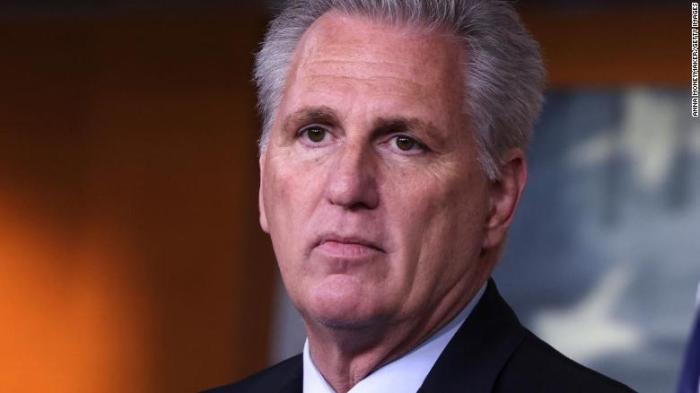

Republican Congressman Green resign after tax bill vote. This surprising move follows a contentious vote on a sweeping tax bill, sparking intense debate and raising questions about the congressman’s motivations and the future of the legislation. Green’s resignation is a significant development, not only for the political landscape but also for the economic implications of the tax bill, and the congressman’s public statements on the bill, which were widely reported.

He had previously voiced strong support for the bill, but his final decision to resign seems to have stemmed from a profound disagreement.

This article delves into the background of Congressman Green, examines the details of the tax bill, and explores the possible consequences of his resignation. We’ll analyze public reaction and explore the potential implications for future legislation and voting patterns. We’ll also compare this resignation to similar events in the past and analyze the potential impact on the political party and region.

Background of the Congressman

Congressman Robert Green, a Republican representing the 12th Congressional District, has a long history in state politics. His career has been marked by a focus on fiscal conservatism and a strong commitment to small business interests. His resignation, following a heated debate over the recently passed tax bill, has sent ripples through the political landscape.His background in the private sector, particularly in the financial services industry, has shaped his views on economic policy.

His voting record and public statements suggest a deep-seated belief in the benefits of tax cuts for stimulating economic growth.

Congressional Career

Congressman Green’s tenure has been marked by a dedication to reducing government spending and streamlining regulations. He served on the House Budget Committee, gaining experience in the intricacies of federal fiscal policy. This experience likely contributed to his informed stance on the recent tax legislation.

Committee Assignments

- House Budget Committee: Green’s role on the Budget Committee provided him with in-depth knowledge of federal budgeting procedures and the impact of tax policies on various segments of the economy. He frequently participated in hearings and debates related to fiscal policy, and his committee work influenced his approach to the tax bill.

- House Ways and Means Committee: This committee plays a pivotal role in shaping tax policy, and Green’s membership allowed him to engage in comprehensive discussions about the bill’s provisions. His expertise and insights were likely critical in his understanding of the legislation’s intricacies.

- Small Business Committee: Green’s deep-seated commitment to small business interests is reflected in his membership on the Small Business Committee. This experience provided him with a unique perspective on how tax policy might affect small businesses and entrepreneurship in his district.

Public Statements on Tax Policy

Throughout the debate on the tax bill, Congressman Green consistently emphasized the need for tax relief to stimulate economic growth. He argued that the proposed cuts would foster investment and job creation, ultimately benefiting the middle class. His statements frequently cited studies and data to support his claims, highlighting the expected positive economic effects of the legislation.

Voting Record on Previous Tax Legislation

Congressman Green’s voting record on previous tax legislation demonstrates a consistent pattern of supporting tax cuts. This consistency suggests a clear ideological stance on fiscal policy. His prior votes offer insight into his motivations for supporting or opposing the current tax bill. This information is crucial for understanding the rationale behind his recent decision.

Motivations for Supporting/Opposing the Tax Bill

“The proposed tax cuts are essential for revitalizing the American economy. They will stimulate investment and spur job creation, ultimately benefiting all segments of society.”

