Us china trade war pause – With the US-China trade war pause, a new chapter in international relations unfolds. This period of respite, after years of escalating tariffs and trade restrictions, offers a chance to assess the past, understand the motivations behind the pause, and explore potential future scenarios. The economic and geopolitical implications are substantial, affecting everything from global supply chains to consumer prices.

The trade war, marked by significant trade actions and diplomatic efforts, profoundly impacted both economies. This pause, born from a complex interplay of political and economic factors, is a pivotal moment to analyze its causes, immediate impacts, and long-term consequences for global trade and relations.

Background of the Trade War Pause

The US-China trade war, a period of escalating economic and political tensions, began in 2018. This conflict significantly impacted global trade, investment, and economic growth. The pause in the trade war, while not a complete resolution, represents a temporary reprieve from the previous escalating trade actions.The trade war’s origins lay in disagreements over trade imbalances, intellectual property theft, and forced technology transfer.

These issues, coupled with broader geopolitical concerns, led to a series of retaliatory tariffs and trade restrictions imposed by both nations. This period of tension significantly altered the global economic landscape, prompting adjustments in supply chains and investment strategies.

Key Events and Escalating Tensions

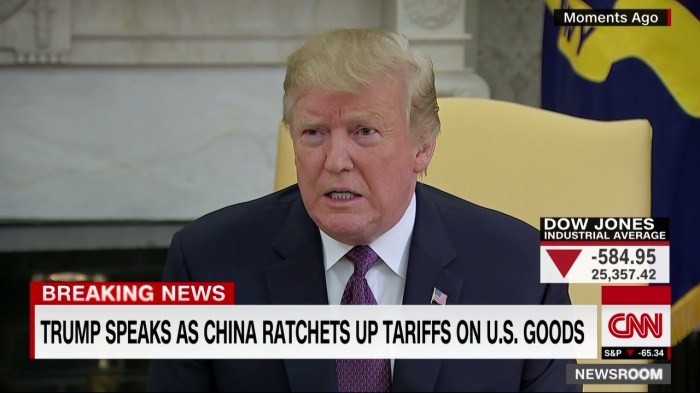

The US initiated the trade war with the imposition of tariffs on Chinese goods in 2018. These initial tariffs targeted a wide range of products, including technology, consumer goods, and agricultural products. China responded with retaliatory tariffs on US goods, leading to a cycle of escalating trade restrictions. This back-and-forth exchange significantly disrupted international trade flows and fostered uncertainty in global markets.

Specific Trade Actions

The US implemented a series of tariffs on Chinese goods, targeting various sectors of the Chinese economy. These tariffs aimed to pressure China to change its trade practices. China responded with tariffs on US goods, impacting industries such as agriculture and manufacturing. These actions significantly affected the competitiveness of both nations in global markets.

- US Tariffs: Tariffs were initially imposed on a range of Chinese imports, including technology products, consumer goods, and agricultural products. Tariffs on specific products, such as steel and aluminum, were also applied as part of the overall trade restrictions.

- Chinese Retaliation: China responded to the US tariffs with retaliatory tariffs on US agricultural products, manufactured goods, and technology. The Chinese response was aimed at mitigating the economic impact of the US actions.

Economic Impacts

The trade war had substantial economic repercussions for both the US and China. Changes in trade volumes, consumer prices, and investment patterns were notable.

- Trade Volumes: Trade volumes between the US and China declined as a result of the tariffs. This impacted global supply chains and reduced overall trade activity.

- Consumer Prices: Consumer prices in both countries were affected by the tariffs, as increased costs were passed down to consumers. The prices of certain goods increased, impacting the affordability of goods.

- Investment Patterns: Investment flows between the US and China were affected by the trade tensions. Companies reassessed their investment strategies in light of the uncertainty and potential disruptions in the trade relationship.

Diplomatic Efforts and Negotiations

Numerous diplomatic efforts and negotiations were undertaken to address the trade disputes between the US and China. These efforts involved high-level talks, meetings, and discussions between representatives from both countries. These attempts ultimately led to a temporary pause in the trade war.

