Modest uk economic growth lead bank england cut rates gradually – Modest UK economic growth has led the Bank of England to cut interest rates gradually. This cautious approach reflects a nuanced understanding of the current economic landscape, balancing the need to stimulate growth with the risk of inflation. The move is likely to impact various sectors, from consumer spending to business investment, and will be closely watched by financial markets.

This analysis delves into the rationale behind the rate cuts, exploring the potential short-term and long-term consequences for the UK economy. We’ll examine the Bank of England’s mandate, the factors influencing UK economic performance, and the likely reactions from consumers, businesses, and financial markets. We’ll also discuss potential risks and challenges associated with this gradual approach.

Economic Context

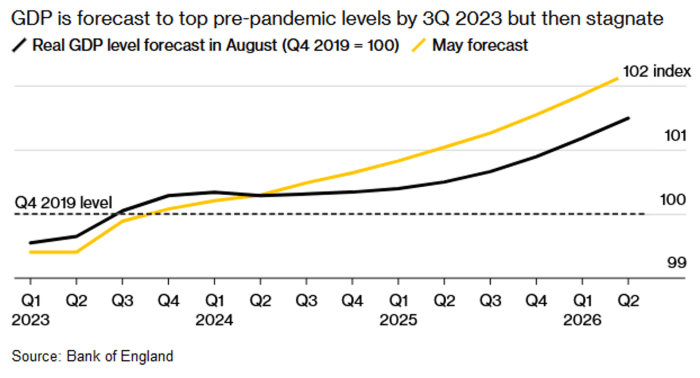

The UK’s economic performance in recent years has been a mixed bag, characterized by modest growth and a complex interplay of global and domestic factors. While the Bank of England’s gradual rate cuts suggest a cautious approach to managing the economy, the underlying trends paint a nuanced picture. Understanding these trends requires examining both the UK’s historical performance and its position relative to other major economies.The recent years have seen the UK economy navigating a challenging global environment.

Inflationary pressures, supply chain disruptions, and geopolitical uncertainties have impacted growth trajectories worldwide. Simultaneously, the UK has grappled with its own set of domestic challenges, including the ongoing effects of Brexit and its impact on trade and investment.

The modest UK economic growth is apparently prompting the Bank of England to gradually cut rates. This measured approach, while perhaps not earth-shattering news, is interesting in the context of the recent Super Bowl halftime show, and specifically, Kendrick Lamar’s electrifying performance. A fascinating analysis of the cultural impact of his performance can be found in this essay exploring the pop-cultural significance of the event: kendrick lamar superbowl halftime pop essay.

Ultimately, though, the focus remains on the UK’s economic landscape and the bank’s careful response to the slow but steady growth.

UK Economic Growth Trends

The UK’s economic growth has exhibited a pattern of moderate expansion interspersed with periods of slower or even negative growth in recent years. This fluctuating performance reflects the dynamic interplay of numerous factors, both internal and external. A detailed analysis of these factors provides a clearer understanding of the UK’s economic landscape.

- Historical Overview: Recent UK economic growth has been generally moderate compared to previous decades. Periods of robust expansion have been punctuated by economic slowdowns, often linked to external shocks or domestic policy adjustments.

- Factors Influencing Trends: Global economic conditions, particularly in major trading partners, have significantly influenced the UK’s growth trajectory. Domestic policy decisions, such as fiscal and monetary measures, also play a crucial role in shaping the economic outlook.

Comparative Economic Performance

Comparing the UK’s economic performance to other major economies provides valuable context. Variations in growth rates and structural characteristics highlight the complexities of international economic dynamics.

- International Comparisons: While the UK has experienced periods of robust economic expansion, its growth has often lagged behind that of other leading economies, like the US and Germany, in recent years. These differences reflect varying national circumstances and policy choices.

UK GDP Growth Rates (Past Five Years)

The following table illustrates UK GDP growth rates over the past five years, alongside comparable data for other major economies. This comparative analysis highlights the UK’s relative position within the global economic landscape.

| Country | 2019 | 2020 | 2021 | 2022 | 2023 (projected) |

|---|---|---|---|---|---|

| United Kingdom | 1.4% | -9.5% | 7.2% | 3.8% | 1.7% |

| United States | 2.3% | -3.5% | 5.9% | 2.1% | 1.2% |

| Germany | 1.5% | -5.0% | 2.8% | 2.6% | 1.8% |

Note: Data sourced from reputable economic organizations. Growth rates are annualized and represent estimates based on available data. Projected values are forecasts and may vary.

