Goldman Sachs pares risk after tariff move braces more uncertainty, signaling a cautious approach to the current economic climate. The bank’s decision to reduce exposure across various asset classes reflects growing concern over the potential for further disruptions from the recent tariff actions. This move highlights the ripple effects of trade tensions on the financial sector, and investors are watching closely to see how other institutions respond.

What specific instruments and asset classes are affected? How will this strategy impact Goldman Sachs’ future performance?

This analysis explores Goldman Sachs’ risk mitigation strategy, the broader market implications of tariff uncertainty, alternative investment strategies for investors, and the overall market reaction and future outlook. Tables detailing the bank’s risk management actions, market index correlations, and potential investment strategies are included for a comprehensive understanding.

Goldman Sachs Risk Mitigation Strategy

Goldman Sachs, a prominent global investment bank, has consistently demonstrated a proactive approach to risk management. The recent surge in global trade tensions, particularly tariff movements, has prompted the bank to implement a more cautious strategy, aiming to minimize potential losses and maintain stability in the face of heightened uncertainty. This adjustment reflects Goldman Sachs’ commitment to long-term value creation while navigating challenging market conditions.

Goldman Sachs’ Risk Management Strategies in the Context of Tariff Movements

Goldman Sachs has implemented a multi-faceted risk management strategy to address the uncertainties posed by tariff movements. This includes diversifying its investment portfolio across various asset classes, actively monitoring market sentiment, and employing sophisticated quantitative models to assess and predict potential risks. The strategy focuses on reducing exposure to sectors most vulnerable to trade disruptions, and strengthening its risk controls in those areas.

Rationale Behind Goldman Sachs’ Decision to Pare Risk

The increased uncertainty stemming from tariff disputes has prompted Goldman Sachs to pare risk. The unpredictable nature of these trade policies creates volatility in financial markets, making it difficult to accurately predict the impact on various asset classes. Reducing exposure to potential losses allows the bank to better manage capital allocation and preserve its long-term financial strength. This strategic decision aligns with a prudent approach to risk management in turbulent economic times.

Goldman Sachs, seemingly bracing for more economic uncertainty after the tariff move, has reportedly pared back its risk. Meanwhile, the good news for Texans fans is that QB CJ Stroud is back on the field, resuming throwing drills. This signals a potential return to normalcy on the football field, but the financial market’s current cautious approach remains, highlighting the ripple effect of global trade tensions on various sectors.

Instruments and Asset Classes Affected by Risk Reduction

The risk reduction strategy encompasses a wide range of instruments and asset classes. Exposure to commodity-related investments, particularly those tied to industries heavily impacted by tariffs, has been reduced. This includes sectors like manufacturing and agriculture. Additionally, specific emerging market investments have seen a decreased allocation, given the heightened vulnerability of these markets to global trade conflicts.

These decisions reflect a deliberate effort to limit exposure to potentially negative consequences of tariff actions.

Potential Impact on Goldman Sachs’ Performance

The short-term impact of this risk reduction strategy may include a slight decrease in trading revenue and potentially a reduced overall profit margin in the near future. However, this strategic decision is expected to bolster Goldman Sachs’ long-term resilience and financial stability. By mitigating potential risks, the bank positions itself to navigate future market fluctuations more effectively. This approach can lead to greater investor confidence and a more robust financial foundation.

Goldman Sachs, reacting to the latest tariff move, has understandably pared back risk projections, anticipating more uncertainty in the market. This cautious approach, mirroring the general economic climate, is a sensible response. Meanwhile, the Diamondbacks’ impressive win against the Mariners, powered by Eugenio Suarez’s stellar performance, highlights a different kind of risk assessment , one where athletic prowess and strategic play seem to be the primary drivers.

Still, the overall market trend suggests continued caution from financial institutions like Goldman Sachs.

Comparison with Other Major Investment Banks

Other major investment banks are also adjusting their strategies in response to global trade tensions. While the specific approaches may vary, a general trend towards risk mitigation and diversification is evident across the industry. The specific actions taken by each institution are often tailored to their individual risk profiles and investment strategies. Goldman Sachs’ strategy emphasizes a comprehensive approach, encompassing both short-term risk management and long-term strategic positioning.