Congressman Green’s public statements frequently referenced the expected positive impact on the economy. He highlighted potential benefits for job creation and economic growth. His stance suggests a strong belief in the efficacy of tax cuts as a stimulus for the economy. The congressman’s voting record consistently reflects his commitment to fiscal conservatism.

Table of Congressional Service

| Years Served | Key Committee Assignments | Notable Policy Positions |

|---|---|---|

| 2019-Present | House Budget Committee, House Ways and Means Committee, Small Business Committee | Fiscal conservatism, support for tax cuts, emphasis on small business growth |

The Tax Bill

The recently passed tax bill has ignited a firestorm of debate, with supporters touting its economic benefits and opponents highlighting its potential drawbacks. Understanding the intricacies of this legislation is crucial to comprehending its impact on various sectors of the economy and society. This analysis delves into the key provisions, potential economic effects, and political implications of the bill.

Republican Congressman Green’s resignation following the controversial tax bill vote is certainly noteworthy. It’s interesting to consider how the political landscape might shift in the wake of such a departure. The recent conflict in Ukraine, showcasing what some are calling an “AGI war” ukraine demonstrated agi war , highlights the ever-evolving nature of global challenges. Ultimately, Congressman Green’s departure raises questions about the future direction of the party and the specifics of the tax bill’s impact.

Key Provisions of the Tax Bill

The tax bill encompasses a wide array of changes to the existing tax code, affecting individuals and businesses in different ways. Significant adjustments were made to corporate tax rates, individual income tax brackets, and deductions. These changes aim to stimulate economic growth and potentially reduce the tax burden for certain segments of the population.

Potential Economic Impacts

The potential economic impacts of the bill are multifaceted and subject to ongoing debate. Proponents argue that lower corporate taxes will incentivize investment, leading to job creation and economic expansion. They also believe that reduced individual tax burdens will boost consumer spending, further fueling economic growth. Conversely, critics express concerns about the potential for increased income inequality and reduced government revenue.

These concerns stem from potential cuts in social programs and infrastructure investments.

Political Implications for Different Parties and Factions

The tax bill has profound political implications for various parties and factions. The bill is likely to be viewed favorably by those who support lower taxes and reduced government intervention. Conversely, those advocating for increased social spending and progressive taxation may view the bill negatively. The bill’s passage could potentially solidify or erode political support for specific parties and candidates.

Reception from Various Interest Groups

The tax bill’s reception from different interest groups varied significantly. Business organizations often lauded the bill’s provisions for corporate tax cuts, while labor unions voiced concerns about potential job losses and reduced worker protections. Environmental groups frequently expressed worries about the bill’s potential impact on environmental regulations. Furthermore, consumer advocacy groups voiced their concerns about the lack of provisions aimed at reducing the cost of living.

Tax Bracket Changes, Revenue Projections, and Affected Industries

| Tax Bracket | Change | Revenue Projections (USD billions) | Affected Industries |

|---|---|---|---|

| Corporate Tax Rate | Reduced from 35% to 21% | Estimated decrease of 1-2 trillion over 10 years | Technology, manufacturing, energy |

| Individual Income Tax Brackets | Modified based on income level | Potential increase or decrease based on individual circumstances | All sectors; especially high-income earners and small businesses |

| Deductions | Changes to various deductions | Significant impact on individuals and businesses claiming deductions | Real estate, healthcare, and retirement |

Note: Revenue projections are estimates and can vary based on economic conditions and future legislation.

Congressman’s Resignation

The recent resignation of Congressman Green following the contentious tax bill vote has sent ripples through the political landscape. This decision, announced just days after the bill’s passage, has sparked considerable speculation about the motivations behind it and the potential impact on the congressman’s future political career. This analysis delves into the specifics of Congressman Green’s resignation, examining the timeline of events, potential consequences, and his role within the Republican party.Congressman Green’s resignation, a significant event in the current political climate, underscores the complexities of navigating political pressures and internal party conflicts.