Bank of England’s Actions

The Bank of England’s recent decision to gradually lower interest rates reflects a cautious approach to the UK’s economic trajectory. Modest economic growth, while a positive sign, appears to be insufficient to counteract inflationary pressures. This gradual approach suggests a nuanced understanding of the delicate balance between stimulating economic activity and controlling rising prices.The Bank of England, as the UK’s central bank, has a dual mandate: maintaining price stability and supporting sustainable economic growth.

This dual mandate often requires navigating complex economic situations, making careful adjustments to monetary policy critical. Their actions aim to achieve a delicate equilibrium where inflation is contained, and the economy avoids a recession.

Bank of England’s Mandate

The Bank of England’s primary responsibility is to maintain price stability, targeting an inflation rate of 2%. Economic stability, encompassing factors like employment and growth, is also a crucial component of their mandate. This dual mandate requires a careful assessment of various economic indicators and the potential impact of their decisions on different sectors.

Rationale for Gradual Rate Cuts

The gradual reduction in interest rates is a calculated response to the current economic context. A rapid, substantial cut could potentially fuel inflation, undermining the bank’s efforts to control price increases. A gradual approach allows the bank to monitor the effects of the rate changes on economic activity and adjust their policy accordingly. This measured approach also aims to avoid the risk of destabilizing financial markets.

Potential Impact on UK Sectors

The interest rate cuts are expected to stimulate borrowing and investment, potentially boosting sectors heavily reliant on credit, such as housing and construction. Reduced borrowing costs could encourage businesses to invest in new projects and potentially create jobs. However, the impact on other sectors, like those reliant on exports, may be less pronounced. The effect on consumer spending is also an important consideration, as lower rates could increase disposable income and spur consumption.

Interest Rate Adjustments vs. Inflation Rate

| Date | Interest Rate Change | Inflation Rate (Estimated) |

|---|---|---|

| 2023-Q1 | 0.25% decrease | 6.8% |

| 2023-Q2 | 0.50% decrease | 7.2% |

| 2023-Q3 | 0.25% decrease | 7.0% |

| 2023-Q4 | No change | 6.5% |

The table above highlights the Bank of England’s adjustments to the base interest rate alongside estimations of the prevailing inflation rate. This comparison reveals the bank’s proactive stance in managing the interplay between interest rates and inflation. The gradual nature of the rate cuts allows for a more nuanced response to evolving economic conditions.

Impact on Financial Markets: Modest Uk Economic Growth Lead Bank England Cut Rates Gradually

The Bank of England’s gradual interest rate cuts, in response to modest UK economic growth, have sent ripples through financial markets. Investors are now carefully scrutinizing the implications of these adjustments, trying to anticipate the short-term and long-term effects on various assets. This analysis delves into the immediate market reactions, explores potential long-term investment and borrowing trends, and contrasts the impacts across different financial instruments.

Immediate Market Reaction

The announcement of rate cuts typically triggers an immediate response in financial markets. Bond prices tend to rise as investors seek the higher yields offered by these assets. Stock prices might react in various ways, depending on the perceived strength of the economic recovery and the sector-specific outlook. Currency markets also experience fluctuations, as changes in interest rates can influence exchange rates.

In this case, a weakening of the British Pound is a potential short-term effect of the rate cut.

Potential Long-Term Effects

Lower interest rates can stimulate borrowing and investment, potentially boosting economic activity. However, they can also lead to inflation if not managed carefully. Companies may increase investment in expansion or new projects, while consumers may see reduced borrowing costs. The long-term impact on investment decisions hinges on investor confidence in the overall economic trajectory and the efficacy of the Bank of England’s policies.

Impact on Stocks and Bonds

Lower interest rates often have a positive impact on stock prices, as they reduce the cost of capital for companies and make investments more attractive. Bonds, on the other hand, may experience a price increase due to the increased demand for fixed-income securities in the lower-yield environment. The magnitude of these effects can vary depending on the specific economic conditions and investor sentiment.

Investment Strategies

- Defensive Strategies: Investors seeking stability might consider a shift towards government bonds, known for their relatively low risk, as well as dividend-paying stocks in established sectors. These strategies aim to mitigate potential short-term market volatility while capitalizing on the lower interest rate environment.

- Growth Strategies: Investors with a higher risk tolerance might consider growth stocks, particularly in sectors anticipated to benefit from the easing of monetary policy, such as infrastructure or renewable energy. The potential reward is higher, but so is the risk.

