Reality trumps steel aluminium tariffs – Reality trumps steel aluminum tariffs, revealing the complex interplay of economics and politics in global trade. This analysis delves into the historical context of tariffs on steel and aluminum, exploring the evolution of trade policies and the political and economic factors driving them. We’ll examine the economic impacts on domestic industries, consumers, and international trade, and how these tariffs ripple through global supply chains.

The discussion will unpack the meaning of “reality trumps steel/aluminum tariffs,” considering the underlying arguments, economic and political justifications, and diverse interpretations. We’ll analyze the potential consequences of ignoring the economic reality of these tariffs, including disruptions and shortages. The broader implications on international trade relationships, retaliatory measures, and the impact on global economic stability will also be examined.

Historical Context of Tariffs

Tariffs on steel and aluminum have a long and complex history, deeply intertwined with global trade policies and economic realities. Understanding this history is crucial to comprehending the current situation and the potential consequences of these policies. From protectionist measures to attempts at fair trade, the evolution of tariffs reflects a dynamic interplay of political and economic forces.The application of tariffs on steel and aluminum has been a recurring theme throughout history, reflecting shifting geopolitical landscapes and economic priorities.

Governments have frequently used tariffs as tools to protect domestic industries, safeguard national security, or retaliate against perceived unfair trade practices. This approach, while sometimes effective in the short term, often leads to complex and unpredictable consequences, impacting not only producers and consumers but also international relations.

Evolution of Trade Policies Related to These Metals

Trade policies regarding steel and aluminum have significantly evolved over time. Early policies often focused on promoting domestic production through protectionist measures. Later, as global trade expanded, the focus shifted towards multilateral agreements aimed at reducing barriers and fostering fairer trade practices. The rise of regional trade blocs and the emergence of new economic powers have further complicated the landscape.

This evolution reflects the changing global economic order and the continuous tension between protectionism and free trade.

Political and Economic Factors Influencing Policies

Various political and economic factors have shaped the development of tariffs on steel and aluminum. National security concerns, the desire to protect domestic industries from foreign competition, and the pursuit of economic advantage have all played a role. Additionally, the level of economic interdependence between countries has influenced the implementation and impact of these policies. Political relations between countries also have a direct influence on the establishment and modification of trade agreements.

Examples of Past Trade Disputes Involving Steel and Aluminum

Numerous past trade disputes involving steel and aluminum have shaped the landscape of international trade. These disputes often arose due to disagreements over pricing, dumping practices, or alleged subsidies provided to domestic producers. The resolution of these disputes has been influenced by international trade agreements, domestic laws, and the political climate of the time. The consequences of these disputes have frequently involved retaliation measures, impacting various industries and stakeholders across multiple countries.

Comparison of Tariffs on Steel and Aluminum

This table illustrates the varied tariffs on steel and aluminum across different countries and time periods. It highlights the dynamic nature of these policies and their impact on international trade.

