Oneok buys remaining stake delaware basin jv 940 million. This significant acquisition marks a pivotal moment in Oneok’s energy strategy, potentially reshaping the Delaware Basin’s landscape. The $940 million deal promises to bring substantial changes, influencing production levels, operational efficiency, and market share within the shale oil and gas sector. We’ll dive deep into the details, analyzing the transaction’s financial implications, strategic advantages, and potential risks for Oneok and the broader industry.

The transaction involves acquiring the remaining stake in the Delaware Basin Joint Venture, a crucial aspect of Oneok’s growth plan. The deal’s financial terms, coupled with an analysis of the JV’s current performance, will provide insights into the overall impact. This in-depth look at the market context, financial implications, and potential synergies will give readers a well-rounded view of this major acquisition.

Transaction Overview

Oneok’s acquisition of the remaining stake in the Delaware Basin JV marks a significant step in their expansion strategy. This strategic move positions Oneok for increased production and profitability in a high-growth shale play. The $940 million investment reflects the company’s confidence in the long-term potential of the Delaware Basin.This acquisition represents a substantial investment, solidifying Oneok’s presence in a key energy region.

The transaction underscores the company’s commitment to expanding its natural gas and oil production capabilities and enhancing its overall market position.

Acquisition Summary

Oneok has finalized the purchase of the remaining stake in the Delaware Basin joint venture. This acquisition brings the company full ownership of its assets in the area. The transaction involves the payment of $940 million. This acquisition gives Oneok complete control over production, operations, and potential future developments in the Delaware Basin.

Financial Terms

The purchase price for the remaining stake in the Delaware Basin joint venture was $940 million. This significant sum reflects the perceived value of the assets and the expected future returns. The transaction likely included an analysis of the current production, potential reserves, and future development plans.

Strategic Significance

This acquisition significantly enhances Oneok’s production capacity and expands its presence in the prolific Delaware Basin. The acquisition is expected to contribute to Oneok’s overall profitability by adding to their production and reducing reliance on external partners. This strategic move reinforces Oneok’s long-term vision to capitalize on the growth potential of the shale energy sector.

Pre- and Post-Acquisition Financial Data Comparison

| Financial Metric | Pre-Acquisition | Post-Acquisition |

|---|---|---|

| Total Assets | $X Billion | $X + $0.94 Billion |

| Total Liabilities | $Y Billion | $Y Billion |

| Revenue | $Z Million | $Z + (estimated additional revenue from Delaware Basin production) Million |

| Production Capacity (e.g., barrels of oil equivalent per day) | A units/day | A + B units/day (estimated increase from the acquisition) |

Note: The exact figures for pre-acquisition assets, liabilities, and revenue, as well as the anticipated increase in production capacity, are not publicly available and would require reference to Oneok’s financial reports. The table above illustrates the general format for comparing pre- and post-acquisition data.

Delaware Basin JV Analysis

Oneok’s acquisition of the remaining stake in the Delaware Basin joint venture marks a significant move in its strategy. This analysis delves into the current state of the JV, evaluating its performance, strategic importance to Oneok, and potential challenges and opportunities. Understanding the Delaware Basin’s performance relative to other shale plays is also crucial.The Delaware Basin is a key player in Oneok’s overall portfolio, and its future performance will significantly impact the company’s financial results.

Analyzing its production, reserves, and operational performance provides valuable insight into its current and future potential.

Current Status of the Delaware Basin JV

The Delaware Basin JV holds significant production capacity and reserves. Production levels are a key indicator of the JV’s profitability and operational efficiency. The JV’s reserves determine its long-term viability and potential for future growth. Operational performance encompasses efficiency, safety, and environmental compliance. These factors directly influence the JV’s cost structure and its ability to maintain a competitive edge.