- Trade Negotiations: Representatives from both countries engaged in various rounds of trade negotiations, aimed at resolving the disputes and finding common ground. These negotiations involved extensive discussions on specific trade issues.

- High-Level Talks: Discussions between high-level officials from both countries aimed to address broader geopolitical concerns and find ways to improve the trade relationship.

Reasons for the Trade War Pause

The US-China trade war, a period of escalating tariffs and economic friction, has seen periods of both intense conflict and temporary pauses. Understanding the motivations behind these pauses is crucial for analyzing the complex relationship between the two economic superpowers. These pauses, while not necessarily representing a complete resolution, often signal shifts in geopolitical priorities and economic realities.The trade war’s pause, though temporary, reveals the delicate interplay of political maneuvering, economic pressures, and global considerations.

It highlights the interconnectedness of national interests and the role of external factors in shaping policy decisions. The following sections delve into the specific political, economic, and international influences that contributed to the temporary cessation of the trade war.

Political Motivations

Both the US and China possess intricate political motivations that influenced the pause. Domestic political pressures, the need for maintaining international standing, and the desire to address specific issues, all played a significant role. The US, for example, might have paused the trade war to focus on other pressing domestic issues, such as election cycles, or to present a more unified front on the global stage.

China, similarly, might have sought to de-escalate tensions to maintain economic stability and foster a positive international image.

Economic Factors

Economic realities are a significant driver in international relations. The global economic slowdown and the resultant impact on both countries’ economies played a critical role in the pause. The US, recognizing the negative consequences of the trade war on its own industries and consumers, might have sought to mitigate these effects. China, facing similar economic headwinds, likely realized the detrimental impact of the trade war on its export-oriented economy and sought to stabilize trade relations.

International Pressure and Global Economic Conditions

The global community exerted considerable pressure on both the US and China to de-escalate the trade war. International organizations, such as the WTO, and global financial institutions, voiced concerns about the negative impacts of the trade war on the global economy. The interconnectedness of global markets meant that the trade war’s effects were felt beyond the borders of the US and China.

This international pressure, coupled with a worsening global economic climate, likely contributed to the pause.

Agreements and Commitments

The specific agreements or commitments made by both countries to achieve the pause are often complex and nuanced. While not always publicly stated, various agreements, perhaps involving specific trade concessions or commitments to future negotiations, likely underpinned the pause. These agreements, though not always formally documented, underscore the willingness of both nations to find common ground in times of economic and geopolitical pressure.

Impact of the Trade War Pause on the Global Economy

The recent pause in the US-China trade war has presented a unique opportunity to assess its impact on the global economy. While the full effects may not be immediately apparent, early indicators suggest a potential for positive shifts in global trade, investment, and market sentiment. This period of relative calm allows for a more measured examination of how the trade friction has affected different economies and industries.The pause in the trade war, though not a complete resolution, has created a climate conducive to a more nuanced understanding of the economic ramifications.

The pause in the US-China trade war might seem like a win for global economies, but its impact on the job market, particularly for recent college graduates, is undeniable. Many are struggling to find employment, facing increased competition and uncertainty. The current state of the job market for college graduates is causing concern, as highlighted in this recent analysis: job market college graduates unemployment.

Ultimately, the trade war’s long-term effects on the job market remain a complex issue, even with the temporary reprieve.

It allows for a more focused analysis of how the trade tensions have affected various sectors and the potential for a shift in economic strategies. The economic performance of both the US and China, as well as global supply chains and financial markets, are key areas for investigation.

Economic Performance of the US and China

The economic performance of the US and China before and after the trade war pause reveals varying degrees of impact. While the US experienced a period of growth preceding the pause, the trade war introduced uncertainty and potentially reduced consumer confidence. China, while experiencing economic challenges during the height of the trade war, demonstrated resilience in maintaining growth through domestic policies.

The US-China trade war pause feels like a temporary reprieve, doesn’t it? While the global economy breathes a collective sigh of relief, it’s hard to ignore the backdrop of current political tension. President Trump’s recent order to investigate President Biden and his aides, as detailed in this article , adds another layer of complexity to the already intricate relationship.

