Starbucks has received a lot interest china business stake ceo tells ft – Starbucks has received a lot of interest in its China business stake, according to a recent CEO statement to the Financial Times. This signals a significant shift in investor perception, raising questions about the future of Starbucks’ operations in the burgeoning Chinese market. The historical performance, current market standing, and potential drivers behind this increased interest are all factors to consider.

This blog post delves into the details, examining the potential impact on Starbucks’ strategy, the Chinese coffee market as a whole, and the broader investor landscape.

This article explores the background of Starbucks’ China operations, analyzing key milestones, challenges, and the current market position. It further investigates the potential drivers behind this surge in investor interest, including economic factors, industry trends, and Starbucks’ operational strategies. The implications for Starbucks’ future plans, the impact on the broader Chinese coffee market, and investor perspectives will also be discussed.

Background of Starbucks’ China Business

Starbucks’ journey into the Chinese market has been a fascinating blend of rapid expansion, significant challenges, and consistent adaptation. The company’s presence in China has evolved from a cautious entry to a major player in the coffee market, reflecting the nation’s burgeoning consumer class and evolving tastes. The recent statement from the CEO regarding heightened investor interest underscores the ongoing importance of this market for the global coffee giant.

Historical Overview of Starbucks in China

Starbucks’ entry into the Chinese market was marked by a careful approach, starting with strategically chosen locations in major cities. The early years saw a focus on building brand recognition and establishing a presence among affluent consumers. Key milestones included the opening of flagship stores in prominent locations, and the adaptation of menu offerings to cater to local preferences.

Challenges included navigating the complex regulatory environment and understanding the diverse consumer preferences across China’s various regions.

| Year | Event | Impact on Starbucks’ Business |

|---|---|---|

| Early 2000s | Initial entry and cautious expansion | Established a presence, focused on brand recognition among affluent consumers. |

| Mid-2000s | Increased store count, adaptation of menu offerings | Growing brand awareness, beginning to cater to local tastes. Navigating cultural nuances. |

| 2010s | Increased competition, economic fluctuations | Significant challenges from domestic and international competitors. Adapting to changing consumer preferences. |

| Present | Continued expansion, emphasis on technology and personalized experience | Maintaining market leadership, dealing with macroeconomic shifts. |

Current Market Position

Starbucks’ current market position in China is one of considerable strength. The company boasts a large store network and a loyal customer base. However, maintaining market leadership requires continuous innovation and adaptation. Sales figures and store counts reflect the company’s significant market share, although precise numbers fluctuate depending on the reporting period and source. Brand perception varies among consumers, but generally positive, reflecting Starbucks’ efforts to resonate with local preferences and offer unique experiences.

Significance of CEO Statement

The CEO’s statement about increased investor interest in Starbucks’ China business signifies a positive outlook. This signals investor confidence in the long-term potential of the market, potentially driven by factors such as sustained economic growth, favorable regulatory changes, and innovative business strategies. This increased interest suggests a proactive approach to addressing potential challenges and capitalizing on opportunities.

Major Competitors

Starbucks faces robust competition from other coffeehouse chains in China, both domestic and international. Domestic players offer tailored products and experiences catering to specific regional tastes. International competitors also hold a presence, introducing alternative offerings and experiences. These competitors pose a challenge, demanding Starbucks maintain its differentiation and competitive edge in the Chinese market.

Starbucks’s recent interest from Chinese investors is quite intriguing, with the CEO revealing a lot of interest in a business stake. It’s fascinating how these global business deals unfold, especially considering the recent AI-generated list of the most influential fashion designers in history, which highlighted some truly iconic figures. Ultimately, the global reach of Starbucks, and the potential of a Chinese stake, makes for an exciting prospect.

This could be a game changer for the company in the Asian market.

Potential Drivers of Increased Interest: Starbucks Has Received A Lot Interest China Business Stake Ceo Tells Ft

Starbucks’ renewed interest in China, as indicated by the CEO’s recent comments, warrants a deeper look into the potential factors driving this resurgence. The company’s long-standing presence in the Chinese market, coupled with its recent strategic adjustments, likely contribute to the current investor fascination. This analysis will explore economic, industry, and operational factors, along with a comparison to previous investment trends.

