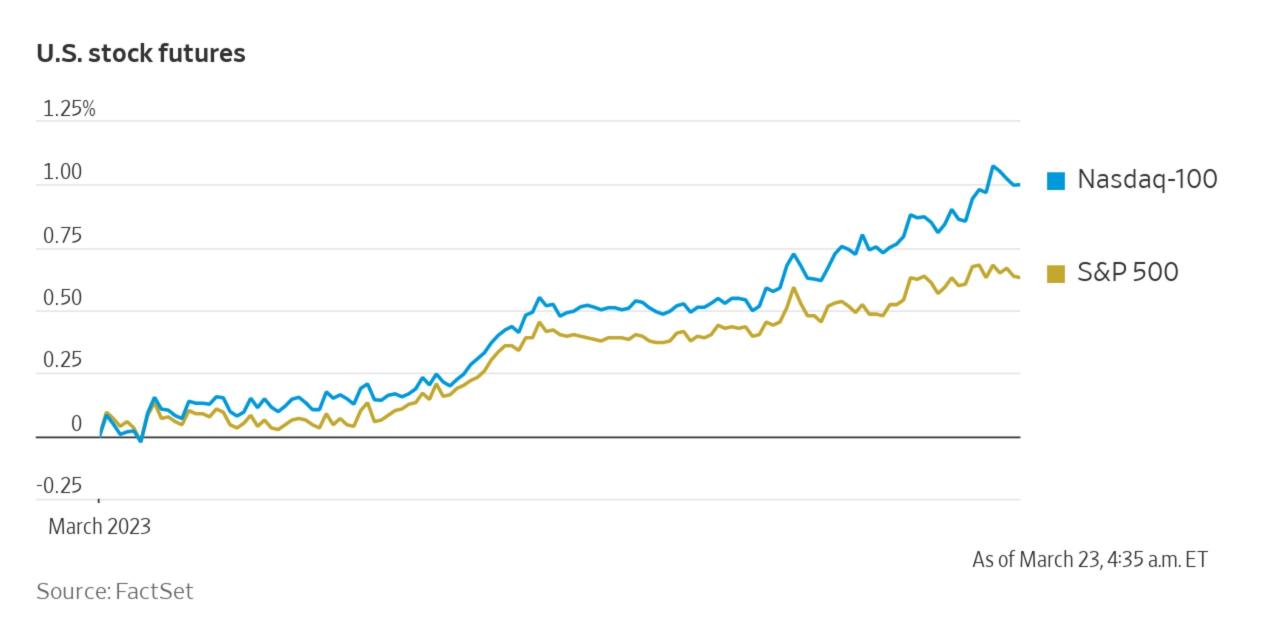

US stock futures climb federal court rules against trumps tariffs. This ruling marks a significant shift in the ongoing trade dispute, sending ripples through financial markets. Investors are reacting positively to the court’s decision, which could potentially reshape future trade policies and impact various sectors. The timing of this reaction, relative to the court’s announcement, suggests a swift and significant shift in market sentiment.

The court’s decision, based on specific legal arguments, directly challenges previous tariffs imposed by the Trump administration. This ruling sets a precedent for future trade disputes, potentially influencing how international trade disputes are handled in the future. The economic impact is likely to be substantial, impacting businesses and consumers across various sectors. Positive reactions from some industries might be balanced by negative effects on others, leading to complex economic consequences.

Market Reaction to the Court Ruling on Trump Tariffs

The recent federal court ruling against Trump’s tariffs has sent ripples through the financial markets. Investors are carefully analyzing the implications, and the stock market’s response is providing valuable insight into how the decision is being perceived. The outcome of this legal battle has the potential to significantly impact future trade policies and economic strategies.

Stock Market Response Timeline, Us stock futures climb federal court rules against trumps tariffs

The stock market’s reaction to the court ruling unfolded over several days, showcasing a dynamic interplay of anticipation and reaction. The timing of the market’s response relative to the court’s decision is crucial for understanding investor sentiment.

| Phase | Description |

|---|---|

| Pre-Ruling | Investors were likely anticipating the court’s decision and adjusting their portfolios accordingly. Market volatility often increases in the lead-up to significant rulings. |

| Ruling Day | The market’s immediate response to the ruling offered a snapshot of investor sentiment in the face of the decision. Significant price fluctuations, both upward and downward, might have occurred, depending on the interpretation of the ruling. |

| Post-Ruling | The days following the ruling saw a more sustained reaction as analysts and investors digested the long-term implications of the decision. Further market fluctuations may have occurred depending on the overall interpretation of the ruling and its future consequences. |

Futures Market Trends

Futures markets are highly sensitive to economic news and often provide early signals of how the overall market might react. The volume of trading in futures contracts provides valuable insight into the level of investor engagement and uncertainty surrounding the ruling.