Risk Categories and Mitigation Actions

| Risk Category | Mitigation Action | Impact Assessment | Timeline |

|---|---|---|---|

| Geopolitical Risk (e.g., trade wars) | Diversification of investments across regions, reducing exposure to specific sectors | Reduced exposure to potential losses stemming from trade conflicts | Ongoing, with adjustments based on market developments |

| Market Volatility Risk | Enhanced monitoring of market sentiment and use of advanced risk models | Minimization of losses during periods of heightened market volatility | Ongoing |

| Credit Risk (e.g., default of borrowers) | Stricter credit underwriting and portfolio monitoring | Reduced likelihood of significant losses from borrower defaults | Ongoing |

| Operational Risk (e.g., internal controls failure) | Investment in enhanced internal controls and risk management systems | Minimized risk of operational failures | Ongoing |

Impact of Tariff Uncertainty on the Market

Tariff uncertainty, a direct consequence of recent trade policies, casts a significant shadow over market stability. This uncertainty ripples through various sectors, affecting investor confidence and potentially triggering volatility. The potential for retaliatory measures and the unknown long-term effects of these policies create a complex landscape for businesses and investors alike. Goldman Sachs’s risk mitigation strategy addresses the potential ramifications, but the overall impact remains a subject of ongoing analysis and speculation.

Broader Market Implications

The introduction of tariffs creates a ripple effect across the global market. It disrupts established supply chains, potentially leading to higher input costs for businesses, which in turn can translate into price increases for consumers. This inflationary pressure can affect economic growth and consumer spending, potentially leading to a downturn in certain sectors. Furthermore, uncertainty surrounding future tariff actions can stifle investment, as businesses and investors become wary of potential disruptions and financial losses.

Expected Effects on Financial Market Sectors

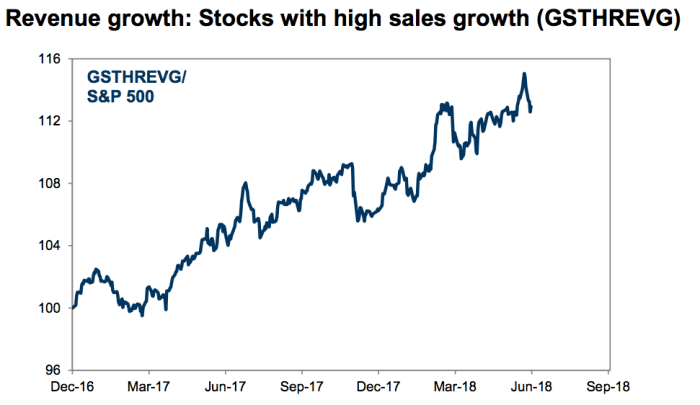

Tariff uncertainty can impact various financial market sectors in significant ways. The stock market often experiences volatility as investors react to the perceived risk. For example, sectors reliant on international trade, such as manufacturing and logistics, may see a decline in share prices. Similarly, commodity prices can fluctuate due to changes in demand and supply, influenced by tariffs.

The bond market can also experience stress as investors seek higher-yielding assets, and currency markets can become unstable due to the impact on trade flows and investor confidence.

Potential Scenarios

Several scenarios can emerge from ongoing tariff uncertainty. One possibility is a gradual decline in global economic activity as businesses adjust to higher costs and reduced trade volumes. Another potential scenario involves a sharp correction in market indices as investors react to negative news. A third scenario encompasses a period of heightened market volatility as investors grapple with the potential for further tariff actions and their impact.

The unpredictable nature of these scenarios necessitates careful consideration and preparedness by market participants.

Historical Context

Similar tariff-related events in the past have resulted in various market responses. For example, the 1930 Smoot-Hawley Tariff Act, which imposed significant tariffs on numerous imported goods, led to a decline in international trade and contributed to the Great Depression. More recently, trade disputes between countries have caused significant fluctuations in market indices, underscoring the sensitivity of markets to tariff-related uncertainties.

Correlation Between Tariff Changes and Market Indices

| Tariff Change | Market Index | Correlation |

|---|---|---|

| Increase in tariffs on steel imports | Dow Jones Industrial Average | Negative (possible decrease) |

| Imposition of tariffs on imported consumer electronics | S&P 500 | Negative (possible decrease) |

| Removal of tariffs on agricultural exports | Nasdaq Composite | Positive (possible increase) |

| Retaliatory tariffs by trading partners | Volatility in all indices | High |

The table above illustrates potential correlations between tariff changes and specific market indices. However, it’s crucial to remember that the correlation isn’t always linear and can be influenced by numerous other factors, such as overall economic conditions and investor sentiment. Furthermore, the precise nature of the correlation depends on the specific goods targeted by tariffs and the reactions of various stakeholders.

