Trade war is tougher threat than covid emerging market cenbanks imf says. This stark assessment highlights a critical economic challenge facing emerging markets. The ongoing trade disputes are causing significant disruptions, far surpassing the economic fallout of the pandemic in their impact on these nations. Reduced exports, strained supply chains, and ripple effects throughout various sectors are just a few of the devastating consequences.

This article delves into the multifaceted impact of trade wars, comparing them to the COVID-19 pandemic, examining the IMF’s role, and analyzing emerging market central bank responses.

The IMF’s findings underscore the profound economic ramifications of trade wars, emphasizing their disproportionate impact on developing economies. This analysis examines the intricate interplay between trade restrictions and economic performance, focusing on the specific vulnerabilities of emerging markets. The report also considers how these challenges interact with other global shocks, ultimately threatening long-term growth prospects. The implications for these economies are significant, requiring careful consideration and tailored responses from both national governments and international organizations like the IMF.

Impact of Trade Wars on Emerging Markets

Trade wars, characterized by escalating tariffs and trade restrictions between nations, pose a significant threat to emerging market economies. These economies, often heavily reliant on international trade for growth and development, are disproportionately vulnerable to the disruptions caused by such conflicts. The ripple effects extend beyond the immediate trading partners, impacting global supply chains and investor confidence, with emerging markets frequently bearing the brunt of the fallout.Trade wars negatively affect emerging market economies through a multitude of channels.

Reduced exports due to higher tariffs and retaliatory measures directly diminish revenue streams and economic activity. Supply chain disruptions, often resulting from the imposition of trade barriers, lead to increased costs for businesses, hindering production and potentially causing job losses. The resulting decrease in foreign direct investment (FDI) further compounds the problem, limiting access to capital and technology crucial for economic development.

The IMF’s recent report highlighting trade wars as a bigger threat than COVID-19 to emerging markets is a sobering reminder of global economic fragility. While the pandemic certainly wreaked havoc, the escalating trade tensions are proving a more persistent and potentially crippling issue. This echoes some of the satirical humor seen in SNL’s most controversial moments , where comedic exaggerations can sometimes surprisingly reflect real-world anxieties.

Ultimately, the IMF’s warning underscores the need for global cooperation to navigate these challenging economic waters.

Reduced Export Revenue

Reduced export revenue is a primary channel through which trade wars harm emerging markets. Emerging economies frequently rely on exporting raw materials, manufactured goods, and agricultural products to developed nations. When trade barriers are erected, export volumes decline, leading to a contraction in export-led growth. This contraction translates into a significant reduction in foreign exchange earnings, impacting the ability of these economies to import essential goods and services.

For instance, a decrease in exports of textiles from Bangladesh due to increased tariffs from major trading partners would directly affect the country’s GDP.

Supply Chain Disruptions

Supply chain disruptions caused by trade wars can be particularly damaging to emerging market economies. These economies often serve as crucial components in global supply chains, providing intermediate goods or assembling final products. When trade restrictions are imposed, the smooth flow of inputs and outputs is disrupted, leading to delays, increased costs, and reduced production. This is often seen in industries relying on global components for production, such as electronics manufacturing in countries like Malaysia or Vietnam.

Impact on Specific Emerging Markets

Several emerging market economies have been particularly vulnerable to trade wars in the past. For example, Brazil, heavily reliant on agricultural exports, has faced significant challenges during periods of trade tensions. Similarly, countries heavily involved in manufacturing, such as Mexico, have experienced disruptions in their export-oriented sectors due to trade barriers. Furthermore, countries like South Africa, reliant on both manufacturing and commodity exports, have faced difficulties navigating the complexities of global trade disputes.

Comparison to Other Economic Shocks

While global recessions and pandemics also inflict economic pain, trade wars present a unique set of challenges. Trade wars specifically target international trade flows, often leading to retaliatory measures that amplify the initial impact. Pandemics, on the other hand, often disrupt production and consumption through restrictions on movement and social distancing. Global recessions typically impact all economies, but trade wars can disproportionately affect emerging markets due to their reliance on international trade.