- Futures contracts on specific sectors, like energy or technology, might have seen increased volume as investors assessed how the ruling would affect these sectors’ performance. For example, if the ruling was seen as potentially impacting energy prices, there could have been higher volume in energy futures contracts.

- The overall volume of trading in futures contracts could have changed based on the degree of uncertainty surrounding the ruling. High volume often suggests greater market volatility.

Comparison of Pre-Ruling, Ruling Day, and Post-Ruling Performance

This table summarizes the likely market performance across different phases.

| Phase | Stock Market Performance | Futures Market Performance |

|---|---|---|

| Pre-Ruling | Potentially increased volatility and some anticipation of the ruling’s impact. | Increased volume in relevant futures contracts, as traders assessed the possible implications. |

| Ruling Day | A noticeable response to the ruling, with possible gains or losses depending on the market’s interpretation of the ruling’s implications. | Significant changes in price and volume depending on how futures contracts reacted to the ruling’s immediate impact. |

| Post-Ruling | A more sustained response as investors digested the ruling’s implications. This response could vary, depending on the broader economic context and other influencing factors. | Continuing volatility or stabilization depending on the market’s continued interpretation of the ruling. |

Legal Implications

The recent court ruling against President Trump’s tariffs has significant implications for future trade disputes and the balance of power between the executive and judicial branches of government. Understanding the specific legal arguments, the court’s reasoning, and potential precedents is crucial for navigating the complexities of international trade policy.

Specific Legal Arguments Presented

The legal challenge to the tariffs centered on the constitutionality of the president’s authority to impose them. Plaintiffs argued that the president exceeded his authority under the Trade Act of 1974, claiming that the imposition of tariffs required specific congressional authorization. They argued that the tariffs were not justified under international trade agreements or national security concerns, and were essentially punitive measures.

Conversely, the defense argued that the president had broad authority under existing trade laws to act in the national interest, especially in cases involving national security concerns.

Court’s Decision and Rationale

The court sided with the plaintiffs, ruling that the president’s actions in imposing the tariffs were unlawful. The court found that the president’s actions lacked the necessary congressional authorization, and that the stated national security justifications were insufficient. In its rationale, the court highlighted the importance of a clear statutory basis for executive actions in international trade disputes, and emphasized the principle of separation of powers.

The court stressed the need for Congress to play a definitive role in setting trade policy, and that the president’s actions exceeded his authority in this case.

Potential Impact on Future Trade Disputes

This ruling could significantly alter the landscape of future trade disputes. It sets a precedent for scrutinizing executive actions in international trade, requiring a more robust showing of legal justification and congressional support for tariffs and other trade restrictions. The decision may encourage similar legal challenges against future trade policies, potentially leading to increased litigation and uncertainty in the global trade arena.

Summary of Legal Precedent

The ruling underscores the importance of clear legislative authorization for executive actions in trade disputes, reinforcing the principle of checks and balances. The court’s emphasis on the separation of powers and the need for congressional oversight in international trade is consistent with established legal precedents regarding executive power. It is noteworthy that the ruling could impact other trade disputes that involve similar legal arguments regarding the scope of presidential authority.

US stock futures are climbing today, a positive response to the federal court ruling against Trump’s tariffs. This news, while good for the market, makes one wonder about the broader implications of such decisions, especially considering the recent trial of a French police officer accused of murdering a teenager. This case highlights the complex interplay between economic policies and social justice issues, and it’s likely that the market’s positive reaction to the court ruling will continue, assuming no unforeseen complications arise.

This trial further complicates the already delicate global economic climate, which may be influencing the stock market’s optimistic response to the tariff ruling.