Will this investigation, however, distract from the urgent need for a long-term solution to the trade imbalance, impacting the fragile pause in the US-China trade war? It’s certainly a tricky situation.

After the pause, indicators suggest a potential easing of the tensions affecting both economies.

Impact on Global Supply Chains and Trade Flows

The trade war pause has had a noticeable impact on global supply chains and trade flows. Initially, the uncertainty surrounding tariffs and trade restrictions led to disruptions and higher costs for businesses. The pause has created an environment for companies to reassess their supply chains and potentially reduce reliance on specific regions. This could lead to more diversified and resilient supply chains in the future.

The pause in the US-China trade war is certainly intriguing, but it’s also worth considering the broader implications for digital safety. With kids spending increasing amounts of time online, understanding the current status of the Kids Online Safety Act is crucial. For more details on this, check out this helpful resource: kids online safety act status what to know.

Ultimately, these parallel developments highlight a complex interplay between global economics and digital well-being, impacting both international relations and family life in significant ways, potentially influencing the future trajectory of the US-China trade war as well.

It also encourages businesses to focus on efficiency and reducing costs.

Changes in International Investment and Business Strategies

The trade war pause has spurred changes in international investment and business strategies. Companies are now reassessing their global footprint and supply chains, potentially seeking new partnerships and markets. Investment decisions are likely to be more cautious and strategic, focusing on long-term stability and risk mitigation. There may be a shift towards diversification and reduced dependence on single regions.

Impact on Commodity Prices and Global Financial Markets

The pause in the trade war has also affected commodity prices and global financial markets. The uncertainty surrounding trade disputes created volatility in commodity markets. However, with the trade war pause, commodity prices are likely to stabilize, reflecting the reduced trade tensions and associated risks. Financial markets have shown a tendency to react positively to a reduction in trade conflicts, leading to increased confidence and reduced volatility.

Potential Future Implications

The pause in the US-China trade war presents a unique opportunity to reassess the long-term trajectory of their economic relationship. While the immediate impact is noticeable, the true ramifications will unfold over the next several years, influenced by a complex interplay of political, economic, and technological factors. This period of relative calm allows for a deeper examination of the potential future scenarios, ranging from a renewed commitment to cooperation to a continued escalation of tensions.

Potential Scenarios for Future Trade Relations

The future of US-China trade relations hinges on several key variables. Political posturing, economic growth trajectories, and technological advancements will all contribute to the shape of the relationship. A comprehensive understanding requires considering a spectrum of possibilities.

| Scenario | Political Tensions | Economic Growth | Technological Advancements | Impact on Global Economy |

|---|---|---|---|---|

| Renewed Cooperation | Declining trade disputes, increased diplomatic engagement | Continued growth in both economies, fostering mutual benefit | Joint research and development efforts, technological sharing | Increased global economic stability, potentially boosting global trade volumes. |

| Continued Competition | Persistent trade disputes, heightened geopolitical rivalry | Economic growth in both economies but with limited collaboration | Increased technological decoupling, with both countries pursuing independent innovation | Potentially fragmented global supply chains, slower economic growth in certain sectors. |

| Escalated Confrontation | Heightened trade restrictions, significant sanctions, increased military posturing | Reduced economic growth in both countries due to trade restrictions | Aggressive protectionist policies, with significant technological decoupling | Significant global economic disruption, potential recessionary pressures. |

Impact on Global Economic Landscape

The trade war pause’s impact on the global economy will be multifaceted. For example, if the US and China can find common ground, the benefits would ripple through global supply chains. Increased trade and investment flows could stimulate economic activity and potentially lower inflation. However, if tensions persist, global supply chains could become more fragmented, potentially increasing production costs and reducing overall economic efficiency.

Impact on Consumer Goods Prices and Market Share Allocation

The trade war pause has the potential to influence consumer goods prices and market share allocation in the following ways. If the trade relationship improves, consumers could benefit from lower prices and greater product variety as trade barriers decrease. However, if tensions persist or escalate, consumers might face higher prices and reduced choices, as companies may be forced to diversify supply chains.