Table: Effects of Trade Wars on Emerging Market Sectors

| Sector | Impact of Trade Wars |

|---|---|

| Manufacturing | Reduced exports, supply chain disruptions, lower production, potential job losses. |

| Agriculture | Reduced export opportunities, higher input costs, market volatility, impacting food security. |

| Services | Reduced demand from foreign tourists and businesses, lower FDI. |

| Finance | Reduced capital inflows, currency volatility, decreased investor confidence. |

Comparison of Trade Wars and COVID-19 Impacts

The global economy has faced unprecedented challenges in recent years, with trade wars and the COVID-19 pandemic significantly impacting emerging markets. Understanding the similarities and differences in their economic effects is crucial for formulating effective policy responses and mitigating future risks. Both crises have disrupted supply chains, reduced investment, and exacerbated existing vulnerabilities in these economies.The intertwined nature of these crises underscores the importance of a holistic approach to economic policymaking.

Addressing the specific challenges posed by each crisis while recognizing their interconnectedness is vital for promoting sustainable and resilient growth in emerging markets.

Similarities in Economic Effects

Both trade wars and the COVID-19 pandemic led to significant disruptions in global supply chains. Reduced trade volumes and uncertainty hindered export-oriented industries in emerging markets, leading to job losses and economic contraction. Both crises also triggered capital flight, as investors sought safer havens, further exacerbating financial vulnerabilities in many emerging economies. Moreover, both crises contributed to a decline in consumer confidence and reduced domestic demand, leading to a slowdown in economic activity.

Differences in Economic Effects

While both crises share some common economic effects, crucial differences exist. The trade war’s impact was primarily concentrated in specific sectors reliant on international trade. The COVID-19 pandemic, however, had a more widespread impact across various sectors and economies, due to lockdowns and social distancing measures. Furthermore, the COVID-19 pandemic led to an unprecedented surge in government spending and debt in many countries, a phenomenon less directly linked to trade wars.

The initial response to the pandemic also involved significant central bank intervention, which was less pronounced during the trade war period.

Interaction of Crises

The trade war and the COVID-19 pandemic interacted to exacerbate economic challenges in emerging markets. Reduced trade volumes during the trade war created vulnerabilities that were amplified by the pandemic’s disruption of supply chains and demand. The combined effect led to significant economic hardship and hindered efforts to recover from either crisis in isolation. For example, countries heavily reliant on exports were particularly vulnerable, as both crises reduced demand for their goods.

The IMF’s recent report highlighting trade wars as a bigger threat than COVID-19 to emerging market central banks is certainly a sobering thought. It’s a stark reminder of the global economic instability we’re facing. While issues like the recent controversy over US military bases restoring names changed after racial justice protests (see us military bases restore names changed after racial justice protests trump says ) definitely grab headlines, the long-term economic fallout from trade disputes could ultimately have a far greater impact on global stability, echoing the IMF’s warning about the vulnerability of emerging markets.

Long-Term Consequences

The long-term consequences of trade wars and the COVID-19 pandemic are likely to be significant and intertwined. Trade wars can permanently alter trading patterns, while the pandemic has accelerated digitalization and e-commerce, reshaping global trade. The pandemic’s impact on labor markets and human capital development could also have long-lasting consequences for emerging market growth prospects. The extent of these consequences depends on the policies implemented to address the short-term and long-term impacts of both crises.

Economic Responses of Emerging Market Central Banks

| Crisis | Immediate Response | Long-Term Response |

|---|---|---|

| Trade Wars | Limited monetary easing; focus on managing exchange rate volatility. | Emphasis on structural reforms to enhance resilience to external shocks; diversifying export markets. |

| COVID-19 Pandemic | Aggressive monetary easing and fiscal stimulus; increased liquidity provision. | Focus on strengthening healthcare systems and promoting digitalization; supporting job creation and SME development. |

This table highlights the contrasting approaches taken by emerging market central banks in response to the two crises. The immediate responses reflected the specific challenges posed by each crisis, while the long-term responses aimed at building resilience and promoting sustainable growth.

