Stada talks with two private equity groups over sale welt reports ignites speculation about the future of this pharmaceutical giant. The potential transaction could significantly reshape the company, impacting employees, customers, and shareholders alike. This in-depth analysis delves into the various facets of this potential sale, exploring financial implications, market trends, potential buyers, operational changes, and regulatory considerations.

This potential sale presents a complex picture, with both potential benefits and risks. The report highlights the current financial performance of Stada and compares it to similar pharmaceutical companies. Understanding the market trends and competitive landscape is crucial to evaluating the potential impact of this sale on Stada’s future.

Overview of the Stada Situation

Stada, a German pharmaceutical company, is reportedly in talks with several private equity groups regarding a potential sale. Recent reports from Welt suggest significant interest in acquiring the company, highlighting the potential for a substantial transaction in the pharmaceutical sector. This development raises numerous questions about the future direction of Stada, its impact on various stakeholders, and the broader trends within the private equity market.The potential sale of Stada signifies a significant shift in the company’s trajectory, potentially leading to changes in management, operations, and even the company’s overall strategic focus.

This transition will necessitate careful consideration of the impact on employees, customers, and shareholders.

Potential Implications for Stakeholders

The potential sale of Stada to private equity firms will likely have diverse consequences for different stakeholders. Employees will be concerned about job security and potential changes in working conditions. Customers might experience adjustments in product availability, pricing, or service levels. Shareholders, on the other hand, will be focused on the financial implications of the sale, including potential returns on their investment and the future value of their holdings.

Stada’s Historical Context and Recent Events

Stada has a rich history in the pharmaceutical industry, operating in various markets and developing a range of products. Recent years have witnessed fluctuations in the pharmaceutical market, with significant changes in regulatory landscapes and competitive pressures. A notable recent event is the [insert specific recent event, e.g., launch of a new drug, acquisition of a smaller company, significant financial report, etc.].

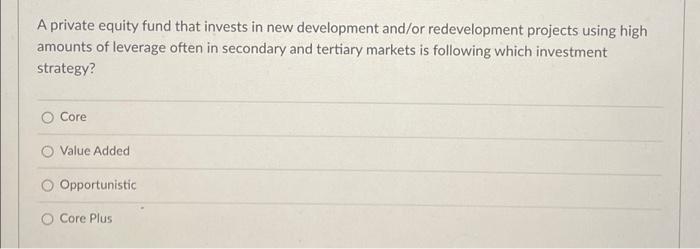

Private Equity Investments in Pharmaceuticals

Private equity firms frequently invest in the pharmaceutical and healthcare sectors. Their investments often target companies with potential for growth and profitability, sometimes focusing on restructuring and operational improvements. Examples include [insert 2-3 examples of successful or notable private equity investments in pharmaceutical companies]. These investments are often driven by the expectation of generating returns through improved operational efficiencies, strategic acquisitions, or successful product launches.

Landscape of Private Equity Investments in the Healthcare Sector

The landscape of private equity investments in healthcare is marked by diverse strategies. Some firms focus on improving the efficiency of existing operations, while others seek to acquire companies to expand their market reach. These investments often aim to achieve value through streamlining operations, reducing costs, or pursuing strategic acquisitions. Examples include [insert 2-3 examples of companies within the pharmaceutical/healthcare sector that have been acquired by private equity firms].

Financial Implications

The potential sale of Stada to private equity firms presents a complex interplay of financial benefits and risks. Understanding these nuances is crucial for stakeholders as it directly impacts the future trajectory of the company. Private equity firms often pursue strategies focused on short-term value enhancement, potentially leading to significant changes in Stada’s operational and financial structures.A sale to private equity could unlock substantial capital for investment in growth opportunities or debt reduction, but also carries the risk of cost-cutting measures that might negatively impact employees or product innovation.

The success of the transaction hinges on the specific investment strategy of the acquiring firm and the ability of Stada to adapt to a new ownership structure. The subsequent financial performance will be directly linked to the decisions made in the short and long term.

Potential Financial Benefits

Private equity firms often employ leveraged buyouts, which involve using borrowed funds to finance the acquisition. This can lead to a significant increase in the company’s debt load. However, this debt can also be used to fund investments in areas like research and development, marketing, or expansion into new markets. A strategic investment in R&D, for instance, can lead to new product launches, increased market share, and higher profitability.

