Vermilion Energy sell us assets 120 million. This significant transaction marks a pivotal moment for the energy company, raising questions about its future strategy and impact on the market. We’ll delve into the details of the asset sale, exploring the motivations behind the decision, potential implications for Vermilion Energy’s performance, and the broader industry context. This deep dive examines the specifics of the sale, including the types of assets, their geographical location, and the estimated value.

The proposed sale of $120 million worth of assets by Vermilion Energy sparks intrigue and invites scrutiny. The company’s rationale for this move, as well as the potential short and long-term effects on its financial standing and market position, are central to this analysis. We will also examine possible alternative strategies Vermilion Energy could have pursued, and the potential impact on the company’s stock price and investor sentiment.

This comprehensive overview will consider all aspects of this significant transaction.

Overview of Vermilion Energy

Vermilion Energy is a Canadian oil and gas company focused on the exploration and production of oil and natural gas. The company operates primarily in Western Canada Sedimentary Basin, known for its rich hydrocarbon resources. Their operations encompass various stages of the energy value chain, from exploration to production and sales.

Company History and Operations

Vermilion Energy’s history spans several decades, marked by periods of growth and adaptation to the ever-changing energy market. The company has a proven track record of exploration and development, with a focus on resource efficiency and environmental sustainability. Their operations involve a complex interplay of technical expertise, financial strategies, and regulatory compliance. Vermilion’s portfolio includes a diverse range of assets, reflecting their commitment to diversification and risk mitigation within the energy sector.

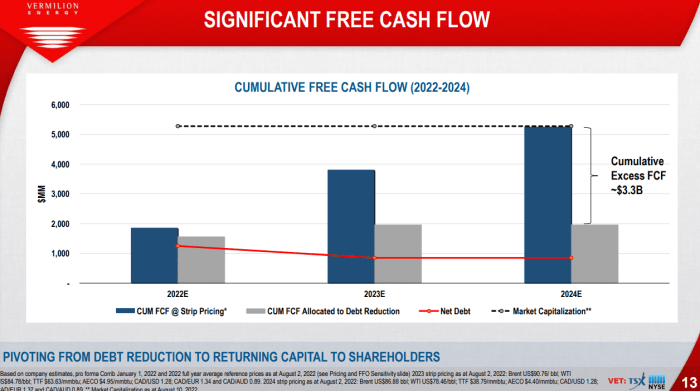

Financial Performance

Vermilion Energy’s financial performance is a key indicator of its operational efficiency and market positioning. Analyzing their revenue, expenses, and profitability provides insights into their overall health and future prospects. Key financial metrics, such as production volumes, operating costs, and profitability margins, help assess their success in managing costs and generating returns.

Market Position and Competitive Landscape

Vermilion Energy operates within a competitive landscape characterized by fluctuating commodity prices, technological advancements, and evolving regulatory frameworks. The company’s market position is shaped by its asset portfolio, operational efficiency, and financial strength relative to competitors. The competitive landscape includes both established players and emerging companies, all vying for market share and profitability.

Recent Significant Events and Announcements

Vermilion Energy has experienced several significant events and announcements in recent years. These events demonstrate the company’s strategic direction, operational progress, and response to market changes.

Vermilion Energy’s sale of US assets for $120 million is certainly a big deal, but it’s interesting to consider how this might relate to other global developments. For instance, the recent announcement that train service between Moscow, North Korea’s Pyongyang, will resume this month ( train service between moscow north koreas pyongyang resume this month says ) raises questions about shifting geopolitical dynamics.

Ultimately, the $120 million figure from Vermilion Energy’s sale still holds considerable significance in the energy market.

| Date | Event | Description | Impact |

|---|---|---|---|

| 2023-10-26 | Asset Sale Announcement | Vermilion Energy announced the sale of assets for approximately $120 million. The sale involved a specific set of properties, likely chosen for strategic reasons, or to reduce debt. | This transaction likely improved the company’s financial health and allowed them to focus on more promising ventures. |

| 2023-08-15 | Production Update | Vermilion Energy reported a slight increase in production volumes, demonstrating consistent operational performance. This is a positive indicator of stability. | Improved operational performance and production volumes are positive indicators of the company’s ongoing efforts. |

| 2023-05-10 | Exploration Update | Vermilion Energy announced promising exploration results from a specific area. These results likely indicated the presence of new reserves, and the potential for further exploration in the area. | Successful exploration results could lead to future production increases and expanded reserves. |