Potential Effects on Specific Industries

The electronics and apparel industries, in particular, would be significantly affected by the trade war pause’s evolution. The shift in production or sourcing decisions, and corresponding changes in consumer demand, would be a significant consideration for both producers and consumers.

Specific Industries Affected

The US-China trade war, punctuated by periods of escalation and de-escalation, significantly impacted various industries reliant on trade between the two nations. The pause in the trade war, while not a complete resolution, offers a chance for affected sectors to re-evaluate strategies and adapt to the evolving landscape. This section delves into specific industries, examining their pre-pause performance and potential post-pause shifts.

Technology Sector

The technology sector, a key area of contention, experienced substantial disruption during the trade war. Companies faced challenges in supply chains, intellectual property concerns, and market access restrictions. The pause offers an opportunity for a recalibration of supply chains and a reduction in the uncertainty that previously hampered growth.

| Industry Metric | Pre-Pause (2018-2020) | Post-Pause (2021-Present) |

|---|---|---|

| US Semiconductor Exports to China (USD Billion) | Declining due to tariffs and supply chain disruptions | Showing signs of stabilization and potential recovery |

| Foreign Direct Investment (FDI) in Chinese Tech Sector (USD Billion) | Significant decrease | Potential for increased FDI, but contingent on broader economic factors |

| Chinese Smartphone Market Growth Rate (%) | Negative growth impacted by tariffs and consumer confidence | Expected to show some recovery, but slower than pre-trade war levels |

Consumer Goods

The consumer goods industry, including apparel, electronics, and household goods, felt the pressure of trade restrictions. Tariffs increased costs and complicated global supply chains, leading to price increases and reduced consumer choice. A trade war pause might lead to a normalization of supply and pricing.

- Apparel: Manufacturers in both countries experienced difficulties managing raw material sourcing and logistics. The pause could lead to more stable pricing and a broader range of products, but long-term implications depend on the overall economic climate.

- Electronics: The disruption in component supply chains led to production delays and higher costs. The pause offers the potential to restore these chains and streamline production.

Agricultural Products

Agricultural products were another sector hit hard by the trade war. Tariffs on agricultural goods imposed by both countries led to significant price fluctuations and market disruptions. A pause in the trade war might lead to a return to more predictable trade patterns and prices.

- Soybeans: US soybean exports to China were dramatically affected by tariffs. A pause could lead to renewed trade but may depend on broader agricultural trade negotiations.

- Livestock: Similar to soybeans, US livestock exports faced significant reductions due to tariffs. The pause could lead to more stable demand and market access.

Automotive Sector

The automotive sector faced disruptions due to tariffs on imported components and finished vehicles. The pause could help ease these pressures and restore more stable supply chains. Automakers are closely monitoring the developments in trade relations.

- Car Parts: Tariffs on imported car parts impacted production costs and availability. The pause could lead to more predictable costs and sourcing for automakers.

- Finished Vehicles: Tariffs on finished vehicles increased prices for consumers and created challenges for manufacturers. A pause in the trade war could ease this pressure and help bring down prices for consumers.

Political and Geopolitical Context

The pause in the US-China trade war, while seemingly economic, carries significant geopolitical implications. It reflects a complex interplay of power dynamics, shifting regional alliances, and the evolving relationship between the world’s two largest economies. This period of relative calm, however, doesn’t erase the underlying tensions and competition, and the pause itself is a dynamic factor shaping global affairs.The geopolitical implications of the trade war pause extend far beyond economic considerations.

The temporary truce has had ripple effects on regional stability, altering the balance of power in various international forums and influencing the strategic choices of other nations. This pause is a crucial moment to understand the evolving nature of the US-China relationship and its impact on global affairs.

Geopolitical Implications on Regional Stability

The trade war pause, while not a complete resolution, has potentially lessened the immediate threat of escalation in certain regions. This has allowed for a temporary reduction in economic friction, indirectly fostering a more stable environment in some areas. However, underlying tensions remain, and the pause doesn’t necessarily guarantee long-term peace. The pause might influence regional powers to reassess their relationships with both the US and China, seeking to navigate the complexities of the evolving global order.