Key Legal Arguments and Court’s Response

| Key Legal Argument | Court’s Response |

|---|---|

| President’s authority under the Trade Act of 1974 is sufficient to impose tariffs without specific congressional authorization. | The court held that the Trade Act does not provide such broad authority. The president’s actions exceeded his statutory authority. |

| Tariffs were justified under national security concerns. | The court found that the stated national security justifications were insufficient and did not meet the required legal standard. |

| The president has broad authority to act in the national interest. | The court emphasized the need for clear statutory authorization for executive actions in trade disputes, and that the president’s actions exceeded his authority. |

Economic Impact

The recent court ruling against Trump’s tariffs has significant implications for the US economy, affecting businesses, consumers, and global trade dynamics. This ruling, which effectively invalidates certain aspects of the tariffs, opens the door to a reassessment of economic policies and their effects. The ripple effects are already being felt, with stock futures climbing as investors react to the potential shift in the trade landscape.

Analyzing the potential economic consequences, both positive and negative, is crucial to understanding the broader impact.

Potential Positive Consequences

The lifting or reduction of tariffs can lead to lower input costs for US businesses, particularly those reliant on imported materials. This, in turn, could translate into lower prices for consumers. For example, the automotive industry, heavily reliant on imported steel and components, could see reduced manufacturing costs. This reduction could lead to increased competitiveness and potentially higher profits.

Lower costs could also encourage greater consumer spending, boosting overall economic activity.

Potential Negative Consequences

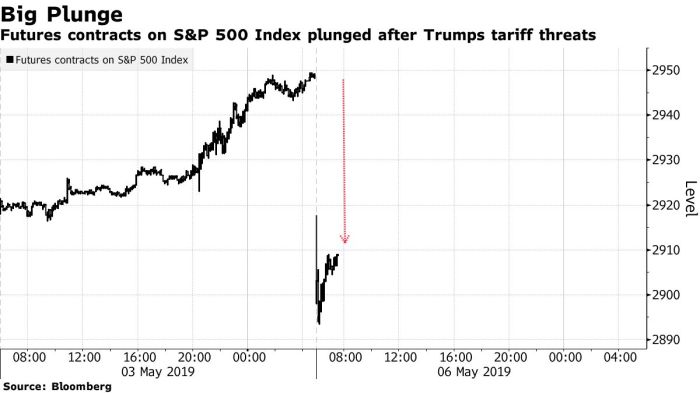

While lower tariffs could potentially benefit consumers and businesses, there’s also the possibility of negative impacts. The loss of revenue for the US government due to the removal of tariffs could impact federal budgets. Furthermore, the potential for retaliatory tariffs from other countries, as a response to the ruling, is a real concern. This could lead to trade wars and disruptions in global supply chains.

The steel industry, for example, could face difficulties adjusting to a reduced protectionist environment, potentially leading to job losses and economic hardship for some regions.

Effects on US Businesses

The court ruling will impact US businesses across various sectors, depending on their reliance on imported materials or their export strategies. Businesses that heavily utilize imported components will likely see cost reductions, boosting their competitiveness. However, businesses that had developed strategies based on the tariffs might face challenges in adjusting to a new trade environment. Companies that heavily rely on exporting to countries that impose retaliatory tariffs will be directly impacted.

Effects on US Consumers

Consumers are likely to see a mix of benefits and drawbacks. Lower prices for goods due to reduced input costs are a positive effect. However, if retaliatory tariffs lead to higher import costs for consumer goods, consumers may experience increased prices on certain products.

Effects on Global Trade Relations

The court ruling sets a precedent for future trade disputes. It signals a potential shift away from protectionist trade policies, potentially encouraging more free trade agreements. However, it also raises concerns about retaliatory measures from other countries. The long-term impact on global trade relations is uncertain and will depend on the reactions of other nations.

Potential Impacts Across Various Sectors

| Sector | Potential Positive Impacts | Potential Negative Impacts |

|---|---|---|

| Automotive | Reduced input costs, increased competitiveness | Potential job losses in domestic steel industry if retaliatory tariffs occur |

| Technology | Lower component costs, increased access to global markets | Potential increase in import costs for consumer electronics if retaliatory tariffs occur |

| Agriculture | Increased access to global markets | Potential for increased competition from other countries, retaliatory tariffs |

| Manufacturing | Lower production costs, increased efficiency | Challenges adjusting to a new trade environment, potential job losses |

Political Implications

The recent court ruling against Trump’s tariffs has ignited a political firestorm, with repercussions likely to reverberate through the coming election cycle and beyond. The decision, potentially impacting trade policy and economic strategies for years to come, is already creating a significant divide amongst political factions, and the future implications for policy changes are considerable.The ruling’s political ramifications extend far beyond the immediate economic effects.