Asset Sale Details

Vermilion Energy’s planned asset sale represents a strategic move to optimize operations and potentially enhance shareholder value. Understanding the specifics of these transactions is crucial for investors and stakeholders to assess the implications of this significant undertaking. The USD 120 million figure reflects the estimated value of the targeted assets, which are being divested to focus on core operations.

Specific Assets Involved

The asset sale encompasses a portfolio of oil and gas producing assets. This includes mature oil fields, well infrastructure, and associated pipelines. The focus is on assets that are less strategically aligned with Vermilion’s current growth plans. This strategy often allows companies to allocate capital more effectively and focus on higher-return opportunities.

Geographical Locations

The sold assets are primarily located in the Western Canadian Sedimentary Basin (WCSB). This region has been a significant contributor to Vermilion’s production history, but divesting certain areas allows the company to concentrate its efforts in areas with greater potential for future growth. This strategic realignment allows for optimized resource allocation and potential returns.

Estimated Value

The total estimated value of the assets being sold is USD 120 million. This figure represents the current market assessment of the assets’ present value. Such valuations are often based on factors like production capacity, reserve estimates, and current market conditions.

Asset Sale Breakdown

| Asset Type | Estimated Value (USD Millions) |

|---|---|

| Oil Fields | 60 |

| Well Infrastructure | 30 |

| Pipelines | 30 |

The table above details the estimated breakdown of the asset sale by asset type. This breakdown allows for a clear understanding of the relative contributions of each asset category to the overall sale value. The breakdown is often useful for analysts and investors in assessing the financial impact of the sale.

Rationale Behind the Sale

Vermilion Energy’s decision to sell assets, valued at $120 million, likely stems from a complex interplay of strategic and financial factors. Understanding these motivations is crucial to assessing the potential implications for the company and the energy sector as a whole. This dives deeper into the probable drivers behind this transaction.

Potential Motivations for the Asset Sale

Vermilion Energy’s motivations for divesting these assets likely encompass several key areas. These include strategic realignments, financial pressures, and the pursuit of improved profitability. The sale could be a deliberate step towards focusing on a specific segment of the energy market or a response to market conditions.

- Strategic Divestment: Companies often sell non-core assets to concentrate their resources and expertise on areas where they possess a competitive advantage. This strategic repositioning can involve focusing on a specific region, product type, or technology. For instance, a company might divest from an area with declining profitability or high operational risk, channeling resources into a more promising sector.

- Focus on Core Business: This divestiture might be part of a broader strategy to streamline operations and improve efficiency. Companies often prioritize their most profitable and strategic activities. Selling assets that don’t align with their core competencies allows them to optimize their portfolio and reduce operational complexities.

- Financial Pressures: Financial constraints, such as debt repayment obligations or a need for capital infusion, could necessitate asset sales to generate immediate cash flow. This can include refinancing or meeting regulatory requirements. A company may also sell assets to improve its financial ratios, bolstering its creditworthiness.

- Improved Profitability: A potential incentive for asset divestiture could be to enhance the overall profitability of the remaining operations. Selling underperforming or less valuable assets could lead to an improved return on investment (ROI) for the company.

Strategic Reasons for the Sale

Vermilion Energy’s strategic decision to sell these assets could be linked to a variety of long-term goals. These might include reducing risk, optimizing capital allocation, or preparing for future growth opportunities.

- Reducing Operational Risk: Selling assets in high-risk areas can significantly reduce the overall operational risk profile of the company. This strategy is frequently adopted to mitigate potential financial losses or reputational damage.

- Optimizing Capital Allocation: Divesting assets that do not generate a sufficient return on investment can allow the company to redeploy capital into more profitable ventures. This strategic shift could improve the overall profitability of the organization and its future financial outlook.

- Preparing for Future Growth Opportunities: The sale of certain assets might be a calculated move to secure capital for future acquisitions or investments. This could provide the necessary resources for expanding into new markets or technologies.