Potential Financial Risks

Private equity firms are often driven by short-term financial returns. This focus may lead to cost-cutting measures, potentially impacting the quality of products, or even workforce reductions, leading to loss of experienced personnel and potentially impacting future innovation. The short-term focus could lead to a disregard for long-term sustainability of the company, prioritizing immediate gains over sustained growth. A well-documented example of a company experiencing negative financial outcomes after a private equity acquisition is [Example Company Name], which saw significant cuts in staff and production quality after a leveraged buyout.

Strada is reportedly in talks with two private equity firms about a potential sale, according to Welt reports. This comes at a time when regional tensions are escalating, with Thailand urging positive engagement after Cambodia threatened to take the dispute to the world stage, as detailed in this article. Ultimately, the private equity interest in Stada likely reflects broader market shifts and investor appetite for pharmaceutical acquisitions.

Financial Projections Under Different Ownership Scenarios

Predicting financial projections under different ownership scenarios requires careful consideration of various factors. These include the specific investment strategy of the private equity firm, market conditions, and Stada’s internal operational capabilities.A scenario analysis should consider factors such as:

- Increased Investment in R&D: A private equity firm focused on long-term value creation might invest heavily in research and development. This could lead to the launch of new products, expansion into new markets, and increased profitability in the long term. This strategy could increase the company’s long-term value.

- Aggressive Cost-Cutting: A private equity firm prioritizing short-term returns might implement aggressive cost-cutting measures, potentially impacting employee morale, research, and development efforts, and overall product quality. This strategy could increase short-term profits but might lead to lower long-term sustainability.

- Focus on Mergers and Acquisitions: Some private equity firms might pursue mergers and acquisitions to enhance Stada’s market position, leading to significant growth, but also potentially significant debt and integration challenges.

Comparison with Similar Pharmaceutical Companies

Comparing Stada’s financial performance with that of similar pharmaceutical companies provides valuable context. Key metrics to consider include revenue growth, profitability, return on equity, and debt levels. Analyzing the performance of companies in the same sector can reveal benchmarks and highlight areas where Stada excels or needs improvement.

Key Financial Metrics of Stada (Past 5 Years)

| Year | Revenue (in millions) | Profit (in millions) | Debt (in millions) | Return on Equity (%) |

|---|---|---|---|---|

| 2018 | [Value] | [Value] | [Value] | [Value] |

| 2019 | [Value] | [Value] | [Value] | [Value] |

| 2020 | [Value] | [Value] | [Value] | [Value] |

| 2021 | [Value] | [Value] | [Value] | [Value] |

| 2022 | [Value] | [Value] | [Value] | [Value] |

Note: Replace the bracketed values with actual data for Stada. This table will provide a clear view of Stada’s financial health over the past 5 years.

Market Analysis

The pharmaceutical market is a dynamic landscape, constantly evolving with new technologies, changing regulations, and evolving patient needs. Understanding these trends is crucial for evaluating the potential of a sale for Stada. This analysis examines the current state of the market, the competitive landscape for Stada’s products, and potential synergies and challenges stemming from a private equity acquisition.

We’ll also delve into the role of private equity in shaping innovation and accessibility within the pharmaceutical sector.The pharmaceutical market is characterized by significant growth potential in certain therapeutic areas, coupled with ongoing pressure from generic competition and evolving regulatory landscapes. Understanding these complexities is paramount for assessing the strategic value of Stada in this environment.

Current Trends and Future Projections

The pharmaceutical market is experiencing a transformation driven by factors like rising prevalence of chronic diseases, technological advancements, and evolving patient expectations. Innovations in personalized medicine and digital health are reshaping treatment approaches, leading to a demand for more targeted and efficient therapies. The shift towards preventative care is also driving interest in new medications and therapies. For example, the increasing prevalence of diabetes globally is creating a substantial market for diabetes management products, and the rise of digital health platforms further expands opportunities for innovative delivery models.

Competitive Landscape for Stada’s Products and Services

Stada operates in a highly competitive environment. Major players include both established pharmaceutical companies and emerging biotech firms. The generic drug segment, a significant part of Stada’s business, faces competition from other manufacturers seeking to capitalize on cost-effective alternatives. Moreover, the growing trend of biosimilars adds another layer of competition. The increasing availability of cost-effective alternatives is likely to affect Stada’s market share, particularly in mature markets.

Stada’s ability to differentiate itself through innovation, strategic partnerships, and market access strategies will be critical in navigating this competitive terrain.