| Country | Metal | Tariff Year | Tariff Rate |

|---|---|---|---|

| USA | Steel | 2018 | 25% |

| USA | Aluminum | 2018 | 10% |

| China | Steel | 2020 | Variable |

| EU | Steel | 2022 | Variable |

| Japan | Aluminum | 2021 | 2% |

Economic Impacts of Tariffs

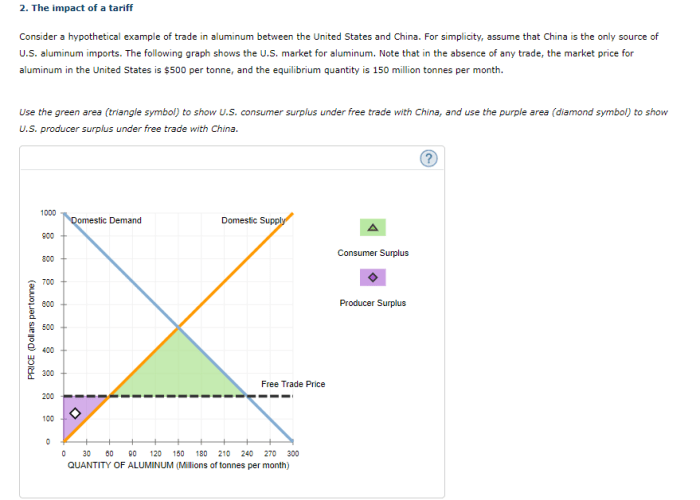

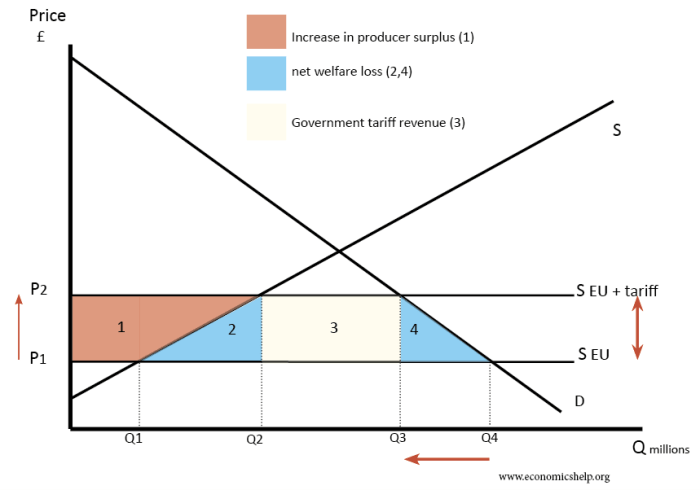

The reality of tariffs, particularly those on steel and aluminum, extends far beyond the headlines. These seemingly straightforward trade policies have profound and complex ripple effects throughout the global economy, impacting various sectors and individuals in ways that are often unforeseen. Understanding these impacts is crucial for assessing the true cost and benefit of such measures.The imposition of tariffs on steel and aluminum, while intended to protect domestic industries, can trigger a cascade of negative consequences.

These consequences, while potentially short-term, can create long-term structural issues. The tariffs’ effects on international trade, domestic industries, consumers, and the very fabric of global supply chains are multifaceted and require careful consideration.

Potential Positive Effects on Domestic Industries

Tariffs can theoretically increase domestic production by making imported goods more expensive. This increased competitiveness could foster growth in domestic steel and aluminum manufacturing, potentially leading to job creation within these sectors. However, this positive impact is often offset by other factors.

Potential Negative Effects on Consumers

Consumers face higher prices as tariffs increase the cost of imported steel and aluminum, often passed on to finished goods. This translates to higher prices for automobiles, appliances, and countless other products, impacting consumer purchasing power. The higher cost can also lead to reduced choices and a decline in overall economic welfare. For example, if a manufacturer uses aluminum in their products, and aluminum tariffs increase, they are forced to pass those increased costs onto the consumer, leading to higher prices.

Impact on International Trade

Tariffs can lead to retaliatory measures from other countries, creating trade wars. These retaliatory tariffs can damage export markets for other industries, creating a domino effect on various sectors. This disruption in global supply chains can significantly affect economies, as seen in the case of the 2000s trade wars between China and the US.

While the steel and aluminum tariffs were a hot topic, reality often proves more complex. Recent news about Kilmar Abrego Garcia, who had criminal charges returned against him, highlights how real-world events can sometimes overshadow larger economic debates. This situation, like the ongoing effects of the tariffs, shows that the complexities of life and legal processes often trump even carefully considered economic strategies, especially when it comes to global trade.

The case of Kilmar Abrego Garcia adds another layer to the ongoing discussion about tariffs and their real-world impact, proving that reality, in all its messy glory, often wins out.

Ripple Effects on Global Supply Chains

Tariffs disrupt the smooth flow of materials and components across international borders. Manufacturers reliant on imported steel and aluminum face higher costs, potentially impacting their profitability and competitiveness. The resulting delays and disruptions can also affect the production schedules of other industries, creating a significant ripple effect. Imagine an auto manufacturer who relies on imported aluminum sheets for car body construction.

The reality of tariffs on steel and aluminum is hitting home, and it’s a painful lesson. While the political posturing might seem impressive, the economic fallout is undeniable. It’s a stark reminder that, in the end, reality trumps any carefully constructed trade policy. This is particularly true when considering the history of albums like Brian Wilson’s Smile, which, in its own way, demonstrates how creative visions can sometimes clash with the harsh realities of production and commercial pressures.

Brian Wilson’s Smile album history is a fascinating example of artistic struggle. Ultimately, practical application and market forces always have the final say, even in the realm of high-minded trade deals. So, the tariffs are a sobering reminder that sometimes, reality really does trump steel and aluminum.

Tariffs increase the cost of those aluminum sheets, causing the auto manufacturer to either absorb the cost or increase prices for their vehicles.