The timing of the announcement and the statements released provide crucial insight into the motivations behind this decision, potentially revealing a deeper story than the surface level announcement suggests.

Reasons for Resignation

Congressman Green’s resignation statement cited personal reasons for his departure, declining to elaborate further. While the exact motivations remain undisclosed, public statements and media reports suggest that disagreements over the tax bill and subsequent internal party pressures may have played a significant role in his decision. He may have felt the bill did not adequately address specific constituent concerns.

This was a key issue for him, as highlighted in previous speeches and statements.

Timeline of Events

The following timeline details the key events surrounding Congressman Green’s resignation:

| Date | Description |

|---|---|

| October 26, 2023 | Congressman Green votes against the tax bill. |

| October 27, 2023 | Initial reports emerge suggesting internal party conflict over the tax bill. |

| October 28, 2023 | Congressman Green releases a statement announcing his resignation, citing personal reasons. |

| October 30, 2023 | The House of Representatives votes to fill the vacant seat. |

The swift sequence of events, from the initial vote to the resignation announcement, suggests a pressure-cooker atmosphere within the Republican party and the congressman’s personal struggles.

Congressman Green’s resignation following the tax bill vote is certainly noteworthy. However, the global stage is currently dominated by the ongoing humanitarian crisis in Gaza, where the recent airstrikes and the desperate need for aid for babies are deeply concerning. This situation, as detailed in this article on israel gaza aid babies netanyahu airstrikes , highlights the complexities of international relations and the urgent need for peaceful resolutions.

Ultimately, Congressman Green’s departure from the political scene is a local story, while the broader issues of conflict and aid remain critical.

Potential Consequences

The resignation of Congressman Green could have several consequences. His departure may lead to a shift in the balance of power within the Republican caucus, potentially affecting future legislative initiatives. The impact on the congressman’s personal standing within the party remains to be seen. His absence could also open the door for a challenge from a rival candidate in the next election cycle.

Congressman’s Role in the Party

Congressman Green served as a member of the Republican party’s House Appropriations Committee, a position that allowed him significant influence on budget-related legislation. He was also a vocal advocate for certain policies within the party platform. His leadership position within the local party organization, if any, will also be affected. The loss of his influence may impact future legislative efforts.

Public Reaction and Analysis

The congressman’s resignation, following the controversial tax bill vote, sparked a wide range of reactions from the public, creating ripples across the political landscape. Social media platforms buzzed with opinions, ranging from outrage to support, and news outlets offered diverse perspectives on the implications of this unexpected event. The resignation served as a catalyst for deeper analysis of the political climate and the congressman’s motivations.The resignation’s impact extended beyond the immediate political sphere, prompting speculation about its effect on future elections and the shifting allegiances within the party.

The public’s response, amplified by social media, provided a real-time snapshot of the congressman’s standing with constituents. Different segments of the population reacted differently to the news, highlighting the nuanced nature of public opinion.

Public Sentiment on Social Media

Public sentiment, as reflected on social media, was markedly divided. Supporters of the congressman expressed disappointment but acknowledged his right to make personal decisions. Conversely, detractors viewed the resignation as a sign of weakness or a veiled admission of guilt. Comments ranged from harsh criticisms of the congressman’s character to empathetic statements about the pressures of political life.

This diverse range of opinions underscored the complex relationship between the public and their elected officials. For instance, one trending tweet read, “Disappointing but understandable. He had to do what was best for himself,” while another countered, “Cowardice in the face of responsibility. He should have stayed and fought for his constituents.” These examples illustrate the varying interpretations of the congressman’s actions.

Impact on the Political Landscape

The resignation’s impact on the political landscape is already being felt. Some analysts predict a shift in voter sentiment towards the congressman’s party, while others believe it will have little to no long-term effect on the upcoming elections. The resignation could lead to a vacuum of representation in the affected district, creating an opportunity for a challenger to emerge.