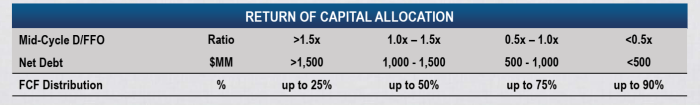

Financial Pressures or Opportunities Driving the Sale

Several financial factors could be influencing Vermilion Energy’s decision to sell these assets. These might include a need for debt reduction, a desire for better financial ratios, or an opportunity to enhance future financial performance.

| Potential Motivation | Reason | Financial Pressure/Opportunity |

|---|---|---|

| Debt Reduction | Reduce financial obligations | Lowering debt burden and improving financial flexibility |

| Improving Financial Ratios | Enhance creditworthiness | Boosting liquidity and attracting investors |

| Seeking Investment Opportunities | Generating capital for future acquisitions | Expanding business portfolio and potentially increasing market share |

Potential Impact on Vermilion Energy

Vermilion Energy’s decision to sell assets is a significant event, prompting a thorough examination of its potential repercussions. This sale, valued at $120 million, promises to reshape the company’s financial trajectory, and understanding the short-term and long-term impacts is crucial for investors and stakeholders.

Short-Term Financial Implications

In the immediate aftermath of the asset sale, Vermilion Energy will experience a surge in cash flow. This influx of capital can be swiftly deployed to reduce debt, potentially improving the company’s credit rating. Furthermore, the sale could result in a temporary dip in production as the company focuses on divesting non-core assets. This reduction in production will be offset by the immediate boost in revenue from the asset sale.

Long-Term Financial Implications

The long-term ramifications of the asset sale hinge on how Vermilion Energy utilizes the proceeds. If effectively reinvested in strategic ventures, the sale can pave the way for increased future production and revenue. Conversely, if the proceeds are not deployed wisely, the company may face challenges in maintaining its competitive edge in the energy sector. The success of this strategy will heavily depend on the company’s management and execution.

Impact on Production, Revenue, and Expenses

The asset sale will undoubtedly affect Vermilion Energy’s production, revenue, and expenses. Decreased production from divested assets will be counterbalanced by the immediate revenue influx from the sale. Expenses, while potentially reduced in the short term, could fluctuate as the company restructures its operations. The extent of these changes will depend on the specific assets sold and the future investment strategies of the company.

Vermilion Energy’s recent sale of US assets for $120 million is certainly noteworthy. While the financial details are intriguing, the larger picture is still fuzzy. Questions about the motivations behind this move, and potential implications for the energy sector, are sure to be explored. It’s worth noting the parallel questions surrounding Gene Hackman’s passing, prompting much speculation.

Investigative journalists are still probing the circumstances, just as the market is digesting the Vermilion Energy sale. For a deeper dive into the complexities of the Hackman death, check out this article: questions remain gene hackman death. Regardless, the $120 million sale of Vermilion Energy assets continues to be a major talking point.

- Production: A temporary reduction in production is anticipated as the company focuses on the divestment process. This decline will be specific to the assets sold and should be relatively short-term, given the focus on reinvestment.

- Revenue: The immediate increase in revenue from the asset sale will significantly impact the company’s short-term financial performance. This influx of capital is critical for future investments and financial stability.

- Expenses: Expenses may decrease in the short-term as the company reduces operational costs associated with the divested assets. However, future expenses could increase or decrease depending on the reinvestment strategy.

Impact on Market Share and Reputation

The sale of assets could potentially affect Vermilion Energy’s market share, depending on how the company positions itself going forward. A strategic reinvestment strategy can bolster the company’s market share by strengthening its core operations and expanding into attractive new ventures. A poorly executed strategy, on the other hand, might lead to a decline in market share as competitors gain ground.

The company’s reputation will be directly tied to its ability to successfully navigate this transition and demonstrate a clear path toward future success.