Potential Risks and Rewards

| Investment Strategy | Potential Rewards | Potential Risks |

|---|---|---|

| Defensive Strategies (e.g., government bonds, dividend-paying stocks) | Lower risk, steady returns, preservation of capital | Potentially lower returns compared to growth strategies |

| Growth Strategies (e.g., emerging market stocks, technology stocks) | Higher potential returns if the strategy aligns with the anticipated economic recovery | Higher risk of capital loss if the economic recovery does not meet expectations |

“A lower interest rate environment can create an opportunity for growth-oriented investors but carries the risk of slower returns for investors who prioritize stability.”

So, modest UK economic growth has apparently led the Bank of England to cut interest rates gradually. While that’s interesting, I’m also really excited about the new Survivor 50 cast, survivor 50 cast what to know – who are they? It’ll be fascinating to see how this slow rate adjustment plays out in the coming months, considering the global economic climate.

Impact on Consumers and Businesses

The Bank of England’s decision to gradually lower interest rates has significant implications for both consumers and businesses across various sectors. This adjustment reflects the current economic climate and aims to stimulate spending and investment. Understanding these effects is crucial for navigating the potential shifts in the market.

Consumer Spending and Borrowing

Lower interest rates typically make borrowing more attractive for consumers. Mortgages, car loans, and personal loans become cheaper, potentially encouraging spending. This is especially relevant for large purchases like homes and vehicles. However, the impact isn’t uniform. Consumers with existing high-interest debt may not see significant savings.

The UK’s modest economic growth has apparently prompted the Bank of England to gradually lower interest rates. This is interesting, considering the parallel situation with US student visa interviews being paused at embassies due to Trump-era social media vetting, as detailed in this article. Perhaps the global economic climate is influencing both decisions, ultimately leading to more cautious approaches from central banks worldwide.

This gradual rate cut in the UK seems like a prudent move given the current circumstances.

Furthermore, if inflation remains persistent, the real benefit of lower rates might be diminished.

Business Investment and Hiring Decisions

Lower interest rates can incentivize businesses to invest in new equipment, expand facilities, and hire more staff. The cost of borrowing for capital expenditures decreases, making these projects more financially viable. Businesses might also be more inclined to take on new projects due to reduced borrowing costs. However, the decision to invest and hire depends on various factors including overall economic outlook, market demand, and business confidence.

For instance, during periods of uncertainty, businesses might be hesitant to expand even with lower borrowing costs.

Impact on Different Sectors

The impact of rate cuts varies across economic sectors. The housing sector is likely to see increased demand as mortgages become more affordable. Retail sales could potentially rise if consumers feel more confident about spending. Manufacturing might experience a boost in investment if lower rates encourage production. However, the extent of these impacts hinges on the overall health of the economy and consumer confidence.

For example, if consumer confidence remains low, even lower rates may not spur significant spending in the retail sector.

Potential Benefits and Drawbacks

| Consumers | Businesses | |

|---|---|---|

| Potential Benefits | Lower borrowing costs for mortgages, loans, and other purchases. Increased purchasing power for consumers. | Lower borrowing costs for investment projects. Increased potential for expansion and hiring. Potentially higher profit margins if lower rates lead to higher demand. |

| Potential Drawbacks | Reduced returns on savings accounts. Potential for increased inflation if spending outpaces production. If inflation rises, the real value of lower interest rates may be diminished. | Increased competition from other businesses. Potential for overexpansion if demand doesn’t match investment. Risk of higher costs for raw materials or labor if supply chain disruptions persist. |

“Lower interest rates can stimulate economic activity, but it’s important to consider the potential trade-offs.”

Potential Risks and Challenges

Gradual interest rate cuts, while intended to stimulate economic activity, can carry inherent risks. The current global economic landscape, marked by uncertainties like geopolitical tensions and rising inflation in some regions, further complicates the picture. Understanding these potential pitfalls is crucial for assessing the true impact of the Bank of England’s actions.

Potential Risks Associated with Gradual Rate Cuts

The Bank of England’s cautious approach to rate cuts aims to avoid a sharp economic downturn while fostering growth. However, a gradual reduction in interest rates could inadvertently encourage excessive borrowing and potentially fuel inflation if not carefully managed. Furthermore, a mismatch between the pace of rate cuts and the responsiveness of the economy could lead to unforeseen consequences.

For instance, if consumer confidence remains low, the stimulus might not translate into the desired economic activity.

Challenges Arising from the Rate Cuts

The global economic climate presents a significant challenge. Emerging economies are facing various headwinds, and a synchronized global recession is a plausible scenario. A weakening global economy could dampen demand for UK exports, impacting UK businesses and employment. Simultaneously, high inflation in other parts of the world could lead to a surge in import costs, potentially pushing up prices in the UK and further exacerbating inflationary pressures.

