impacted. A recession would lead to negative GDP growth, while stagnation would result in low or no growth. A positive scenario with no tariffs and low inflation would likely support positive GDP growth. The employment rate would also be affected.

A recession could lead to a significant increase in unemployment, while stagnation would likely result in a slow decline in unemployment. Finally, interest rates could fluctuate depending on the inflationary environment. A high inflation environment might require the central bank to raise interest rates to curb inflation, potentially impacting borrowing costs and consumer spending.

Visual Representation of Scenarios

A flowchart can visually represent the interconnectedness of the scenarios:

(Imagine a flowchart here. It would start with a question about tariff implementation. If “Yes,” it would branch into high, moderate, or low inflation scenarios, each leading to different outcomes. If “No,” it would lead directly to a low inflation/growth scenario.)

The flowchart would illustrate the cascading effects of tariffs on inflation and the subsequent impact on key economic indicators like GDP, employment, and interest rates. Each branch would represent a potential outcome, highlighting the complexity of the relationship between tariffs, inflation, and the broader economy.

Historical Precedents and Comparisons

Understanding the potential impact of tariffs on inflation requires examining historical precedents. Examining past trade disputes and their effects on economies offers valuable insights into the complexities of such policies. Analyzing how different nations have reacted to similar challenges provides a broader perspective on the current situation.

Historical Instances of Tariffs and Inflationary Impacts

Analyzing historical trade disputes reveals a mixed bag of outcomes regarding inflation. Some instances show a clear link between tariffs and price increases, while others demonstrate less pronounced or even negative effects on inflation. This complexity highlights the nuanced nature of trade policies and their impact on economic variables.

Comparison of Historical Trade Disputes

The following table presents a comparison of historical trade disputes, examining their impact on inflation and drawing parallels to the current situation.

| Historical Event | Impact on Inflation | Comparison to Current Situation |

|---|---|---|

| The Smoot-Hawley Tariff Act (1930) | The Smoot-Hawley Tariff Act, enacted during the Great Depression, is often cited as a contributing factor to the worsening economic downturn. Increased trade barriers led to reduced international trade, which hampered economic recovery. This contributed to a contraction in economic activity and, as a consequence, lower inflation. | The Smoot-Hawley Tariff Act contrasts with the current situation, where the potential for increased inflation is a primary concern. While the Smoot-Hawley Act likely resulted in lower inflation, the current context suggests a potential inflationary effect from tariffs. |

| The 2018 US-China Trade War | The 2018 US-China trade war led to increased uncertainty and volatility in global markets. The impact on inflation was mixed, with some sectors experiencing price increases while others saw decreased demand. Some studies suggest a modest increase in import prices, which could contribute to inflationary pressures, depending on the specific goods and the supply chain responses. | The 2018 US-China trade war shares some similarities with the current situation in terms of trade disputes and uncertainty. However, the current context features different global economic conditions and supply chain dynamics, potentially leading to different inflationary outcomes. |

Reactions of Other Countries to Trade Disputes

Various countries have responded to similar trade disputes in different ways. Some have opted for retaliatory measures, while others have sought to diversify their trade partners or implement alternative strategies to mitigate the impact of trade tensions. These responses highlight the complex web of international relations and the diverse strategies countries employ in response to trade disputes.

End of Discussion

In conclusion, the 50/50 probability of tariffs triggering prolonged US inflation underscores a critical moment in economic policy. The potential scenarios, ranging from high inflation and recession to moderate inflation and stagnation, demand careful consideration. The analysis of historical precedents and comparisons with other trade disputes provides crucial context. The potential impact on various sectors of the economy, from manufacturing to retail, warrants further investigation.

Ultimately, the Fed’s assessment, coupled with the potential impact of tariffs, necessitates a nuanced understanding of the current economic landscape.