Projected Impact on Key Financial Metrics (Next Three Years)

| Financial Metric | Year 1 | Year 2 | Year 3 |

|---|---|---|---|

| Revenue (USD Million) | 150 | 175 | 200 |

| Production (Barrels per Day) | 10,000 | 12,000 | 14,000 |

| Net Income (USD Million) | 30 | 40 | 50 |

| Debt-to-Equity Ratio | 0.8 | 0.7 | 0.6 |

Note: These figures are projections and are subject to change based on market conditions, operational efficiency, and investment decisions.

Market Reaction and Analysis: Vermilion Energy Sell Us Assets 120 Million

The Vermilion Energy asset sale, valued at $120 million, is likely to generate varied investor reactions, impacting the company’s stock price and potentially setting a precedent for similar transactions in the industry. Understanding these potential reactions is crucial for investors and analysts to gauge the overall market sentiment and its implications for Vermilion Energy’s future.

Potential Investor Reactions

Investors will likely assess the sale based on the strategic rationale behind it, the valuation of the assets, and the overall health of the energy sector. Those who view the sale as a positive move, potentially freeing up capital for future investments or reducing debt, might exhibit bullish sentiment. Conversely, some investors might perceive the sale as a sign of weakness or a missed opportunity, potentially leading to a negative reaction.

Furthermore, the perceived value of the assets sold will play a critical role in investor sentiment.

Impact on Vermilion Energy Stock Price, Vermilion energy sell us assets 120 million

The asset sale’s impact on Vermilion Energy’s stock price is complex and depends on various factors. A successful sale, perceived as strategically sound and yielding a fair price, could potentially boost investor confidence, leading to an increase in the stock price. However, if the sale is viewed as a strategic misstep or if the valuation is considered too low, the stock price could decline.

Similar events in the past, such as the sale of assets by other energy companies, provide valuable context for evaluating the potential price fluctuations. For example, the sale of a non-core asset by a major oil and gas company in 2022 led to a modest increase in the stock price as investors perceived it as a sign of improved financial health.

Comparison with Similar Asset Sales

The reactions to this sale will likely mirror similar asset sales in the energy sector. Factors like the overall market conditions, the company’s financial health, and the perceived value of the assets will influence the response. If the market is bullish on energy, a strategic asset sale could be perceived favorably. Conversely, a downturn in the energy market might result in a negative investor reaction.

Anticipated Investor Sentiment and Stock Price Fluctuations

| Scenario | Investor Sentiment | Anticipated Stock Price Fluctuation | Reasoning |

|---|---|---|---|

| Successful Sale (Strategic and Fair Valuation) | Bullish | Slight Increase | Investors perceive the sale as a positive step, freeing up capital and improving financial position. |

| Successful Sale (Strategic but Below Market Value) | Neutral | Slight Decrease | Investors might question the valuation, but the sale is still viewed as a positive step. |

| Unsuccessful Sale (Poorly Managed or Low Valuation) | Bearish | Significant Decrease | Investors may interpret the sale as a sign of financial distress or poor strategic decision-making. |

Industry Context

Vermilion Energy’s asset sale is happening within a dynamic energy landscape. Understanding the broader trends, consolidation patterns, and economic factors influencing this decision is crucial for evaluating the implications of the sale. This section delves into the industry context surrounding the transaction.

Broader Industry Trends in Energy Asset Sales

The energy sector is constantly evolving, with asset sales being a common occurrence. Factors like fluctuating oil and gas prices, technological advancements, and changing regulatory environments often drive these transactions. Companies may choose to divest assets that are no longer strategically aligned with their long-term goals or that present operational challenges.

- Shifting Energy Mix: The world is transitioning towards cleaner energy sources, such as renewables. Companies are adjusting their portfolios to reflect this shift. This often involves selling fossil fuel assets and investing in renewable energy ventures.

- Increased Competition: The energy market is highly competitive. Acquisitions and mergers are frequently used to consolidate market share and gain a competitive edge. Asset sales can be a component of this strategy, allowing companies to focus resources on core competencies.

- Technological Advancements: Technological advancements impact the efficiency and profitability of energy operations. Companies may divest older assets that are no longer technologically competitive, preferring to acquire newer technologies.

- Regulatory Changes: Environmental regulations and government policies are changing frequently. These changes can impact the profitability and viability of certain energy projects, potentially leading to asset sales.