Alternative Investment Strategies

Navigating the turbulent waters of tariff uncertainty requires a robust and diversified investment strategy. Investors must look beyond traditional stocks and bonds to explore alternative investment avenues that can potentially offer hedging mechanisms and attractive risk-adjusted returns. This exploration involves analyzing various asset classes, evaluating their risk-reward profiles, and constructing a portfolio that effectively mitigates the impact of tariff-induced market volatility.Alternative investments can play a crucial role in portfolio diversification during times of economic uncertainty.

Goldman Sachs’ recent risk reduction after the tariff move suggests a growing sense of uncertainty in the market. This is certainly understandable given the current global climate, with foreign energy companies continuing normal operations in Iraq, as an official there stated. However, the overall picture for Goldman Sachs still points towards a cautious outlook as more global uncertainty emerges.

By incorporating assets with differing correlation patterns to traditional equities and fixed income, investors can potentially reduce overall portfolio risk and enhance long-term returns. This diversification strategy can act as a buffer against unforeseen market shocks, such as those triggered by fluctuating tariffs.

Potential Alternative Investment Strategies

Alternative investment strategies can help investors navigate the complexities of tariff uncertainty. These strategies often involve assets that are less correlated with traditional financial markets, providing a potential hedge against market downturns.

- Real Estate Investment Trusts (REITs): REITs provide exposure to the real estate market without direct ownership. REITs can be a useful diversifier, as real estate often has a lower correlation with equities and bonds, particularly during periods of economic volatility. A diversified portfolio of REITs across different sectors (residential, commercial, etc.) can provide stability.

- Commodities: Commodities, such as gold, oil, and agricultural products, can serve as a hedge against inflation and currency fluctuations, which are often associated with trade disputes and tariff uncertainty. Their price movements are often uncorrelated with the stock market, making them a potential tool for risk mitigation.

- Private Equity: Private equity investments provide exposure to privately held companies. The illiquidity of these investments can make them less correlated with publicly traded equities, offering a potential diversification benefit. However, the higher barriers to entry and lack of transparency make these investments riskier than more accessible alternatives.

- Hedge Funds: Hedge funds employ various strategies to generate returns, often utilizing sophisticated techniques to profit from market inefficiencies. They can offer exposure to uncorrelated assets and potentially provide higher returns than traditional investments, but their complexity and high management fees should be carefully considered.

Portfolio Diversification Strategy

A robust portfolio diversification strategy is essential for mitigating the risks associated with tariff movements. Diversification involves spreading investments across different asset classes, sectors, and geographies. This reduces the impact of a negative event in one area on the overall portfolio.

- Asset Allocation: Allocate a specific percentage of your portfolio to each asset class, based on your risk tolerance and investment goals. For example, a higher percentage might be allocated to assets considered less volatile during uncertainty, such as real estate, while a lower percentage might be allocated to more speculative investments.

- Geographic Diversification: Diversify investments across different countries and regions. This can reduce the impact of specific tariffs on a particular region.

- Sector Diversification: Diversify across different sectors to minimize the impact of a negative trend in one sector on the overall portfolio. This can involve a diversified mix of consumer staples, technology, healthcare, and other sectors.

Risk-Reward Profiles

The risk-reward profiles of various investment options vary significantly. Evaluating these profiles is crucial for making informed investment decisions.

- Low-Risk, Low-Reward: Traditional fixed-income investments, such as bonds, typically offer a low-risk, low-reward profile. These investments are generally less sensitive to market volatility, making them suitable for risk-averse investors.

- Medium-Risk, Medium-Reward: Equities, REITs, and commodities often fall into the medium-risk, medium-reward category. Their returns can fluctuate with market conditions, but they also have the potential for higher returns compared to fixed-income investments.

- High-Risk, High-Reward: Private equity and hedge funds generally fall into the high-risk, high-reward category. These investments can offer significant potential returns, but they also carry a higher degree of uncertainty and risk.

Alternative Assets as Hedges, Goldman sachs pares risk after tariff move braces more uncertainty

Several alternative assets can offer a hedge against tariff uncertainty. These assets typically have low correlations with traditional asset classes, offering diversification benefits.

- Gold: Gold has historically been viewed as a safe haven asset during times of economic uncertainty. Its value is often less correlated with the stock market and is viewed as a hedge against inflation.