Potential for Job Losses or Gains

The impact on employment is complex. While tariffs might lead to job creation in the domestic steel and aluminum industries, they can simultaneously result in job losses in other sectors reliant on imported steel and aluminum, and in export industries facing retaliatory tariffs. The net effect is uncertain and depends on various factors, such as the magnitude of the tariffs and the reactions of other countries.

Economic Effects on Different Groups

| Group | Potential Positive Impacts | Potential Negative Impacts |

|---|---|---|

| Manufacturers (using steel/aluminum) | Increased domestic supply (potentially) | Higher input costs, reduced competitiveness in export markets |

| Consumers | Nil | Higher prices for goods, reduced choice |

| Steel/Aluminum Workers | Potential for increased employment | Potential for job losses if retaliatory tariffs are significant |

| Exporters | Nil | Reduced demand for their products, due to retaliatory tariffs |

| Import-dependent Industries | Nil | Increased costs, potential for reduced production and job losses |

The Concept of “Reality Trumps Steel/Aluminum Tariffs”: Reality Trumps Steel Aluminium Tariffs

The phrase “reality trumps steel/aluminum tariffs” suggests that the intended economic outcomes of these tariffs are ultimately unsustainable or ineffective. It implies that the practical consequences of the policy, including its effects on the economy and the political landscape, will contradict the initial goals and assumptions. The statement highlights a fundamental difference between theoretical policy and the actual, complex interplay of global markets and domestic industries.The underlying arguments for this statement are multifaceted.

Advocates contend that tariffs, while potentially bolstering some domestic industries, will likely lead to negative consequences, such as retaliatory tariffs, supply chain disruptions, higher consumer prices, and job losses in related sectors. These arguments often point to the historical record of tariffs, demonstrating their tendency to harm the very economies they are intended to protect.

Economic Justifications

Tariffs on steel and aluminum, aiming to protect domestic producers, can disrupt global supply chains. Companies reliant on imported steel and aluminum will face increased costs, potentially impacting their competitiveness and profitability. These increased costs can be passed on to consumers, resulting in higher prices for goods and services. Furthermore, retaliatory tariffs from other countries can significantly harm American exports and create a negative trade environment, reducing overall economic growth.

These repercussions can be substantial, impacting not just the targeted industries but also related sectors and employment across the economy.

While the steel and aluminum tariffs were a hot topic, reality often bites back harder than any trade war. Ultimately, supporting university research, like exploring new materials and manufacturing techniques, is crucial for long-term economic resilience. This investment can lead to breakthroughs that could potentially render tariffs obsolete, as a nation strengthens its own capabilities in the sector.

For a deeper dive into the importance of government funding for university research, check out this insightful article: why government should pay for university research costs. In the end, the reality is that focusing on innovation might just be a more effective way to navigate global trade challenges than relying solely on tariffs.

Political Justifications

Politically, the “reality trumps tariffs” argument centers on the potential for domestic political backlash against tariffs. While proponents may initially gain support from specific industries, the negative economic effects can lead to public discontent and erode political support for the policy. The argument further suggests that international relations are significantly affected by tariffs. Retaliatory measures from other nations can lead to trade wars, escalating tensions and potentially harming diplomatic efforts.

Different Interpretations

The phrase “reality trumps steel/aluminum tariffs” can be interpreted in several ways. Some view it as a simple statement of economic principle – tariffs, regardless of intent, are often ineffective or counterproductive. Others see it as a critique of the political motivations behind the tariffs, highlighting the potential for short-sighted policy decisions. Still others view it as a cautionary tale about the complexities of international trade, emphasizing the need for comprehensive analysis before implementing such policies.

Different interpretations reflect varying perspectives on the potential economic and political consequences.

Potential Consequences of Ignoring Tariff Reality

Ignoring the economic reality of steel and aluminum tariffs can lead to various adverse outcomes, as shown in the table below.

| Scenario | Consequence |

|---|---|

| Ignoring the effects of tariffs on supply chains | Disruptions and shortages of essential materials, impacting production and potentially causing price hikes. |

| Underestimating retaliatory measures | Escalating trade conflicts, harming American exports, and reducing overall economic growth. |

| Failing to account for consumer price increases | Decreased consumer purchasing power, potentially triggering economic recession. |

| Ignoring the impact on related industries | Job losses in downstream sectors, impacting the broader economy. |

| Overlooking the complexities of international relations | Increased international tensions, jeopardizing diplomatic efforts. |

Global Trade Implications

The imposition of steel and aluminum tariffs by the United States had far-reaching consequences, significantly impacting international trade relationships. These measures triggered a cascade of retaliatory actions, creating uncertainty and disrupting global supply chains. The ripple effect extended beyond the immediate participants, affecting various sectors and economies worldwide. Understanding these ramifications is crucial to comprehending the complex interplay of global trade and economic stability.