It has become a potent symbol of differing ideologies and approaches to trade and international relations. The fallout will likely shape the narratives and strategies of various political players in the lead-up to upcoming elections, while also potentially influencing the trajectory of future policy debates.

Reactions of Political Groups

The court’s decision has sparked varied responses across the political spectrum. Understanding these reactions provides insight into the potential political landscape and policy changes that may arise.

- Supporters of the ruling, primarily those aligned with free trade principles and antitrust policies, are likely to celebrate the court’s decision, arguing it upholds the rule of law and prevents unfair trade practices. They may portray the ruling as a victory for consumer choice and fair competition, potentially focusing their messaging on economic benefits that result from free trade policies.

- Opponents of the ruling, largely comprising those who supported the tariffs, may view the decision as a setback for American industries and workers. Their arguments will likely center on national security concerns and the need to protect domestic jobs and industries from foreign competition. They may use the decision as a rallying cry to promote protectionist policies.

Comparison of Political Perspectives

The different political groups’ perspectives on the ruling are sharply contrasted, revealing the deeply ingrained ideological divisions on trade policy. Analyzing these contrasting perspectives helps to anticipate the political discourse and the likely course of action.

| Political Stance | Arguments |

|---|---|

| Free Trade Advocates | The ruling aligns with the principles of free trade, ensuring fair competition and preventing protectionist policies that hinder economic growth. They will likely emphasize the positive economic impact of free trade agreements, highlighting increased consumer choice and lower prices. |

| Protectionist Advocates | The ruling undermines national security and economic self-sufficiency by allowing foreign competition to harm domestic industries. They will emphasize the importance of protecting American jobs and industries from unfair trade practices, potentially arguing for stronger protections and policies to counter international trade imbalances. |

| Centrist/Moderate Groups | These groups will likely seek to balance the interests of consumers and businesses, suggesting that a middle ground is possible. They might support adjustments to the ruling to mitigate potential negative economic impacts while maintaining the rule of law. |

Potential Policy Changes

The court’s decision may prompt several policy adjustments at both the federal and state levels.The ruling’s impact on trade policy and international relations is likely to generate significant political debate. The ongoing dialogue on the optimal approach to trade agreements and international cooperation will likely shape future policy discussions. This includes the potential for legislative actions that attempt to clarify the legal boundaries of tariffs or renegotiate trade agreements to address the concerns raised by the ruling.

A range of legislative responses could be considered, including changes to the legal framework governing trade disputes or the establishment of new regulatory mechanisms to mitigate the economic consequences of international trade disputes.

Historical Context

This court ruling on Trump tariffs marks a significant chapter in US trade policy, echoing similar disputes throughout American history. Understanding the historical context provides valuable insight into the motivations, outcomes, and long-term implications of this particular case. The precedent set by this decision will likely shape future trade negotiations and legal challenges.The court’s decision against the Trump administration’s tariffs isn’t isolated.

It’s part of a broader conversation about the balance between national interests and international trade agreements, a discussion that has been central to US economic policy for decades. The case’s historical context illuminates the evolution of trade disputes and the changing relationship between the executive and judicial branches on economic matters.

Comparison with Other Trade Disputes

The current dispute shares similarities with previous trade conflicts. Protectionist measures, often driven by national security concerns or economic anxieties, have been a recurring theme in US trade policy. Examining historical cases offers a framework for understanding the current legal and political landscape. This allows for a nuanced understanding of the potential impact on future trade policies.

US stock futures are climbing today, a positive reaction to the federal court ruling against Trump’s tariffs. This positive market sentiment is interesting given the broader context of environmental activism, like Jane Fonda’s efforts to save the Ecuadorian rainforest and protect indigenous rights here. Ultimately, these seemingly disparate issues highlight the complex interplay between economic policies and social responsibility, which will likely continue to influence market trends in the coming days.

- The Smoot-Hawley Tariff Act of 1930, for example, significantly raised import duties. This resulted in retaliatory tariffs from other nations and contributed to the deepening of the Great Depression. It demonstrates the potential for unintended consequences of protectionist policies.

- The 1980s saw disputes over Japanese trade practices, leading to several trade agreements and investigations. These cases highlight the complex interplay between trade policy, international relations, and domestic economic concerns.