Role of IMF in Addressing Trade War Challenges

The escalating trade wars of recent years have significantly impacted emerging market economies, disrupting supply chains, hindering export growth, and eroding investor confidence. The International Monetary Fund (IMF) has played a crucial role in mitigating these negative consequences, offering various forms of support to countries facing these challenges. Their actions aim to stabilize economies, promote resilience, and ultimately foster sustainable growth in the face of global trade disputes.The IMF’s involvement in addressing trade war challenges goes beyond simply providing financial assistance.

Their approach encompasses a wide range of tools and strategies tailored to specific country needs, recognizing the diverse economic landscapes of emerging markets. The IMF’s efforts focus on promoting policy reforms, structural adjustments, and financial stability, thus enhancing the resilience of these economies against future trade shocks.

IMF Support for Emerging Market Countries

The IMF provides a range of support to emerging market economies facing trade war pressures. This assistance is designed to address the specific economic challenges arising from trade disputes. It often involves financial resources, technical expertise, and policy advice tailored to each country’s situation. For instance, the IMF may provide loans to help stabilize a country’s currency or balance of payments, a vital measure during times of economic turmoil.

The IMF’s recent report highlighting trade wars as a bigger threat than COVID-19 to emerging market central banks is a sobering reminder. This aligns with the current market sentiment, which shows a mild bearish bias for the rupee against the dollar, particularly with the ongoing US-China trade talks ( mild bearish bias rupee dollar strength us china talks eyed ).

Ultimately, the trade war’s long-term implications for global economies remain a far more significant concern than the lingering impact of the pandemic.

Types of IMF Assistance

The IMF offers a variety of assistance mechanisms to mitigate the negative impacts of trade wars. These mechanisms include:

- Financial Assistance: Loans can help countries maintain essential services, stabilize their currencies, and manage balance of payments issues. These loans often come with conditions, promoting sound economic policies and structural reforms.

- Technical Assistance: The IMF provides expertise and training in areas such as fiscal management, monetary policy, and financial sector development. This technical support helps countries strengthen their capacity to manage the complexities of trade disputes.

- Policy Advice: The IMF offers advice on economic policies and reforms that can help emerging markets adapt to trade war challenges. This might include advice on trade diversification, investment promotion, and structural reforms.

IMF Strategies for Fostering Economic Resilience

The IMF employs strategies to bolster economic resilience in emerging markets amidst trade disputes. These strategies focus on strengthening institutions, improving governance, and enhancing the overall economic environment.

- Strengthening Institutions: The IMF works with countries to improve the effectiveness of their institutions, including central banks, fiscal ministries, and regulatory bodies. This enhances their ability to respond effectively to economic shocks and trade disruptions.

- Improving Governance: Promoting good governance and transparency helps attract foreign investment and reduce corruption, strengthening a nation’s ability to navigate trade disputes.

- Enhancing the Economic Environment: The IMF promotes policies that foster a more conducive economic environment, including measures that promote competitiveness, improve infrastructure, and enhance human capital.

IMF Recommendations for Varying Economic Development Levels

The IMF tailors its recommendations to the specific economic development levels of each country. Countries with different levels of economic development require varying approaches. For instance, a recommendation for a developing country may focus on promoting export diversification, while a recommendation for a more established emerging market might emphasize financial sector reforms to manage external shocks.

IMF Key Initiatives and Outcomes

| IMF Key Initiative | Intended Outcomes |

|---|---|

| Capacity Building Programs | Enhanced capacity of emerging market countries to manage trade shocks and develop strategies for resilience. |

| Policy Advice on Trade Diversification | Reduced reliance on specific export markets, thereby lessening the impact of trade disputes. |

| Financial Support for Balance of Payments | Maintenance of essential imports and services, preventing severe economic disruptions. |

| Structural Reforms to Promote Economic Growth | Sustainable and resilient economic growth in the long term, minimizing the long-term impact of trade disputes. |

Emerging Market Central Bank Responses

Emerging market economies have been disproportionately affected by global trade wars. The disruptions to supply chains, reduced export demand, and uncertainty surrounding trade policies have created significant economic headwinds. Central banks in these regions have played a crucial role in mitigating the impact of these trade wars, often navigating complex economic landscapes and balancing competing objectives.Central banks in emerging markets face unique challenges when responding to trade wars.