- Real Estate: Real estate can be a relatively stable investment during periods of market volatility, and its value can be influenced by local economic factors less susceptible to tariffs.

- Commodities: Certain commodities, such as agricultural products, can provide a hedge against tariff uncertainty, particularly if tariffs impact supply chains or pricing.

Factors to Consider

Several key factors should be considered when choosing alternative investment strategies.

- Risk Tolerance: Your risk tolerance should be a primary determinant in choosing investment options.

- Investment Goals: Your investment goals and time horizon will impact the suitability of different investment strategies.

- Liquidity Needs: The liquidity of an investment option is a critical consideration for investors who may need access to their funds quickly.

Investment Strategy Comparison

| Investment Strategy | Risk Assessment | Potential Return |

|---|---|---|

| Real Estate Investment Trusts (REITs) | Medium | Moderate |

| Commodities (e.g., Gold) | Low to Medium | Variable |

| Private Equity | High | High |

| Hedge Funds | High | High |

Market Reaction and Future Outlook: Goldman Sachs Pares Risk After Tariff Move Braces More Uncertainty

Goldman Sachs’ recent decision to pare back risk exposure following the tariff announcement has sent ripples through financial markets. Investors are grappling with the implications of this move, particularly concerning the potential for further market volatility and the longer-term impact on global economic growth. The uncertainty surrounding trade policies and their effect on various sectors is a significant factor influencing the overall market sentiment.The immediate market reaction to Goldman Sachs’ risk mitigation was a decrease in stock prices, particularly in sectors directly tied to international trade and investment.

This drop reflected investor apprehension about the escalating trade tensions and the potential for further economic disruption. The reaction highlights the interconnectedness of global markets and the contagious nature of economic uncertainty.

Immediate Market Reaction

The immediate market response was a noticeable dip in stock prices across multiple sectors. This was most pronounced in companies involved in international trade, reflecting investor concerns about the direct impact of tariffs on their business operations. The decline also extended to broader market indices, signaling a broader sense of unease about the economic implications of the escalating trade disputes.

Potential Long-Term Effects on the Global Economy

Tariff uncertainty, coupled with Goldman Sachs’ risk reduction, could lead to a protracted period of economic slowdown. Reduced investment activity, as seen in Goldman Sachs’ strategy, can hamper overall growth. The cascading effect of reduced investment and trade can ripple through supply chains, impacting production and employment in various sectors across multiple countries. Historical precedents of trade wars, like the 1930s Great Depression, demonstrate how prolonged uncertainty can severely damage economic activity.

Explanations for Observed Market Trends

Several factors contribute to the current market trends. The uncertainty surrounding the tariffs and the global political climate is causing investors to adopt a more cautious approach. This is evident in the risk mitigation strategies employed by major financial institutions, like Goldman Sachs, who are reducing exposure to potentially volatile markets. The anticipation of further escalation in trade disputes also plays a significant role in the market’s current trajectory.

Role of Other Global Factors

Several global factors beyond tariffs influence the current market outlook. Geopolitical tensions, monetary policy decisions by central banks, and the ongoing pandemic’s impact on global supply chains all contribute to the current volatility. For example, a significant shift in monetary policy in a major economy can have immediate consequences for financial markets, impacting interest rates and investor confidence.

These intertwined factors create a complex web of interconnectedness, affecting market sentiment and investment decisions.

Global Economic Interconnectedness

The global economy is interconnected, and any significant event in one part of the world can have ripple effects across other regions. This interconnectedness is further emphasized by the complex web of supply chains that crisscross the globe, linking various nations and economies. This interdependence creates both opportunities and challenges for investors and policymakers alike.

This interconnectedness is vividly illustrated by the recent tariff disputes. A disruption in trade flows between the United States and China, for example, can have repercussions for manufacturers and consumers in other countries that rely on these trade relationships. This interconnectedness underscores the need for a global approach to addressing trade disputes and economic uncertainties.

Closing Summary

Goldman Sachs’ proactive risk reduction in response to tariff uncertainty underscores the growing volatility in global markets. The move suggests a cautious outlook on future economic conditions, and the interconnected nature of global economies. Investors face a complex environment, requiring careful consideration of alternative strategies to navigate these challenges. The long-term implications of this uncertainty remain to be seen, but the current situation demands a nuanced understanding of the risks and opportunities.