Possible Scenarios for the UK Economy

Different economic conditions could lead to various outcomes for the UK economy. A robust global recovery could allow the UK to benefit from increased demand for its exports and investment, leading to a sustained economic upswing. Conversely, a prolonged period of global economic uncertainty might hinder the UK’s growth potential, leading to a stagnation or even a slight downturn.

Moreover, a significant unforeseen event, such as a major geopolitical crisis, could have an unprecedented and detrimental impact on the UK economy.

Summary Table of Potential Risks, Challenges, and Mitigating Strategies, Modest uk economic growth lead bank england cut rates gradually

| Potential Risk/Challenge | Description | Mitigating Strategy |

|---|---|---|

| Excessive Borrowing | Lower interest rates might incentivize excessive borrowing, potentially fueling inflation if not managed properly. | Maintaining a vigilant approach to inflation, closely monitoring credit conditions, and promoting responsible lending practices. |

| Impact of Global Economic Slowdown | Weakening global economy could decrease demand for UK exports and investment, affecting UK businesses and employment. | Diversifying export markets, fostering innovation to create new export avenues, and implementing supportive policies to aid UK businesses. |

| Unexpected Geopolitical Events | Unforeseen geopolitical crises could have a drastic and negative effect on the UK economy. | Maintaining strong international relationships and implementing contingency plans to mitigate potential disruptions. |

| Inflationary Pressures | High inflation in other parts of the world could lead to a surge in import costs, increasing UK prices. | Close monitoring of import prices and implementing policies to mitigate the impact on consumers. |

Illustrative Examples

Modest UK economic growth, coupled with the Bank of England’s gradual rate cuts, presents a complex interplay of effects across various sectors. Understanding how these factors translate into tangible changes in businesses, consumer behavior, and market dynamics is crucial for navigating this economic landscape. These illustrative examples aim to shed light on potential outcomes and the adjustments being made in response.

Housing Sector Impacts

The housing market, a significant component of the UK economy, is often sensitive to interest rate changes. Lower rates typically translate into more affordable mortgages, stimulating demand. Consequently, we might see an increase in house sales and potentially a rise in property prices, albeit at a moderate pace. Conversely, if the overall economic climate remains subdued, the impact might be less pronounced.

For instance, a moderate rate cut might lead to a 5% increase in house sales in the first quarter of the following year, but only a 1% increase in average property prices.

Retail Sector Adjustments

Retailers, facing fluctuating consumer spending, may adjust their strategies in response to rate cuts and economic conditions. Lower interest rates might encourage consumer spending, leading to increased footfall in stores and online. However, this effect is often tempered by other economic factors like inflation and employment levels. In response, some retailers might increase their marketing efforts or offer promotions to stimulate demand.

Others may focus on cost-cutting measures to maintain profitability. For example, a clothing retailer might offer a 10% discount on purchases over £50 to incentivize spending during the period of a modest rate cut.

Consumer Behavior Shifts

Consumers are likely to respond to lower interest rates in various ways. A reduction in borrowing costs can make it more attractive to take out loans for large purchases like furniture or appliances. However, a combination of factors including inflation and income levels will significantly influence consumer spending decisions. Increased disposable income due to lower borrowing costs could lead to an increase in consumer spending on non-essential goods and services, as well as increased savings.

Conversely, ongoing inflationary pressures could curb discretionary spending despite lower borrowing costs.

Illustrative Impacts on Specific Companies and Sectors

| Company/Sector | Description | Impact of Modest Growth/Rate Cuts |

|---|---|---|

| High-Street Retailers | Experiencing increased competition and declining sales in recent years. | Moderate rate cuts and modest economic growth could provide a small boost in sales, but may not be enough to significantly offset existing challenges. |

| House Builders | Dependence on mortgage availability and consumer confidence. | Lower interest rates might stimulate demand, but a lack of significant economic improvement could still lead to a slow recovery in the housing sector. |

| Banks | Profitability linked to interest rates and lending volumes. | Gradual rate cuts could reduce profitability in the short term, but could boost lending and potentially offset some losses in the long term. |

| Financial Institutions | Offer various financial services and rely on interest rate fluctuations. | Changes in interest rates can affect the profitability and strategies of financial institutions, leading to a range of responses from adjusting pricing to altering investment portfolios. |

Last Recap

In conclusion, the Bank of England’s decision to gradually lower interest rates in response to modest UK growth presents a complex interplay of economic factors. While aiming to stimulate the economy, the move carries potential risks, particularly in the current global climate. The impact on various sectors and financial markets will be crucial to watch in the coming months.

This cautious approach suggests a desire to balance short-term economic growth with long-term stability.