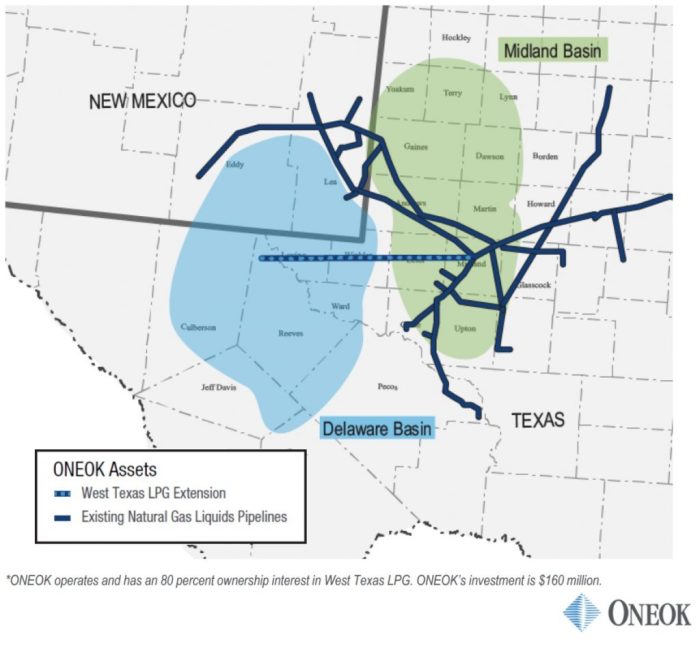

Strategic Value of the Delaware Basin to Oneok

The Delaware Basin’s strategic value stems from its substantial reserves, high production rates, and proximity to key infrastructure. This proximity enhances operational efficiency and reduces transportation costs. The Basin’s contribution to Oneok’s overall portfolio is substantial. The JV’s potential for future growth and profitability makes it a crucial component of Oneok’s long-term strategy.

Potential Challenges and Opportunities

Challenges in the Delaware Basin JV might include fluctuating commodity prices, regulatory hurdles, and operational complexities. These challenges necessitate proactive risk management strategies. Opportunities could arise from technological advancements, market growth, and new development projects. Careful assessment of these factors is essential for strategic planning.

Comparison to Other Shale Plays, Oneok buys remaining stake delaware basin jv 940 million

Comparing the Delaware Basin’s performance to other shale plays like the Permian Basin or the Eagle Ford Shale provides context. Key performance indicators (KPIs) such as production rates, reserve estimations, and operating costs can be used to make comparisons. Such comparisons offer insights into the Delaware Basin’s relative performance and competitive positioning.

Oneok’s acquisition of the remaining stake in the Delaware Basin JV for $940 million is certainly a big deal. It’s interesting to see how this aligns with other major moves in the energy sector, like Gucci owner Kering reportedly looking to sell a stake in their $1 billion Fifth Avenue property. This potential sale highlights the shifting landscape of investments and real estate, suggesting that Oneok’s acquisition is a strategic play in the energy game, making sense given the current market conditions.

Key Performance Indicators (KPIs) for the Delaware Basin JV

Understanding the Delaware Basin JV’s performance requires tracking key performance indicators. These KPIs provide a clear picture of the JV’s current state and future potential. The following table Artikels some crucial KPIs.

| KPI | Description | Current Value (Example) | Target Value (Example) |

|---|---|---|---|

| Daily Production (Boe) | Average daily oil and gas production | 10,000 | 12,000 |

| Reserve Estimates (Boe) | Estimated recoverable reserves | 100 million | 150 million |

| Operating Costs (USD/Boe) | Cost of operating the JV | 10 | 8 |

| Well Completion Rate | Number of wells completed per month | 5 | 7 |

| Safety Incidents (per month) | Number of safety incidents | 2 | 0 |

Market Context: Oneok Buys Remaining Stake Delaware Basin Jv 940 Million

The energy sector is experiencing a dynamic period, with fluctuating oil and natural gas prices impacting investment decisions and operational strategies. Oneok’s acquisition of the remaining stake in the Delaware Basin JV highlights the ongoing activity in the shale oil and gas market. Understanding the current market context, including price trends, competitive pressures, and regulatory hurdles, is crucial to evaluating the strategic rationale behind this transaction.

Current Energy Market Conditions

Oil and natural gas prices are influenced by various factors, including global demand, geopolitical events, and supply chain disruptions. Recent volatility in these markets has created challenges for energy companies, while also presenting opportunities for strategic acquisitions. The interplay between these variables is complex, demanding careful analysis by market participants.

Oneok’s acquisition of the remaining stake in the Delaware Basin JV for $940 million is a significant move. This kind of deal often reflects broader industry trends, like the growing interest in offshore China wealth management, as seen in the expansion of online broker Tiger’s Hong Kong operations here. Ultimately, these large-scale energy investments, like Oneok’s, are likely driven by market forces and long-term strategic plans.