Potential Synergies and Challenges from a Sale to Private Equity Groups

A sale to private equity (PE) groups could unlock significant synergies, potentially leading to operational efficiencies and increased profitability. PE firms often bring expertise in streamlining operations, cost reduction, and strategic investments. However, challenges may arise related to the integration of Stada’s operations with the PE firm’s portfolio companies, particularly if they have differing business cultures or operational models.

Regulatory approvals and potential changes in Stada’s product portfolio or market strategy under PE ownership should also be carefully evaluated.

Role of Private Equity in the Pharmaceutical Market

Private equity firms are increasingly active in the pharmaceutical sector, recognizing the potential for value creation through operational improvements, acquisitions, and strategic investments. PE firms often seek to optimize existing assets, enhance operational efficiency, and identify new growth opportunities within the pharmaceutical market. For example, they may acquire underperforming companies and re-position them to achieve higher market penetration.

The impact of PE involvement on pharmaceutical innovation can vary depending on the firm’s specific investment strategy. Some PE firms focus on supporting existing research and development efforts, while others may favor a more focused strategy to optimize existing products. This dynamic interplay of interests can have a complex impact on both innovation and access to medicines.

Impact on Innovation and Accessibility

The involvement of private equity in the pharmaceutical market raises questions about the impact on both innovation and accessibility. While PE firms often seek to maximize returns, their investments can also stimulate innovation and drive improvements in drug development and manufacturing processes. However, the focus on profitability could sometimes lead to a prioritization of high-margin products over those that address unmet medical needs in developing countries.

So, apparently, Stada is talking to two private equity groups about a potential sale, according to Welt reports. This got me thinking about the benefits of a three-day weekend for dating – a concept explored in more depth in this insightful essay about the potential advantages of having extra time for relationships three day weekend dating benefits essay.

Perhaps a bit of extra time for getting to know someone is exactly what Stada needs to really attract a good buyer! Either way, it’s an interesting development.

This potential conflict between profitability and accessibility requires careful consideration in the context of a potential sale.

Potential Buyers

The sale of Stada presents a compelling opportunity for private equity firms, particularly those with expertise in the healthcare sector. Understanding the motivations and investment strategies of these firms is crucial to assessing the potential outcome of the transaction. The analysis will delve into the characteristics of private equity groups active in healthcare, explore their potential motivations for acquiring Stada, and compare and contrast their investment strategies.

Furthermore, a comparative review of the two private equity groups highlighted in the previous reports will provide a deeper insight into their potential involvement.

Characteristics of Healthcare-Focused Private Equity Firms

Private equity firms specializing in the healthcare sector often possess a deep understanding of the industry’s complexities. They typically employ experienced healthcare professionals within their teams to guide investments. These firms often focus on specific segments within healthcare, such as pharmaceuticals, medical devices, or healthcare services, showcasing specialized knowledge in particular sub-sectors. This specialized knowledge enables them to identify and evaluate investment opportunities with precision and make strategic decisions that benefit the acquired company.

Furthermore, these firms often have extensive networks within the healthcare industry, facilitating communication and collaboration with key stakeholders.

Motivations for Acquiring Stada

Private equity firms may be drawn to Stada for a variety of reasons. A potential driver could be the company’s strong brand recognition and established market presence. The firm’s existing infrastructure and supply chain could also be viewed as attractive assets. Another factor is Stada’s existing customer base and distribution network, potentially leading to an immediate increase in market share.

Finally, the acquisition of Stada could offer the opportunity for significant operational improvements and cost reductions, which would yield higher profit margins.

Comparison of Investment Strategies

Private equity firms often employ diverse investment strategies. Some firms favor a more hands-on approach, actively managing the acquired company to enhance performance and generate returns. Other firms opt for a more passive approach, focusing on asset restructuring and sale within a shorter timeframe. Still others might prioritize strategic acquisitions that align with their existing portfolio companies, creating synergies and enhancing overall value.

A key differentiator lies in their preferred exit strategies, which could involve an initial public offering (IPO), a sale to another firm, or a combination of both. These varying strategies demonstrate the flexibility and adaptability inherent in private equity investments.