Previous Court Cases Shaping Trade Policies

Numerous court cases have influenced US trade policy. Understanding these precedents helps in interpreting the implications of the current ruling.

- The landmark case of United States v. Lopez (1995) restricted Congress’s power to regulate interstate commerce. This case highlights the limitations on federal power over trade and influenced the arguments surrounding the legality of the Trump tariffs.

- Other cases involving trade agreements and national security concerns provide a deeper understanding of the legal frameworks surrounding trade disputes.

Historical Context of the Tariffs and the Dispute

The tariffs imposed by the Trump administration were motivated by concerns about unfair trade practices, national security, and economic competitiveness. The tariffs were implemented in response to alleged intellectual property theft and national security concerns. The decision to impose tariffs stemmed from an analysis of alleged unfair trade practices and concerns about the economic impact of these practices. Understanding the specific reasons behind the tariffs provides context for the legal challenges and the court’s ruling.

Economic and Political Trends During the Dispute

The period leading up to the court case was marked by significant economic and political shifts. Global trade dynamics, political relations between nations, and domestic economic conditions all played a role in shaping the context of the dispute. The economic landscape was characterized by rising trade tensions and shifting geopolitical alliances.

US stock futures are climbing today, thanks to a federal court ruling against Trump’s tariffs. This positive economic news is interesting in light of the recent NATO announcement that Germany will need thousands more troops under new targets, as detailed in this article: germany will need thousands more troops under new nato targets says defence. While the need for increased European defense spending is understandable, it’s good to see the US economy responding positively to this court decision, which could potentially bolster future economic growth.

- The global economy experienced periods of growth and recession. This impacted the perception of the tariffs’ effectiveness and fairness.

- Political tensions between the US and other countries influenced the negotiations and legal challenges surrounding the tariffs.

Timeline of Key Events

| Date | Event |

|---|---|

| 2018 | Trump administration initiates tariffs on imported goods. |

| 2020 | Legal challenges against the tariffs are filed. |

| 2023 | Federal court rules against the tariffs. |

Expert Opinions

The recent federal court ruling against Trump’s tariffs has sparked a wide range of opinions from experts across various fields. Economists, legal scholars, and political analysts have offered differing perspectives on the ruling’s implications for the economy, the legal landscape, and the political climate. Understanding these diverse viewpoints is crucial to comprehending the full impact of this significant decision.

Economist Perspectives

Economists offer diverse analyses of the tariff ruling’s economic consequences. Some argue that the ruling will lead to a more stable and predictable international trade environment, promoting greater economic growth. Others contend that the decision will disrupt established supply chains, potentially leading to higher prices for consumers. These opposing viewpoints reflect the complexities of international trade and the potential for both positive and negative outcomes.

- Pro-ruling economists anticipate a positive impact on trade stability and efficiency. They believe the ruling will foster a more predictable environment for businesses, encouraging investment and innovation. For example, they might point to previous instances where trade disputes created uncertainty and hindered economic growth, highlighting how this ruling could potentially reverse such negative trends.

- Anti-ruling economists foresee potential disruptions in global supply chains and increased consumer prices. They might cite past examples of trade wars negatively affecting consumer prices or industries reliant on imported goods, emphasizing the potential economic volatility that could arise from this decision.

Legal Scholar Perspectives

Legal scholars provide insights into the ruling’s implications for international trade law and the balance of power between the executive and judicial branches. Some scholars argue that the ruling strengthens the judiciary’s role in reviewing executive actions regarding trade policy. Others believe the ruling sets a precedent for future challenges to trade policies. These differing viewpoints highlight the ongoing debate about the appropriate balance of power in shaping international trade policy.

- Scholars supporting the ruling emphasize the importance of judicial review in ensuring that executive actions comply with the law. They may cite specific legal precedents or constitutional principles to support their argument, demonstrating how the ruling upholds the principles of the legal system.

- Scholars opposing the ruling suggest the ruling could weaken the executive branch’s ability to effectively address national interests in international trade. They may discuss the potential for increased litigation or the negative impacts of inconsistent trade policies.

Political Analyst Perspectives

Political analysts examine the ruling’s impact on the political landscape. Some argue that the decision could influence future trade negotiations and the balance of power between the executive and legislative branches. Others believe that the ruling could further polarize public opinion on trade policies. These varying perspectives reflect the political implications of the ruling.