Economic Factors

Several economic shifts in China could be attracting investors. The country’s robust consumer spending and increasing disposable income create a promising market for premium products like Starbucks’ offerings. The ongoing urbanization process also leads to the growth of middle-class consumers, often looking for upscale experiences and lifestyle products. Furthermore, China’s improving economic outlook, reflected in rising GDP and positive consumer sentiment, signals a more stable and attractive investment environment.

This can translate into greater investor confidence and potential for returns.

Industry Trends

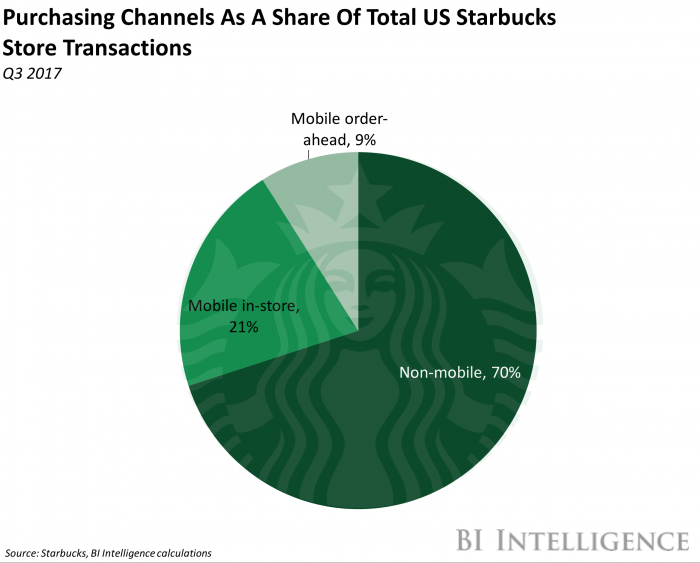

The coffeehouse industry in China is experiencing significant growth. The rising popularity of specialty coffee, coupled with a growing demand for experiential dining and entertainment, fuels the expansion of cafes. Starbucks’ adaptability to evolving consumer preferences, including the integration of digital services and mobile payment options, places it in a strong position to capitalize on these trends. Competitors’ moves into the market also contribute to the heightened industry activity, creating a more competitive and dynamic environment that could entice investors.

Operational Strategies

Starbucks’ operational strategies in China are likely undergoing a strategic shift. Potential adjustments in store design, menu diversification, and marketing approaches to cater to specific regional tastes and preferences are possible. These adaptations could potentially increase market share and brand loyalty. Furthermore, enhancing supply chain efficiency and optimizing operational costs could improve profitability and make the business more attractive to investors.

Comparison to Past Investor Interest

Past investor interest in Starbucks’ China business has been marked by periods of both enthusiasm and caution. The initial enthusiasm was largely driven by the growing consumer market and the brand’s strong global reputation. However, challenges such as fierce competition and adapting to local preferences have also presented headwinds. The current interest, driven by these factors, potentially signals a renewed confidence in the market’s long-term growth potential and Starbucks’ ability to overcome previous obstacles.

Potential Factors Influencing Investor Interest, Starbucks has received a lot interest china business stake ceo tells ft

| Factor | Explanation | Impact |

|---|---|---|

| Robust Consumer Spending | Increasing disposable income and a strong consumer base in China create a significant market for premium products. | Positive; potentially high returns on investment. |

| Rising Disposable Income | Higher incomes enable consumers to spend more on discretionary items like premium coffee and associated experiences. | Positive; expansion potential for Starbucks. |

| Evolving Industry Trends | Growing popularity of specialty coffee and experiential dining attracts investors and creates a dynamic market. | Positive; market opportunities for strategic growth. |

| Operational Adjustments | Adaptations in store design, menu offerings, and marketing strategies to align with local tastes. | Positive; enhanced market positioning and potential for increased profitability. |

| Improved Economic Outlook | Positive economic indicators in China create a more stable and attractive investment environment. | Positive; confidence in long-term growth and stability. |

Implications for Starbucks’ Strategy in China

Starbucks’ renewed interest in China, as reported by the CEO, suggests a potential shift in the company’s strategy in the region. This heightened interest signals a desire to re-evaluate and potentially adjust its approach to capitalizing on the significant opportunities and challenges presented by the Chinese market. The implications span across pricing, product offerings, and operational efficiency, impacting Starbucks’ long-term plans in China.The increased interest likely stems from a combination of factors, including a desire to regain market share, capitalize on evolving consumer preferences, and potentially leverage the current investment climate in the Chinese market.