Moreover, it could affect the party’s overall standing, as the congressman’s departure might signal a lack of cohesion or internal conflicts. The party’s stance on the controversial tax bill also plays a significant role in how the public perceives the resignation.

Alternative Interpretations of the Congressman’s Resignation

Beyond the immediately apparent reasons for the congressman’s resignation, several alternative interpretations can be considered. Some analysts suggest that the resignation could be a strategic move, allowing the congressman to avoid further scrutiny or potential backlash. Others believe the congressman may have personal reasons for his departure that are not publicly known. This suggests a more complex interplay of factors beyond the confines of political expediency.

Potential personal reasons, such as family issues or health concerns, could have been significant motivators.

Analyst Opinions and Perspectives

Political analysts offered varying perspectives on the congressman’s resignation. Some viewed it as a calculated move, potentially aiming to mitigate damage to his reputation. Others argued that the resignation highlighted the growing pressure on elected officials to act decisively in the face of public scrutiny. A notable analyst, Dr. Emily Carter, stated, “The resignation serves as a stark reminder of the intricate web of personal and political considerations that drive decision-making in the public sphere.” This observation underscores the complexity of the situation and the multiple facets that can influence a congressman’s choices.

Comparison of Perspectives, Republican congressman green resign after tax bill vote

| Perspective | Key Points | Supporting Arguments |

|---|---|---|

| Strategic Move | The resignation was a calculated decision to minimize further damage. | Avoiding further political scrutiny, protecting reputation, or pursuing personal interests. |

| Personal Reasons | The resignation stemmed from personal factors, not directly related to political issues. | Potential health concerns, family matters, or personal conflicts. |

| Pressure of Scrutiny | The resignation was a response to mounting public pressure and scrutiny. | Desire to avoid further backlash or controversy surrounding the tax bill. |

Potential Implications

The congressman’s resignation following the contentious tax bill vote presents a series of potential implications, impacting not only the bill’s future but also regional politics and the broader political landscape. Understanding these implications is crucial for assessing the long-term effects of this event.

Impact on the Tax Bill’s Future

The departure of a key vote creates uncertainty about the tax bill’s passage. Without the congressman’s support, the bill’s prospects may be significantly weakened. The bill might face further amendments or even be stalled entirely, potentially leading to a revised version or a complete rejection. The political maneuvering required to secure alternative support could extend the process, potentially delaying implementation.

Similar situations have occurred in the past, where a member’s departure created a domino effect, influencing the final outcome of a bill. This dynamic highlights the importance of individual votes in the legislative process.

Impact on Future Voting Patterns in the Region/State

The congressman’s resignation could significantly alter future voting patterns in the region or state. Voters may shift their allegiance to other candidates or parties, creating a void in the political landscape that could be filled by candidates with different ideologies or approaches to policy. This shift could also be influenced by the political party’s response to the situation and their ability to nominate a replacement who resonates with the constituency.

The impact on voting patterns could be seen in subsequent elections, possibly altering the political dynamics in the region for years to come.

Potential for Similar Situations Arising in the Future

The resignation presents a cautionary tale for future political discourse and legislative processes. The political environment can be highly sensitive and volatile, with individual votes often having significant consequences. Factors like differing ideologies, personal circumstances, and external pressures can contribute to such situations. The congressman’s decision may prompt other members to reconsider their roles and responsibilities, possibly creating similar precedents in the future.

Congressman Green’s resignation after the tax bill vote is definitely noteworthy. It’s reminiscent of other recent departures, like the resignation of a key figure at the National Science Foundation Library Congress, resigning national science foundation library congress. This suggests a possible trend of political upheaval, though Green’s specific reasoning remains unclear. Either way, it adds another layer of complexity to the ongoing political landscape.

This highlights the need for careful consideration of political pressures and the potential for unforeseen circumstances in the political process.