Impact on US-China Relations on Other Fronts

The trade war pause has demonstrably influenced other aspects of the US-China relationship. For instance, there have been observed shifts in diplomatic engagements, with discussions on other global issues becoming more frequent. This indicates a recognition that resolving trade disputes is essential for a more productive overall relationship, regardless of the outcome. However, deep-seated differences and competing interests persist, and the pause is not a guarantee of long-term cooperation.

Influence of Political Leaders and Policies

The policies of both US and Chinese leaders have significantly shaped the trade war pause. Decisions made by presidents and other political figures have influenced the tone and direction of the negotiations. These decisions have often been driven by domestic political considerations and economic pressures. Ultimately, the pause can be viewed as a strategic maneuver to manage domestic pressures, even if the long-term geopolitical consequences remain uncertain.

Impact on Balance of Power in International Organizations, Us china trade war pause

The pause has affected the balance of power in international organizations. The US and China, as major players, have adjusted their approaches within these bodies. The pause has allowed both countries to reassess their positions and recalibrate their strategies. This shift, though temporary, can be seen as a response to changing global dynamics and a recognition of the need for greater cooperation, or a way to maintain influence and prestige.

Public Perception and Discourse: Us China Trade War Pause

The trade war pause, a period of temporary respite from escalating tariffs and trade restrictions, has undoubtedly impacted public perceptions in both the US and China. Public opinion, often shaped by media narratives and personal experiences, plays a crucial role in influencing policy decisions and public support for trade agreements. Understanding these perceptions is key to analyzing the potential long-term implications of this pause.

US Public Perception

US public opinion on the trade war pause is multifaceted, reflecting diverse economic interests and varying political viewpoints. While some segments of the population may view the pause as a positive step towards stabilizing economic relations, others might see it as a strategic retreat that could ultimately harm US interests in the long run.

- Economic Concerns: A significant portion of the US public is concerned about the potential economic consequences of the pause, particularly regarding job losses in import-competing industries. For example, labor unions and manufacturers in sectors heavily reliant on tariffs might be worried about a return to prior trade imbalances.

- Political Stances: The political climate in the US often influences public perception of trade policy. The pause’s impact is likely perceived differently by supporters of protectionist policies versus those advocating for free trade. This divergence is often evident in media coverage and social media discussions.

- Media Representation: US media outlets often frame the trade war pause through the lens of geopolitical rivalry. This narrative might portray the pause as a temporary tactical maneuver rather than a significant shift in policy, thereby influencing public perception of the long-term consequences.

Chinese Public Perception

Public perception in China regarding the trade war pause is likely more nuanced, encompassing considerations of national pride, economic stability, and potential future trade benefits. The narrative of the pause is likely more intertwined with national strategic goals and the long-term vision of the Chinese economy.

- Nationalistic Sentiment: Chinese public opinion may view the pause as a demonstration of China’s growing economic and political influence on the global stage. A strong sense of national pride may underpin this perception.

- Economic Optimism: The pause could be interpreted as a positive sign of improved economic prospects, particularly for export-oriented businesses and those involved in the global supply chain. Positive economic indicators may strengthen this view.

- Media Coverage: Chinese media coverage of the trade war pause might emphasize the potential for greater economic opportunities and cooperation, while downplaying any potential risks or challenges. This could significantly influence public perception.

Comparison of Public Opinions

The public discourse in both countries reveals contrasting perspectives on the pause. While the US public might be more concerned about economic competition and potential job losses, the Chinese public may be more optimistic about the opportunities for economic growth and global influence.

| Aspect | US Public Opinion | Chinese Public Opinion |

|---|---|---|

| Primary Concern | Economic impact on domestic industries | Long-term economic benefits and global influence |

| Media Framing | Geopolitical rivalry | Economic opportunity |

| Political Context | Diverse viewpoints, including protectionist and free-trade advocates | National strategic interests |

Summary

The US-China trade war pause represents a significant turning point. While it offers a temporary reprieve from escalating tensions, the future of their trade relationship remains uncertain, hinging on a variety of factors. The economic, political, and geopolitical consequences of this pause will undoubtedly shape the global landscape for years to come. Looking ahead, the potential for renewed conflict or a sustained period of cooperation remains to be seen.