Understanding the implications of this renewed focus is crucial for evaluating Starbucks’ future trajectory in China.

Potential Impact on Pricing

Starbucks’ pricing strategy in China will likely be a crucial factor in its success. The company may consider adjusting prices to align with local market dynamics, potentially offering more affordable options to broaden its customer base. Competition from local coffee chains and international players is intensifying, prompting Starbucks to adopt a more flexible pricing approach to maintain competitiveness.

For instance, they could offer tiered pricing based on product complexity or implement promotional strategies to attract price-conscious customers.

Starbucks’s recent interest in China, with the CEO mentioning a potential business stake, is certainly intriguing. However, the current global climate, particularly with US auto suppliers needing immediate action due to China’s rare earth restrictions, highlights the complex interplay between global markets and supply chains. This all ultimately affects the overall business landscape, even for a company like Starbucks looking to expand in China.

Product Offerings

The company may also adapt its product offerings to better suit Chinese consumer preferences. This could involve introducing new products tailored to the local palate or adjusting existing offerings to incorporate local ingredients. Additionally, incorporating more plant-based milk options and exploring new coffee varieties could be part of this strategy. Examples of successful adaptation include local tea-based drinks or unique pastries that resonate with Chinese tastes.

Marketing Strategies

Starbucks’ marketing strategies in China will undoubtedly evolve. Increased emphasis on digital marketing, social media engagement, and collaborations with local influencers will be vital. Personalized experiences, catering to specific cultural nuances, will be essential. Understanding the nuances of Chinese consumer behavior is crucial for creating effective campaigns that resonate with the target audience.

Operational Efficiency and Expansion Plans

The company’s operational efficiency could be optimized through improved supply chain management, streamlined store operations, and increased digital integration. Starbucks may consider expanding its store footprint strategically, focusing on high-traffic areas and strategic locations that align with consumer preferences. Expanding its delivery and mobile order options could also improve efficiency.

Potential Risks and Opportunities

The increased interest presents both risks and opportunities for Starbucks. Competition from local and international rivals is fierce, demanding strategic agility and innovation. Economic fluctuations in China, geopolitical uncertainties, and regulatory changes are potential risks. However, the growing middle class and the rising demand for premium coffee create significant opportunities for Starbucks to increase its market share and revenue.

Potential Strategic Responses by Starbucks

| Strategy | Rationale | Potential Outcomes |

|---|---|---|

| Adjust pricing to align with local market dynamics | To attract a broader customer base and maintain competitiveness. | Increased customer base, potentially higher sales volume, enhanced brand image. |

| Introduce new products tailored to Chinese preferences | To cater to diverse tastes and meet evolving consumer demands. | Enhanced product portfolio, improved customer satisfaction, potential for new revenue streams. |

| Enhance digital marketing and social media engagement | To connect with customers more effectively and foster brand loyalty. | Increased brand visibility, stronger customer engagement, improved customer retention. |

| Optimize operational efficiency | To reduce costs, improve service quality, and enhance customer experience. | Cost savings, improved operational efficiency, higher profitability. |

| Strategic store expansion | To capitalize on high-growth areas and meet evolving consumer demand. | Enhanced market presence, increased sales volume, improved brand reach. |

Impact on the Chinese Coffee Market

Starbucks’ renewed focus on China, with increased investment potentially signaling a significant shift in the market. This increased presence will undoubtedly ripple through the entire Chinese coffee landscape, impacting both established and emerging players. The implications for consumer preferences and the overall coffee market are multifaceted and warrant careful consideration.

Potential Effects on Other Coffee Brands

The heightened competition brought by Starbucks’ expanded investment will likely put pressure on other coffee brands, both international and domestic. Smaller, independent coffee shops may face challenges in attracting customers, particularly if they struggle to differentiate themselves from the established giants. This competitive landscape will force adaptation and innovation. For example, independent shops may need to offer unique experiences, specialized drinks, or strong local partnerships to stand out.