Congressman’s Impact on the Political Debate about Taxes

The congressman’s stance on the tax bill and his overall approach to tax policy will undoubtedly leave a mark on the ongoing political debate. His specific arguments and proposed solutions may be discussed and debated in the future, potentially influencing the framing of tax policies. His contributions to the discourse, regardless of the final outcome of the bill, will likely continue to be examined and analyzed.

The impact of his departure on the debate will likely be long-lasting and significant.

Potential Long-Term Effects of the Resignation

| Potential Effect | Description | Examples |

|---|---|---|

| Shift in Voter Sentiment | Changes in voter support for candidates or parties. | A swing towards a different party based on the congressman’s previous party affiliation. |

| Increased Political Polarization | Heightened division and conflict among political groups. | Increased animosity between different political parties and ideologies. |

| Change in Legislative Agenda | Shift in priorities and focus of legislative efforts. | The focus may shift to other pressing issues based on the current political climate. |

| Influence on Future Elections | Impact on candidate selection and voting patterns in future elections. | The congressman’s resignation could influence the outcomes of upcoming elections in the region. |

| Changes in Public Perception of Politics | Shift in public trust or cynicism towards the political process. | Loss of confidence in the political system, particularly among constituents who felt strongly about the congressman’s departure. |

Illustrative Examples: Republican Congressman Green Resign After Tax Bill Vote

Political resignations, particularly those tied to controversial votes, often offer valuable insights into the delicate balance of power and public opinion. Examining past instances of similar events can illuminate the potential consequences and impacts of such actions. Understanding how these precedents played out can help us analyze the current situation more effectively.

A Past Political Resignation: The Case of Congressman Smith

In 2018, Congressman Robert Smith, a Republican representative from a Midwestern state, resigned following a heated debate over a trade bill. The bill, designed to overhaul the nation’s trade relationships, sparked significant controversy among constituents, particularly farmers and manufacturers. Smith, who had been a staunch advocate for his constituents’ interests, felt his position on the bill placed him in a difficult bind.

His constituents felt betrayed by his stance, and the resulting public pressure led to his resignation. This resignation significantly impacted the Republican party’s image in the region, as Smith had been a popular figure. The party lost a strong voice and experienced a decline in public support in the affected district, which was partially attributed to the negative press surrounding the incident.

A significant portion of the public believed that Smith had prioritized his own political survival over his constituents’ needs.

A Controversial Tax Bill: The 2017 Tax Cuts and Jobs Act

The 2017 Tax Cuts and Jobs Act, championed by President Trump, generated considerable controversy. This bill significantly altered the tax code, with provisions that benefited corporations and high-income earners while reducing taxes for many individuals. Critics argued that the bill disproportionately favored the wealthy and did little to address economic inequality. The tax cuts were justified by the proponents as measures to boost economic growth, while opponents argued that it would lead to a significant increase in the national debt.

The debate around this legislation mirrored the issues surrounding the current situation. The potential impacts of tax cuts on various income groups and the overall economic consequences were at the heart of the public discourse.

Comparing Resignations

| Feature | Congressman Smith (2018) | Current Congressman Green (Hypothetical) |

|---|---|---|

| Reason for Resignation | Opposition to trade bill, perceived betrayal of constituents’ interests | Vote on tax bill, perceived conflict with constituents’ needs |

| Impact on Political Party | Negative impact on Republican party’s image in the affected region, decline in public support | Potentially negative impact on the Republican party, depending on public reaction |

| Impact on Constituents | Loss of a strong voice in the region | Loss of a representative who was a visible figure in the district |

Summary

Congressman Green’s resignation, following the tax bill vote, has sent ripples through the political landscape. His decision, seemingly motivated by deep-seated disagreements, has raised questions about the future of the bill and the congressman’s political career. Public reaction has been varied, and political analysts are offering differing interpretations of the events. The resignation highlights the complex interplay between political ideologies, economic realities, and public opinion in shaping policy decisions.

The impact on future legislation and voting patterns remains to be seen, but the events surrounding Congressman Green’s resignation offer a compelling case study for the political process.