Retaliatory Measures

The US tariffs sparked a wave of retaliatory actions from numerous countries. China, for instance, implemented tariffs on a wide range of US goods, including agricultural products and industrial machinery. The European Union imposed tariffs on US steel and aluminum products, demonstrating a concerted effort to counter the American measures. Canada and Mexico, while initially targeted by the tariffs, also implemented retaliatory measures against US goods, showcasing the interconnected nature of global trade.

Impact on Global Economic Stability

The introduction of tariffs significantly influenced global economic stability. The uncertainty surrounding trade policies discouraged investment and hindered economic growth in affected regions. The disruption to supply chains added further complications, causing price increases and shortages of essential materials. The cumulative impact on businesses, consumers, and governments resulted in a substantial loss of economic efficiency.

Effects on Global Supply Chains

The steel and aluminum tariffs disrupted established global supply chains. Manufacturers reliant on imported steel and aluminum faced increased costs and production delays. This forced them to explore alternative suppliers, often at higher prices, and to adapt their production processes. The complexities of navigating new trade barriers and finding reliable replacements presented considerable challenges to businesses across various sectors.

Table of Affected Countries and Responses, Reality trumps steel aluminium tariffs

| Country | Tariff Response | Impact on Economy |

|---|---|---|

| China | Retaliatory tariffs on US goods, including agricultural products and industrial machinery. | Reduced exports to the US, impacting Chinese businesses reliant on US markets. Potential for economic slowdown. |

| European Union | Tariffs on US steel and aluminum products. Implemented measures to protect European industries. | Increased costs for EU manufacturers using US steel and aluminum, potentially leading to price adjustments for consumers. |

| Canada | Retaliatory tariffs on US goods, including certain agricultural products and manufactured goods. | Disrupted trade flows between Canada and the US, impacting Canadian businesses involved in export-import activities. |

| Mexico | Retaliatory tariffs on US goods, including agricultural products. | Reduced exports to the US, impacting Mexican businesses involved in trade with the US. Potentially negative impact on the Mexican economy. |

| Japan | Limited retaliatory tariffs on US goods. | Smaller impact on the Japanese economy compared to some other countries, as the volume of trade with the US was less significant. |

Alternative Trade Policies

The steel and aluminum tariffs imposed by the United States sparked a debate about the effectiveness and fairness of trade protectionism. While these tariffs aimed to safeguard domestic industries, they also triggered retaliatory measures from other countries, creating ripple effects across global markets. Exploring alternative trade policies is crucial to finding solutions that address concerns about domestic job security and fair international trade practices.

Exploring Alternative Trade Policies

Addressing the complex issues surrounding trade protectionism requires a nuanced approach beyond simple tariffs. Alternative policies, while potentially less dramatic, can achieve similar goals through different mechanisms. These policies often focus on supporting domestic industries while simultaneously promoting fairer and more sustainable international trade relationships.

Free Trade Agreements

Free trade agreements (FTAs) aim to reduce or eliminate tariffs and other trade barriers between participating countries. These agreements typically increase trade volumes and potentially lead to greater economic growth for all parties involved. However, they also raise concerns about potential job losses in industries that face increased competition from imported goods.

- Benefits of FTAs include reduced barriers to trade, potentially leading to lower prices for consumers and greater access to a wider variety of goods and services. Increased competition can also stimulate innovation and efficiency gains within domestic industries.

- Drawbacks of FTAs often include potential job losses in specific sectors that cannot compete with foreign producers. This can lead to social and economic disruption in affected communities, requiring careful consideration of worker retraining and support programs.

Trade Adjustment Assistance Programs

Trade adjustment assistance programs (TAA) are designed to help workers and industries adapt to the challenges posed by increased international competition. These programs typically provide financial support, retraining opportunities, and other resources to those negatively impacted by trade liberalization. This can mitigate the negative social and economic consequences of trade policies.

- TAA programs can provide crucial support to workers and businesses facing job losses or declining profits due to international trade. This support can help mitigate economic hardship and promote a smoother transition to new employment or industries.