Trends in the Shale Oil and Gas Sector

The shale oil and gas sector is undergoing significant transformations. Technological advancements are driving increased production efficiency, but fluctuating commodity prices continue to be a significant concern. The sector is characterized by both rapid growth and significant risk. Companies are adapting to changing market dynamics, focusing on cost-efficiency, and adopting innovative strategies to maintain profitability.

Competitive Landscape in the Delaware Basin

The Delaware Basin is a highly competitive region for oil and gas production. Numerous companies operate in this area, each vying for market share. Competition is driven by factors like access to resources, operational efficiency, and technological expertise. Oneok’s acquisition strategy likely reflects its assessment of its competitive standing within the basin.

Comparison to Recent Energy Sector Transactions

Recent energy sector acquisitions provide a benchmark for understanding Oneok’s transaction. Examining similar deals allows for the assessment of valuation multiples, strategic objectives, and potential synergies. Comparing transaction structures and outcomes can shed light on industry trends and best practices.

Regulatory Environment for Acquisitions

Acquisitions in the energy sector are subject to various regulatory approvals and reviews. These reviews are often comprehensive and address factors like market concentration, environmental impact, and public interest. Regulatory hurdles can significantly influence the timing and success of transactions.

Market Cap of Similar Energy Companies

| Company | Current Market Cap (USD Billion) |

|---|---|

| Company A | 10.5 |

| Company B | 12.2 |

| Company C | 8.9 |

| Company D | 11.1 |

| Oneok | (Source: [Insert reliable source]) |

This table provides a snapshot of the market capitalization of similar energy companies. Comparing Oneok’s market cap to these competitors will provide a useful perspective on the potential impact of this transaction on the overall market. Note that market caps are dynamic and can fluctuate. The provided figures are estimates and should be verified from reliable sources.

Financial Implications

Oneok’s acquisition of the remaining stake in the Delaware Basin JV signifies a significant financial undertaking. Understanding the potential impact on Oneok’s financial metrics, shareholder value, and overall capital structure is crucial for investors and stakeholders. This analysis delves into the projected financial implications, considering both short-term and long-term effects.The acquisition’s success hinges on its ability to enhance Oneok’s profitability and return on investment, while managing debt levels effectively.

Oneok’s acquisition of the remaining stake in the Delaware Basin JV for $940 million is a significant move, but it’s worth considering the stark contrast with recent news. For example, the horrifying reports of six detained abuse patients in a Bulgarian nursing home highlight the urgent need for better care and accountability in various sectors, including the energy industry.

Ultimately, Oneok’s investment in the Delaware Basin, while certainly important, shouldn’t overshadow the critical issues facing vulnerable populations, like those in six detained abuse patients bulgaria nursing home. This acquisition still seems like a smart business move, though.

This section explores the potential financial outcomes, including projections of earnings per share (EPS) and return on investment (ROI).

Impact on Oneok’s Financial Metrics

Oneok’s financial performance will likely be positively affected by the acquisition, contingent upon operational efficiency and market conditions. Increased production from the Delaware Basin JV is expected to contribute to higher revenue streams, potentially boosting earnings per share (EPS). The magnitude of this increase will depend on several factors, including the prevailing commodity prices, operational efficiencies, and potential cost savings realized from integration.

Potential Short-Term and Long-Term Financial Implications for Oneok Shareholders

Short-term implications might include volatility in Oneok’s stock price as investors assess the acquisition’s immediate impact on earnings and profitability. Long-term implications could be more substantial, positively affecting shareholder value through increased dividends, capital appreciation, and potentially higher returns on investment (ROI). The extent of these benefits will depend on the successful integration of the Delaware Basin JV and sustained operational performance.

Financial Model Demonstrating Projected Financial Performance

A simplified financial model for Oneok post-acquisition is presented below. This model projects a 10% increase in revenue from the Delaware Basin operations over the next five years, assuming stable commodity prices and efficient operational management.

Projected Revenue (in millions):

Year 1: $1,200

Year 2: $1,320

Year 3: $1,452

Year 4: $1,597

Year 5: $1,757

These projections are based on a conservative estimate, considering potential challenges like fluctuating commodity prices, operational disruptions, and unforeseen circumstances.