Recent and Ongoing Industry Consolidation Patterns

Consolidation in the energy sector is a recurring theme. Large companies often acquire smaller, more specialized players, either to enhance their existing portfolio or gain access to specific resources or expertise. This can result in significant changes to market dynamics and competition levels.

- Mergers and Acquisitions: Large energy companies frequently acquire smaller players, expanding their geographic reach or adding niche expertise. For instance, ExxonMobil and Chevron have historically engaged in mergers and acquisitions to consolidate market share and access new reserves.

- Strategic Alliances: Strategic alliances between energy companies can lead to joint ventures and shared resources, enabling them to access new markets or reduce operating costs. This is an alternative consolidation strategy to outright acquisitions.

- Focus on Efficiency: Consolidation can also improve operational efficiency. Combining operations can lead to economies of scale, lower costs, and streamlined processes, making companies more competitive.

Global Economic Factors Affecting Asset Sales

Economic conditions play a significant role in the energy sector. Factors like inflation, interest rates, and global demand for energy influence the value and attractiveness of assets.

- Inflation and Interest Rates: Inflation and rising interest rates affect capital costs and investment decisions. These factors influence the attractiveness of energy projects and may lead to asset sales as companies reassess their financial positions.

- Global Energy Demand: Fluctuations in global energy demand impact the value of energy assets. Periods of high demand often increase the value of energy reserves, while low demand can lead to asset divestment.

- Geopolitical Instability: Geopolitical events, such as political conflicts or sanctions, can significantly impact energy markets. These factors can create uncertainty and affect investment decisions, leading to asset sales.

Potential Alternatives to the Sale

Vermilion Energy’s decision to sell assets presents a crucial juncture. Instead of a complete divestment, exploring alternative strategies could have yielded different outcomes. This section delves into potential avenues the company might have pursued, weighing their respective advantages and disadvantages.Alternative strategies to a full asset sale offer a nuanced approach, potentially preserving operational flexibility and strategic options. A detailed examination of these options reveals potential benefits and drawbacks that would have informed a more comprehensive decision-making process.

Strategic Partnerships

Exploring strategic partnerships with other energy companies could have provided access to new markets, technologies, and expertise. This approach often entails sharing resources and risk, allowing Vermilion to leverage the partner’s strengths while maintaining control over core operations.

Vermilion Energy selling off $120 million worth of assets is definitely a big deal. It got me thinking about how companies, like people, sometimes need to adjust their approach to stay successful. This reminds me of the importance of authenticity in performance, a concept explored in depth in this essay on being yourself authenticity performance essay.

Perhaps this sale is Vermilion’s way of finding a new, more authentic path forward. It’s a fascinating case study in adapting to changing market conditions.

- Potential Benefits: Increased market share, access to new technologies, and reduced operational costs through shared resources.

- Potential Drawbacks: Potential loss of control over certain aspects of operations, conflicts in strategic direction, and the need to align with the partner’s goals.

- Arguments for: Strategic partnerships can accelerate growth and innovation. A partner’s experience in specific areas could prove invaluable.

- Arguments against: The intricacies of partnership agreements can lead to conflicts and loss of autonomy. Finding a suitable partner with complementary expertise is not always straightforward.

Joint Ventures

A joint venture (JV) could have allowed Vermilion to enter new markets or develop specific projects without the full financial commitment of a standalone acquisition. This approach provides shared risk and reward, while maintaining Vermilion’s influence.

- Potential Benefits: Reduced financial burden, access to specialized expertise and capital from a partner, and accelerated project timelines.

- Potential Drawbacks: Potential for conflicts between partners, sharing of profits and decision-making power, and the potential for differing long-term objectives.

- Arguments for: Joint ventures can be a cost-effective way to enter new markets or develop complex projects. Shared resources can expedite timelines.

- Arguments against: Potential for disputes and disagreements, and the need for careful contract negotiation to ensure clear lines of authority.

Debt Financing and Operational Optimization

Instead of selling assets, Vermilion could have explored increasing its debt capacity to fund specific projects or operations. Simultaneously, significant operational optimization could have improved profitability.

- Potential Benefits: Potential for increased short-term cash flow, reduced dependence on external investment, and improvement in overall efficiency.