Their economies are often more reliant on exports and foreign investment, making them highly susceptible to global shocks. Additionally, they frequently operate in a less developed financial environment, with less sophisticated financial markets and instruments available to them. The responses of these central banks, therefore, must consider not only the immediate effects of trade disputes but also the long-term stability of their economies.

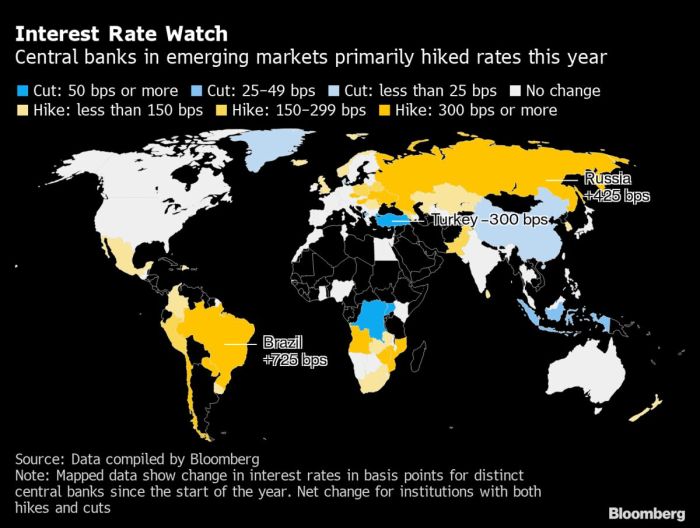

Monetary Policy Tools Employed

Central banks in emerging markets have employed a range of monetary policy tools to address the economic fallout from trade wars. These tools often include adjusting interest rates, managing exchange rates, and implementing quantitative easing measures. The specific tools and strategies employed have varied across regions, depending on the particular vulnerabilities and characteristics of each economy.

- Interest Rate Adjustments: Central banks often adjust policy interest rates to influence borrowing costs and stimulate or cool down economic activity. For instance, during a trade war impacting exports, a central bank might lower interest rates to encourage investment and consumption, boosting domestic demand. However, a significant drop in interest rates could also lead to currency depreciation, which may not be desirable in the context of the trade war, if it exacerbates import costs.

This necessitates a careful balancing act.

- Exchange Rate Management: Central banks may intervene in foreign exchange markets to manage the value of their currency. A depreciating currency can boost exports, but it can also increase import costs, potentially fueling inflation. The choice of whether to actively manage the exchange rate or allow it to float depends on the specific circumstances and trade dynamics of each country.

- Quantitative Easing (QE): In some cases, central banks might use QE, injecting liquidity into the financial system to support credit availability and overall economic activity. This can be particularly relevant when credit markets are under stress due to uncertainty stemming from the trade war. However, the effectiveness of QE can vary depending on the maturity of the financial market and its overall structure.

Regional Comparisons of Responses

The responses of central banks in different regions have varied significantly during trade disputes. For example, central banks in Latin America might focus on maintaining currency stability to mitigate inflationary pressures from increased import costs, while those in Southeast Asia might emphasize supporting export-oriented industries. These differences highlight the need for tailored responses based on the specific characteristics of each economy.

Challenges and Limitations

The effectiveness of central banks’ responses to trade wars is often constrained by various factors. These include limited policy space, political considerations, and the presence of other economic shocks, such as commodity price volatility. The simultaneous occurrence of multiple economic shocks can make it challenging for central banks to isolate the effects of trade wars and respond appropriately.