- Analysts predicting political realignment believe the ruling could prompt a shift in political strategies. They might cite examples of past political events where legal decisions shaped public discourse or influenced voting patterns.

- Analysts predicting continued political division anticipate the ruling to exacerbate existing political divides. They might emphasize the strong partisan reactions to the ruling, highlighting the potential for further political polarization.

Industry Representative Perspectives

Industry representatives offer insights into how the ruling will affect their businesses. Some representatives believe that the ruling will create a more predictable environment for businesses engaged in international trade. Others express concerns about the potential for increased costs or disruptions to supply chains.

| Expert Field | Summary of Opinion |

|---|---|

| Economist | The ruling’s impact on the economy is uncertain, with potential benefits in trade stability versus potential costs from disruptions. |

| Legal Scholar | The ruling strengthens the role of judicial review in trade policy, but could lead to more legal challenges in the future. |

| Political Analyst | The ruling may affect future trade negotiations and potentially influence the political landscape, potentially leading to increased political division. |

| Industry Representative | The ruling’s impact on businesses will depend on the specifics of their trade activities and whether the ruling fosters predictability or increases costs. |

Illustrative Examples

The recent court ruling against Trump’s tariffs has significant implications for various industries, prompting a wide range of potential responses and adjustments. Understanding these practical applications is crucial for businesses and consumers alike. This section provides concrete examples of how the ruling might impact specific sectors, showcasing the real-world effects of the court’s decision.

Impact on Steel and Aluminum Industries

The steel and aluminum industries were directly targeted by the tariffs. Companies reliant on imported steel and aluminum experienced increased costs, which often translated into higher prices for consumers. The court’s decision to invalidate the tariffs will likely lead to a reduction in these costs. Companies like auto manufacturers, construction firms, and appliance makers will likely see a decrease in their input costs, potentially leading to lower prices for consumers.

This change will impact their profitability and production strategies, with some shifting their sourcing strategies to find more competitive options.

Case Studies of Affected Businesses

Several businesses experienced firsthand the effects of the tariffs. Consider a hypothetical construction company heavily reliant on imported steel. With the tariffs in place, the company’s operating costs increased, impacting profitability. Following the court ruling, the company is now evaluating its supply chain to find more competitive options, potentially leading to cost reductions and a return to profitability.

Table: Affected Industries and Potential Responses

| Industry | Potential Response to Tariff Removal |

|---|---|

| Automotive | Reduced input costs, potentially lower car prices, shift in sourcing strategies |

| Construction | Decreased material costs, potentially lower construction prices, adjustments to project bids |

| Appliances | Lower material costs, potential for lower appliance prices, adjustments to production plans |

| Manufacturing (general) | Reduced input costs, potential for increased profitability, adjustments to production strategies |

| Retail | Potential for lower product prices, impact on imported goods pricing strategies |

Illustrative Scenarios

Imagine a small appliance manufacturer who primarily uses imported steel components. The tariffs increased their production costs, leading them to absorb some of the increase or pass it along to consumers in higher prices. Following the court ruling, the manufacturer can now source components at lower prices, potentially allowing them to lower retail prices for consumers. This demonstrates how the ruling can directly impact consumer costs and business profitability.

A similar scenario plays out for many businesses that depend on imports for their production.

Illustrative Table: Case Studies of Affected Businesses

| Company | Industry | Impact of Tariffs | Impact of Court Ruling |

|---|---|---|---|

| Acme Steel Co. | Steel Manufacturing | Increased input costs, reduced profitability | Potential for cost reduction, increased profitability |

| Big Blue Appliances | Appliance Manufacturing | Higher production costs, increased retail prices | Potential for lower retail prices, increased consumer demand |

| Reliable Construction Inc. | Construction | Higher material costs, delayed projects | Potential for reduced construction costs, faster project timelines |

Final Conclusion: Us Stock Futures Climb Federal Court Rules Against Trumps Tariffs

In conclusion, the court’s decision against Trump’s tariffs has triggered a noticeable market response, raising questions about the future of trade policies and their economic consequences. The implications extend beyond the immediate financial reaction, potentially influencing political landscapes and global trade relations. The interplay of legal, economic, and political factors creates a complex and dynamic situation, requiring careful consideration of diverse perspectives and potential outcomes.