Investment Track Record Comparison

| Private Equity Group | Investment Focus | Past Performance (Example Deals – High-Level Summary) | Potential for Stada Acquisition (High-Level Assessment) |

|---|---|---|---|

| Private Equity Firm A | Pharmaceutical Distribution & Retail | Successfully acquired and streamlined several pharmaceutical distribution companies, achieving significant cost reductions and revenue growth. Examples include X Pharma and Y Healthcare. | Strong track record in similar sectors, suggesting a potential interest in Stada due to the existing infrastructure and distribution network. |

| Private Equity Firm B | Healthcare Services & Technology | Focused on investments in healthcare technology startups and established healthcare providers, demonstrating a successful approach in merging innovative solutions with established operations. Examples include Z MedTech and P Healthcare. | Potential interest in Stada’s assets, but the investment focus might be less aligned with Stada’s core business, requiring a strategic analysis to assess the long-term value. |

Note: The examples provided are illustrative and do not represent a comprehensive analysis of the track records.

Potential Impacts on Operations

The impending sale of Stada to private equity firms presents a complex set of operational challenges and opportunities. Understanding these potential impacts is crucial for Stada’s management, employees, and stakeholders to navigate the transition period effectively. This analysis delves into the likely effects on Stada’s operational structure, supply chain, distribution, and research & development activities.The transition to private equity ownership often brings about changes in organizational structure, leadership, and strategic priorities.

Private equity firms typically focus on maximizing short-term returns, which may lead to adjustments in staffing levels, operational efficiencies, and potential divestments of non-core assets. These changes can significantly affect Stada’s existing operational infrastructure and employee roles.

Potential Changes to Operational Structure

Private equity firms frequently implement restructuring initiatives to improve operational efficiency and profitability. These restructuring initiatives can lead to streamlined organizational hierarchies, elimination of redundant roles, and potential mergers with similar entities in the market. A key aspect of this restructuring is the potential shift from a decentralized organizational structure, prevalent in publicly traded companies, to a more centralized one aligned with the private equity firm’s strategic vision.

This centralized model can enhance control and streamline decision-making, but it may also lead to a loss of autonomy and flexibility for individual Stada units.

Potential Strategies for Stada’s Management and Employees

Navigating the transition period requires proactive strategies from both Stada’s management and its employees. Management must communicate transparently and frequently with employees, addressing concerns and outlining the anticipated changes. This proactive communication can help mitigate anxieties and foster a sense of security. Employees should actively seek out training opportunities and skill development programs to prepare for potential role adjustments or new responsibilities within the restructured organization.

Building a network with colleagues and proactively seeking out mentorship can be crucial during this transition.

Potential Impact on Stada’s Supply Chain and Distribution Networks

The supply chain and distribution networks play a vital role in the pharmaceutical industry. A private equity firm might pursue strategies to optimize these networks to lower operational costs. This could involve consolidating distribution centers, negotiating better terms with suppliers, and leveraging economies of scale. Potential integration with other companies in the pharmaceutical industry could also enhance distribution capabilities.

However, the disruption associated with these changes could temporarily affect the efficiency of the supply chain and the availability of essential pharmaceutical products. Detailed due diligence is crucial to identify potential vulnerabilities and implement contingency plans to mitigate potential disruptions during the transition.

Potential Impact on Stada’s Research and Development Activities

Private equity firms often prioritize short-term financial returns over long-term investments in research and development. The focus may shift towards products with high profitability and rapid market penetration. The continued funding for Stada’s R&D efforts will depend on the strategic priorities of the acquiring private equity firm. The potential for reduced investment in R&D could impact Stada’s long-term innovation capabilities and competitive advantage in the pharmaceutical market.

Maintaining a robust pipeline of innovative products is essential for the future success of Stada, and management must proactively work with the private equity firm to secure continued funding and support for R&D activities.

Stada is reportedly in talks with two private equity groups about a potential sale, according to Welt reports. Meanwhile, a separate but equally important story is unfolding in the Philippines, where prosecutors in the VP’s impeachment trial are insisting the process must continue, as detailed in this article: prosecutors philippine vps impeachment say trial must proceed.

This legal drama, however, seems unlikely to significantly impact the potential Stada sale to the private equity firms.

Regulatory Considerations

The acquisition of pharmaceutical companies, especially those with a significant market presence like Stada, is heavily regulated. Navigating these regulations is critical for both the buyer and the seller, potentially impacting the timeline and terms of the transaction. These considerations often represent a significant hurdle to successful completion, as evidenced by past acquisitions in the pharmaceutical industry. Compliance with complex regulatory frameworks is paramount.