Furthermore, the interconnected nature of global markets can make it difficult to predict the full impact of trade disputes on a particular economy.

| Emerging Market Region | Key Monetary Policy Tools | Specific Considerations |

|---|---|---|

| Latin America | Interest rate adjustments, exchange rate management | Maintaining currency stability, mitigating inflationary pressures |

| Southeast Asia | Interest rate adjustments, supporting export-oriented industries, QE | Stimulating domestic demand, supporting export competitiveness |

| Eastern Europe | Interest rate adjustments, foreign exchange interventions | Balancing the need to support growth with maintaining stability |

Illustrative Case Studies

Trade wars inflict significant hardship on emerging markets, often exacerbating existing vulnerabilities. These nations, heavily reliant on international trade, face disruptions in supply chains, reduced export revenues, and diminished investor confidence. Analyzing specific case studies reveals the diverse impacts and the crucial role of policy responses, particularly from central banks and governments, in mitigating the damage. Understanding how emerging economies navigate these crises provides valuable insights for future preparedness and resilience.

Impact on a Specific Emerging Market Country

The impact of trade wars on emerging markets is frequently severe. One such example is the impact on South Africa during the 2018-2020 period. South Africa, heavily reliant on exports of raw materials and manufactured goods, suffered from reduced demand from major trading partners embroiled in trade disputes. The trade war’s ripple effect significantly hindered economic growth and contributed to rising unemployment.

Central Bank and Government Responses, Trade war is tougher threat than covid emerging market cenbanks imf says

South Africa’s central bank, the South African Reserve Bank (SARB), adopted a cautious monetary policy approach in response. This involved lowering interest rates to stimulate economic activity and potentially mitigate the negative impact of reduced trade volumes. The government implemented measures aimed at diversifying export markets, bolstering local industries, and providing social safety nets for vulnerable populations.

IMF Assistance

The International Monetary Fund (IMF) played a crucial role in assisting South Africa. The IMF provided technical support and financial assistance, focusing on structural reforms to enhance the country’s resilience to external shocks. This included support for fiscal consolidation and promoting sustainable economic growth.

Successful and Unsuccessful Strategies

Various emerging market countries have employed a range of strategies to navigate trade war challenges. Successful strategies often focused on diversifying export markets and strengthening domestic industries. This diversification reduces reliance on a single or a few trading partners, thereby lessening the impact of trade tensions.

- Successful strategies often involved bolstering domestic industries to create alternative sources of economic activity, creating a more robust and resilient economy.

- Conversely, some countries experienced setbacks due to inadequate diversification efforts, leading to greater vulnerability during trade conflicts.

Key Takeaways from Case Studies

The following table summarizes the key lessons learned from trade war impacts on emerging market economies, using South Africa as a case study:

| Aspect | Impact on South Africa | Key Takeaway |

|---|---|---|

| Economic Growth | Reduced due to reduced export demand | Diversification of export markets is crucial for mitigating trade war risks. |

| Employment | Increased unemployment | Strong social safety nets and targeted support programs are essential to protect vulnerable populations. |

| Central Bank Response | Lowered interest rates to stimulate activity | Flexible and proactive monetary policy can help to mitigate the economic downturn. |

| Government Response | Measures to diversify export markets and support local industries | Government support for diversification and local industries is critical. |

| IMF Assistance | Provided technical and financial assistance | International support, such as from the IMF, can play a significant role in providing resources and expertise. |

Conclusion: Trade War Is Tougher Threat Than Covid Emerging Market Cenbanks Imf Says

In conclusion, the IMF’s assertion that trade wars pose a graver threat than the COVID-19 pandemic to emerging markets demands urgent attention. The interconnected nature of these economic challenges underscores the need for coordinated global responses. Central banks’ actions, IMF support, and the specific strategies adopted by emerging markets will play a crucial role in mitigating the long-term consequences of trade disputes.

The case studies presented highlight the varied experiences and responses to these pressures, emphasizing the importance of tailored solutions to address the unique challenges faced by each nation.