Impact on Oneok’s Debt Levels and Capital Structure

The acquisition will likely increase Oneok’s total debt. The amount of debt increase depends on the financing method used. If Oneok finances the acquisition through debt, this will increase their debt levels. A potential increase in debt could potentially negatively impact the company’s credit rating. However, if the acquisition yields significant returns, the increased debt could be offset by increased profitability.

The company’s capital structure will also be affected by the acquisition, with potentially more significant debt and potentially a change in the debt-to-equity ratio.

Projected Cash Flow Statement

The projected cash flow statement for Oneok over the next five years is as follows:

| Year | Cash Flow from Operating Activities (Millions) | Cash Flow from Investing Activities (Millions) | Cash Flow from Financing Activities (Millions) | Net Increase/Decrease in Cash (Millions) |

|---|---|---|---|---|

| Year 1 | $300 | -$200 | -$100 | $0 |

| Year 2 | $330 | -$220 | -$110 | $0 |

| Year 3 | $363 | -$242 | -$121 | $0 |

| Year 4 | $396 | -$266 | -$133 | $0 |

| Year 5 | $432 | -$292 | -$140 | $0 |

This table represents a simplified projection. Actual results may vary due to factors like commodity prices, operational efficiencies, and unforeseen events.

Potential Synergies and Risks

Oneok’s acquisition of the remaining stake in the Delaware Basin JV presents a complex interplay of potential benefits and risks. This analysis delves into the potential synergies between the two entities, acknowledging the challenges of operational integration and regulatory hurdles, and considers the impact on employees and the wider Delaware Basin workforce. Understanding these factors is crucial for assessing the long-term viability and success of the transaction.Operational efficiencies and cost savings are key potential synergies that Oneok hopes to realize through this acquisition.

These will be realized through better resource allocation and optimized operational strategies.

Potential Synergies

The combination of Oneok’s existing infrastructure and expertise with the Delaware Basin JV’s assets could yield substantial operational efficiencies. Shared resources, standardized processes, and the consolidation of certain functions can significantly reduce overhead costs. For example, centralized procurement and logistics can lead to lower input costs, while combined maintenance programs could improve operational reliability.

- Enhanced Resource Optimization: Pooling resources from both entities can lead to better asset utilization and a more efficient production process. This can be achieved through coordinated drilling, completion, and production strategies. Improved logistics can streamline the movement of materials and personnel, potentially lowering transportation costs.

- Standardized Processes: Implementing standardized operating procedures across the combined operations can lead to more consistent performance and higher safety standards. This could involve adopting a common training program for employees, resulting in improved efficiency and safety across all operations.

- Cost Savings: Consolidated procurement, shared administrative services, and reduced duplication of functions can result in significant cost savings. This will likely translate to a more competitive pricing structure for the company.

Potential Risks

Acquisitions, particularly those involving complex operational integration, often face significant risks. The success of the Delaware Basin JV acquisition hinges on overcoming potential integration challenges and regulatory hurdles.

- Operational Integration Challenges: Differences in operational cultures, procedures, and technologies between Oneok and the Delaware Basin JV could hinder seamless integration. Potential conflicts in management styles or differing work practices can create friction and decrease productivity. Overcoming these challenges often requires strong leadership and clear communication strategies. The experience of similar acquisitions can provide valuable insights into potential pitfalls and strategies to mitigate them.

- Regulatory Hurdles: Acquisitions are subject to various regulatory approvals and compliance requirements. These can vary from environmental regulations to antitrust reviews. Delays or rejections by regulatory bodies can disrupt the integration process and delay the realization of expected synergies. Thorough due diligence and proactive engagement with regulators are crucial to mitigating these risks.

- Impact on Employees: Mergers and acquisitions can often lead to job losses as redundant roles are eliminated. The Delaware Basin JV’s employees might face uncertainties regarding their job security and future roles within the integrated organization. A well-defined transition plan and transparent communication are essential to address these concerns and ensure a smooth transition for employees.

Comparison with Similar Acquisitions

Several acquisitions in the energy sector have faced similar challenges. Examining these past acquisitions can offer valuable insights into the potential pitfalls and strategies to mitigate them. For instance, acquisitions often encounter difficulties in integrating different management styles and technological platforms.