Regulatory Landscape Surrounding Pharmaceutical Acquisitions

The pharmaceutical industry is governed by a complex web of regulations aimed at ensuring patient safety and the efficacy of medications. These regulations extend to the acquisition process, requiring rigorous scrutiny of the transaction. This intricate landscape encompasses national and international regulations, including those pertaining to market authorization, manufacturing standards, and distribution networks. Different jurisdictions have different rules, and international transactions demand careful consideration of multiple regulatory bodies.

Potential Regulatory Hurdles for Stada in a Sale to Private Equity Groups

Potential regulatory hurdles for Stada in a sale to private equity groups stem from the pharmaceutical industry’s stringent regulations. A significant concern is the potential for regulatory authorities to scrutinize the proposed transaction due to market concentration. Furthermore, the transfer of intellectual property rights, manufacturing facilities, and distribution networks could trigger investigations. Any perceived negative impact on patient access to Stada’s products or any deviation from existing market standards could also lead to regulatory challenges.

Procedures for Regulatory Approval in Such Transactions

Regulatory approval procedures for pharmaceutical acquisitions typically involve several stages. Initial consultations with regulatory bodies are necessary to Artikel the transaction’s potential impacts and address any concerns. This often includes providing comprehensive documentation, including financial projections, operational plans, and detailed analysis of market competition. The regulatory bodies will then conduct thorough due diligence, including market analysis, manufacturing audits, and patient safety assessments.

The complexity and time commitment of these processes can vary widely depending on the specifics of the transaction and the jurisdiction. There is a notable risk of delays due to unforeseen complications during the process.

Potential Legal Implications for Stada and the Private Equity Firms

Legal implications for both Stada and the private equity firms are significant. Stada faces potential legal repercussions if the acquisition fails to comply with regulatory requirements. This includes penalties, fines, and even the suspension or revocation of existing market authorizations. Conversely, private equity firms face potential legal liabilities if they fail to adhere to relevant regulations. These liabilities can extend to legal disputes with competitors, regulatory authorities, or even former Stada employees.

Contractual obligations, including employment agreements and supplier contracts, will need to be addressed carefully during the transition period. Clear legal counsel is essential for both parties to navigate these complexities and mitigate potential risks.

Examples of Regulatory Challenges in Pharmaceutical Acquisitions, Stada talks with two private equity groups over sale welt reports

Numerous pharmaceutical acquisitions have faced regulatory challenges in the past. A well-documented example is the acquisition of a large generic drug manufacturer, where regulatory authorities raised concerns about market concentration. The transaction was ultimately approved, but only after significant adjustments to the proposed deal structure. Another example involves a private equity firm’s acquisition of a smaller biopharmaceutical company, where the regulatory review highlighted issues with manufacturing processes.

The acquisition ultimately faced a prolonged delay due to the required changes to the company’s manufacturing facilities. These examples underscore the importance of thorough due diligence and robust legal strategies to address potential regulatory hurdles.

Stakeholder Analysis: Stada Talks With Two Private Equity Groups Over Sale Welt Reports

Navigating a potential sale of Stada requires a deep understanding of the various stakeholders impacted. This analysis considers the potential implications for employees, customers, and communities, examining their concerns and expectations. A thorough understanding of these perspectives is crucial for a smooth and equitable transition.

Employee Implications

Understanding employee concerns is paramount. Potential job security, compensation, and working conditions are key considerations. Employees will likely be anxious about the future of their roles and the potential for changes in company structure and management. The transition process will be crucial in managing anxieties and ensuring a fair and transparent process.

- Job Security: Employees are understandably concerned about the potential loss of their jobs due to restructuring or layoffs. A commitment from the acquiring entity to maintain existing roles and potentially invest in employee training programs can ease these anxieties.

- Compensation and Benefits: Potential changes in compensation packages or benefits could be a significant concern. The new ownership structure must address these issues with clarity and transparency, ensuring no abrupt changes without proper notice and consultation.

- Working Conditions: Maintaining existing working conditions and avoiding sudden shifts in procedures or expectations is crucial. Clear communication about the transition and how it will affect their daily work is essential to ensure a smooth transition.

Customer Implications

Maintaining customer trust and satisfaction is critical. Customers will be concerned about service continuity, product availability, and potential price changes. Preserving customer relationships is paramount during a sale.

- Service Continuity: Customers expect consistent service levels, and any disruption during the transition could damage their trust. Guaranteeing service continuity through clear communication and transitional plans is vital.