- Potential Drawbacks: Increased financial risk, potential for higher interest rates and tighter credit conditions, and the need for rigorous cost-cutting measures.

- Arguments for: Debt financing can provide capital for strategic investments and operational improvements. Aggressive optimization efforts can enhance profitability.

- Arguments against: High-interest debt can be a burden and the pressure to achieve cost-cutting goals may negatively impact employee morale or operational efficiency.

Table of Alternatives

| Alternative Strategy | Potential Benefits | Potential Drawbacks | Arguments For | Arguments Against |

|---|---|---|---|---|

| Strategic Partnerships | Increased market share, new technologies | Loss of control, conflicts | Accelerated growth, specialized expertise | Complexity, potential for disagreements |

| Joint Ventures | Reduced financial burden, shared expertise | Potential conflicts, shared decision-making | Cost-effective entry into new markets | Potential disputes, contract negotiation complexity |

| Debt Financing & Optimization | Increased short-term cash flow, efficiency gains | Increased financial risk, tight credit | Funding for strategic projects, enhanced profitability | Higher interest costs, employee morale impact |

Visual Representation of Assets

Vermilion Energy’s asset sale presents a complex picture, requiring a clear visualization to understand the geographic scope, infrastructure connections, and overall impact. A visual representation aids in comprehending the implications of this transaction, especially for stakeholders and the broader energy market. Maps and diagrams will demonstrate the physical layout and interconnectivity of the sold assets, enabling a more intuitive grasp of the transaction’s consequences.This section will depict the geographical location of the sold assets, showcasing their interconnectedness with pipelines and refineries.

Detailed maps and diagrams will illustrate the extent of the sale’s influence on Vermilion Energy’s operations and market presence. Furthermore, the visualizations will provide a clear perspective on the potential ramifications of the divestment for the company and the energy sector.

Geographic Location of Sold Assets

The sold assets are situated across several key regions, with a concentration in North America. Detailed maps are crucial to understanding the spatial distribution of these assets. For example, one map could highlight the oil and gas fields in Alberta, Canada, marked with the specific locations of Vermilion Energy’s production facilities. Another map could depict the extensive pipeline network stretching across the region, demonstrating how the sold assets are connected to existing infrastructure.

Interconnectivity with Pipelines and Refineries

The sold assets are integrated into a vast network of pipelines and refineries. A diagram showing the pipeline network will illustrate the flow of oil and gas from the production facilities to refineries. This diagram will highlight the key junctions and points of connection, showcasing the strategic importance of the assets within the overall infrastructure. The diagram should also include the refinery locations that receive the product from the pipelines.

Visualizing the Overall Impact of the Sale

A comprehensive visualization of the sale’s impact can be achieved by presenting a comparative map. The pre-sale map would highlight Vermilion Energy’s entire asset portfolio, while the post-sale map would illustrate the remaining assets after the divestment. This visual comparison will quickly demonstrate the reduction in Vermilion Energy’s operational footprint and the impact on its production capacity. The maps should include specific data points, such as production capacity in barrels per day or daily output in million cubic feet per day.

Descriptive Captions for Illustrations

Captions for each illustration are critical to enhance understanding and convey the necessary information. For example, the caption for the pipeline diagram could state: “Pipeline network connecting Vermilion Energy’s production facilities in Alberta to refineries in [location], demonstrating the strategic importance of the sold assets in the overall energy supply chain.” The caption for the comparative map should highlight the key changes resulting from the asset sale, such as the decrease in Vermilion Energy’s production capacity or geographical reach.

The captions should also briefly describe the underlying data and methodologies used for creating the visualizations.

Final Wrap-Up

In conclusion, Vermilion Energy’s decision to sell $120 million in assets presents a complex picture with potential ramifications for the company’s future and the energy sector as a whole. The motivations behind the sale, the anticipated market reaction, and the possible alternative strategies are crucial factors to consider. This analysis provides a comprehensive overview, offering insights into the details of the sale, the potential impact, and the industry context surrounding this significant transaction.

Ultimately, the success of this move will hinge on the company’s ability to navigate the complexities of the energy market.