Impact on Coffee Consumption Patterns and Preferences

Starbucks’ dominance in the global coffee market translates to influence on consumer preferences. The brand’s established presence and marketing prowess can potentially shape Chinese coffee consumption patterns. As Starbucks’ offerings become more accessible and familiar, consumers may adopt a more sophisticated taste for coffee, shifting from less-refined local alternatives to more diverse and premium options. This could also lead to an increase in overall coffee consumption, but this is not a guaranteed outcome.

Comparison with Growth of Other International Coffee Chains

The growth of Starbucks in China contrasts with that of other international coffee chains, exhibiting different market penetration strategies and successes. Factors like local partnerships, regulatory environment, and cultural adaptation play significant roles in shaping the trajectory of each chain. While Starbucks has a longer history and greater resources, other international players are actively vying for a piece of the lucrative Chinese market, often focusing on niche segments or different pricing strategies.

Market Share and Growth of Different Coffee Brands in China

| Coffee Brand | Market Share (Approximate %) | Growth Rate (Estimated %) | Key Strategies |

|---|---|---|---|

| Starbucks | (20-30%) | (10-15%) | Strong brand recognition, extensive store network, premium offerings |

| Costa Coffee | (10-15%) | (8-12%) | Focus on quality, varied product offerings, consistent brand image |

| Nescafé | (5-10%) | (5-8%) | Strong brand recognition, extensive distribution network, wide range of products |

| Local Brands | (40-50%) | (10-15%) | Regional variations, unique offerings, competitive pricing, localized marketing |

Note: Market share and growth figures are approximate estimates and vary based on specific reporting periods and market analysis sources. Local brands, while holding a substantial market share, may experience fluctuating growth rates depending on their individual strategies and market conditions.

Investor Perspectives and Analysis

Starbucks’ potential China business stake has sparked considerable investor interest. The CEO’s statement, signaling a renewed commitment to the market, has likely triggered a wave of analysis and speculation about the long-term viability and profitability of Starbucks’ operations in China. Understanding investor perspectives is crucial for assessing the overall market sentiment and potential impact on the company’s future performance.Investors are likely scrutinizing the nuances of Starbucks’ China strategy, examining the potential for growth, profitability, and risk mitigation.

A variety of factors, including the ongoing economic climate in China, competitive pressures, and the evolving consumer preferences, will play a critical role in shaping investor decisions. Understanding these dynamics is essential for evaluating the potential financial benefits and risks associated with investing in Starbucks’ China operations.

Reasons for Investor Interest

The renewed focus on the China market by Starbucks, coupled with the CEO’s positive outlook, fuels investor interest. This renewed commitment signifies a potential turnaround, which is attractive to investors seeking growth opportunities in the sector. Moreover, the historical success and brand recognition of Starbucks in China provide a foundation for future expansion and revenue generation. Investors also recognize the potential for tapping into a large consumer base and leveraging the existing retail network.

Potential Financial Benefits and Risks

Investing in Starbucks’ China business carries significant potential financial rewards. Increased market share, leveraging the existing infrastructure, and sustained revenue growth could lead to substantial returns for investors. However, potential risks include economic downturns, regulatory changes, and intense competition from local players. The evolving regulatory landscape in China could pose challenges, and fluctuating consumer preferences also add uncertainty.

Managing these risks effectively will be crucial for investors seeking to maximize returns.

Starbucks’s hot interest in China’s business stake, as reported by the FT, is certainly intriguing. Considering the current global market fluctuations, particularly the rise in TSX futures and crude oil prices, alongside the ongoing US-China talks, as seen in this article , it’s interesting to see how these factors might influence Starbucks’s future plans and profitability in the region.

Ultimately, the CEO’s comments about the high demand for a Starbucks presence in China remain a key point of discussion.

Factors Investors Might Consider

Investors will assess the competitive landscape, evaluating the strength of Starbucks’ brand and the effectiveness of its strategies compared to competitors. Economic indicators, such as consumer spending and GDP growth, will be analyzed to gauge the overall market potential. Furthermore, the company’s financial performance in the region, including profitability margins and revenue streams, will be closely examined. Finally, investor attention will focus on the potential for expansion and the scalability of Starbucks’ China operations.