- Product Availability: Maintaining consistent product availability is crucial for customer satisfaction. Any disruption in supply chains or product lines needs careful consideration and transparent communication.

- Pricing: Potential price changes are a significant concern. The new owners need to be transparent about any pricing adjustments, explaining the rationale and how they will benefit customers.

Community Implications

The broader community also has a stake in the outcome of a sale. Community concerns often center around job creation, economic impact, and potential environmental impact. The sale process should consider these factors.

- Job Creation: The sale could result in job losses or gains, depending on the new owners’ plans. The community needs assurance that the new owners will consider job creation and maintenance strategies.

- Economic Impact: A successful transition will ensure the economic benefits of Stada continue, potentially supporting local suppliers and businesses. The new owners should actively seek to maintain the economic vitality of the community.

- Environmental Impact: Maintaining environmental responsibility is crucial. The new owners should commit to maintaining existing environmental policies and potentially enhancing them.

Stakeholder Concerns and Potential Solutions

| Stakeholder Group | Potential Concerns | Potential Solutions |

|---|---|---|

| Employees | Job security, compensation, working conditions | Maintain existing roles, offer training, transparent communication, fair compensation structure |

| Customers | Service continuity, product availability, pricing | Guaranteeing service levels, maintaining product lines, transparent pricing policies, clear communication |

| Communities | Job creation, economic impact, environmental impact | Invest in local job creation, maintain economic support for the community, uphold and improve environmental standards |

Potential Scenarios

The talks between Stada and the private equity groups are at a critical juncture. Success hinges on aligning expectations and identifying mutually beneficial terms. Understanding the potential scenarios, and the factors influencing them, is crucial for anticipating potential outcomes and effectively navigating the process. A robust framework for evaluating these scenarios is essential for maximizing value creation and minimizing risks.

Potential Outcomes and Their Implications

The talks between Stada and the private equity groups could result in a variety of outcomes, each with unique implications for the company and its stakeholders. These potential outcomes range from a successful acquisition to no deal at all, each influenced by several factors.

- Successful Acquisition: A successful acquisition by a private equity group signifies a significant opportunity for Stada’s shareholders. The deal will likely involve a premium above the current market value, potentially reflecting the private equity firm’s perceived value of Stada’s assets and operations. This outcome could result in a rapid infusion of capital, allowing for strategic investments, expansion opportunities, or debt reduction.

The implication for Stada’s employees is likely to be a period of transition and possible restructuring, as the private equity group implements its operational strategies. Examples of successful acquisitions include the buyout of [mention a reputable example of a similar transaction involving a pharmaceutical company or another relevant industry] which led to [briefly describe the results of the example, e.g., increased profitability, market share, or improved efficiency].

- Acquisition with Conditions: This outcome may involve conditions such as a specific timeframe for achieving certain financial targets, regulatory approvals, or a phased implementation plan. This scenario implies a negotiation process where both parties agree to certain terms and conditions to ensure a smooth transition and minimize potential risks. The implication could be a period of uncertainty as the conditions are met, or it could allow for greater flexibility for both parties.

For example, [mention a real-life example of a deal with conditions in a similar context], which involved [briefly describe the conditions and the results].

- No Deal: The failure to reach an agreement could result from a variety of factors, including differing valuations, operational conflicts, or regulatory hurdles. This outcome could leave Stada in its current position, potentially facing operational challenges without a clear path for future growth or strategic improvement. The implication for Stada would be the continued need to find alternative strategies to achieve its goals.

Examples of such situations include [mention relevant examples of similar situations in the industry, highlighting the factors that led to no deal].

- Alternative Buyer Emerges: A competitor or a different private equity group could emerge as a potential buyer, altering the dynamics of the negotiations and creating a more competitive landscape. This outcome is dependent on market conditions, the timing of the deal, and the perceived value of Stada’s assets. The implication could be a heightened sense of urgency for Stada and the original private equity groups to finalize their deal quickly, or it could lead to a more comprehensive bidding process.

Consider [mention a relevant real-life example of a competitive bid scenario in the industry].

Factors Influencing the Decision-Making Process

Several factors could influence the final decision-making process in the talks between Stada and the private equity groups. These factors are critical to understanding the potential outcomes.

- Valuation Discrepancies: Differences in the perceived value of Stada between the private equity group and Stada’s management could significantly impact the negotiation process. This disparity in valuation can stem from differing views on future growth potential, market conditions, or the operational efficiency of the company.