- Implementing TAA programs can be complex and costly. Determining eligibility criteria and ensuring adequate funding can be challenging, and there’s always a debate about the appropriate level and duration of assistance.

Negotiated Dispute Resolution Mechanisms

International trade disputes are often resolved through bilateral or multilateral negotiations. This approach emphasizes diplomatic solutions and compromises to resolve trade disagreements rather than resorting to punitive tariffs. This approach fosters cooperation and mutual understanding among trading partners.

- Negotiated solutions often lead to mutually beneficial outcomes by addressing specific concerns and finding common ground between countries. This can result in improved trade relationships and a more stable international trading environment.

- Negotiations can be time-consuming and may not always lead to a successful resolution. The potential for deadlock or failure to reach an agreement remains a possibility, and enforcement of agreed-upon measures can be challenging.

Table of Alternative Trade Policies

| Policy | Pros | Cons |

|---|---|---|

| Free Trade Agreements | Reduced barriers to trade, potentially lower prices, greater access to goods and services | Potential job losses in certain sectors, social and economic disruption, requires careful consideration of worker retraining and support |

| Trade Adjustment Assistance Programs | Support for workers and industries impacted by trade, mitigates economic hardship, promotes a smoother transition | Complex implementation, challenging eligibility criteria, ensuring adequate funding |

| Negotiated Dispute Resolution Mechanisms | Diplomatic solutions, mutually beneficial outcomes, improved trade relationships | Time-consuming, potential for deadlock or failure to reach agreement, enforcement challenges |

Case Studies and Examples

The imposition of tariffs on steel and aluminum by the United States had profound and multifaceted impacts on various industries and individuals. These impacts, while often debated in economic circles, manifested in tangible ways for businesses, workers, and consumers. This section will delve into specific case studies to illustrate these effects, examining the responses of different sectors and the resulting economic and social consequences.

Impact on Automotive Manufacturers

The steel and aluminum tariffs significantly impacted the automotive industry, a crucial sector of the US economy. Many car manufacturers rely heavily on imported steel and aluminum components for their production processes. The tariffs increased the cost of these inputs, leading to higher production costs for vehicles.

- Several automakers reported increased costs as a direct result of the tariffs. This translated into higher prices for consumers, as manufacturers passed on the increased input costs to the final product. Examples of increased prices for automobiles are readily available in industry reports.

- Some automakers shifted production to countries with lower tariffs or no tariffs to mitigate the impact on their bottom line. This led to job losses in some US-based auto manufacturing plants as production was relocated to other locations.

- The ripple effect of higher production costs extended to related industries such as parts suppliers and logistics companies, resulting in decreased profits and job losses in these supporting sectors. These impacts are further detailed in available industry reports.

Impact on Construction and Manufacturing

The tariffs affected a wide range of industries beyond automobiles. Construction and manufacturing companies, reliant on steel and aluminum, faced similar challenges.

- Construction projects experienced significant cost increases due to higher material prices. This led to delays in projects, reduced profitability, and in some cases, project cancellations.

- Manufacturers using steel and aluminum in their products saw their production costs rise. This impacted their profitability and competitiveness in the global market. The tariffs also increased the costs of exporting products, further reducing their competitiveness in international trade.

- Smaller businesses were disproportionately affected by the tariffs, as they often lack the resources to absorb significant cost increases. This led to challenges in maintaining profitability and potentially led to business closures in some cases. Reports on the economic impacts of tariffs can provide detailed insights into the specific challenges faced by these businesses.

Impact on Consumers

The tariffs indirectly impacted consumers through higher prices for goods and services.

- Higher production costs for goods containing steel or aluminum translated into higher retail prices for consumers. Examples include appliances, vehicles, and building materials.

- Consumers ultimately bore the brunt of the increased costs, as manufacturers passed on the added expenses to the final price of products.

- The tariffs affected not only the cost of manufactured goods but also services like construction, where the increased costs of materials were passed on to clients.

Summary

In conclusion, the analysis of reality trumps steel aluminum tariffs highlights the multifaceted nature of global trade policies. The historical context, economic impacts, and global trade implications reveal a complex system where tariffs have far-reaching consequences. Ultimately, alternative trade policies and case studies offer a deeper understanding of how to navigate these complexities and achieve a more sustainable and equitable global trade environment.

The tables provided offer a glimpse into the intricate details and provide a more comprehensive understanding of the subject matter.