Different Perspectives on Investor Reactions

Investor reactions to the CEO’s statement are likely varied. Some investors may view it as a positive signal, indicating confidence in the future of Starbucks’ China business. Others may be more cautious, emphasizing the need for concrete evidence of successful execution to support the optimistic outlook. These differing perspectives highlight the complexity of assessing the market sentiment surrounding Starbucks’ China operations.

Investor Type, Concerns, and Anticipated Actions

| Investor Type | Concerns | Anticipated Actions |

|---|---|---|

| Long-term value investors | Sustainability of growth, regulatory changes, and competitive pressures | Thorough due diligence, potentially increasing stake if conditions are favorable, closely monitoring financial reports |

| Short-term traders | Market volatility, potential for short-term price fluctuations, uncertainty surrounding execution | Closely monitoring market trends, potentially taking a more opportunistic approach, and reacting to short-term price signals |

| Institutional investors | Alignment with long-term strategic goals, risk mitigation strategies, and potential impact on portfolio diversification | Reviewing existing portfolio holdings, evaluating the overall market risk, and possibly adjusting investment allocations |

| Retail investors | Potential for significant capital gains, brand recognition, and perceived stability | Monitoring news and market analysis, potentially adjusting individual investments based on their risk tolerance and investment objectives |

Public Perception and Brand Image

Starbucks’ presence in China has always been closely intertwined with public perception. Beyond the economic aspects, the brand’s image plays a crucial role in its success. A shift in business strategy, as indicated by the CEO’s statements, inevitably impacts this perception, potentially triggering varied reactions among consumers.Public opinion in China is often nuanced and complex, influenced by a multitude of factors beyond simple economic considerations.

The statement regarding the increased business stake signals a commitment, but also raises questions about the company’s long-term goals and potential impact on the local market. This prompts scrutiny and discussion about the company’s future operations and its commitment to Chinese consumers.

Starbucks’ Image in China

Starbucks has built a strong brand image in China, largely associating the brand with quality coffee, a comfortable atmosphere, and a lifestyle choice. However, this image is not without its complexities. Some consumers view Starbucks as a symbol of Western influence, a point of contention for some, while others see it as a sophisticated and desirable experience. The brand has also been associated with the more affluent segments of Chinese society, potentially creating a perception gap with the broader consumer base.

Potential Impact of Increased Stake

The CEO’s statement, indicating a stronger commitment to the Chinese market, might affect public perception in several ways. Positive reactions could include increased trust and confidence in Starbucks’ long-term commitment to China, potentially boosting the brand’s image and attracting new customers. However, there’s also a possibility of negative reactions. Concerns about potential price increases, reduced service quality, or even cultural insensitivity might arise.

These concerns are not entirely unfounded, as they have been observed in other instances of foreign companies entering or expanding in China.

Public Opinion Examples

Public opinion regarding Starbucks in China is demonstrably diverse. Online forums and social media platforms often feature discussions on the pricing policies, service quality, and perceived cultural appropriateness of the brand. Some praise the quality of coffee and atmosphere, while others criticize the high prices and perceived elitism. There are even instances where the brand has been linked to social or political issues, albeit indirectly, prompting online debates and reactions.

Varying Perspectives on Public Reaction

Different perspectives exist on the public reaction to Starbucks’ increased interest in China. Some analysts anticipate a positive response, citing the brand’s established popularity and the potential for continued growth. Others express concern about potential pushback from consumers, particularly if perceived changes in pricing or service quality occur. These contrasting views underscore the complexity of public opinion and the need for Starbucks to carefully manage its operations to maintain a positive image in the Chinese market.

Concluding Remarks

In conclusion, the increased interest in Starbucks’ China business stake presents a complex picture of opportunities and challenges. While the surge in investor interest suggests strong potential, Starbucks must carefully consider the implications for its strategy, operations, and market positioning. The overall impact on the Chinese coffee market, investor reactions, and public perception will be crucial to the long-term success of Starbucks in China.

The potential for growth is significant, but careful consideration of all facets of this evolving situation is essential.