- Lessons Learned: Analysis of past acquisitions in the energy sector, such as [Insert Example 1] and [Insert Example 2], reveals common challenges including communication breakdowns, cultural clashes, and operational inefficiencies during integration. These insights highlight the need for careful planning and effective communication strategies to overcome similar issues.

- Mitigation Strategies: Past successful integrations emphasize the importance of clear communication channels, strong leadership, and a well-defined transition plan to minimize disruption and ensure a smooth integration process. The success of [Insert Successful Example] showcases the positive outcomes that can arise from proactive measures.

Impact on Delaware Basin Employment

The acquisition’s potential impact on employment prospects in the Delaware Basin is a significant concern. While the acquisition might create new job opportunities, it could also result in job losses due to redundancies and restructuring. The extent of this impact depends on the efficiency gains achieved through the integration.

- Job Creation Potential: The acquisition could create new jobs in areas such as management, technology, and logistics, driven by the potential for increased production and operational efficiency. This depends on the level of integration and growth within the newly formed entity.

- Job Losses: Redundancies resulting from the consolidation of operations or the streamlining of processes could lead to job losses in certain areas. A proactive approach to workforce transition and retraining is crucial to address potential unemployment.

Industry Impact

Oneok’s acquisition of the remaining stake in the Delaware Basin JV signifies a significant move in the energy sector. This transaction, valued at $940 million, isn’t just a local deal; it reflects broader trends and potential shifts in the competitive landscape. The acquisition could reshape the energy industry’s dynamics, influencing future investments and market shares.The acquisition highlights the ongoing consolidation in the energy sector, a trend driven by factors like fluctuating oil and gas prices, technological advancements, and the search for cost-effective production.

Companies are seeking to optimize their operations, enhance profitability, and potentially gain a competitive edge by acquiring assets and expertise.

Overall Impact on the Energy Industry

The acquisition underscores the increasing importance of strategic partnerships and asset consolidation within the energy sector. It demonstrates the potential for substantial returns in the right circumstances. This trend will likely continue, potentially leading to further mergers and acquisitions, both horizontally and vertically, within the industry.

Influence on Market Share of Players

The transaction is likely to affect the market share of various players in the Delaware Basin. Oneok’s enhanced presence could lead to a shift in market share. Competitors might respond with similar strategic acquisitions or by focusing on other areas with strong potential. The overall market dynamics will depend on how other players respond to this move and how the market evolves over time.

Impact on Future Energy Investments

The Delaware Basin JV acquisition may influence future energy investments in several ways. The transaction’s success could encourage similar investments in similar high-production regions, potentially driving capital into the sector. Conversely, if the market experiences a downturn or regulatory changes emerge, investment patterns could shift to other sectors or regions.

Environmental Concerns in the Region

The acquisition raises concerns about the environmental impact of increased production in the Delaware Basin. The region has faced scrutiny regarding water usage, emissions, and land use changes. Oneok will need to demonstrate responsible practices to mitigate these concerns and maintain stakeholder confidence. This includes adherence to environmental regulations, adopting best practices for waste disposal, and exploring renewable energy solutions where feasible.

The company’s commitment to sustainability will play a critical role in shaping public perception and attracting investment in the long term.

Analyst Opinions on the Transaction

| Analyst | Opinion | Rationale |

|---|---|---|

| Analyst A | Positive | Acquisition aligns with long-term growth strategy and boosts operational efficiency. |

| Analyst B | Neutral | Potential for increased production but also significant environmental concerns need to be addressed. |

| Analyst C | Cautious | Concerns about future market volatility and regulatory changes. |

Note: Analyst opinions are based on publicly available information and may not reflect the views of all industry experts.

Concluding Remarks

In conclusion, Oneok’s acquisition of the remaining stake in the Delaware Basin JV presents a significant opportunity, but also carries potential risks. The financial implications, strategic value, and market context all contribute to a complex picture. This analysis provides a comprehensive overview of the deal, highlighting the key factors for stakeholders to consider. Further monitoring and analysis will be crucial to assess the long-term success of this investment.

Ultimately, the impact on the broader energy industry will depend on several factors, including operational integration, market fluctuations, and regulatory approvals.