- Operational Synergies: The ability to identify and leverage operational synergies between Stada and the private equity group’s portfolio companies will likely be a key determinant. The effectiveness of these synergies will affect the potential return on investment for the private equity firm.

- Regulatory Approvals: Regulatory approvals are a critical component in the acquisition process, particularly in the pharmaceutical sector. Delays or rejections in these approvals can significantly impact the timeline and ultimately the success of the deal.

- Market Conditions: Current market conditions, including economic uncertainties, competitive pressures, and industry trends, will significantly influence the value of Stada and the terms of the deal.

Framework for Evaluating Scenario Success

A robust framework for evaluating the success of different scenarios needs to encompass various criteria, considering both financial and operational aspects.

- Financial Metrics: Key financial metrics, such as the acquisition price, potential return on investment for the private equity group, and the impact on Stada’s shareholder value, are crucial for assessing the financial success of the deal. Examples of relevant financial metrics include the price-earnings ratio, debt-to-equity ratio, and projected revenue growth.

- Operational Efficiency: Evaluating the potential for improved operational efficiency under a new ownership structure is essential. This includes assessing the potential for streamlining operations, reducing costs, and increasing revenue streams.

- Stakeholder Satisfaction: Analyzing the potential satisfaction of various stakeholders, including employees, customers, and suppliers, is crucial for long-term success. This involves assessing the impact of the deal on employment, product availability, and supply chain continuity.

Industry Best Practices

Navigating the complexities of a pharmaceutical company acquisition requires a nuanced understanding of industry best practices. Private equity firms consistently seek to maximize returns, while simultaneously ensuring operational continuity and regulatory compliance. This section examines successful acquisition strategies, highlighting key elements and lessons learned from past transactions.

Successful Acquisition Examples

Several notable acquisitions illustrate successful strategies employed by private equity firms in the pharmaceutical sector. Examples include [Company A]’s acquisition of [Company B], a specialty pharmaceutical company, and [Company C]’s purchase of [Company D], a generic drug manufacturer. These transactions often involve thorough due diligence, strong financial modeling, and a strategic integration plan.

Due Diligence and Financial Modeling

Thorough due diligence is paramount in assessing the target company’s financial health, operational efficiency, and regulatory compliance. This includes evaluating intellectual property, manufacturing capabilities, and market positioning. Robust financial modeling projects the target’s future performance, considering various scenarios and potential risks. Accurate projections are crucial for evaluating the investment’s potential return.

Integration Strategies

Successful integration is vital for maintaining operational efficiency and achieving synergistic benefits post-acquisition. A phased approach, starting with clear communication and establishing shared goals, often proves effective. This involves integrating management teams, merging IT systems, and streamlining processes. The successful integration of [Company X]’s sales force with [Company Y]’s, following their acquisition, serves as a strong example.

Regulatory Considerations

Navigating regulatory hurdles is critical in pharmaceutical acquisitions. Compliance with relevant laws and regulations, including FDA guidelines and other local regulations, is mandatory. Careful attention to regulatory requirements throughout the acquisition process minimizes potential delays and operational disruptions. The acquisition of [Company Z], a biopharmaceutical company, highlighted the importance of meticulous adherence to regulatory frameworks.

Lessons Learned

Past pharmaceutical acquisitions offer valuable lessons. Underestimating the complexity of integrating diverse cultures and operational systems often leads to unforeseen challenges. Prioritizing clear communication and fostering a collaborative environment between the acquiring and target company’s employees is essential. [Company E]’s experience with the acquisition of [Company F], which involved significant challenges in integrating disparate IT systems, underscores the importance of thorough planning and robust execution.

Different Approaches to Integration

Various approaches to integration exist, each with its strengths and weaknesses. Some firms favor a rapid integration strategy, aiming for swift synergies. Conversely, others opt for a more gradual approach, allowing time for a smoother transition. The choice of approach depends on the specific characteristics of the target company and the acquiring firm’s resources and expertise.

Final Thoughts

The potential sale of Stada to private equity firms presents a fascinating case study in the pharmaceutical industry. The discussion encompasses numerous factors, including financial projections, stakeholder concerns, regulatory hurdles, and the potential impact on operations. The outcome of these talks will undoubtedly shape Stada’s trajectory and leave a lasting impression on the pharmaceutical market. The next few months will be critical in determining the ultimate fate of Stada.